Nezha Auto once again embroiled in wage arrears controversy, facing numerous challenges on the IPO path

![]() 10/17 2024

10/17 2024

![]() 527

527

In order to reverse the adverse situation, Nezha quickly acted to revamp its marketing system, but this did not lead to significant sales growth.

@Tech Insights Original

Nezha Auto employees reveal that the company owes wages and suppliers a lot of money?

On October 16th, a verified Nezha Auto employee on social media claimed that Nezha Auto did not pay salaries for last month on time and owed a lot of money to suppliers, urging everyone to be cautious when purchasing Nezha vehicles. The related topic "Nezha Auto can't afford to pay salaries anymore?" topped the Maimai trending list.

In response to rumors of unpaid salaries, Nezha Auto told The Paper that salaries for frontline employees have been paid, while middle management and executives are undergoing equity optimization and salary structure adjustments in preparation for IPO confirmation, which has led to a slight delay in some salary payments.

A salesperson at a Nezha Auto 4S dealership in Hangzhou told Ifeng Technology that salaries are usually paid on time, with occasional delays of one or two days for some employees, but most salaries should be paid today.

In fact, this is not the first time Nezha Auto has been embroiled in a wage arrears controversy. After resuming work after the Chinese New Year this year, several employees revealed that promised year-end bonuses for the first week back at work were not fulfilled, and the bonuses were delayed until March. Finally, Nezha Auto CEO Zhang Yong posted a response, stating that the year-end bonuses were still under final review and confirmation. Since 2016, employees' salaries, bonuses, and social security benefits have never been late, and even during difficult times last year, there was no thought of reducing salaries or layoffs.

Regarding the issue of unpaid salaries, Nezha Auto has stumbled twice in less than a year, plunging itself into a whirlwind of public opinion.

01.

Declining Sales

In June of this year, Nezha Auto's parent company, Hopelion New Energy Automobile Co., Ltd., submitted an IPO prospectus to the Hong Kong Stock Exchange. As of now, there has been no clear progress. Notably, in early September, Nezha Auto's CFO Chen Rui resigned, and he was replaced by former Goldman Sachs (Asia) Managing Director Pan Deng. Nezha Auto stated that this adjustment was a normal change and "expected to further advance Nezha Auto's IPO process."

During the just-concluded "Golden September" sales season, several new energy vehicle makers achieved record delivery volumes. However, Nezha Auto's sales decline remained unabated. In September, it delivered 10,118 vehicles, a year-on-year decrease of 23.41% and a month-on-month decrease of 8.06%, making it the only leading new energy vehicle maker to experience declines in both year-on-year and month-on-month terms.

In 2022, Nezha Auto surpassed "NIO, XPeng, and Li Auto" to become the sales champion with 152,000 vehicles delivered throughout the year. However, since 2023, Nezha Auto has been on a downward trajectory, with sales continuously declining. For the entire year, it delivered only 127,500 vehicles, a year-on-year decrease of 16.16%, making it the only leading new energy vehicle maker to experience a decline in deliveries and only achieving 51% of its annual KPI. In the first eight months of this year, Nezha Auto delivered a cumulative total of 75,790 vehicles, indicating that its achievement rate for the 2024 annual sales target is only 25.26%.

Qihoo 360 Chairman and CEO Zhou Hongyi, a shareholder in Nezha Auto, believes in an interview that weak brand power is one of the reasons for Nezha Auto's poor sales performance.

To reverse the adverse situation, Nezha Auto quickly acted to revamp its marketing system. Earlier this year, a document exposing the appointment adjustments in Nezha Auto's marketing company surfaced, revealing that Zhang Yong would serve as the president of the marketing company and personally lead the marketing efforts. Since then, Zhang Yong has frequently appeared at Nezha Auto's press conferences, and investor Zhou Hongyi has also frequently "guided" Nezha Auto's work, even urging its executives to learn from Xiaomi's Lei Jun. However, based on this year's delivery data, the revamped marketing system has not significantly boosted Nezha Auto's sales growth.

Lin Shi, Secretary-General of the Intelligent and Connected Vehicles Branch of the China-Europe Association, told Securities Daily that one of the major factors hindering Nezha Auto's sales is the lack of a distinctive brand identity.

02.

Going Abroad for Survival

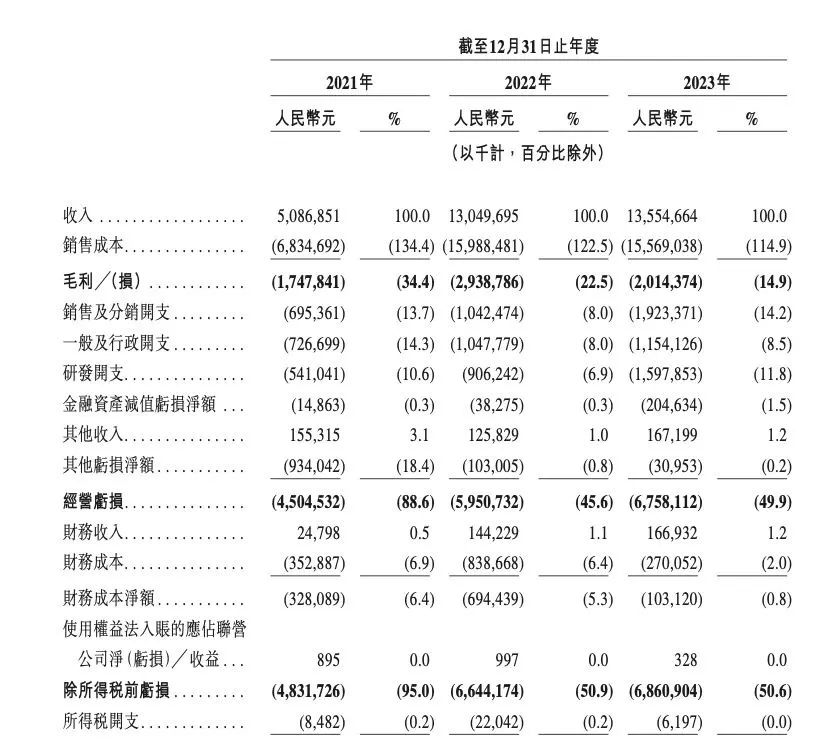

It is undeniable that among the leading new energy vehicle makers, Nezha Auto seems to be gradually falling behind. The prospectus reveals that Nezha Auto incurred net losses of 4.84 billion yuan, 6.666 billion yuan, and 6.867 billion yuan in 2021, 2022, and 2023, respectively, totaling 18.373 billion yuan in losses over the three-year period.

Although only NIO has achieved profitability among the current new energy vehicle makers, as of the end of 2023, XPeng and Li Auto had gross margins of 5.5% and 1.5%, respectively, and even Zero Run achieved a positive gross margin, while Nezha Auto's gross margin remained negative at -14.9%.

The prospectus shows that since 2017, Hopelion New Energy has completed 10 rounds of funding, raising a total of 22.844 billion yuan. In October 2023, Nezha Auto CEO Zhang Yong stated, "Nezha Auto raised 10 billion yuan in funding in 2022 and tens of billions of yuan in 2023. Currently, we have over 10 billion yuan in cash on hand and are not in a hurry to go public." However, as of December 31, 2023, Nezha Auto's year-end cash and cash equivalents amounted to only 2.84 billion yuan.

Facing increasingly serious company losses, a shortage of funds, and an overall sluggish sales performance, Nezha Auto has had to accelerate its IPO process.

As the domestic market becomes increasingly competitive, Nezha Auto has turned its attention to overseas markets in search of new growth opportunities, having established factories and subsidiaries in Thailand, Indonesia, and Malaysia. With sales of 3,600 vehicles, Nezha Auto ranked first among new energy vehicle brands in the Thai market from January to May 2024, second overall, trailing only BYD.

However, the overseas market is not without challenges, as many domestic new energy vehicle makers are also entering these markets, especially against the backdrop of the European Union imposing high import tariffs on Chinese electric vehicles.

Currently, competition in the automotive industry is intensifying, and Nezha Auto's survival and development are fraught with uncertainties. For Nezha Auto, which is at a crucial juncture, the exposure of this wage arrears incident undoubtedly adds variables to its IPO path.