Should Dongfeng Honda take up the mantle of leading Japanese automakers in the electric vehicle future, surpassing Toyota and Nissan?

![]() 10/18 2024

10/18 2024

![]() 558

558

In the face of shrinking market share, Dongfeng Honda's proactive approach does not seem to have changed the current situation.

Entering 2024, it seems that domestic consumers are no longer paying attention to the performance of joint venture brands, especially in terms of new energy vehicles. Apart from Tesla, other brands are often seen as inferior electric vehicles.

Market focus, ranked by importance, can be roughly ordered as follows: New Energy Vehicle (NEV) startups > domestic independent brands > joint venture brands.

According to statistics from the China Passenger Car Association, in September, the penetration rate of domestic independent brands reached 67.6%, while the market share of joint venture brands was compressed to around 30%. Among them, Japanese brands only accounted for 10.6% of the market, a further decline of over 30% compared to a year ago.

The most intuitive market reaction is that only a few Japanese brands remain in the domestic market, with Toyota, Honda, and Nissan being the only ones commonly mentioned.

It can be said that Japanese brands have been the hardest hit by the acceleration of new energy adoption in the domestic auto industry. From once sharing the market with German and domestic brands, they have now retreated to a corner, a rapid decline unprecedented in just a few years.

However, facing declining sales, the three brands have adopted vastly different attitudes. Among them, Dongfeng Honda has been particularly active this year, seemingly aiming to rewrite the landscape of the Japanese auto market amidst the turmoil.

Unstoppable Decline

Looking back at Dongfeng Honda's sales changes this year, it is evident that the cruelty of the market often comes unexpectedly.

On April 3, Honda China released its first-quarter sales figures, reporting sales of 98,546 units for Dongfeng Honda, a year-on-year decline. However, Dongfeng Honda's own figures showed sales of 136,000 units for the quarter, up 25.6% year-on-year.

There is a discrepancy of 40,000 units between the two sets of figures for the same quarter. Neither side has responded to the discrepancy, but by mid-year, the numbers somehow aligned again.

In July, Dongfeng Group released its half-year production and sales figures, showing that Dongfeng Honda sold 237,900 units, an increase of 4.79% year-on-year, making it one of the few joint venture brands to achieve positive sales growth in the first half of the year.

However, beneath the impressive numbers lies a hidden decline. Sales in June plummeted to just 35,400 units, a year-on-year decrease of 16.41%, indicating that Dongfeng Honda had not truly emerged from its trough.

Entering the third quarter, most automakers faced significant pressure, as the traditionally slow sales months of July and August made it difficult to boost sales. The only hope was the traditionally busy sales season of September and October, known as the "golden September and silver October." However, Dongfeng Honda failed to capitalize on the "golden September" momentum.

Data shows that Dongfeng Honda sold 31,316 units in September, a year-on-year decrease of 56.26%. Cumulative sales for the year reached only 300,000 units, down 25.5% year-on-year. It can be said that Dongfeng Honda's market position collapsed completely in the third quarter, erasing the cumulative advantages gained in the first half of the year.

The only silver lining is that Dongfeng Honda's sales decline was less severe than that of Guangzhou Honda. According to Honda China, cumulative sales for the first nine months of the year reached 580,000 units, down 29.27% year-on-year.

Looking at specific models, several of Dongfeng Honda's best-selling models have experienced significant declines in 2024. The first to be impacted was the cornerstone of Dongfeng Honda's sales – the CR-V. In 2023, Honda CR-V sold 213,515 units, making it the only model from Dongfeng Honda to surpass the 200,000-unit sales mark in China.

However, in 2024, CR-V sales have dropped to just over 10,000 units per month. In September, sales were 13,915 units, a year-on-year decrease of 20%, with cumulative sales for the year currently standing at only 124,593 units. Achieving the annual sales target of 200,000 units now seems highly challenging.

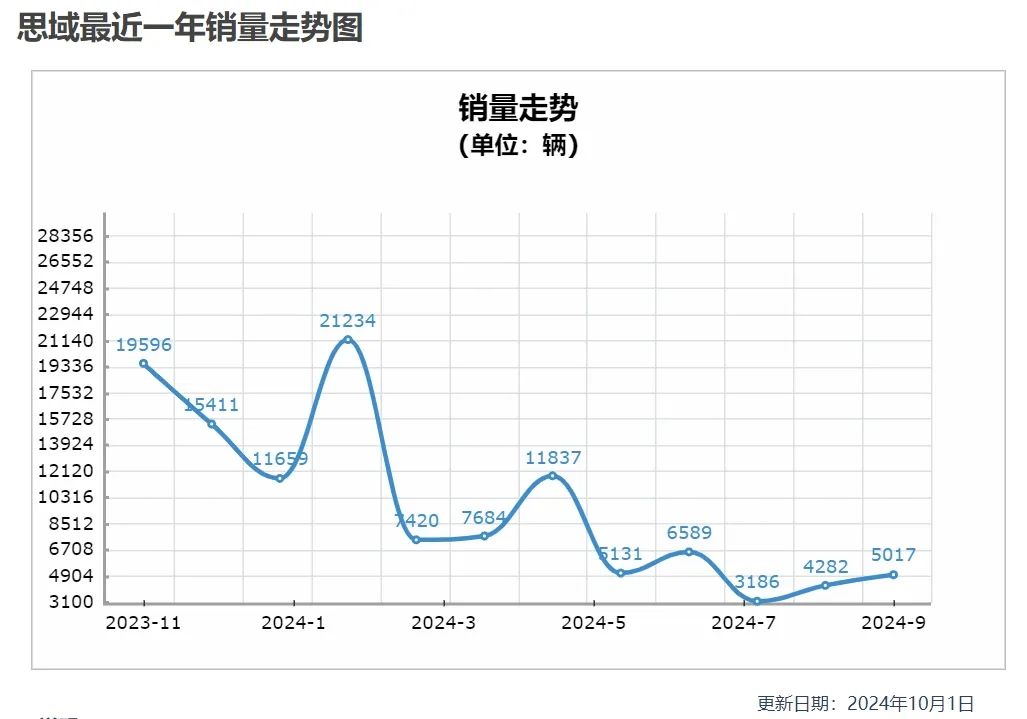

In the sedan segment, Dongfeng Honda's pride and joy was once the Civic, which was renowned for its speed and performance. In 2023, Honda Civic sold 177,721 units, contributing significantly to Dongfeng Honda's overall sales. However, in 2024, the Civic's fate is similar to that of the CR-V.

Monthly sales of the Civic have struggled to maintain above 10,000 units in 2024. Apart from January and May, sales have been below 10,000 units, with a particularly steep decline in September, when only 5,017 units were sold, a year-on-year decrease of over 70%.

Crucially, both the CR-V and Inspire have introduced plug-in hybrid models to keep up with the times, and these are included in sales figures. Nevertheless, sales continue to decline.

It can be said that Dongfeng Honda's existing models have been overwhelmed by the ever-changing domestic market, lacking the ability to resist effectively, much like the Song Dynasty struggling against the Jin invaders.

Change is imminent for Dongfeng Honda.

Addition or Subtraction?

Regarding countermeasures, Dongfeng Honda has been more proactive than other Japanese joint venture automakers. Perhaps due to Dongfeng Group's influence or Honda's reluctance to abandon the Chinese market, Dongfeng Honda has taken a more aggressive approach to electrification in 2024 than other joint venture brands.

Honda has its own electric vehicle brand, Honda e:N, developed by a Japanese R&D team and launched in the Chinese market in 2021, with sales starting in 2022, split between Dongfeng Honda and Guangzhou Honda.

However, it is evident that many consumers have never even seen a real Honda e:N vehicle, relegating the brand to the ranks of "inferior electric vehicles" in the domestic market.

Under these circumstances, Dongfeng Honda launched a new electric vehicle brand, Lingxi, on September 21, 2023, earlier than many second-tier NEV startups. According to Pan Jianxin, Deputy General Manager of Dongfeng Honda Automobile Co., Ltd., Lingxi is a new product adapted to the times, created by Dongfeng Honda's young engineering team.

On the eve of this year's Beijing Auto Show, Honda also introduced a new electric vehicle brand, Ye, with Dongfeng Honda's Ye S7 already appearing in the Ministry of Industry and Information Technology's application list and scheduled for launch within the year.

To date, Dongfeng Honda's new energy brand lineup has expanded to four. Amidst stagnant sales growth, Dongfeng Honda has chosen to add new brands to its portfolio, seemingly using them as experimental fields rather than as a direct challenge to the NEV startups.

Apart from adding new brands, Dongfeng Honda has also been actively developing new products. On September 26, the first model under the Lingxi brand, the Lingxi L, was launched, offering only one configuration at a price of 129,800 yuan.

In terms of pricing, the Lingxi L is almost on par with Xpeng's new model, the MONA M03. Furthermore, the Lingxi L breaks with Dongfeng Honda's traditional approach by offering a fully loaded configuration, reminiscent of a turnkey solution compared to the Xpeng MONA M03.

The front row is equipped with five large screens, including a HUD, electronic exterior mirrors, a central control screen, an instrument cluster, and a co-pilot screen, making it a luxurious and fully featured option compared to the single central control screen of the M03. Additionally, the Lingxi L offers cup holders and a desk tray in the rear, a stark contrast to Dongfeng Honda's previous reputation for selling cars with engines as the main attraction.

Whether due to a low-key approach or other considerations, it would be reasonable to expect strong sales for the highly configured Lingxi L, given the success of the Xpeng MONA M03. However, to date, no order data for the Lingxi L has been made public by Dongfeng Honda's official channels.

The only sales-related news is that on October 11, Dongfeng Honda's new energy vehicle factory officially commenced production in Wuhan, with an annual production capacity of 120,000 new energy passenger vehicles. Initially, it will produce models such as the Lingxi L and Ye S7. This is also Honda's first global new energy vehicle factory.

This can be considered Honda's biggest investment of the year, given the numerous reports of factory closures and layoffs throughout the year. By launching a new factory, Honda has demonstrated its ambition and commitment, surpassing both Toyota and Nissan in this regard.

Judging from Dongfeng Honda's series of moves in new energy, it is clear that the company does not intend to merely survive like other Japanese automakers. Amidst a rapidly changing market, Dongfeng Honda aims for a strategic overtaking, with its target being other Japanese brands, its compatriots in the automotive industry.

Perhaps the times have indeed changed, and it is unexpected that Dongfeng Honda models could one day offer a cost-performance ratio surpassing domestic vehicles. However, whether consumers will embrace this remains to be seen. From the perspective of other brands, it is challenging for joint venture brands' new energy vehicles to penetrate the market, even for premium brands offering discounts.

Recognizing the market risks, Dongfeng Honda announced discounts for the CR-V, Civic, and Inspire in early October, aiming to boost sales for the month.

Whether the new brands can revive declining sales and salvage the future of Japanese automakers in the new energy sector remains to be seen. Only time will tell.

Note: Images are sourced from the internet. If there is any infringement, please contact us for removal.