Does China's electric vehicle industry lack core technologies? Who does Wei Jianjun of Great Wall Motors refer to when he says "we"?

![]() 10/18 2024

10/18 2024

![]() 676

676

Author

Lu Zhenxi

Auto executives don't have to be big talkers

One of the most notable changes brought about by Yu Chengdong of Huawei in the automotive industry is that some auto executives mistakenly believe that simply grabbing attention can bring about positive changes.

Recently, Great Wall Motors' founder Wei Jianjun's statement that "China's electric vehicle industry lacks core technologies" sparked heated debate. Wei believes that the original invention of battery technology in China's electric vehicle supply chain originated in the United States, and that China has no advantage in core technologies, only leading the supply chain.

Image source: Tencent Finance Video

Regardless of whether China's electric vehicle industry has advantages in core technologies, its leading position in the supply chain is already its greatest strength and a safety net for the entire industry. Great Wall Motors, led by Wei Jianjun, is enjoying the dividends brought about by this advantage, as its production capacity would otherwise be impossible to guarantee.

In the manufacturing industry, whoever controls the supply chain has a voice in the international market. Especially against the backdrop of increasing uncertainty in global manufacturing, a leading and secure supply chain is the greatest advantage. This is why Tesla chose to build its first overseas factory in Shanghai, which has now become a pillar of Tesla's production capacity.

01 A leading and secure supply chain is crucial for every enterprise's survival

The automotive industry is highly complex, with upstream supply chain involving steel, machinery, rubber, petrochemicals, electronics, textiles, etc., and downstream involving sales, maintenance, insurance, finance, etc. The length of the automotive supply chain is unparalleled, and the automotive manufacturing industry is increasingly constrained by it.

After the 2020 pandemic, all auto companies should have realized the importance of supply chain stability for high-quality manufacturing development and stable corporate growth. The most striking example is Tesla's Shanghai factory, which officially started production at the end of 2019 and provided Tesla with significant production capacity from 2020 onwards. Thanks to its secure and reliable supply chain, China's electric vehicle production capacity surged to become the world's largest from 2020 onwards.

It was also from 2020 that China's electric vehicle industry faced blockades in the global market. To date, Europe and the United States have continued to increase tariffs on China's electric vehicles. Regarding the EU's plan to impose tariffs of up to 45% on imports of Chinese electric vehicles, China and the EU have held eight rounds of intensive consultations since September 20th, but the two sides have yet to reach a consensus on interests.

While some may see this as a battle for industry interests, in reality, Germany, as the leader of the European automotive industry, stands on China's side. On October 16th (local time), German Chancellor Olaf Scholz criticized the EU's policy of imposing tariffs on Chinese electric vehicles during a speech in the German parliament, stating that 17 EU countries do not support this policy, nor do most EU automakers. If Scholz's statements are true, it begs the question of how the EU was able to pass this proposal in the first place.

Prior to this, the United States determined on September 13th to significantly increase tariffs on products imported from China to strengthen the protection of strategic industries. The United States will impose a 100% import tariff on Chinese-made electric vehicles, a 50% tariff on Chinese-made solar cells and semiconductors, and a 25% tariff on Chinese-made steel, aluminum, electric vehicle batteries, critical minerals, and components. Among them, tariffs on Chinese electric vehicles, lithium-ion batteries for electric vehicles, critical minerals, and components will take effect on September 27th of this year.

The day before, the US House of Representatives passed legislation tightening restrictions on the use of Chinese components in electric vehicles eligible for the US electric vehicle tax credit. Vehicles containing "Chinese components" will not be eligible for the US electric vehicle tax credit, which will further reduce the number of eligible electric vehicles.

Given this context, it is unclear whether Wei Jianjun of Great Wall Motors included the United States and Europe in his statement that "they have the technology, but not the strategy." It is also unclear if his understanding of "strategy" aligns with the author's. Comments and corrections are welcome.

Image source: Tencent Finance Video

In terms of the current global competitive landscape, Baker Street Detectives believes that Europe and the United States have strategic plans for electric vehicles. As China's automotive industry competitiveness continues to improve, the scale of automotive product exports has begun to increase rapidly, posing a significant impact on the market share of European, American, Japanese, and Korean automakers. The strategic planning of these regions in the electric vehicle field will become increasingly clear, using tariff increases to curb the speed of China's electric vehicle exports overseas.

However, this approach is too simplistic. To address this continuing issue, China's auto exports have shifted from a single product trade model to a strategic layout that combines technology, talent, and capital exports. For example, by establishing R&D centers and vehicle manufacturing plants overseas, China is actively promoting its overseas export process.

Public information shows that 22 domestic auto companies, including Geely, JAC Motor, Chery, Great Wall Motors, and Lifan, have established over 90 factories in 35 major export countries and regions such as Russia, Brazil, Iran, and South Africa, with most focusing on technical cooperation and adopting KD (Knocked Down) methods for local assembly and production.

It is important to note that the primary mode of cooperation for Chinese automakers building factories overseas is "technical cooperation," which presupposes that automakers possess core technologies.

02 Summary of core technologies of Chinese automakers

Focusing on domestic automakers' technological accumulation, BYD is recognized as the "only new energy vehicle company that masters the core 'three electric' technologies" and has been included in college entrance exam questions.

The 'three electric' technologies in electric vehicles refer to batteries, motors, and electric controls, which are as crucial as the 'three major components' in traditional gasoline vehicles. In the gasoline vehicle era, automakers that mastered the 'three major components' usually had pricing power. Domestic automakers struggled in gasoline vehicle product competition due to limitations in engine technology.

In the new energy era, automakers that master the three electric systems can better integrate the entire vehicle manufacturing supply chain and control manufacturing costs, thereby achieving "small profits but quick turnover." BYD is a prime example, now collaborating with Toyota to develop pure electric vehicles, despite previous perceptions that it only imitated Toyota.

Focusing on the battery field, which Wei Jianjun highlighted, BYD has not only developed its well-known self-developed "Blade Battery" but also conducted in-depth research in solid-state battery technology, as announced at the World New Energy Vehicle Congress. BYD's Chief Scientist and Chief Engineer Lian Yubo presented the company's continuous innovation and leading position in new energy vehicle technology.

In other companies, Tai Lan New Energy has developed a new solid-state battery with a weight of only one-seventh to one-third that of conventional batteries but an energy density of up to 720Wh/kg, quadrupling that of traditional lithium-ion batteries.

In the hybrid field, BYD released its DMI5.0 hybrid technology this year, achieving a fuel consumption of 2.9L/100km when the battery is depleted. Huaxi Securities believes that DMI has strengthened its leading position in the plug-in hybrid market, accounting for 66% of the market share below 200,000 yuan in 2023.

In the field of electric vehicle intelligence, Huawei is a clear frontrunner, and Great Wall Motors is also collaborating with Huawei in the field of marketing digitization. At the Huawei Developer Conference 2024, Great Wall Motors and Huawei signed a "HUAWEI HiCar Integration Development Cooperation Agreement" to deepen cooperation in the field of smart cockpits.

Regarding Wei Jianjun's statement that "our main chips are all from the United States," it is worth noting that BYD, which develops its own 'three electric' systems, has a high level of localization for automotive chips, particularly its IGBT chips, which are well-known. Previously, BYD Semiconductor even planned to spin off and go public.

Image source: Great Wall Motors WeChat Video

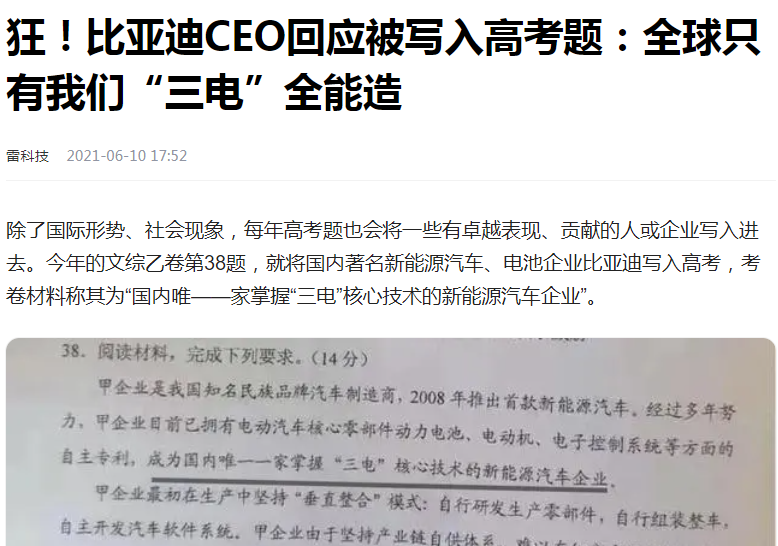

In addition to IGBT chips, other high-potential segments such as automotive SOCs, automotive sensors, storage, multi-function MCUs, automotive Ethernet, and advanced communication systems supporting OTA upgrades all have Chinese companies involved. Taking automotive SOCs as an example, Horizon Robotics is a leading player in the mass production of assistance driving SOCs, while NVIDIA dominates high-level autonomous driving SOCs, with Qualcomm poised to compete. In the global cockpit SOC market, Qualcomm dominates the mid-to-high-end segment, while domestic cockpit chips are accelerating their adoption.

To further increase the share of domestic chips, Huawei launched the MDC600 intelligent driving domain controller platform at the Huawei Connect 2018, which integrates chips, platforms, operating systems, and development frameworks. Equipped with eight Huawei-developed Ascend 310 AI chips, the MDC600 boasts a total computing power of 352 TOPS, meeting L4 autonomous driving requirements.

Huawei's MDC product matrix covers intelligent driving data platforms from L2+ to L4 and beyond, with clients including GAC Motor, Geely, JAC Motor, FAW Hongqi, Dongfeng Motor, Great Wall Motors, BYD, Beijing Automotive Group, Changan Automobile, and Nezha, among others.

In the cockpit domain, the market share of Chinese companies has also increased significantly, rising from 2.20% in 2023 to 9.2% in the first seven months of 2024. Xinqing Technology, in particular, boasts China's first 7nm cockpit chip and is gradually expanding into the intelligent driving domain.

Moreover, Chinese electric vehicle-related companies have made concerted efforts this year in the field of self-developed chip substitutions, covering perception systems, decision-making and control systems, and communication systems. The localization rate in the lidar field, which relies heavily on autonomous driving, is close to 100%.

According to data from Gasgoo Auto Research Institute, 2022 marked the first year of lidar mass production, with 118,000 units installed that year. In 2023, lidar installations approached 550,000 units, representing a year-on-year growth rate exceeding 300%. In the first half of 2024, lidar installations reached 584,400 units, exceeding the total installations for all of 2023. The penetration rate of lidar-equipped models increased from 1.5% in January-May 2023 to 4.7% in the same period of 2024, reaching 6.3% in May 2024 alone.

In terms of pricing, the shift from mechanical lidar to solid-state/semi-solid-state lidar has led to lower manufacturing costs. Additionally, the rapid development of intelligent driving has driven lidar into mass production, resulting in a continuous decline in product prices. RoboSense's latest lidar price in Q1 2024 has dropped to approximately RMB 2,600.

It is worth noting that before 2021, the lidar market was dominated by foreign manufacturers such as Velodyne and Valeo, with low market shares for domestic manufacturers. However, by the end of 2021, as models equipped with domestic lidar were successively launched and delivered, domestic manufacturers' market shares rapidly increased.

In the first half of 2024, four domestic manufacturers—Hesai Technology, RoboSense, Huawei Technologies, and Innovusion—accounted for over 97% of the domestic market share. According to the latest data from S&P Global Mobility, with the rapid development of ADAS and Robotaxi in the Chinese market, Chinese lidar sales accounted for over 80% of global sales in 2023.

03 Leading the supply chain is the greatest advantage!

It is evident that today's Chinese electric vehicle companies have gradually mastered core electric vehicle technologies, particularly in the lidar field, where high autonomy reliance is crucial. China now leads globally in this field and leverages its complete supply chain to capture the global market through price advantages.

Image source: Great Wall Motors WeChat Video

In a video interview clip released on Great Wall Motors' WeChat video account, Wei Jianjun emphasized, "As the chairman, I should set an example for our team." It is unclear whether Wei's "setting an example" includes rigor and accuracy in his statements.

References: 1. Pan Hongying. Industrial Chain Innovation Promotes the Transformation and Upgrading of China's Manufacturing Industry [J]. Business Manager·Mid-Month Edition, 2017. 2. Gong Jianli, Gu Yan. Research on the Integration Mode of China's Automobile Manufacturing Industry Supply Chain [J]. Shopping Mall Modernization. 3. He Zhengchu, Li Yujie, Wu Yan. Industrial Synergistic Agglomeration, Technological Innovation, and Resilience of the Manufacturing Industry Supply Chain. Science Research Network First-Published Paper. 4. Huajin Securities, Intelligent Driving Series Report (IV): The Era of Intelligent Driving Arrives, Are Domestic Auto Parts Manufacturers Ready?

© THE END

This article is for sharing and learning purposes only and does not constitute investment advice.

This article is originally created by Baker Street Detective Agency and should not be reproduced without permission.