How many chances in life do we have to strive? A-share market embraces a new bull market 2.0

![]() 10/21 2024

10/21 2024

![]() 527

527

Commenting on the auto stocks of the week, observing the various dynamics of the auto market.

After a week of volatility, adjustments, and wait-and-see attitudes, finally, the dawn arrived on Friday.

"To advance China's modernization, science and technology must take the lead. Scientific and technological innovation is the only way forward. How many chances in life do we have to strive? Everyone should unleash their potential, continue to work hard, and contribute their intelligence and wisdom to achieving technological self-reliance and self-improvement."

These words from the top echelons were deafening and ignited the passion of investors. Both new and experienced investors expressed their determination, saying, "We are striving, we are working hard, unleashing our potential, starting businesses with one hand and engaging in scientific and technological innovation with the other. We will contribute to the creation of a major bull market in technology."

The index has returned to 3,300 points, trading volume has surpassed 2 trillion yuan, the weekend has once again become a buzz on Douyin, securities firms are seeing a resurgence in account openings, and investors are back to feeling left out and anxious. This scene feels like it just ended.

Right after those words, the People's Bank of China and the China Securities Regulatory Commission jointly issued the "Notice on Improving the Swap Facilitation (SFISF) for Securities, Funds, and Insurance Companies," with 20 securities and fund companies approved to participate in the swap facilitation operation, and the first batch of applications exceeding 200 billion yuan. The People's Bank of China officially introduced a relending program for stock repurchases and increases, with an initial quota of 300 billion yuan.

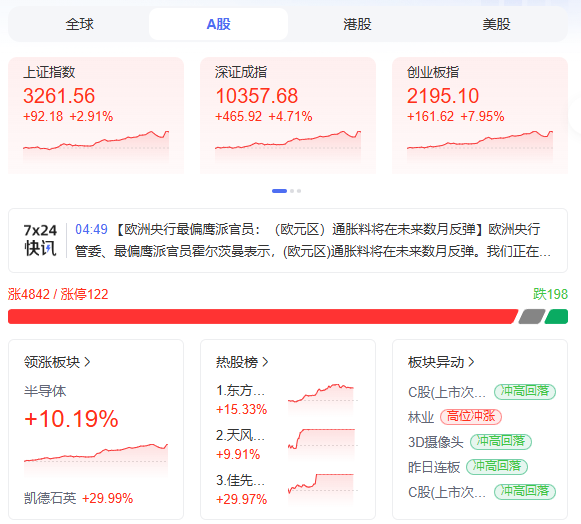

With the resonance of capital and confidence, the A-share market took off again. By the close on Friday, the Shanghai Composite Index rose 2.91%, the Shenzhen Component Index rose 4.71%, the ChiNext Index rose 7.95%, the Beijing Stock Exchange 50 Index rose 10.3%, and the STAR Market 50 Index rose 11.33%. Trading volume on the Shanghai and Shenzhen stock exchanges reached 2.1 trillion yuan, an increase of 606.4 billion yuan from the previous trading day. The technology and growth sectors led the gains, with semiconductor, AI hardware, and other concept sectors all rising across the board.

Ironically, Yibo Technology responded immediately, sealing a 20% gain limit in a straight line. Many stocks with the character "bo" in their names, such as Bohui Technology, Aibo Medical, CITIC Bo, and Anbotong, all surged, each expressing their ability to surge.

It must be said that the A-share market is a joke. From the 90 billion yuan trapped on October 9th and the 52 billion yuan on October 10th, just over a week has passed, and both new and experienced investors are already rushing in full force and preparing to welcome the new bull market 2.0.

Just as the A-share market was about to explode in silence, the combination of the Intel backdoor scandal that fermented the night before and the Replace Domestic Products and autonomous controllable ideas triggered by an incident involving a company's use of autonomous driving mapping further ignited the entire technology sector, represented by semiconductors and chips.

Amid this wave of enthusiasm, the automotive sector also continued to rise, with JAC Motor surging to a new high and Ankai Automobile gaining over 8%. BAIC BJEV, Zhongtong Bus, and JMC Motor also followed suit. However, compared to the technology and growth sectors, there is still a significant gap.

In the eyes of investors, the automotive sector does not have much technological content.

State-owned enterprises such as SAIC Motor, GAC Group, and Changan Automobile have all followed similar K-line trends, remaining relatively stable while the A-share market soars.

Even BYD, the pride of the nation, closed at 300.30 yuan on Friday, essentially remaining flat with Monday's level amidst the week's volatility.

And this is almost BYD's bottleneck. It must be said that Warren Buffett's insight is truly sharp.

Back in 2008, Buffett purchased BYD shares at the incredibly low price of 8 yuan per share, making a bold move from an unexpected perspective. Subsequently, BYD soared to 80 yuan during the previous bull market. However, the good times did not last long, and as the bull and bear markets alternated, the share price plummeted, falling to 9 yuan.

In the years that followed, BYD's share price once again soared, returning to the 80-yuan level before quickly falling back to 33 yuan. At that time, some argued that 80 yuan was BYD's bottleneck, but Buffett remained unwavering. It was not until 2021, when BYD's end market exploded and its share price peaked at 333 yuan, that Buffett began to reduce his holdings.

Until now, Buffett's exit at the peak has proven to be BYD's true peak.

While the A-share market is bustling with activity, the U.S. stock market is relatively quiet. NIO's share price fell by a cumulative 16.20% over the week, XPeng's fell by 18.68%, and Lixiang, relying on strong market sales, managed to maintain its share price, rising by a cumulative 6.32% over the week. This objectively demonstrates that the U.S. stock market is still a place where strength speaks volumes.

On October 18th, Lixiang Automobile officially announced that it had delivered over 1 million vehicles cumulatively. From the first vehicle to the millionth, it took 58 months, making Lixiang the first Chinese new-energy vehicle brand to achieve this milestone. This achievement was unexpected by many critics of Lixiang.

Compared to Tesla, Lixiang achieved this milestone in a shorter period. Tesla took 8 years to reach this milestone in the Chinese market, while Lixiang accomplished the same feat in less than 5 years.

Lixiang's share price has also performed well, currently trading at $26.88 per share, with a total market value of $28.24 billion. This indicates the market's positive expectations for Lixiang's future development prospects.

After successfully testing and recovering the Starship, Elon Musk faced a new challenge.

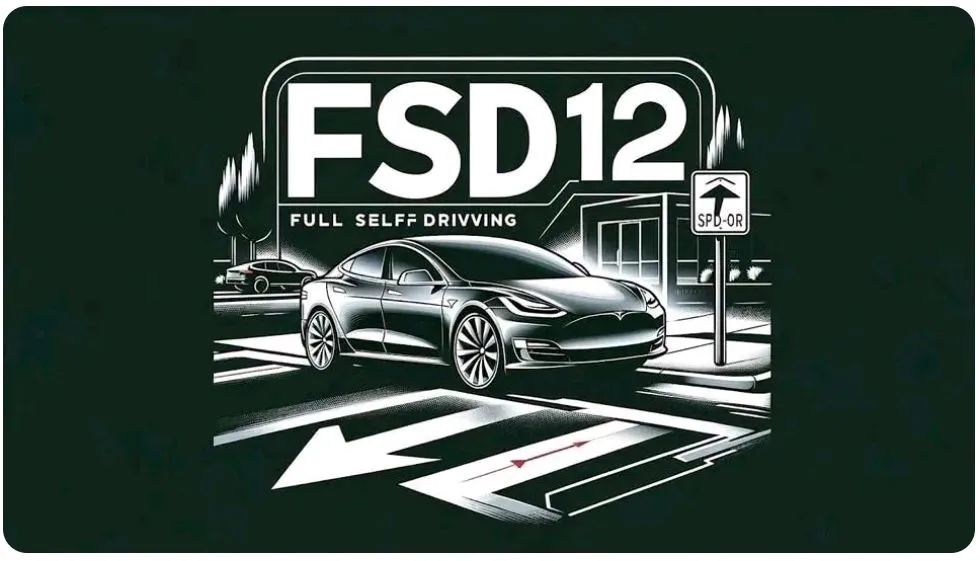

Documents released by the National Highway Traffic Safety Administration (NHTSA) on Friday revealed that the agency has officially launched an investigation into Tesla's Full Self-Driving (FSD) system.

According to the NHTSA, the investigation aims to determine whether Tesla's self-proclaimed "Full Self-Driving" system has the necessary safety measures in place to require drivers to retake control of the vehicle when the autonomous driving technology is unable to handle the situation. Despite its name, Tesla's official website notes that the FSD software requires active driver supervision and does not enable full autonomy.

Notably, the investigation involves four accidents that occurred while FSD was active, including one that resulted in the death of a pedestrian.

Of course, U.S. regulatory reviews often have a strong class color. Just as the outcome of the U.S. presidential election will determine whether Donald Trump faces prison time, this election could also halt U.S. regulatory investigations into Tesla. Trump, who received $75 million in political donations, has stated that he would appoint Musk to lead a "Government Efficiency Commission."

Currently, Tesla's share price has reached a relatively stable stage, and news has a relatively small impact on its share price. As of Friday's close, Tesla shares closed at $220.70, with a slight decline of 0.09%.

Both U.S. and A-share investors are poised to face a highly volatile market leading up to the Lunar New Year. The old saying, "How many chances in life do we have to strive?" may once again take on new life.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.