"Pony.ai Rushes to Be the First Robotaxi IPO" with Revenue of 1.2 Billion in Two and a Half Years

![]() 10/21 2024

10/21 2024

![]() 514

514

Last week, Tesla just announced Cybercab, officially entering the Robotaxi market. This week, China's Robotaxi star unicorn is already busy going public.

On October 18th, Pony.ai officially submitted its IPO prospectus and plans to list on Nasdaq under the ticker symbol "PONY". According to Bloomberg, Pony.ai aims to raise up to $300 million in this IPO.

As one of the first startups in China to invest in autonomous driving and gather many talented technicians, Pony.ai has established commercialized autonomous driving scenarios in its eight years of existence and ranks among the top globally in terms of commercialization scale.

In 2024, the domestic autonomous driving industry has seen an "IPO wave," and Pony.ai's rush to go public marks a new acceleration phase.

01

Revenue of 1.2 Billion and Losses of 2.3 Billion in Two and a Half Years

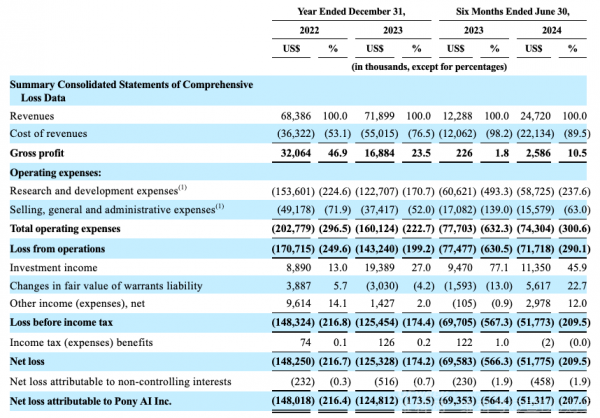

It's no secret that autonomous driving companies struggle to turn a profit and often incur losses, and Pony.ai is no exception. Over the past two and a half years, Pony.ai has accumulated a revenue of approximately 1.2 billion yuan, but its cumulative losses have reached approximately 2.3 billion yuan.

The prospectus shows that Pony.ai's revenue for 2022, 2023, and the first half of 2024 was $68.39 million (approx. 490 million yuan), $71.9 million (approx. 510 million yuan), and $24.72 million (approx. 180 million yuan), respectively.

During the same period, Pony.ai's net losses before adjustments were $148 million (approx. 1.05 billion yuan), $125 million (approx. 890 million yuan), and $51.78 million (approx. 370 million yuan), respectively.

However, the prospectus data also indicates that Pony.ai has achieved large-scale revenue, particularly in the first half of 2024, when revenue doubled year-over-year. Reports suggest that Pony.ai is currently the domestic L4 autonomous driving company with the highest revenue scale.

Moreover, Pony.ai's losses are narrowing. The financial statements reveal that the losses are primarily due to high revenue costs and operating expenses, particularly significant R&D investments within operating expenses.

As a technology-driven company, Pony.ai's R&D investments have consistently been high, totaling approximately 2.4 billion yuan over two and a half years.

Specifically, Pony.ai invested $154 million (approx. 1.1 billion yuan) in R&D in 2022, $123 million (approx. 880 million yuan) in 2023, and $58.725 million (approx. 420 million yuan) in the first half of 2024.

In terms of team composition, Pony.ai has a high proportion of R&D personnel. By the end of the first half of 2024, Pony.ai had 1,359 employees, over 40% of whom were R&D personnel.

Notably, at the end of the first half of the year, Pony.ai had a total of $473 million (approx. 3.437 billion yuan) in cash, cash equivalents, short-term investments, and restricted cash on its books.

In other words, Pony.ai is not short on cash in the short term, and it believes that these funds can sustain stable operations for another five years.

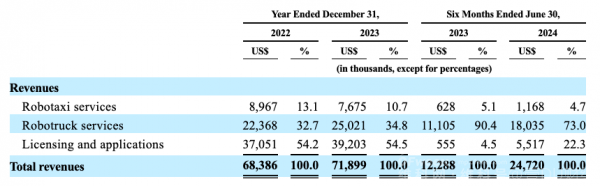

Breaking down the business further, Pony.ai has three main pillars: autonomous mobility services (Robotaxi), autonomous trucking (Robotruck), and technology licensing and application services.

In 2022 and 2023, Pony.ai's technology licensing and application services accounted for the largest proportion of revenue, followed by autonomous trucking, which exceeded 30%.

In the first half of 2024 alone, Pony.ai's autonomous trucking business accounted for the highest proportion of revenue, while the autonomous mobility services revenue increased by 86.0% year-on-year.

In autonomous mobility services, Pony.ai is the first company in China to obtain driverless mobility service licenses in Beijing, Shanghai, Guangzhou, and Shenzhen, and has already started fully autonomous, commercial, and paid Robotaxi services in these cities.

Currently, Pony.ai operates over 250 Robotaxis, with cumulative autonomous driving mileage exceeding 33.5 million kilometers, including over 3.9 million kilometers of driverless driving. By the end of the first half of the year, Pony.ai had over 220,000 registered users on its app, with an average of over 15 daily Robotaxi orders.

In autonomous trucking, Pony.ai operates over 190 Robotrucks (including Level 2 and Level 4), both self-operated and in partnership with Sinotrans, China's largest freight logistics company. Equipped with safety drivers, these trucks complete freight orders within the existing national logistics network.

According to reports, this fleet has accumulated approximately 5 million kilometers of autonomous driving, transporting over 767 million tonne-kilometers in commercial operations. Additionally, Pony.ai has partnered with Sany Group to co-develop Level 4 autonomous trucks.

In technology licensing and application services, Pony.ai has secured contracts for ADAS solutions, domain controller products, and data analysis tools from OEMs and other enterprises.

02

Expected Gross Margin Turnaround and Move Towards Large-Scale Commercialization in 2025

Founded in 2016, Pony.ai has long been a pioneer in the autonomous driving sector, with both of its founders boasting strong technical backgrounds.

Pony.ai's co-founder and CEO, Peng Jun, and co-founder and CTO, Lou Tiancheng, share many similarities in their backgrounds. Both studied at Tsinghua University and worked at Google and Baidu.

Peng Jun was previously the Chief Architect of Baidu's autonomous driving business, responsible for autonomous driving technology research and development, and had worked at Google for seven years, receiving the Google Founders Award.

Lou Tiancheng, known as the "Lou Sect Leader" due to his programming prowess, previously worked at Google's Waymo and served as Technical Committee Chairman of Baidu's Autonomous Driving Unit, becoming the youngest T10-level engineer in history.

The pursuit of autonomous driving by the two founders has, to some extent, shaped Pony.ai into a heavily technology-focused company.

From the start, Pony.ai was determined to develop Robotaxi technology and aimed directly at Level 4 autonomous driving. Peng Jun has mentioned that Pony.ai's technical goal is to create a "virtual driver" suitable for various vehicle platforms and application scenarios.

Over the past eight years, Pony.ai has been steadily advancing and has become the first company globally to offer driverless mobility services using automotive-grade solid-state LiDAR, with leading Level 4 technology mass production capabilities.

In its prospectus, Pony.ai notes that its "virtual driver" autonomous driving technology stack is not limited by vehicle platform types, with a core technology reuse rate exceeding 80%.

At the end of last year, Pony.ai unveiled the appearance and sensor iteration concepts of its seventh-generation autonomous passenger vehicle hardware and software system. In terms of sensors, it still adopts an automotive-grade multi-sensor solution that includes solid-state LiDAR, cameras, and millimeter-wave radars, improving the perception accuracy and safety of fully autonomous driving.

For the software system, the development focus of Pony.ai's seventh-generation system is on city-level deployment for fully autonomous driving. By driving down BOM costs and adopting forward design and verification processes, it aims to improve system reliability and meet automotive-grade standards, preparing for commercialization in terms of cost.

Pony.ai's technical capabilities have consistently ranked among the top tier in the industry. However, it was not the first company to embark on commercialization. Once it decided to pursue commercialization, Pony.ai moved quickly.

In mid-2024, Peng Jun pointed out that Pony.ai's top priority was to achieve scale, with the core goal of ensuring positive gross margins.

In its prospectus, Pony.ai also clarifies that it expects to achieve positive gross margins in 2025, indicating break-even operations per vehicle and a move towards large-scale commercialization of Robotaxi.

Zhang Ning, Vice President of Pony.ai and head of autonomous mobility services, has stated publicly that internal calculations show that in cities like Beijing, Shanghai, Guangzhou, and Shenzhen, operations will reach the break-even point when 1,000 Robotaxis are deployed.

Pony.ai is already equipped to mass-produce thousands of vehicles. It has formed a joint venture with Toyota, investing over 1 billion yuan to promote the mass production and service deployment of autonomous taxis. The new-generation Robotaxis will be equipped with Pony.ai's seventh-generation Level 4 autonomous passenger vehicle hardware and software system.

In addition, Pony.ai has partnered with companies like Qiqi Limousine & chauffeur, Alipay, and Gaode Map to expand user channels. Simultaneously, it has also partnered with core autonomous driving component suppliers like NVIDIA and RoboSense to reduce costs.

03

The Autonomous Driving IPO Wave is Also a Shuffling of the Industry

Upon successfully rushing to IPO, Pony.ai will become the global "first Robotaxi IPO." However, it is not the first autonomous driving company to do so.

Prior to Pony.ai, the autonomous driving sector has already seen an "IPO wave" in 2024, with autonomous driving unicorns like WeRide and Momenta, as well as autonomous driving chip companies like Horizon Robotics and Black Sesame, all rushing to go public.

Among them, WeRide has submitted its IPO prospectus twice and delayed its listing. On the same day Pony.ai submitted its prospectus, WeRide again obtained IPO registration and continued its rush to go public.

Behind this "IPO wave" lies the fact that the autonomous driving sector entered a "capital winter" around 2022.

Faced with the difficulties of commercialization and the long-term profitability of the autonomous driving industry, capital is losing patience and no longer favoring autonomous driving. Data shows that disclosed financing in the autonomous driving sector declined from 159.2 billion yuan in 2021 to just 18.2 billion yuan in 2023, a 90% decrease.

As it becomes harder to raise funds in the primary market, some companies in urgent need of "ammunition" have resorted to rushing to go public. While an IPO may not fundamentally solve the difficulties of commercialization, it can alleviate short-term funding pressures.

However, with over 3.4 billion yuan in assets on its books, Pony.ai does not seem to be rushing to go public solely for quick financing.

While its peers struggle with funding, Pony.ai continues to raise round after round of financing. Public data shows that since its founding in 2016, Pony.ai has completed seven financing rounds, raising over $1.3 billion (approx. 9.3 billion yuan) in total, with a valuation exceeding $8.5 billion (approx. 60 billion yuan).

Amid the capital winter in the industry, Pony.ai announced in October 2023 that it had received a $100 million D+ round investment from Middle Eastern capital.

Pony.ai's investors include well-known financial institutions like Sequoia China, IDG Capital, and Matrix Partners China, as well as industrial investors like FAW Group and Toyota, and some overseas capital.

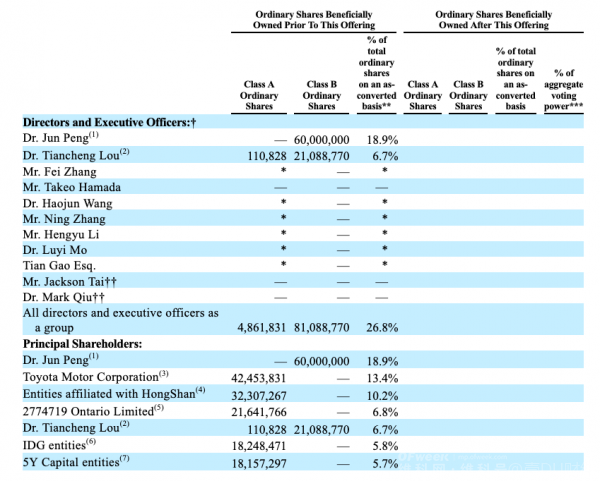

In Pony.ai's shareholding structure, founder Peng Jun holds a 18.9% stake, making him the largest shareholder, while co-founder Lou Tiancheng holds a 6.7% stake. The entire management team holds a 26.8% stake.

Among institutional shareholders, Toyota holds a 13.4% stake, Sequoia Capital holds 10.2%, IDG Capital holds 5.8%, and Matrix Partners China holds 5.7%.

Why is Pony.ai in a hurry to go public, despite not seeming to lack funds?

Firstly, no company ever complains about having too much capital. Pony.ai's IPO, which aims to raise $300 million, will be used in three main areas: large-scale commercialization, including business development, production, sales, marketing, and customer service; continued R&D in autonomous driving technology; and potential strategic investments and acquisitions to build an industry ecosystem.

Secondly, being the "first IPO" means occupying a first-mover advantage in the capital market, which is crucial for revaluing the company. If going public is inevitable, seizing the initiative may give Pony.ai the upper hand.

An IPO is a milestone for a company and a comprehensive test of its technological maturity and market potential.

The "IPO wave" in autonomous driving is also a shuffling of the industry. Only by standing firm and enduring through round after round of tests can autonomous driving companies emerge as the ultimate winners in this transportation revolution.

Images sourced from official websites and prospectuses. Infringement will be removed upon request.