The gap between China and Europe is widening at this Paris Motor Show

![]() 10/21 2024

10/21 2024

![]() 510

510

Introduction

Introduction

Since tariffs are unavoidable, accusations are the least meaningful attitude.

"We are just a company with only ten years of history. We will not overthrow automakers that have been developing for over a hundred years."

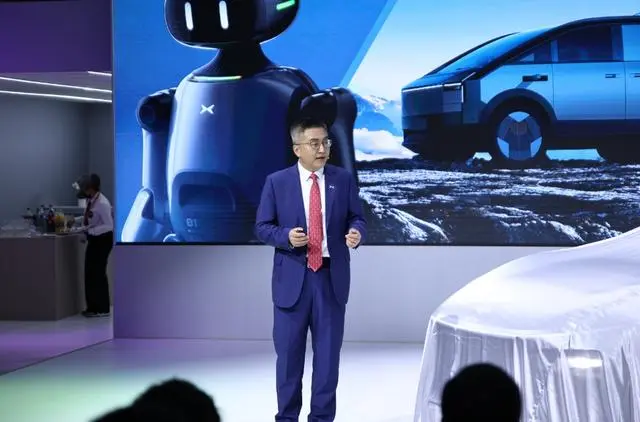

On October 14th, local time, at the beginning of the product launch on the opening day of the 2024 Paris Motor Show, Gu Hong, the Vice Chairman and Co-President of Xpeng Motors who was in charge of hosting the event, deliberately said the above sentence, seemingly to reassure local automakers.

However, it's not just local competitors that need reassurance. In fact, compared to the various European automakers that have significant interests in the Chinese market and maintain some level of cooperation, the biggest problem at the moment is the EU economic and trade policymakers who are lashing out with all sorts of reasons.

"We don't want to engage in a price war. That's not our goal."

Photo | In the end, Chinese automakers can only go with the flow

In fact, at the end of the morning press conference on that day, Gu Hong didn't forget to continue expressing goodwill in order to reduce the threat posed by his brand. While expressing a willingness to provide consumers with more affordable models, he even emphasized the hope that Xpeng Motors would be defined as a supplier of "high-end electric vehicles" in the European market.

However, all these explanations and de-threatening statements, against the backdrop of the looping videos of Xpeng robots, land-based aircraft carrier concept cars, the upcoming autonomous smart car, and the P7+ in the corner of the booth, seem to lack sufficient persuasiveness.

The reality is that no matter how restrained, humble, and cautious one may be in words and attitude, it doesn't matter how one tries to hide one's true strength. Moreover, from the perspective of European automakers, is Xpeng Motors the only threat? BYD's booth is right next door. Additionally, brands like Hongqi, Leapmotor, GAC Motor, and even Skyworth Automobile, among others, have brought to the Paris Motor Show this year, which of these Chinese automakers doesn't have a few tricks up their sleeves that make their hosts feel like they're sitting on pins and needles?

Photo | After years of timid growth, they've suddenly grown three stories tall, yet they still insist on wearing a little bunny rabbit suit. Isn't that right?

Qualitative changes have already led to quantitative changes. As the fourth quarter of 2024 draws to a close, the Chinese automotive industry, unable to continue pretending to be a little bunny rabbit, needs to adopt a new attitude towards the next phase of global expansion - starting with the European market.

The Awkward "Hosts"

The Paris Motor Show dates back to the 19th century. It has been running continuously for 126 years since its inaugural show in 1898.

From its humble beginnings as a car sales exhibition with just over 6,000 square meters of space and 140,000 visitors at the first show, to the technological feast of over 1.5 million visitors in 2008, for a long time, the Paris Motor Show and its permanent venue, the Grand Palais, have been considered a holy grail of global automotive technology.

Photo | If it weren't for the rise of Chinese new energy smart cars, accompanied by the melody of "La Vie En Rose", this would have been another peaceful and beautiful Paris International Motor Show

However, since the beginning of the second decade of this century, the pace of European automakers has slowed down and even gradually lagged behind. This is reflected in the Paris Motor Show, the oldest automotive exhibition in history, where European companies have generally been slow to respond in the field of new energy vehicles and even later in the field of intelligent vehicles, to the point of stagnation.

So what new technologies and latest models did the "hosts" present at this 90th Paris Motor Show?

The French Renault Group and German automakers Volkswagen, BMW, and Mercedes-Benz are undoubtedly the four most "pure-blooded" European automakers.

Renault Group showcased a total of seven global premieres and two concept cars across its four brands: Renault, DACIA (Dacia), Alpine, and Mobilize.

Photo | The overall design of the Renault R5 E-Tech follows that of the Renault 5 from the 1970s. They even brought a Renault 5 to the show to display alongside the R5 E-Tech

Notably, there is the Renault R4 E-Tech, a pure electric compact SUV priced at 35,000 euros (approximately 271,000 yuan), and the upcoming small pure electric SUV Renault R5 E-Tech (priced at 25,000 euros, or approximately 194,000 yuan).

The less "pure-blooded" Stellantis Group also showcased a total of 26 models from its French brands Peugeot and Citroen, Italian brand Alfa Romeo, and Chinese partner Leapmotor. Apart from Leapmotor, the most relevant to new energy is Peugeot's latest electric model, the e408, which is based on the Peugeot 408 sedan's body and converted from gasoline to electric power. Equipped with a relatively large 58.2kWh battery, it has a nominal driving range of 453km and starts at a price of 43,200 euros (approximately 335,000 yuan).

Photo | For the Peugeot e408, it's not that converting from gasoline to electric is necessarily bad, but the architecture inevitably limits certain performance limits and fails to exploit some of the advantages of pure electric vehicles. And in 2024, doesn't your cockpit seem a bit under-equipped and overly reliant on styling to make up for it?

The significance of listing the above new models is that they roughly meet the current demand for lower prices of new energy vehicles among European consumers. According to the latest data from relevant European agencies, the average price of mainstream electric vehicles currently sold in Europe is slightly above 45,000 euros (approximately 348,000 yuan).

Currently, due to the comprehensive freeze in relations with Russia, major European countries can no longer obtain cheap energy from the country. Additionally, while inflation is intensifying and the economy is generally declining, the direct impact on ordinary people is a general reduction in income. This has made European consumers less able to afford the prices of new energy vehicles.

At the same time, while European countries are generally significantly reducing subsidies for the purchase of pure electric vehicles due to economic pressures, they continue to strengthen penalties for tailpipe emissions from fuel-powered vehicles. These measures, which run counter to the economic situation, may be necessary but further exacerbate the pain of car owners.

And electric vehicles made in China have almost become a kind of "salvation" for many European car owners.

Photo | The MG4 EV, which sells poorly in the domestic market and is not a mainstream product, has nevertheless made a big splash in the European market...

Let's take the example of the MG4 EV XPower, which was launched during this year's Beijing Auto Show and is now available in Europe. It is equipped with a dual-motor system with a maximum power of 435 horsepower, a 0-100 km/h acceleration time of 3.8 seconds, and 600N·m of torque, along with a 61.4kWh battery. Yet such a car is priced in Europe at just over 36,000 euros.

Considering that the lower-spec version of the MG4 EV is priced at less than 150,000 yuan (approximately 19,300 euros) in the domestic market, its advantages - or rather, the shortcomings of European automakers - are self-evident. What's more ironic is that the MG4 EV is not even a mainstream product in the domestic market, with sales of just over 1,300 units in September.

In fact, even at last year's Munich Auto Show, where Chinese automakers tried to restrain themselves and even didn't showcase their most advanced models with cutting-edge performance, configurations, and new technologies, along with high-quality smart cockpits and advanced autonomous driving systems, the effect was still like flexing muscles wildly. And at this year's Grand Palais, the only booths that could compete with Chinese automakers are those of Tesla.

Photo | Tesla, which has been absent from domestic auto shows for a long time, returned to Paris as promised

In fact, Japanese brands including Toyota, Honda, Nissan, Mazda, and Subaru collectively skipped this auto show, a situation that is hardly coincidental. In addition, some luxury automakers also failed to make an appearance at this year's Paris Motor Show... In short, they all made it clear that they were avoiding the limelight or getting involved in the turmoil.

Inevitable Tariffs

For Europe, whether it's European automakers, European governments, or even the EU decision-making bodies, they are currently facing a dilemma.

First of all, their overall strategy for new and renewable energy is generally irreversible. Specifically, in the automotive industry, there is an urgent need for European automakers to grow rapidly and establish a strong position, just as they did in the era of fuel-powered vehicles. However, this demand cannot be met under the current circumstances due to the overwhelming competition from China and the United States.

Generally speaking, good things are usually more expensive, and price gaps often leave room for weaker companies to breathe. However, the advantages of Chinese and American new energy vehicles are not only reflected in their all-round leadership in in-vehicle electronics, information technology, and intelligent systems but also in their pricing.

Photo | With its ID. series of pure electric vehicles, the Volkswagen Group can be said to be the best automaker in Europe in terms of electrification, but it has no advantage in the face of strong competitors from China and the United States

The combination of technological and pricing advantages also constitutes a so-called "dimensionality reduction attack," which dooms European automakers to defeat under fair competition. At the root of all this lies the huge supply chain advantages of Chinese companies. Even Tesla, an American company, is leveraging China's new energy supply chain to impact the European market.

If, until this year, there was still some hope among European parties to catch up, then Northvolt's announcement in September of entering into layoffs and restructuring marked the phased failure of all previous efforts. This Swedish battery giant, once hailed as Europe's hope of becoming the "CATL of Europe," was unable to resolve issues such as yield rates and capacity after nearly three years of struggle.

Photo | The failure of Northvolt was actually predictable from its inception, but that didn't prevent it from becoming the last lifeline for the battery segment in Europe's ambitious plan to establish a local new energy vehicle supply chain

Beyond the outdated concepts and lack of technology, the deeper reason behind the expensive yet "quaint" electric vehicles produced by European automakers is their inability to establish a reliable and efficient supply chain system within Europe.

Last year, when Europe launched its so-called anti-subsidy investigation into new energy vehicles from China, some viewed this as a reaction to Chinese automakers' muscle-flexing at the Munich Auto Show in September and accused the China Association of Automobile Manufacturers, which coordinated and organized the participation of Chinese automakers, of provoking the investigation.

The sentiment is understandable, but such accusations are naive and ridiculous. From the EU's perspective, it is only natural to launch a trade war against Chinese new energy vehicles. Since their own automakers are unlikely to win in market competition, and the automotive industry provides tens of thousands of jobs and decent profits, which are vital to the economies of European countries, there is only one way out - trade barriers.

Photo | The destruction of the Nord Stream pipelines following the full-scale outbreak of the Russia-Ukraine conflict has had fatal consequences for Europe's energy security and significantly increased manufacturing costs in Germany

In fact, this is the "due meaning" of any sovereign entity. After all, with the Russia-Ukraine conflict in full swing, how could European countries sit idly by and watch their automakers gradually collapse in an increasingly strained economic environment?

By now, readers of this article have probably accumulated a significant amount of frustration - isn't this the fault of European automakers themselves, or even the European Union member states that brought themselves to this point?

Yes, that's right, it's really self-inflicted.

Image|Since 2023, maintaining social stability has become the primary concern for EU countries. The key to maintaining stability lies in safeguarding employment and improving people's livelihoods, with sufficient job opportunities being a prerequisite. Under this premise, industries that can absorb a large number of jobs, such as the automotive manufacturing industry, and even their entire upstream and downstream industrial chains, are crucial and cannot be shaken.

But what about that? To put it bluntly, even if European automakers, European countries, and even the European Parliament, top to bottom, clearly understand or even admit this point, will they abandon the tax increase measures and watch as their automotive market is devoured by the powerful forces from the East?

On October 4th, local time, the EU voted to approve a resolution to impose countervailing tariffs on imported electric vehicles from China, effectively settling the tariff issue. The current room for maneuver lies in whether subsequent negotiations can reduce the upper limit of tariff rates and whether exemption channels can be secured.

Based on the current situation, SAIC Motor, Geely, and BYD, the three major domestic automakers, face countervailing duty rates of 35.3%, 18.8%, and 17%, respectively. Additionally, Tesla applied for a separate review of its Chinese factories, resulting in a confirmed tariff rate of 7.8%.

Image|Unless the EU dissolves in the short term, there is no conventional way to overturn the already approved tariff increase resolution.

Given that these tariffs will be imposed on top of the standard 10% automobile tax in the EU, the cumulative effect will be a tariff rate of up to 45.3% for SAIC Motor's products, 28.8% for Geely, and 27% for BYD.

Tesla, which leveraged China's new energy automotive supply chain to enter the European market, has "joyfully" received the lowest tariff rate of 17.8%. Of course, such a low tariff rate also carries the implicit message from the EU to the US that it is not targeting them.

In fact, for domestic automakers affected by this tariff increase, this outcome is neither unexpected nor unforeseen.

The actual leader behind this tariff increase, Bruno Le Maire, France's Minister of Finance, visited China specifically for work purposes as early as the end of July last year. French media reported at the time that his mission was to "demonstrate France's 'advantages' to Chinese electric vehicle manufacturers." In a press conference prior to his departure, the Elysee Palace explained that the trip aimed to represent France in promoting an "open attitude towards industrial investment in China."

According to reports at the time, the day after his arrival in China, he specifically visited BYD. It is said that he was actively engaged in investment promotion throughout the trip.

Image|Considering that China has already launched precision strikes against French brandy imports, Le Maire's current expression might be even worse.

As for Germany, after confirming that the EU would increase tariffs, they also communicated on multiple occasions. Even their Deputy Prime Minister in charge of the economy, a philosopher by training, personally led a delegation to China for investment promotion. Given Germany's consistent unfriendly attitude and subsequent setbacks, the German government could no longer afford to wait and instead sent Volker Wissing, the Minister of Transport and Digital Infrastructure, who also oversees digitalization, to continue negotiations on sensitive data export issues. It is reported that "certain achievements" were made.

In short, one thing is clear: The EU's new tariffs are intended to "urge" Chinese automakers to invest and build factories in Europe, rather than drive Chinese cars out of Europe.

The essence of doing business is precisely this. Even if it's not exactly a good thing, as long as there is still value and room for negotiation, it should continue. After all, the alternative to investment is a substantial tax increase, leading to either reduced competitiveness or sharply decreased profits.

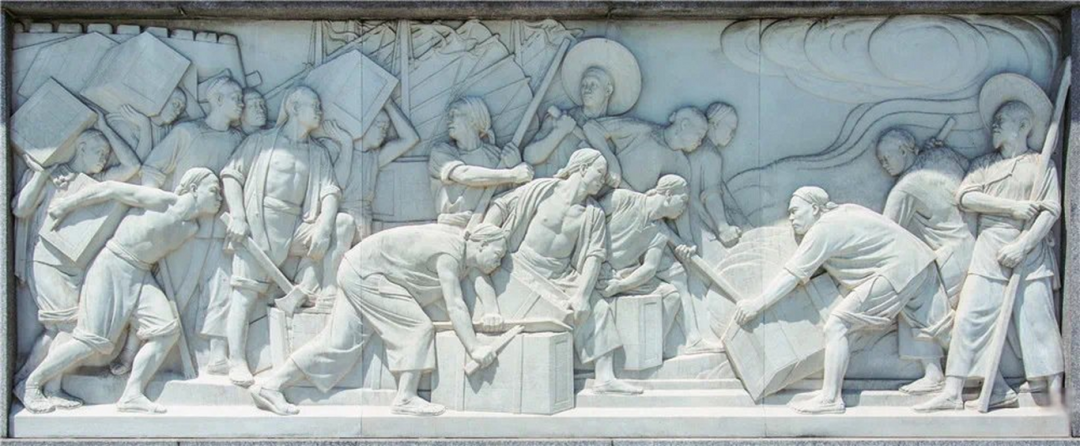

Image|A lesson from modern history is that when you are weak, even domestic anti-drug efforts can be labeled as "disrupting free trade" and subjected to armed intervention.

Or would they follow the example of the great powers of the past and use naval guns to force open the gates of the Qing Dynasty?