Chery Auto chases the "wind" of smart electric vehicles with renewed listing rumors

![]() 10/25 2024

10/25 2024

![]() 679

679

Recently, Bloomberg quoted sources as saying that Chery Holding Group has selected China International Capital Corporation, GF Securities, and Huatai International to arrange the potential IPO of its automotive subsidiary Chery Auto. Chery Auto is expected to list in Hong Kong as early as next year, with an IPO valuation exceeding RMB 100 billion. Informed sources indicated that the review process is ongoing, and details such as IPO size and timing may change.

It is worth noting that in this year's Fortune Global 500 list, a record nine Chinese automotive companies, including Chery Auto, made the cut. Chery Holding Group ranked 385th on the list with revenue of USD 39.0917 billion.

As the core subsidiary of a Fortune Global 500 company, Chery Auto's listing rumors have attracted much attention. So, why is the company pursuing a Hong Kong listing at this time? What are the highlights of its future development?

Listing rumors resurface, as Chery Auto, known for its low-key success, accelerates its transformation

As the only large automotive group in China that is not publicly listed, Chery Auto was founded in 1997 and has grown into a comprehensive automaker with multiple renowned brands such as Chery, Tiggo, and Arrizo after more than two decades of development. Since its inception, the company has consistently pursued a strategy of combining technological innovation with market expansion, achieving remarkable results not only in the domestic market but also globally.

Chery Auto's international journey began in 2001 when it exported its first 10 Fengyun models to Syria, marking its entry into overseas markets. Since then, it has entered more than 80 countries and regions worldwide.

Thus, despite Chery Auto's relatively low-key image in the capital market, its position in the industry cannot be overlooked.

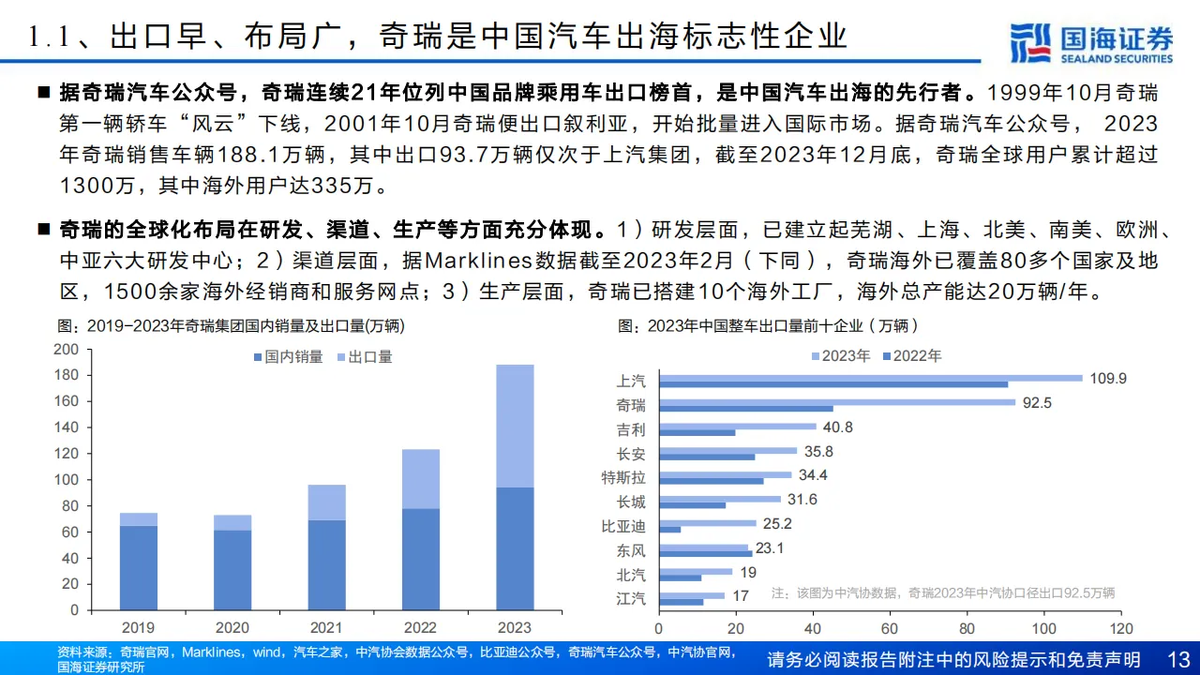

Image source: Guohai Securities

Today, exports account for nearly half of Chery Auto's overall sales, making it one of China's largest automotive exporters. Among domestic brands, Chery Auto ranks second after BYD in terms of strength and performance. In the field of automotive exports, Chery Auto has been the undisputed export champion for 16 consecutive years. According to the latest data from the China Association of Automobile Manufacturers, Chery Auto exported a cumulative total of 829,000 vehicles from January to September this year, ranking first among domestic auto brands in terms of overall vehicle exports.

However, despite its strong performance in overseas markets, Chery Auto has its own pain points in the new energy sector, where it has been "an early riser but a late bloomer."

In fact, Chery Auto has a forward-looking layout in the new energy vehicle segment, with its subsidiary Chery New Energy Vehicle Co., Ltd. established in 2010.

However, as numerous automakers have rushed into the new energy passenger car market, gradually challenging the dominance of traditional luxury brands like BBA, the sales share of Chery's new energy models has failed to make a breakthrough. Even in 2023, new energy vehicles accounted for less than 10% of Chery Auto's total sales for an extended period.

Clearly dissatisfied with this figure, Yin Tongyue, Chairman of Chery Group, publicly stated at the 2023 Chery Tech DAY in October 2023 that "We won't be as polite as before in 2024" and that "next year, our new energy vehicles will definitely enter the top ranks nationwide."

Chery Auto is accelerating its multi-brand product layout, pursuing parallel development of fuel, pure electric, and plug-in hybrid technologies. This includes the fuel-powered Arrizo and Tiggo series, the plug-in hybrid Fengyun series, and the pure electric Star Era series. Within a year, Chery Auto has successively launched multiple new energy products such as the Zhijie R7, Fengyun A8, Jetour Shanhai T2, Star Era ET, new Star Era ES, iCAR 03, and Fengyun T10.

Benefiting from the launch of multiple new models and the company's efforts in the market, Chery Auto has seen significant improvement in the new energy vehicle segment this year. In September, Chery Auto sold 244,500 vehicles, representing a year-on-year increase of 28.6%. Among them, 58,900 were new energy vehicles, marking a year-on-year increase of 183.4%. Of course, considering the overall group size, this figure also indicates that there is still considerable room for improvement in the sales share of Chery Auto's new energy models.

Undoubtedly, amidst the broader trend of new energy adoption in the automotive industry, Chery Auto will continue to promote the development of its new energy vehicle business. Compared to its domestic peers like BYD, Geely Auto, and Great Wall Motor, Chery Auto's weakness lies in its lack of capital market support.

Chery Auto has long recognized that development requires capital assistance. As early as September 2022, Yin Tongyue, Chairman of Chery Auto, revealed that to broaden financing channels, Chery Auto aims to complete its IPO plan by 2025, facilitating the company's new round of transformation.

The year 2025 is a crucial juncture: the second half of the era of intelligent and connected electric vehicles has begun, and Chery needs more "ammunition."

Leveraging the capital market to accelerate the electrification and intelligence transformation may be an essential part of Chery's future development plan.

In the second half of the smart electric era, the "science nerd" accelerates its technological breakthrough

Promoting the new energization of automobiles and accelerating the development of intelligent and connected vehicles is the inevitable path for the comprehensive rise of China's automotive industry, and Chery Auto is unwilling to miss this historical wave.

Recently, Chery Auto celebrated the off-line production of its 15 millionth vehicle globally. Alongside this milestone, Chery Auto also unveiled its flagship C-segment long-range sedan, the Fengyun A9.

From the Fengyun A9, it is evident that Chery Auto is determined to push forward with electrification and intelligence in its transformation. Equipped with the Shenxing Smart Driving System, the Fengyun A9 offers point-to-point autonomous driving capabilities across various scenarios, from highways to urban streets. Meanwhile, its human-like intelligent cockpit possesses self-learning, self-growth, self-evolution, and active interaction capabilities.

Image source: Chery Auto

Chery Auto is firmly committed to securing a significant share of the new energy and intelligent automotive market. At the 2024 Chery Global Innovation Conference, Chery Auto announced that it would no longer be polite in the field of intelligence and would actively explore technological "uncharted territories," aiming to become an industry "leader" through disruptive technological breakthroughs.

As China's first truly international mainstream automotive brand, Chery Auto's technological prowess is undeniable. The launch of a series of proprietary core technologies, such as the Kunpeng engine and 8AT transmission, underscores its identity as a "top science nerd."

Now, Chery has unveiled its advanced intelligent driving technology solutions for the future, evolving from C-Pilot 4.0 to C-Pilot 5.0, empowering future mobility with AI. According to the plan, Chery's advanced intelligent driving systems will be mass-produced and launched on over a dozen models by 2025, ranging from NOA in unmapped urban areas to autonomous flagship NOA on highways, leveraging end-to-end technology to rapidly achieve large-scale NOA production.

This plan undoubtedly targets the growth potential of NOA functions in the downstream market. Data shows that the market size for NOA functions will reach RMB 19 billion in 2024 and is expected to exceed RMB 300 billion by 2030. Building upon this foundation, Chery Auto is also making inroads into the upstream battery sector, initiating research and development of Kunpeng solid-state batteries, with plans for targeted operations in 2026 and mass production in 2027.

From advanced intelligent driving to solid-state batteries, Chery Auto's ambition to seize the first-mover advantage in the second half of the smart electric vehicle era is clear. So, what are the prospects for Chery Auto's listing? Will investors buy into Chery Auto's grand strategy?

Chery Auto's listing could become an essential catalyst for the new energy vehicle sector next year

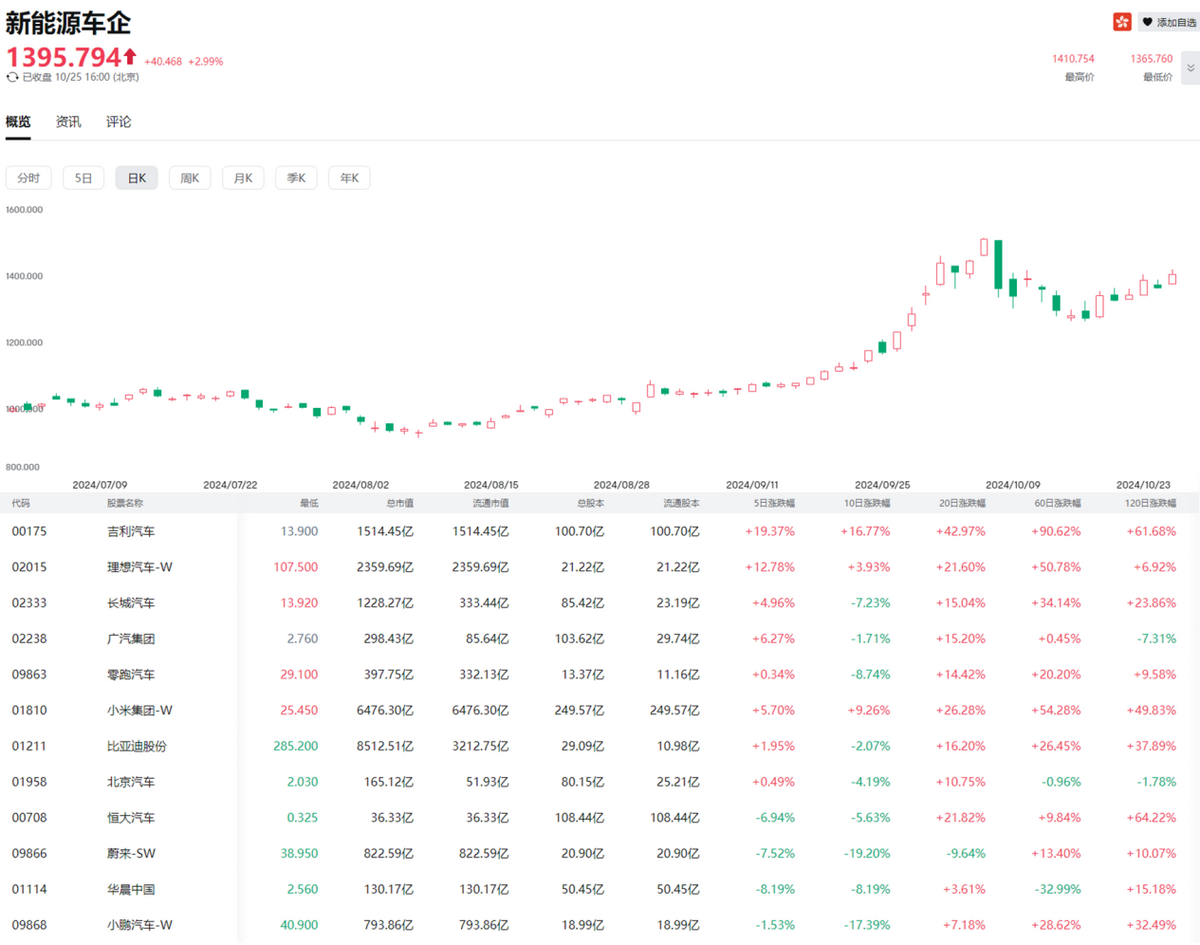

As the competitive advantage of the automotive industry continues to emerge, investor expectations for the automotive sector are positive. Since the second half of the year, the Hong Kong stock market's new energy vehicle sector has gradually strengthened, with most stocks in the industry chain rising.

Image source: Futu NiuNiu

This trend is fueled by a combination of favorable policies, the peak sales season for automobiles, and recent advancements in intelligent technologies by automakers.

On October 16, GAC Aion reached a strategic cooperation agreement with autonomous driving technology company Momenta, aiming to jointly promote the mass production and popularization of advanced intelligent driving technologies, including city NDA.

On October 17, Yu Chengdong, Executive Director of Huawei, revealed that Huawei's ADS 4.0 will be launched in 2025, including commercial L3 autonomous driving services on highways and pilot projects for L3 autonomous driving in urban areas.

On October 23, Lixiang Auto announced the official launch of its next-generation dual-system intelligent driving technology architecture - end-to-end + VLM.

As its peers make strides in the field of intelligent driving, Chery Auto is naturally unwilling to lag behind. In August this year, Chery Auto initiated the first internal test of its self-developed CheryGPT. Yin Tongyue told the team on-site that the AI large model is like "a fairy falling from heaven," presenting Chery with a vital tool. He urged the team to cherish, develop, and utilize it effectively.

Following rumors of Chery Auto's listing, the company made a high-profile declaration that it would no longer be polite in the field of intelligence, undoubtedly attracting the attention of investors to its capitalization process. If the rumors are true, Chery Auto has the potential to become a catalyst for the new energy vehicle beta trend.

Chery Auto boasts cost-effective products, a well-established supply chain, strong cost control capabilities, and a relatively certain business outlook. Looking at Chery Holding Group, according to the Fortune Global 500 list for 2024, Chery is the only Chinese automotive company among the top 50 with the highest return on equity.

Good profitability is a crucial investment factor currently valued by the capital market. Previously, Haitong International pointed out that the capital market valuation system is undergoing a reconstruction from P/S to P/E and potentially to P/FCF and EV/EBITDA in the future. Sustained profitability and free cash flow are key factors in assessing the long-term health of automakers.

It is foreseeable that once Chery Auto crosses the threshold of listing, it is likely to attract investors' favor and catalyze the Hong Kong new energy vehicle sector's performance.

Source: Hong Kong Stocks Research Institute