1500KM endurance, safer, solid-state batteries will overwhelm fuel vehicles, extended-range electric vehicles, and hybrid electric vehicles

![]() 10/27 2024

10/27 2024

![]() 580

580

According to September data, the penetration rate of new energy vehicles in China has reached about 54%.

Among all global sales of new energy vehicles, China accounts for 66% of the share. These two figures are sufficient to demonstrate the remarkable performance of China's new energy vehicles.

However, everyone is aware that the current new energy vehicles are primarily extended-range electric vehicles and plug-in hybrids, with pure electric vehicles not as popular.

Leading players like Li Auto, Wenjie, and NIO are all focused on extended-range electric vehicles. Among BYD's total sales, plug-in hybrids outsell pure electric vehicles.

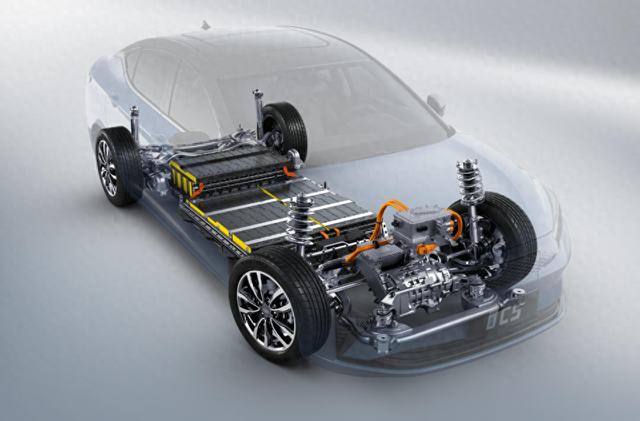

Why is this the case? It is because there is still range anxiety surrounding pure electric vehicles. Typically, pure electric vehicles can only travel 300-500 kilometers, which is insufficient for many people's needs. Additionally, charging takes significantly longer than refueling.

As a result, extended-range electric vehicles and plug-in hybrids are popular, while fuel vehicles still have a market share due to their convenience in refueling, which takes only five minutes and is widely available at gas stations, eliminating range anxiety.

However, with the emergence of solid-state batteries, fuel vehicles, extended-range electric vehicles, and plug-in hybrids may lose their market share, as these battery-powered alternatives will be overshadowed by solid-state batteries.

Firstly, concerns about range anxiety will be alleviated with solid-state batteries. Compared to current batteries, solid-state batteries offer a potential 2-3 times higher energy density. Vehicles with a current range of 300-500 kilometers could achieve a range of 1000-1500 kilometers with solid-state batteries. Will you ever run out of power mid-journey with such a range? For 99.99% of use cases, the answer is likely no.

Secondly, regarding safety concerns, solid-state batteries eliminate the risk of thermal runaway or fires due to their solid-state electrolyte, enhancing overall safety.

In conclusion, solid-state batteries promise to resolve issues related to range and safety.

Moving forward, there are two primary concerns: when will solid-state batteries be launched, and what will be their price point, making them accessible to ordinary consumers?

Regarding the launch timeline, CATL previously stated it would take approximately three years, or by 2027.

Recently, Chery also unveiled its solid-state battery at the 2024 Global Innovation Conference, boasting an energy density exceeding 600 Wh/kg, more than double that of current batteries. According to Chery, targeted operations will commence in 2026, with a market launch planned for 2027.

It is evident that even the fastest-developing solid-state batteries will require approximately three years, or until 2027, for their commercialization. We must wait another three years.

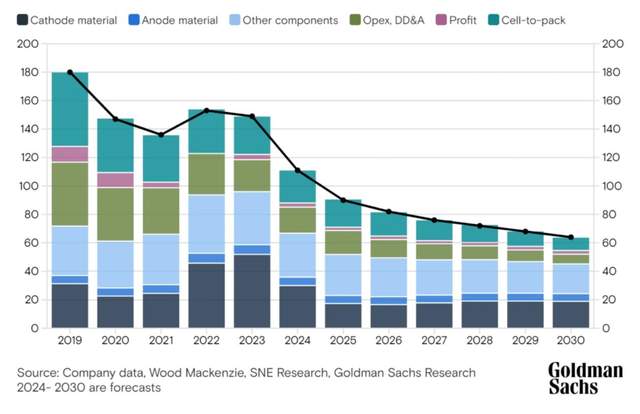

Turning to pricing, the current price of a conventional lithium-ion battery is approximately $111 per kWh. For a 100 kWh battery pack, this translates to $11,100 or roughly RMB 80,000.

By 2027, the price of batteries is projected to drop to $75 per kWh, making a 100 kWh battery pack approximately $7,500 or roughly RMB 53,000.

For solid-state batteries to replace conventional batteries, they cannot be too expensive, as this would significantly increase vehicle costs and make them unaffordable for consumers. Who would buy a car originally priced at RMB 200,000 if the addition of solid-state batteries raised the price to RMB 400,000? However, the exact pricing of solid-state batteries remains uncertain and can only be determined in 2027.