Profit returns to growth path, new growth points may land next year - Tesla 2024Q3 financial report analysis

![]() 10/28 2024

10/28 2024

![]() 602

602

Judging from the trend of US stock trading after-hours, Tesla's performance in 2024Q3 was satisfactory to market participants.

On October 23, Eastern Time, Tesla released its 2024 Q3 financial report ending September 30. In the third quarter, Tesla's revenue increased by 8% to $25.18 billion, with net profit increasing by 17% to $2.167 billion. In the third quarter, Tesla delivered a total of 462,900 electric vehicles, an increase of 6% year-on-year, and produced 469,800 electric vehicles, an increase of 9% year-on-year.

Thanks to the better-than-expected financial report, Tesla's share price surged 12% in after-hours trading in the US on Wednesday. In Thursday's US stock trading, Tesla's share price continued to rise after an opening gap, closing up 21.92%, setting a new single-day high for the year.

Although the numbers suggest that Tesla's achievements in the third quarter were not particularly satisfactory, Tesla's promises for the future during this earnings season may be more eye-catching than its current performance. And the sustained positive outlook for the future is often the most alluring pie in the capital market.

01

Cost reduction significantly improves gross margin, and net profit growth returns to the growth path

Starting with the financial report, although Tesla achieved positive growth in automotive revenue and deliveries in the third quarter, compared to Wall Street expectations, Tesla's performance in the third quarter was actually below the market's expected $25.37 billion. And compared to the 19.7% quarter-on-quarter growth rate in the second quarter, the third quarter's performance on this front was not impressive, with Tesla's third-quarter revenue only barely satisfactory.

Breaking down revenue sources, Tesla's primary automotive business surpassed the $20 billion mark for the first time in the third quarter, with a year-over-year growth rate of 2%. And on October 22, Tesla also celebrated the rollout of its 7 millionth vehicle. In addition to automotive revenue, the company's renewable energy generation and energy storage revenue was $2.376 billion, up 52% year-on-year; service and other revenue was $2.79 billion, up 29% year-on-year. Both accounted for a relatively small proportion of the company's total revenue, but their growth rates were consistently impressive.

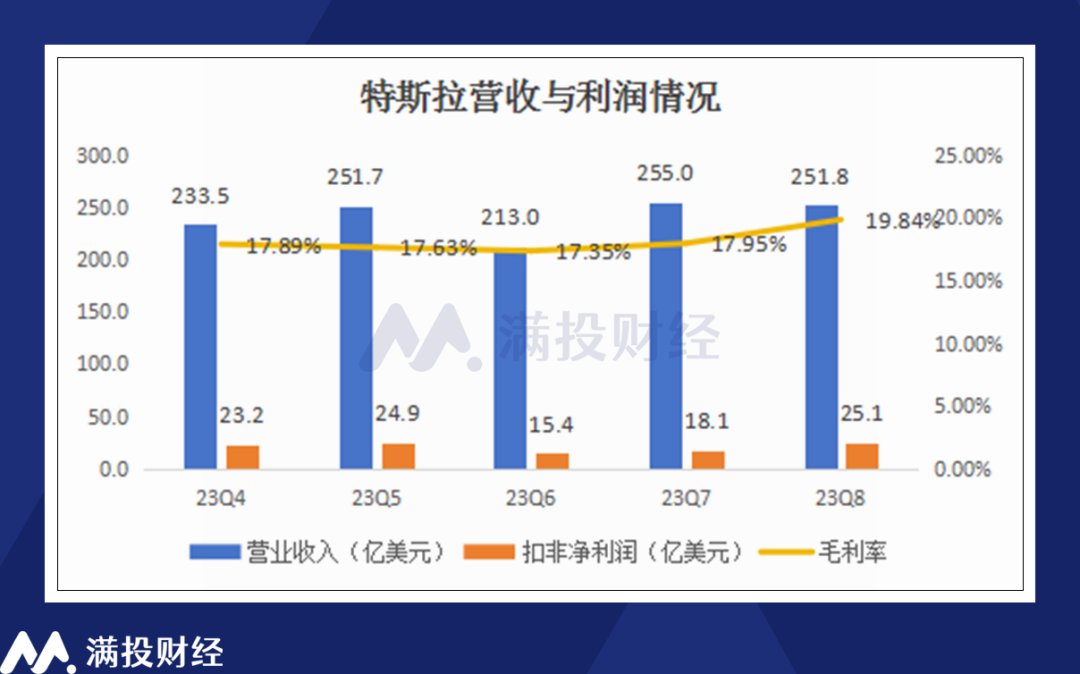

From a gross margin perspective, the company's "cost savings" in the third quarter resulted in impressive gross margin performance. Tesla's overall gross margin in the third quarter was 19.8%, an increase of approximately 2 percentage points year-over-year and quarter-over-quarter, not only continuing the uptrend since the second quarter but also significantly exceeding market expectations. Even excluding the impact of carbon credits, its gross margin remained at 17%, also exceeding the 14% recorded in the second quarter. According to the company's management on the conference call, the increase in gross margin was attributed to the Cybertruck achieving a positive gross margin for the first time this quarter and the reduction in the company's cost of goods sold (COGS) per vehicle.

This translated to a 17% year-over-year increase in net profit, significantly exceeding Wall Street expectations. Under non-GAAP accounting, Tesla's third-quarter non-GAAP net profit was $2.51 billion, up 8.1% year-on-year, ending the previous trend of declining net profit. It is worth noting that of Tesla's $2.16 billion in profits, $739 million came from carbon credits sold to other automakers, accounting for one-third of its revenue.

In terms of expenses, Tesla's total expenses in the third quarter were $2.28 billion, down 5.4% year-on-year, with R&D expenses declining more significantly, from $1.16 billion in the same period last year to $1.04 billion, a year-on-year decrease of 10.5%. This indicates that the layoffs implemented in the second quarter began to show results in terms of expenses. It is expected that in subsequent quarters, the reduction in expenses will continue to contribute to the company's profitability.

Overall, the company's main strategy in the third quarter seemed to be "cost reduction." With revenue growth falling short of expectations, the company achieved significant improvements in both gross and net margins through cost savings measures such as reducing the cost per vehicle and layoffs. Although it remains uncertain how sustainable these cost savings measures will be, Tesla has at least demonstrated results that have won over investors in the current quarter.

02

New product matrix supports growth expectations, autonomous driving business awaits policy approval

Compared to specific products and actual profits in hand, Tesla investors may be more interested in Elon Musk's "pie in the sky" promises about the company's future layout. Although Musk failed to provide a satisfactory answer at the robotaxi launch event in early October, he provided sufficient content during the third-quarter earnings call to give investors confidence in the company's prospects.

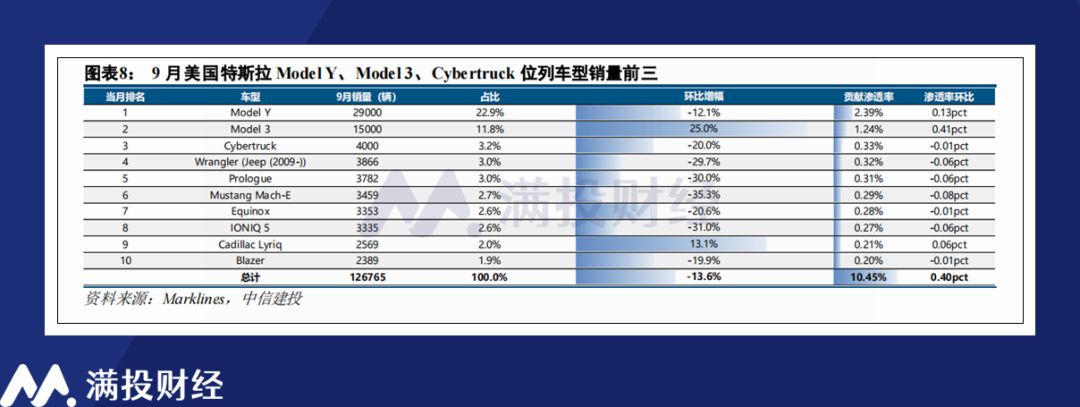

First, in terms of the automotive business, Musk announced that the company will launch a new, affordable model priced at $25,000 in the first half of 2025 to supplement its current aging product matrix. Tesla's current flagship models are the Model 3, Model Y, and the Cybertruck. All three ranked among the top three in North American auto sales in September. However, the Model 3 and Model Y have been on the market for a relatively long time, while the Cybertruck has yet to achieve mass production.

According to Musk's expectations, the new $25,000 model and the Cybertruck will be Tesla's "new blood" in the next stage. The Cybertruck is scheduled to enter mass production in 2026, with a target annual production of at least 2 million units. Regarding the affordable model, Musk did not reveal much information. Based on Musk's projections, Tesla's vehicle sales are expected to grow by 20% to 30% in 2025.

Regarding robotaxi, Tesla unveiled the Cybercab (a cybernetic self-driving electric vehicle) and Robovan (a self-driving multipurpose vehicle) on October 10 to tap into the self-driving electric vehicle market. However, based on information released after the event, the robotaxi deployment may encounter significant policy resistance. Similarly, Tesla's FSD application is in a similar situation.

During the third-quarter earnings call, Musk stated that Robotaxi and FSD would be prioritized for launch in Texas and that efforts would be made to deploy them in California by 2025. However, judging from the statement, this expectation is not particularly solid and will largely depend on policy approvals for implementation. Therefore, until after the US presidential election, this expectation cannot be considered definitive.

Regarding humanoid robots, the third-quarter earnings call did not reveal much new information, mostly reiterating past announcements. From a product perspective, Tesla does have the most advanced humanoid robot on the market, but there is still much room for improvement in terms of practicality and pricing. At least in the next few years, I do not expect this segment to contribute significantly to Tesla's revenue.

Overall, among the announcements Tesla made in the third quarter, the most anticipated items remain the "affordable new model" and the Cybertruck, both of which are easy to monetize. This also reflects changes in the US stock market environment. With the start of the interest rate cut cycle, US stock investors may be more inclined to seize "certain expectations." Tesla, at least, has provided a relatively clear direction in this regard.

03

Closing Thoughts

As the US presidential election draws to a close, Musk's support for Trump has become increasingly frequent, drawing more market attention to Musk himself than to Tesla. News reports suggest that Musk and Trump have established a close relationship, with Musk showing significant support for Trump's election efforts.

If Trump is elected, it is reasonable to expect that Musk's autonomous driving and electric vehicle businesses in the US will receive substantial support. However, if Trump fails to win, Tesla may face significant negative factors in the coming months.