Mercedes-Benz, BMW, and Porsche face off against Chinese automakers in Europe

![]() 10/30 2024

10/30 2024

![]() 491

491

Compiled by Yang Yuke

Edited by Li Guozheng

Produced by Bangning Studio (gbngzs)

For years, Mercedes-Benz, BMW, and Porsche have been hailed as flag bearers of automotive excellence. Despite the disruption caused by the price advantage of Chinese electric vehicles in the auto industry, it is widely believed within the industry that luxury brands can remain secure due to their tradition and premium reputation.

However, this assumption is now being questioned. Sales and profits of luxury brands such as Mercedes-Benz, BMW, and Porsche are fluctuating, highlighting the pressure felt even in the lucrative high-end automotive market from China.

Led by BYD and NIO, Chinese automakers have opened a new front in the battle for dominance in the automotive industry, redefining 'Made in China' as a global symbol of luxury in the era of electric vehicles.

After challenging companies like Mercedes-Benz, BMW, and Audi in the Chinese domestic market, Chinese automakers are now turning their focus to Europe and beginning to make an impact.

The clearest sign of this impact emerged on October 25th, when Mercedes-Benz announced its weakest profitability since the spin-off of the former Daimler Group in 2021.

Porsche also announced that it was considering cost cuts and reviewing its model lineup after earnings plunged significantly due to declining demand in the Chinese market.

'We will not take competition (from China) lightly,' said Mercedes-Benz CFO Harald Wilhelm on October 25th. While he questioned whether Chinese brands could sustain their aggressive pricing, he 'does not believe the pressure will disappear tomorrow.'

At the Paris Motor Show, which opened on October 14th, Chinese automakers showcased luxury sedans and SUVs, such as FAW Group's Hongqi and BYD's Yangwang, aiming to compete with Mercedes-Benz, BMW, Porsche, and even Rolls-Royce for European customers. With the latest digital technology, leather dashboards, champagne buckets, and other amenities – all at affordable prices – Chinese electric vehicles threaten European automakers in the luxury segment where profits are crucial.

NIO, known for its battery swap technology to alleviate range anxiety, has opened luxury showrooms in cities like Berlin, Oslo, and Amsterdam, showcasing models like the EL8 SUV priced at 95,000 euros.

Geely's Polestar brand has begun deliveries in some European markets and plans to enter France, Hungary, and Poland by 2025.

BYD's Yangwang brand sells a luxury off-road vehicle that can float on water, and BYD is establishing relationships with local dealer groups.

Xiaomi's automotive ambitions are also evident. Known as the 'Apple of China,' the tech and communications company has pledged to invest $10 billion in the automotive market. In March this year, Xiaomi unveiled the SU7, targeting models like the Porsche Taycan. This stylish Chinese sports car has already caused a stir in the automotive industry.

'It's fantastic. I've had it for six months, and I don't want to give it up,' said Ford CEO Jim Farley after importing a Xiaomi SU7 for testing. Farley mentioned this in a podcast last week.

Xiaomi has demonstrated its ambition in the European automotive industry by showcasing the SU7 during the Paris Olympics and setting up a garage pit at Germany's famous Nürburgring racetrack. Xiaomi's founder, Lei Jun, has stated his plan to launch the Xiaomi SU7 globally but has not provided a timeline.

As China promotes luxury vehicles, European automakers are entering a delicate phase.

In recent weeks, BMW, Aston Martin, and Volkswagen Group, the parent company of Porsche, have all issued warnings about lower-than-expected profits. They anticipate slower growth, largely due to the slowdown in China, the world's largest automotive market.

For years, Chinese consumers have purchased more Mercedes-Benz S-Class sedans than anywhere else in the world; China is also one of the few markets with high demand for the brand's ultra-luxury Maybach models.

Sales of these highly profitable models declined significantly in the third quarter, and Mercedes-Benz's key profitability indicator fell to 4.7%, below the minimum target of 8%. A rapid turnaround is not expected.

'We are cautious about future market developments,' said CFO Wilhelm. 'We will do everything possible to further improve the efficiency and cost of the entire business.'

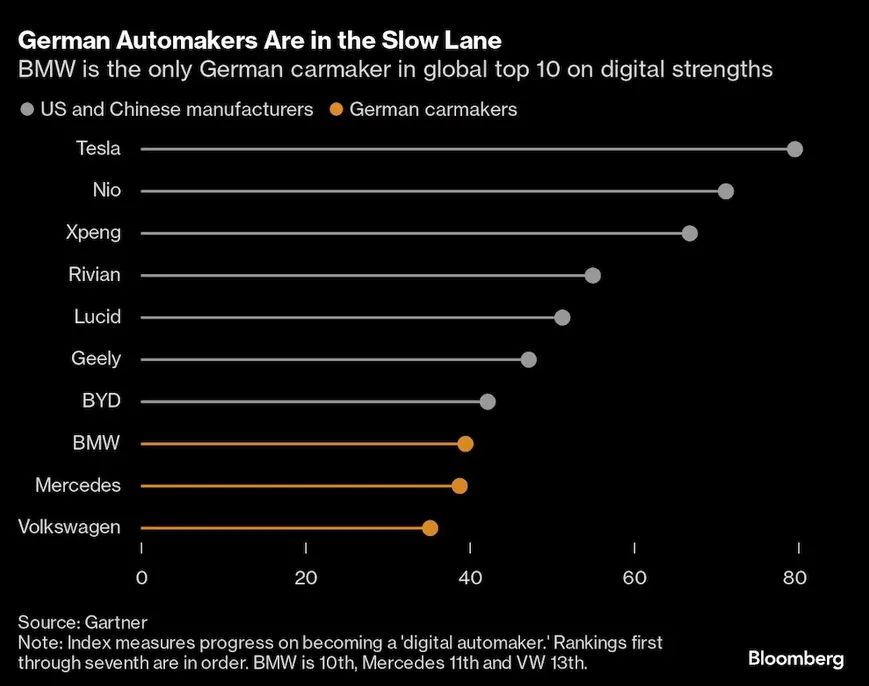

While Europe once dominated the high-end automotive market, Tesla's Model S, launched in 2012, challenged this status quo by shifting consumer perceptions of automotive excellence towards digital functionality. Companies like BYD and NIO have followed suit, promoting their leadership in software and battery technology.

Driven by the domestic market in China, companies like BYD and NIO have doubled their share of China's premium market in the past two years, exceeding one-fifth by the end of May this year, according to Huaxin Securities data.

'High-end Chinese brands are very confident that they will find huge opportunities in Europe if given some time, a little investment, and patience,' said Tu Le, founder of Automotive Insights China. 'The Chinese are trying to convince Europeans that Chinese cars can also be dynamic and performance-oriented.'

Although overcoming the appeal and tradition of Porsche and Mercedes-Benz will be challenging, the allure of the luxury segment for Chinese automakers is evident. Luxury vehicles boast the highest profit margins in the industry, and consumers tend to be more loyal and repeat buyers.

According to McKinsey data, the luxury segment is projected to grow faster than the mass market, a rare path of sustained expansion.

Europe has become the primary battleground in the luxury segment. On the one hand, tensions between China and the US have virtually halted Chinese expansion in the US. On the other hand, facing economic difficulties and intense domestic competition, Chinese automakers urgently need exports.

To win over Europeans, BYD showcased the 1.1 million yuan (€143,000) Yangwang U8 in Paris. This boxy SUV has motors on each wheel, enabling it to move laterally like a crab. While Mercedes' electric G-Class has many similar features, the German version costs roughly twice as much.

AITO showcased the AITO 9 (known as M9 in China). This SUV comes equipped with a pull-down cinema screen and reclining leather seats, priced at roughly half the cost of German models.

'It impresses me with so many features,' said 23-year-old Parisian Maxim Fromont. 'If I were to buy a car to drive around, I might choose it.'

Chinese automakers' efforts to build brand recognition extend to elite events. Chery and MG, a subsidiary of SAIC Motor, joined brands like Aston Martin, Lamborghini, and Ferrari at this year's Goodwood Festival of Speed in the UK.

BYD's Yangwang brand participated in the Bicester Racing Festival, celebrating classic British luxury sedans and sports cars.

To advance its luxury ambitions, BYD has partnered with luxury dealers like the Netherlands' Louwman Group, which typically sells Mercedes-Benz and Lexus models. In the UK, BYD has teamed up with Inchcape, which also sells Land Rover, Jaguar, and BMW, and Vertu Motors, which sells Mercedes-Benz.

So far, the influence of Chinese brands has been limited. However, Lexus' experience shows that Europe's luxury market is not entirely closed off. Initially met with skepticism, the Japanese brand has carved out a niche, selling nearly 56,000 vehicles in the first nine months of this year, an increase of over a quarter.

'The European luxury car buyer still loves his or her three-pointed star (Mercedes),' said automotive analyst Michael Dunne. 'Western consumers don't seem to value the digital experience as much, at least not yet.'

Returning to the Paris Motor Show, Hongqi focused on showcasing elements of its traditional heritage, with custom styling and intricate ceramics evoking China's craftsmanship expertise.

In terms of vehicles, the main attraction was the Hongqi Guo Ya luxury sedan, featuring exquisite leather, textured wood, and chrome plating in its interior. The exterior is dominated by a slender front end topped with a winged hood ornament reminiscent of Rolls-Royce's famous Spirit of Ecstasy.

This similarity is no coincidence. Since 2018, former Rolls-Royce design director Giles Taylor has been working at Hongqi, leading the brand towards modern aesthetics aimed at attracting global luxury buyers.

NIO, Yangwang, and XPeng have hired former designers from BMW, Mercedes-Benz, and Ferrari.

'Success in the premium market is not just about selling flashy, expensive cars but having value propositions,' said XPeng Vice Chairman Brian Gu. XPeng's G9 SUV, priced at around €60,000, can be equipped with massage seats and a 22-speaker audio system.

'We can actually offer more convenience, comfort, safety, and features – at a more affordable price,' said Gu at the Paris Motor Show.

(Parts of this article are compiled from Automotive News and Bloomberg reports, with some images sourced from the internet)