The pressure of transformation has forced SAIC to bow down

![]() 10/31 2024

10/31 2024

![]() 442

442

Faced with the pressure of real transformation, even SAIC has to bow down. But in the end, straightening up the posture means a brand new start.

Body

Recently, an internal speech by SAIC Motor President Jia Jianxu has attracted widespread attention on the Internet.

A sentence that SAIC should "learn to kneel down and behave" has attracted countless netizens.

You know, SAIC is undoubtedly a giant in the domestic passenger car market, the auto group that has been the sales leader for eighteen consecutive years.

But why does it also take such a humble posture today?

If we zoom out and look down on SAIC Motor's real situation, we will find that in fact, today's SAIC is like a giant that is constantly being "cut up by a knife." Its inherent advantages are facing erosion, and new opportunities are difficult to grasp.

SAIC's market pressure comes from all directions, which is an important background for SAIC to lower its profile.

So, how is SAIC doing today? What kind of difficulties is it facing? Where is its way out?

Sales fell first

When looking at a car factory, first look at sales.

According to the latest data, SAIC sold 2.65 million vehicles in the first nine months of this year.

It sounds good, but looking at the trend, it's a bit disappointing. This sales figure is down 21.6% from the same period last year.

What's more regrettable is that while SAIC has entered a downward channel, some competitors, such as BYD, have continued to grow. In the first nine months of this year, BYD sold a total of 2.7479 million new vehicles, an increase of 32.13%.

Behind the increase and decrease is also a reflection of the changing automotive market.

What's even more alarming is that while sales are declining, SAIC's profit margin has fallen even more significantly.

The financial report shows that in the first half of this year, SAIC's net profit after deducting non-recurring items fell by more than 80%.

What does that mean? If you could earn 100 yuan last year, you can only earn 20 yuan this year.

Why is it suddenly not profitable anymore?

In fact, this is also a characteristic of the automotive industry, with a strong scale effect. When sales go up and scale increases, the marginal cost of production will decrease significantly, and profits will increase exponentially.

But if sales fall, various costs accumulate, which will also appear. This is the core reason behind it.

Therefore, although sales seem to have fallen by about 20%, a series of impacts have also emerged.

Profit is just a manifestation, and news of layoffs at SAIC has also begun to emerge.

Difficult to defend the core business

After seeing the panoramic view of SAIC, let's zoom in a little bit to look at the specific composition of SAIC's sales today.

A closer look reveals that for SAIC, the market performance of joint venture vehicles, at least today, dictates the company's operating conditions.

Joint venture brands like SAIC Volkswagen and SAIC GM, which are familiar to everyone, account for 70% of SAIC Motor's total sales.

It can be said that joint venture brands are the core business of SAIC Motor today.

This core business was once very stable. You know that brands like Audi, Volkswagen, and GM are renowned worldwide and are the first choice for many Chinese families when buying a car.

But. There's always a "but." In recent years, there has been a wave of new energy vehicles in China.

This wave, gathering momentum, has become a trend. A large number of domestic automotive brands have risen with this trend.

With excellent products, they are constantly eroding the market share that used to belong to joint venture vehicles.

There's no way. It's hard not to sway consumers with stronger power, lower maintenance costs, more convenient use, and more comfortable interiors.

From a broader perspective, it can be said that the dilemma faced by SAIC is a microcosm of the defeat of joint venture vehicles in the domestic market today.

In fact, this trend has not happened overnight.

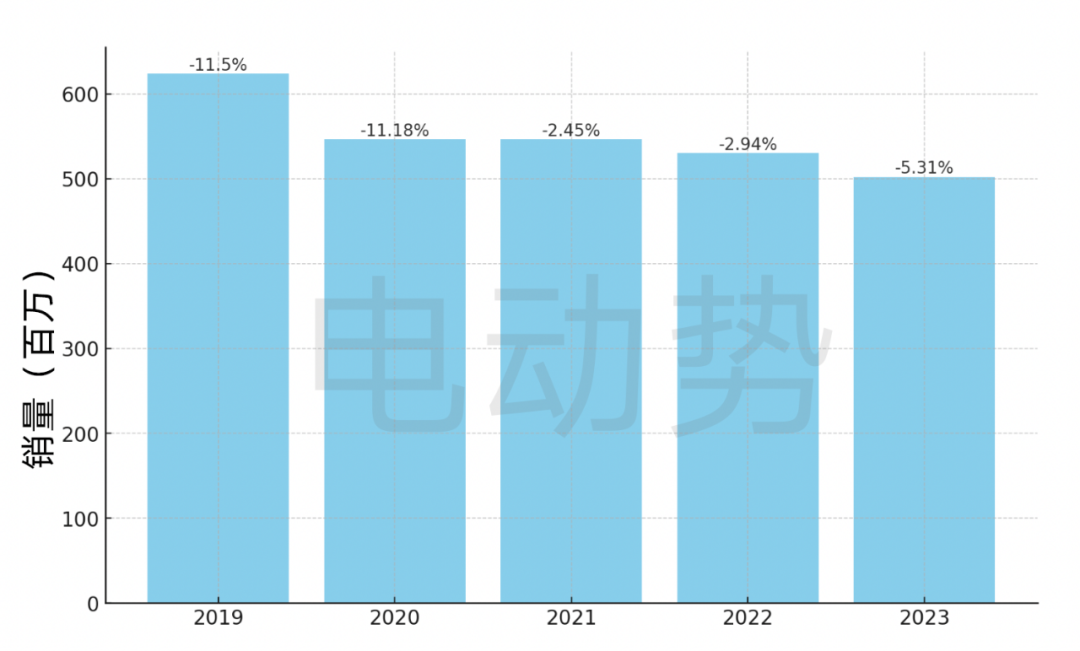

Judging from the data, this decline has lasted for at least five years.

From another perspective, SAIC has had a window of at least five years to stop the bleeding.

But obviously, SAIC did not seize the opportunity well.

Why is that?

One important reason is that SAIC is too successful.

Unfortunately, afflicted with big company disease

In fact, this is the case in many fields, where success often becomes a curse.

Because of too much success, the ability to continue innovating is lost.

After all, necessity is the mother of invention, and when life is too comfortable, how many people can anticipate change?

And as outsiders, it's easy for us to see some signs of "big company disease" at SAIC.

For example, the "infighting" between brands within SAIC.

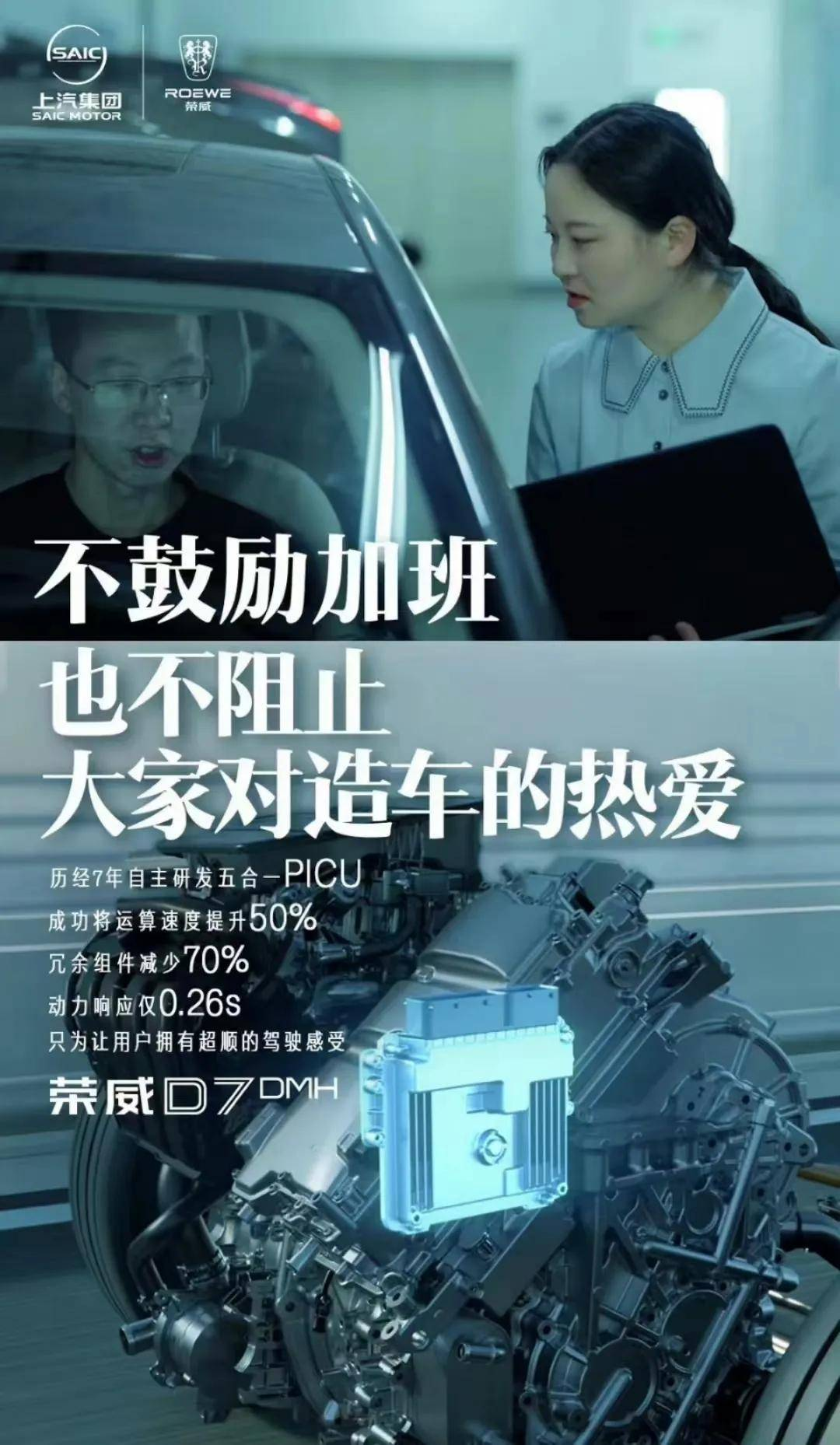

When IM Motors' propaganda of suffering triggered a deterioration in public opinion, it was surprising that Roewe was the first to jump out and mock it publicly.

This is still at the marketing level, but there are also examples at the strategic level.

For example, as pure electric brands, IM Motors and ROEWE have been constantly fighting since their inception due to overlapping positioning and products.

During this period, in order to deal with this kind of brotherly erosion, Jia Jianxu, the head of SAIC, even publicly criticized Lingshu Technology CEO, saying, "You start deceiving your brothers, harming your brothers, deceiving passenger cars, and deceiving IM Motors in the name of profit center."

These signs indicate that there is still a lack of a benign system mechanism between various departments within SAIC, so that the taste of competition is almost tinged with a hint of bloodshed.

This phenomenon of left and right hands fighting each other is obviously not conducive to the allocation of SAIC's resources.

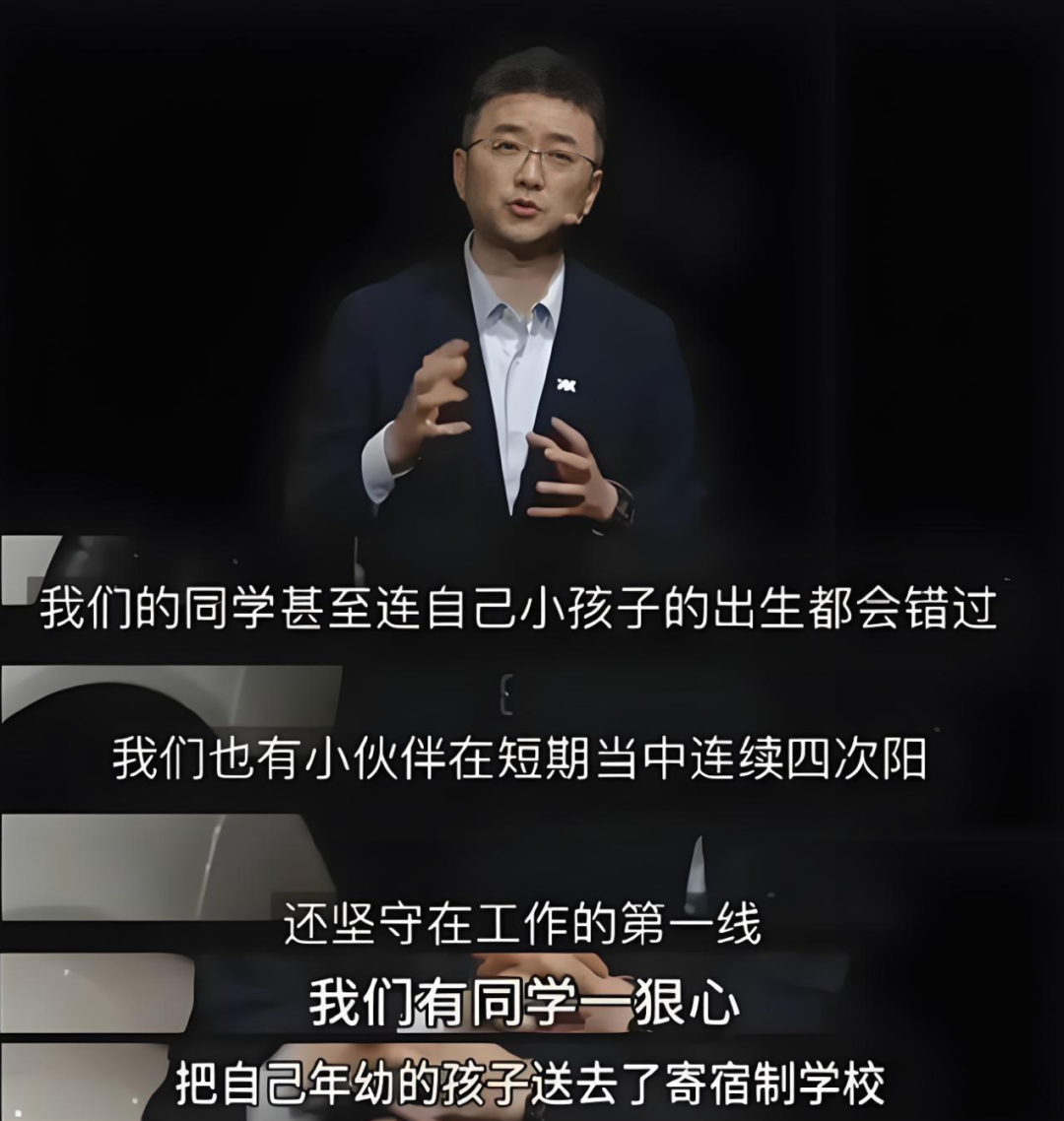

More importantly, compared to new forces brands where the founders work tirelessly, corruption cases have frequently emerged among SAIC's management.

For example, this month, Chen Demei, the former vice president of SAIC, was arrested on suspicion of bribery and illegally profiting for relatives and friends, and in the previous three years, SAIC Motor investigated and dealt with four senior executives due to dereliction of duty and corruption.

Senior executives are only thinking about making money, subordinate companies are fight the enemy separately , and the group lacks the will to innovate.

Let's just say it.

Does such a company resemble some typical large companies?

New energy business still needs improvement

As for new energy, it is a must-answer question for SAIC today, as well as for all automakers who want to continue to maintain their market share in China.

In fact, if we look at sales figures, SAIC's answer is not bad.

After all, its Wuling Hongguang MINI EV has been consistently ranked high on the sales charts, easily selling tens of thousands of units per month.

But unfortunately, the profits from this business are not particularly ideal. The strategy of trading profits for market share is not enough to support SAIC's new energy dream.

In 2020, SAIC also launched two independent pure electric brands, ROEWE and IM Motors.

It's not too late, right? After all, Xiaomi didn't announce its plans to start making cars until 2021.

But comparing the final results, there is a huge difference.

Let's not talk about ROEWE, which was merged into the Roewe system this year due to strategic sales issues and is no longer developing independently.

What about IM Motors? It has some presence in the new energy field. But almost all of it is through negative publicity.

For example, in April, at the launch of the new IM Motors L6, the parameters of Xiaomi SU7 were mislabeled, prompting Xiaomi to issue three consecutive Weibo posts demanding that IM Motors publicly clarify and formally apologize. Then, due to its "misery-selling" marketing strategy, it was criticized by netizens for exploiting employees and glorifying suffering.

At the end of the farce, IM Motors even claimed to be under attack by water army.

In September, IM Motors again showcased its drifting skills at the LS6 launch event, but not only did it fail to consider safety issues, but it also accidentally drove into the cones in the center of the venue during the event.

Although being notorious can also bring attention, which consumer in their right mind would want to buy a brand full of controversy?

The result reflected in sales is that IM Motors sold about 44,000 vehicles from January to September.

For comparison, Tesla sold 72,000 vehicles in September alone.

Well, let's just say that the sales are indeed weak.

So. Seeing this, I wonder if you understand why President Jia suddenly said that SAIC should learn to kneel down and behave.

Faced with the pressure of real transformation, even SAIC has to bow down.

But after all, straightening up the posture means a brand new start.

We look forward to seeing a brand new SAIC in the near future.