Volkswagen also runs out of surpluses, with a 60% plunge in net profit and a 10% pay cut for all employees, labor-management conflicts are imminent

![]() 11/01 2024

11/01 2024

![]() 693

693

Rejecting the union's demand for a 7% pay rise

Author | Wang Lei, Liu Yajie

The shoe has dropped, and Volkswagen is demanding at least a 10% pay cut for employees.

"This is the only way to preserve jobs and maintain competitiveness amidst the lowest profits in three years and union threats of strikes."

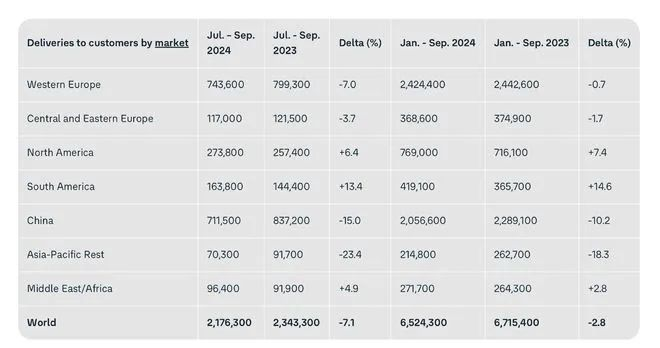

Volkswagen's third-quarter financial report shows that it delivered 2.176 million vehicles during the same period, a year-on-year decrease of 7.1%, with sales revenue reaching 78.478 billion euros in the third quarter, a slight year-on-year decrease of 0.5%.

The hardest hit is profit. Third-quarter profit was 2.855 billion euros, a year-on-year decrease of 41.7%; after-tax profit in the third quarter fell by more than 60%. This is Volkswagen's lowest level in three years.

According to the financial report, the entire Asia-Pacific region, especially the Chinese market, lagged behind. From January to September, Volkswagen delivered 2.056 million passenger cars in the Chinese market, a year-on-year decrease of 10.1%.

Even Europe's largest automaker has run out of surpluses, and the situation may worsen.

01 Pay cuts of 10%, plant closure plans, and worker strikes

"No one is safe!"

On October 28 local time, Daniela Cavallo, chair of Volkswagen's works council in Germany, said at an employee event held at Volkswagen's headquarters in Wolfsburg that management plans to close at least three domestic factories in Germany, lay off tens of thousands of employees, and downsize other factories. Employees at factories not closed will also face pay cuts.

If the plan is implemented, it will be the first time Volkswagen closes a domestic factory in its 87-year history. This series of measures will help Volkswagen save 4 billion euros (about 30.9 billion yuan).

Currently, Volkswagen has about 120,000 employees in its German factories, about half of whom work in Wolfsburg. Volkswagen has 10 factories in Germany, six in Lower Saxony, three in Saxony, and one in Hesse.

The works council stated that it is unclear which specific factories will be closed. However, the factory in Osnabrück, Lower Saxony, is considered "particularly at risk" as it has just lost an order from Porsche, a subsidiary of the Volkswagen Group.

In fact, Volkswagen's wave of layoffs and pay cuts has been ongoing for a long time.

In early September, Volkswagen announced the end of a 30-year-old employment protection agreement that promised no layoffs until the end of 2029. With the agreement terminated, Volkswagen can begin layoffs from mid-2025.

In the past two months, Volkswagen and the works council have been trying to resolve potential factory closures and layoffs through negotiations, but with little success. To protest the closure of German factories, workers also participated in a strike rally on October 28 local time.

In Wolfsburg, where the company's headquarters is located, thousands of people gathered, blowing horns and whistles, claiming that the company should not close any factories.

Union members said workers are being forced to pay for the wrong decisions made by Volkswagen Group's board of directors, including the company's failed transition to electric vehicles and improper pricing policies.

However, Thomas Schaefer, head of Volkswagen's brand department, responded that productivity in German factories is too low, with operating costs 25%-50% higher than target costs, meaning that some factories' costs are twice that of competitors.

Coupled with the decline of the German manufacturing industry, weakening overseas demand, and more competitors entering the European market, Volkswagen will find it difficult to fund future investments without comprehensive measures.

Therefore, Volkswagen directly rejected the union's demand for a 7% pay rise and plans to cut employee salaries by at least 10%, with no pay rises in 2025 and 2026.

From the employees' perspective, however, the economic situation is sluggish, inflation in Germany remains high, and the cost of living has increased, making it harder to accept pay cuts and layoffs.

To make a living, Porsche employees have also joined the wave of strike actions demanding higher wages. IG Metall's Stuttgart branch stated that at 2 am on October 29 local time, employees at Porsche's Stuttgart auto plant planned to join workers from Germany's electrical engineering and metalworking industries in a strike to pressure employers for pay rises.

To date, negotiations between the Volkswagen Group and the union have yielded no results. The next round of negotiations is scheduled for November 21, and if they fail again, the union has announced a warning strike on December 1.

02 Is Germany's status as an automotive powerhouse also at risk?

Volkswagen Group is forced to take the drastic steps of closing factories and laying off employees due to immense internal profit pressure, as evidenced by its recently released third-quarter financial report.

The third quarter of this year has been Volkswagen Group's least profitable quarter in recent years. Moreover, in the first nine months of this year, the operating profit margin of Volkswagen Group's core brand, Volkswagen, has plummeted to just 2.1%.

What does this number mean? According to Arno Antlitz, Chief Financial Officer of Volkswagen Group, "Although the Volkswagen brand has traditionally had low profit margins, unlike in the past, the profits it generates today are insufficient to cover the costs of developing all its new products."

Specifically, Volkswagen Group's total revenue for the third quarter was 78.48 billion euros, equivalent to approximately 605.572 billion yuan. Although this figure decreased slightly by 0.5% year-on-year, operating profit saw a cliff-like drop.

Operating profit fell 42% year-on-year to just 2.86 billion euros, equivalent to about 22 billion yuan, and its after-tax net profit was only 1.576 billion euros (about 12.16 billion yuan), a year-on-year plunge of 63.7%, representing Volkswagen Group's worst performance in over three years.

Volkswagen attributed this to high costs due to restructuring plans and declining auto sales.

Sales were also weak, with Volkswagen's global sales in the third quarter falling 7.1% year-on-year to 2.176 million vehicles. Sales of battery electric vehicles (BEVs) in the third quarter were 189,000, a year-on-year decrease of 9.8%.

China's sales performance was the main reason for Volkswagen's overall sluggish sales. As Volkswagen's largest single market globally, China previously contributed 40% of Volkswagen's global market share during its peak period. Now, Volkswagen's share of the new car market in China has dropped to less than 20%.

In the third quarter, Volkswagen sold 711,500 vehicles in China. Although sales of pure electric vehicles increased by 5.2% year-on-year, overall sales still fell by 15% year-on-year.

Extending the profitability performance to the first nine months of this year, it is also not optimistic. Although Volkswagen Group's total revenue increased from 235.102 billion euros in the same period last year to 237.279 billion euros this year, operating profit plummeted from 16.241 billion euros in the same period last year to 12.907 billion euros, and the group's operating profit margin shrank from 7.0% in the same period last year to 5.4% this year.

Based on such financial performance, Volkswagen Group has twice revised its annual performance forecast in less than three months. It has lowered its full-year 2024 revenue forecast to 320 billion euros (about 2.47 trillion yuan), 0.7% lower than last year.

This means that if Volkswagen does not take aggressive cost-cutting measures, the world's second-largest automaker will enter an even more severe vicious cycle.

At the same time, facing Germany's high energy prices and labor costs, Volkswagen's production costs continue to rise, and profit margins are constantly compressed. Shutting down factories producing high-cost cars is obviously the most significant cost-cutting method.

Michael Dean, an analyst at Bloomberg Intelligence, stated in a report that by closing factories, Volkswagen Group expects to save 2.5 billion euros annually.

As a symbol of the German automotive industry, Volkswagen's plight in its electrification transition also more concretely reflects the current state of the German automotive industry. During the transition from "oil" to "electricity," Germany finds itself in a dilemma where "a big ship is hard to turn around."

One of the most intuitive manifestations is that not only Volkswagen but also local automotive supply chain enterprises in Germany are experiencing an unprecedented wave of closures and layoffs. Since 2024, as many as 20 auto parts suppliers have been forced to file for bankruptcy protection, a 60% increase from the same period last year. Those industry giants that have not gone bankrupt are also struggling to survive.

Moreover, according to the latest research published by the German Association of the Automotive Industry (VDA), the transition of the German automotive industry could lead to the loss of up to 186,000 jobs by 2035.

From 2019 to 2023 alone, 46,000 jobs have disappeared, mainly due to the impact of the transition to electric vehicles.

From the mass bankruptcies of auto parts suppliers to the aggressive downsizing of auto giants, Germany's automotive industry is at a crossroads.

Porsche's Vice President Meschke even warned that the end of the internal combustion engine could turn Germany into a poor country.