Ideal accelerates overseas market expansion! First stop in the Middle East, can it really attract oil-rich tycoons?

![]() 11/01 2024

11/01 2024

![]() 657

657

With the wave of new energy development sweeping in, domestic auto market competition has reached a white-hot stage, and overseas expansion seems to be a necessary step for automakers.

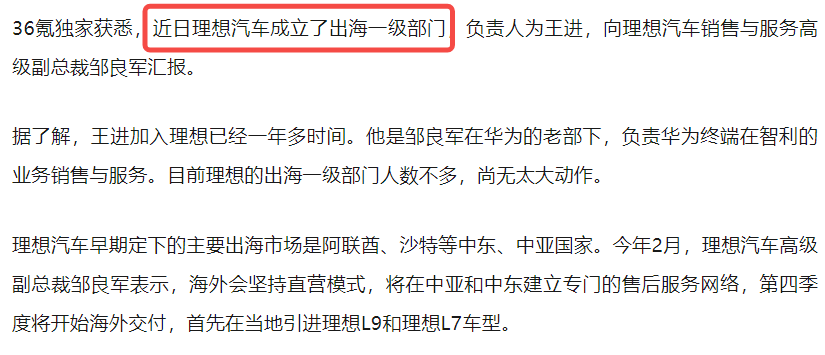

According to 36Kr, Ideal Auto has established an overseas expansion department and will take the lead in establishing a dedicated after-sales service network in the Middle East, Central Asia, and other countries and regions such as the United Arab Emirates and Saudi Arabia. It plans to start overseas deliveries in the fourth quarter, with the Ideal L9 and Ideal L7 becoming the first models introduced to the region.

Image source: 36Kr

Li Xiang, the founder of Ideal Auto, posted on social media, "We will not enter the overseas market before 2025 and will concentrate all resources to achieve our 2025 goals." E-Auto is not saying that Li Xiang has broken his promise; there are still two months left until the end of 2024, and Ideal Auto's establishment of a first-level department is clearly to prepare for next year's overseas expansion plan.

Previously, overseas users who wanted to purchase Ideal Auto vehicles mainly relied on unofficial channels or authorized dealers for parallel import trade, but the prices were significantly higher. The Ideal L9, which sells for 510,000 yuan in the domestic market, can be purchased for nearly 700,000 yuan abroad. Considering the need to increase brand awareness, Ideal Auto's overseas marketing approach will still be direct sales, and it has already planned to recruit dealer partners in overseas local markets.

Image source: E-Auto Photography

It is worth noting that Ideal Auto's first step in overseas expansion is in the Middle East, Latin America, and other countries and regions, which is completely different from other emerging brands such as NIO, XPeng, and LEOPARD that focus on the European market. What considerations are behind this decision?

Is Ideal Auto at risk of not adapting to the local environment with its first stop in the Middle East market?

The first stops for NIO, XPeng, LEOPARD, and other emerging brands expanding overseas are basically European markets. The reason is simple: Many European governments have introduced a number of new energy incentives in the early stages, such as subsidies, facility construction, tax incentives, and more, holding an open attitude towards new energy products. It is the region with the highest penetration rate of new energy vehicles after the domestic market.

However, as everyone knows, although the European Union is more open to new energy vehicles than the Americas, it has roughly imposed high tariffs on Chinese cars. Recently, it also decided to impose a five-year final countervailing duty on pure electric vehicles imported from China. Exploring other overseas markets has become a new path for new energy brands.

Image source: NIO

Among them, NIO announced its Norway strategy as early as May 2021 and announced in October 2022 that its NIO ET7 and NIO EL7 models would be available in Germany, the Netherlands, and other countries through a "subscription model." In June 2024, NIO announced a new round of organizational restructuring for its global business, involving new departments that will cover the Middle East, North Africa, Latin America, Oceania, and other regions.

XPeng's path to overseas expansion is similar to NIO's. In 2020, it took the lead in exporting the XPeng G3 to Norway and launched a "direct sales + authorized" overseas expansion model in 2022. However, this year, XPeng also announced a strategic relationship with the UAE dealer group Ali&Sons, five local dealer groups in the Middle East and Africa, and a dealer group in Thailand, without putting all its eggs in the European market basket.

LEOPARD's overseas expansion path is relatively late, with the announcement of its globalization strategy only at last year's Munich Auto Show. However, LEOPARD has established a global strategic partnership with the European company Stellantis Group to form a joint venture called "LEOPARD International." Compared to NIO and XPeng, LEOPARD is less affected by the increased tariffs. Therefore, LEOPARD's current overseas expansion efforts are still concentrated in the European market but also include layouts in other regions such as Turkey, Australia, Brazil, and more.

Image source: Tesla

Even though the European market has a relatively open attitude towards new energy, it is not conducive to the current development of Ideal Auto. In addition to external factors such as the EU's imposition of high tariffs, there is not a high demand for large SUVs like the Ideal L series in the European market.

Data shows that the more popular products in the European new energy market are mainstream segment products such as the Model Y, Volkswagen ID.4, and Volvo XC40. The next popular products are smaller models such as the Fiat 500e, Ford Kuga PHEV, Volkswagen ID.3, and Peugeot 208 EV. There is not much interest in the Ideal L series, which are often medium to large SUVs.

Image source: Ideal Auto

The Middle East is rich in oil resources and has low demand for new energy. However, there are no absurdly high tariffs (at least for now). Ideal Auto's built-in configuration and technological advantages are indeed unattainable by other products of the same level. Moreover, most countries in the Middle East encourage "having more children," which is indeed an opportunity for Ideal Auto, which mainly targets the household market.

At the same time, Ideal Auto mainly focuses on extended-range vehicles, which are essentially still gasoline-powered vehicles. This is more attractive to users in the oil-rich Middle East. From this perspective, it makes sense for Ideal Auto to aim its first stop in overseas expansion at the Middle East market.

Are BBA no longer viable? Chinese brands are increasingly important on the world stage

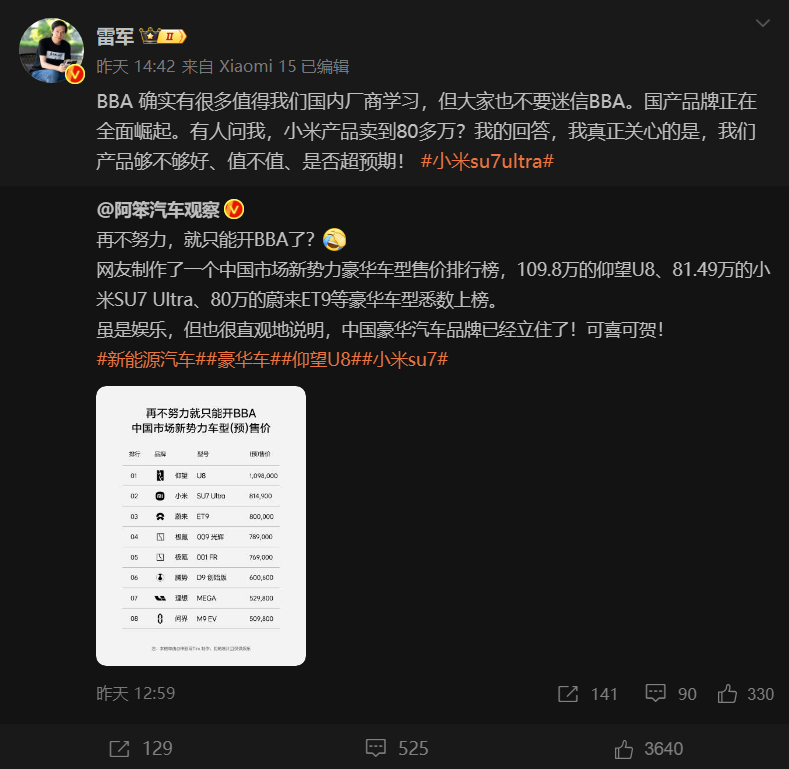

Unlike BBA, Chinese brands started later. Apart from Chery, MG, and other brands, the global recognition and acceptance of other Chinese brands are not particularly high. However, Chinese brands are striving to change this situation. The 1.098 million yuan Yangwang U8, the 814,900 yuan (pre-sale price) Xiaomi SU7 Ultra, the over 700,000 yuan NIO ET9, the Zeekr 01 FR, and more are all indicative of the rapid progress of Chinese cars.

Lei Jun posted on social media, "BBA does have many things worth learning from for domestic manufacturers, but everyone should not be blindly faithful to BBA. Chinese brands are rising comprehensively."

Weibo screenshot: @Lei Jun

Let's focus on the domestic market for now. In September, the market share of Chinese brands reached 63%, an increase of 10.1% from the same period last year. In the passenger car sales rankings, six of the top ten automakers were Chinese brands, showing that Chinese brands have gained recognition from many Chinese consumers.

If I had to use one word to summarize the reason for the successful rise of Chinese brands, E-Auto believes it is comprehensive strength.

In 2020, emerging brands experienced an explosion. Consumers at the time had doubts about these newly launched automotive brands. In the following one or two years, most emerging brands went out of business due to issues such as capital chain disruptions. This convinced more consumers that for bulk consumer goods like cars, they still had to choose traditional manufacturers. Many people even believed that "overseas brand models are better."

However, after several years of in-depth development, traditional and emerging brands have indeed shown sincerity to consumers. Traditional brands, led by BYD, rely on their excellent cost control abilities to launch domestic new energy vehicles with lower prices and richer configurations than competitors. Emerging brands like Ideal Auto and NIO have reached a new level in high-end luxury and comfort, with zero-gravity seats and game-playing cabins that have never been seen in previous luxury models. XPeng and HarmonyOS Intelligent Driving have even brought intelligent driving to a globally leading level, achieving high-level intelligent driving in all scenarios without maps.

Image source: E-Auto Photography

Faced with this situation, joint venture brands have to resort to price cuts to maintain their sales figures, but they seem unable to produce truly competitive products in the new energy market.

Now, let's expand our vision to the global market. The European market has already recognized the strength of Chinese brand models, which is why it uses policy measures to impose high tariffs on Chinese brands. However, in the view of E-Auto, such measures seem to aim to protect the development of local brands but lack strong competitors and cannot positively promote the development of the automotive market. It would be better to find ways to force enterprises to learn from Chinese brand new energy vehicle technologies.

Only by genuinely engaging in technology can one know one's shortcomings and advantages. If a product is not popular, is it because of the product itself or marketing issues? Automakers can learn from each other's strengths and compensate for their weaknesses. Under the premise of increased tariffs, the prices of Chinese brand models may rise, resulting in the loss of many audience groups. However, this will also deprive European local enterprises of many opportunities to learn from their competitors.

The overseas expansion of Chinese new energy vehicles: a long but brilliant road ahead

Overseas expansion is one of the important measures for Chinese brands to increase their visibility and revenue. It is naturally everyone's expectation for brands to succeed in overseas expansion, but the global recognition of Chinese new energy vehicles is not as high as imagined.

Apart from BYD and Tesla China, the export volume of new energy vehicles from other automakers in the third quarter was less than 20,000 units. Even for brands like SAIC Motor and Chery, which already have high recognition for their gasoline vehicles, the export volume in the third quarter was only 17,000 and 13,100 units, respectively. For brands with lower global visibility, such as Great Wall, XPeng, and Geely, the export volume of new energy vehicles in the third quarter was also less than 10,000 units.

Image source: BYD Auto

BYD, which transformed earlier, and Tesla, which has higher visibility, have far exceeded other brands in export volume. Other brands still have not blossomed in the global new energy field.

Great Wall Motor closed its European headquarters in Munich, Germany, on August 31. The company stated that due to the increasingly difficult European electric vehicle market and the gradually increasing high tariffs, Great Wall Motor promptly adjusted its strategic layout and will not open up new markets in Europe for the time being. In the view of E-Auto, Great Wall's move is obviously for the overall situation. Developing in an unfavorable environment may ultimately lead to a lose-lose situation for both parties.

If there is no certainty of achieving at least one of the two goals of increasing visibility and revenue, E-Auto believes that automakers should be as conservative as possible.

(Cover image source: Ideal Auto)

Source: Leitech