239.8% surge! JAC Motors, a turnaround in performance

![]() 11/01 2024

11/01 2024

![]() 471

471

Recently, JAC Motors has been "eye-catching".

After entering October, JAC Motors continued to fluctuate upwards. As of the latest closing, JAC Motors' market value has exceeded 75 billion yuan.

The sudden surge in this round of share prices began with the cooperation with Huawei. On July 16, Yu Chengdong, Executive Director of Huawei, announced in a live broadcast that the brand name of the cooperation between Huawei and JAC Motors is "ZunJie". After the official announcement of the cooperation, its share price accelerated, rising by 6.33% and 4.52% on July 16 and July 17, respectively, and the uptrend has continued to this day.

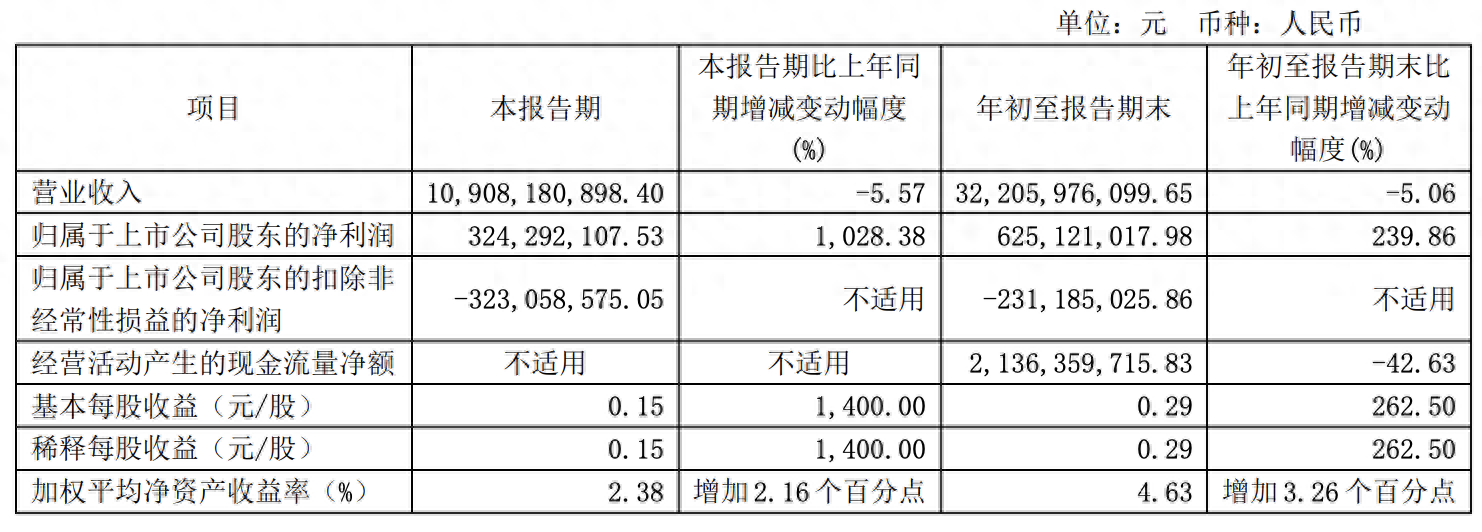

Of course, in addition to the support of the "HarmonyOS Smart Travel" concept, JAC Motors' performance has also improved. On the evening of October 29, JAC Motors disclosed its third-quarter report. The financial report showed that the company achieved operating revenue of 32.206 billion yuan in the first three quarters, a year-on-year decrease of 5.06%; net profit was 625 million yuan, a year-on-year increase of 239.86%. Among them, the net profit in the third quarter was 324 million yuan, a year-on-year increase of 1028.38%.

During the reporting period, the company continued to optimize its product and debt structures, actively explored domestic and international markets, and achieved increased exchange gains and reduced financial expenses; asset disposal income increased significantly.

Surge in performance

In fact, we can see from the financial report data whether the fundamentals of JAC Motors have "reversed".

The financial report showed that the company achieved operating revenue of 32.206 billion yuan in the first three quarters, a year-on-year decrease of 5.06%; net profit was 625 million yuan, a year-on-year increase of 239.86%.

Although net profit increased significantly year-on-year, this was mainly due to the optimization of the financial structure, especially in terms of government subsidies.

According to media statistics, in the first half of 2024, JAC Motors' non-recurring profit and loss items totaled 209 million yuan. Non-current asset disposals and government subsidies became the main sources of JAC Motors' turnaround in net non-recurring profit, with amounts reaching 27.1926 million yuan and 152 million yuan, respectively; in the third quarter, JAC Motors and its subsidiaries received a total of 19.9077 million yuan in government subsidies related to earnings.

According to statistics, from 2021 to 2023, JAC Motors achieved "non-recurring profit and loss" of 2.084 billion yuan, 1.212 billion yuan, and 1.869 billion yuan, respectively, with government subsidies included in current profit and loss reaching 2.005 billion yuan, 1.205 billion yuan, and 1.341 billion yuan, respectively. In this context, except for 2022, JAC Motors' net profit has maintained positive growth in recent years.

However, excluding "non-recurring profit and loss," JAC Motors' performance is not as impressive. In terms of net non-recurring profit, JAC Motors incurred a loss of 231 million yuan in the first three quarters. Although the situation has improved, it is still in a loss state. According to statistics, JAC Motors' net non-recurring profit has been in a loss state since 2017, with net non-recurring profit losses of 1.718 billion yuan, 2.795 billion yuan, and 1.884 billion yuan in the past three years, totaling over 6 billion yuan in losses over three years.

If we look at sales, which better reflect the true operating conditions, JAC Motors' prospects are not optimistic. As an automotive giant, JAC Motors' business covers both commercial vehicles and passenger cars, and both segments have experienced declines of varying degrees.

Taking September as an example, in the commercial vehicle segment, sales of "light and medium trucks, heavy trucks, and buses" among the five major models all declined by double digits year-on-year, with sales of 8742, 1054, and 292 units, respectively, down 21.86%, 11.13%, and 26.26% year-on-year, respectively. Sales of pickup trucks and multi-purpose commercial vehicles increased year-on-year, with 7897 and 2103 units sold, up 63.60% and 58.96% year-on-year, respectively. Although sales of pickup trucks and multi-purpose commercial vehicles increased, the overall trend was still downward; looking at the passenger car segment, according to media statistics, JAC Motors' three models, SUVs, MPVs, and sedans, achieved cumulative sales of 65,330, 12,085, and 53,967 units, respectively, in the first nine months of this year, down 22.41%, 18.07%, and 9.05% year-on-year, respectively.

Can it break through?

Of course, the reason for the surge in JAC Motors' share price is not only due to its performance, but also significantly influenced by the support of the "HarmonyOS Smart Travel" concept.

As we mentioned at the beginning, this round of share price surge began with the cooperation with Huawei. On July 16, Yu Chengdong, Executive Director of Huawei, announced in a live broadcast that the brand name of the cooperation between Huawei and JAC Motors is "ZunJie". Before the official announcement of the cooperation, JAC Motors' share price had already fluctuated upwards; after the official announcement of the cooperation, its share price accelerated, rising by 6.33% and 4.52% on July 16 and July 17, respectively, and the uptrend has continued to this day.

There is a reason for the speculation in JAC Motors' shares, as evidenced by the successful case of Thalys before. Despite many setbacks after cooperating with Huawei, Thalys eventually successfully transformed from a minibus manufacturer to a new energy giant.

According to media reports, the AITO, AITO Smart, and Enjoy brands jointly created by Huawei with Thalys, Chery, and BAIC cover the SUV, sedan, and executive sedan markets, respectively, while the positioning of ZunJie will be more premium, with its first model targeting the ultra-luxury segment priced at the million-yuan level. It is undeniable that positioning in the high-end luxury segment gives JAC Motors greater imagination, but such a level of model cannot bring significant changes in sales to JAC Motors.

Currently, what JAC Motors needs is not a luxury model but for Huawei to empower its new energy vehicle models.

According to production and sales data, from January to September this year, JAC Motors' new energy vehicle production decreased by 26.04% compared to last year; sales increased slightly by 1.48%, but new energy vehicle sales in September were only 3044 units, down 15.93% year-on-year.