BYD Revenue Surpasses Tesla in a Single Quarter, but Market Value Still Trails

![]() 11/01 2024

11/01 2024

![]() 506

506

"If BYD continues to lead Tesla in revenue growth in the fourth quarter, it may catch up with Tesla in annual revenue, but surpassing Tesla in net profit remains challenging."

@TechNewKnowledge Original

BYD's quarterly revenue surpasses Tesla for the first time, but there is still a significant gap in profits and market value!

BYD's latest third-quarter financial report data shows that the company achieved revenue of 502.251 billion yuan in the first three quarters, with revenue reaching 201.125 billion yuan in the third quarter.

Thanks to BYD's sales growth in the third quarter, its quarterly revenue has successfully surpassed Tesla. Tesla's previously announced third-quarter revenue was $25.182 billion. Notably, BYD's gross profit margin also rebounded sequentially in the third quarter. BYD's gross profit margin reached 21.9% in the third quarter, with the automotive business gross profit margin rebounding to 25.6% sequentially.

The market generally believes that this year is undoubtedly a year of rapid development for BYD. Judging from share price performance, BYD's A-share price has increased by more than 50% year-to-date. In contrast, Tesla's share price performance this year has failed to meet expectations, making it one of the poorly performing large-cap U.S. stocks. However, from the perspectives of revenue and market value, Tesla still maintains a significant advantage, and BYD still needs to continue to strive.

01.

Market Value and Profit, Inferior to Tesla

BYD's third-quarter revenue was 201.125 billion yuan, a year-on-year increase of 24%. Its sales volume reached 1.1349 million vehicles, exceeding the market forecast of 1.1 million vehicles and setting a new quarterly sales record for the company. Tesla's previously disclosed third-quarter total revenue was $25.182 billion, equivalent to approximately 179.3 billion yuan, with a total delivery of 462,900 vehicles, the first year-on-year increase this year.

However, in terms of net profit and market value, the gap between BYD and Tesla remains significant. BYD's net profit attributable to shareholders for the third quarter was 11.607 billion yuan, a year-on-year increase of 11.47%. In comparison, the net profit attributable to shareholders in the same period last year increased by 82.16% year-on-year, indicating a slowdown in the growth rate of net profit attributable to shareholders. Tesla's net profit for the third quarter was $2.167 billion, equivalent to approximately 15.4 billion yuan.

The reason Tesla can achieve such high profits lies in its continuous technological breakthroughs and low vehicle manufacturing costs. If BYD maintains a higher revenue growth rate than Tesla in the fourth quarter, it may have an opportunity to catch up with or even surpass Tesla in annual revenue. In terms of net profit, surpassing Tesla still faces enormous challenges.

As of the close of trading on October 31, Beijing time, BYD's current market value was 853 billion yuan, while Tesla's market value was $826.7 billion. BYD's market value is less than one-sixth of Tesla's. Based on the latest net profit figures, BYD's price-to-earnings ratio (TTM) is 25 times, while Tesla's exceeds 70 times. This is also the reason for the excessive gap in market value between Tesla and BYD.

According to China Business News, Fu Wenhao, a researcher at Cheese Fund, believes that the significant difference in valuation between Tesla and BYD is due to the relatively lower risk appetite in the domestic market compared to the U.S. stock market on the one hand, and Tesla's more pronounced advantages in globalization and intelligent driving research and development on the other.

With the rapid growth of BYD's high-end models and overseas sales models, it is expected to drive the improvement of BYD's overall profitability. Wall Street analysts believe that BYD still needs a compelling overseas growth story to stimulate its share price to reach new highs. Analysts such as Tim Hsiao of Morgan Stanley wrote in a report that investors are expected to gradually shift their focus to BYD's high-end brands and overseas sales to observe whether they can recover and drive sales and profit growth in the fourth quarter.

02.

Going Abroad and Pursuing High-End to Seek New Growth

According to the industry perspective cited by Securities Times, the Chinese automobile market has ended the era of rapid growth and entered an era of stock. Faced with this background, going abroad may become an important path for new energy vehicle companies to seek new growth points.

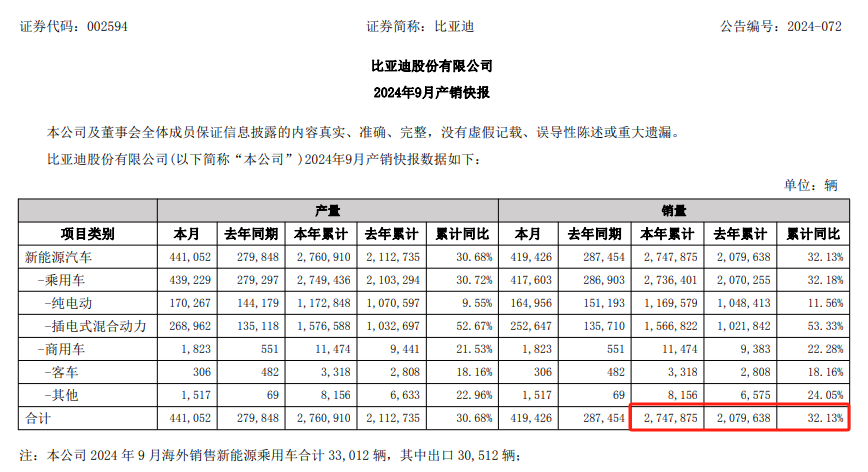

In the first nine months of this year, BYD sold a total of 2.7479 million new energy vehicles, a year-on-year increase of 32.13%. BYD's annual sales target for this year is 3.6 million vehicles. In the first nine months of this year, 76.33% of the annual sales target has been achieved. In the fourth quarter, an average of 284,000 new vehicles need to be sold each month. Based on BYD's current sales situation, this is relatively easy to achieve.

In overseas markets, BYD exported 298,000 new energy passenger vehicles in the first nine months of 2024, a year-on-year increase of 100%. To date, BYD has entered 96 countries and regions worldwide and invested in the construction of new energy passenger vehicle factories in Uzbekistan, Thailand, Brazil, and Hungary. Caitong Securities predicts that BYD's export sales will reach 400,000 to 450,000 vehicles within the year. Currently, there is still a certain gap from this expectation.

In addition, BYD's high-end brands have sold a cumulative total of 127,000 vehicles, a year-on-year increase of 37.4%, accounting for 4.6% of total sales. The proportion of high-end sales is still not high. Taking September as an example, the combined sales of BYD's high-end brands, FANGCHENGBAO, DENZA, and NIO, were still less than 20,000 vehicles.

At the end of July this year, to increase sales, BYD implemented a price reduction strategy for the FANGCHENGBAO 5, with a reduction of up to 50,000 yuan. The price was lowered from the 300,000 yuan range to the 250,000 yuan range, which may have a certain negative impact on FANGCHENGBAO's assault on the mid-to-high-end market. BYD's price reduction also caused dissatisfaction among many users. According to statistics from Chezhinet, the number of complaints about FANGCHENGBAO ranked first on the July automotive complaint list.

Tesla and BYD are undoubtedly the two largest automakers in China and even globally, with significant influence in the global electric vehicle market. Nowadays, as competition in the new energy vehicle industry intensifies, BYD still needs to make more efforts to shorten or even equalize the gap with Tesla.