Annual sales targets have been successively lowered, and Li Auto first awarded its CEO a 600 million yuan incentive

![]() 11/01 2024

11/01 2024

![]() 463

463

Li Xiang will receive a total of 635 million yuan in equity incentives this year.

Author|Zhang Wen

Editor|Wang Bin

Cover|Unsplash

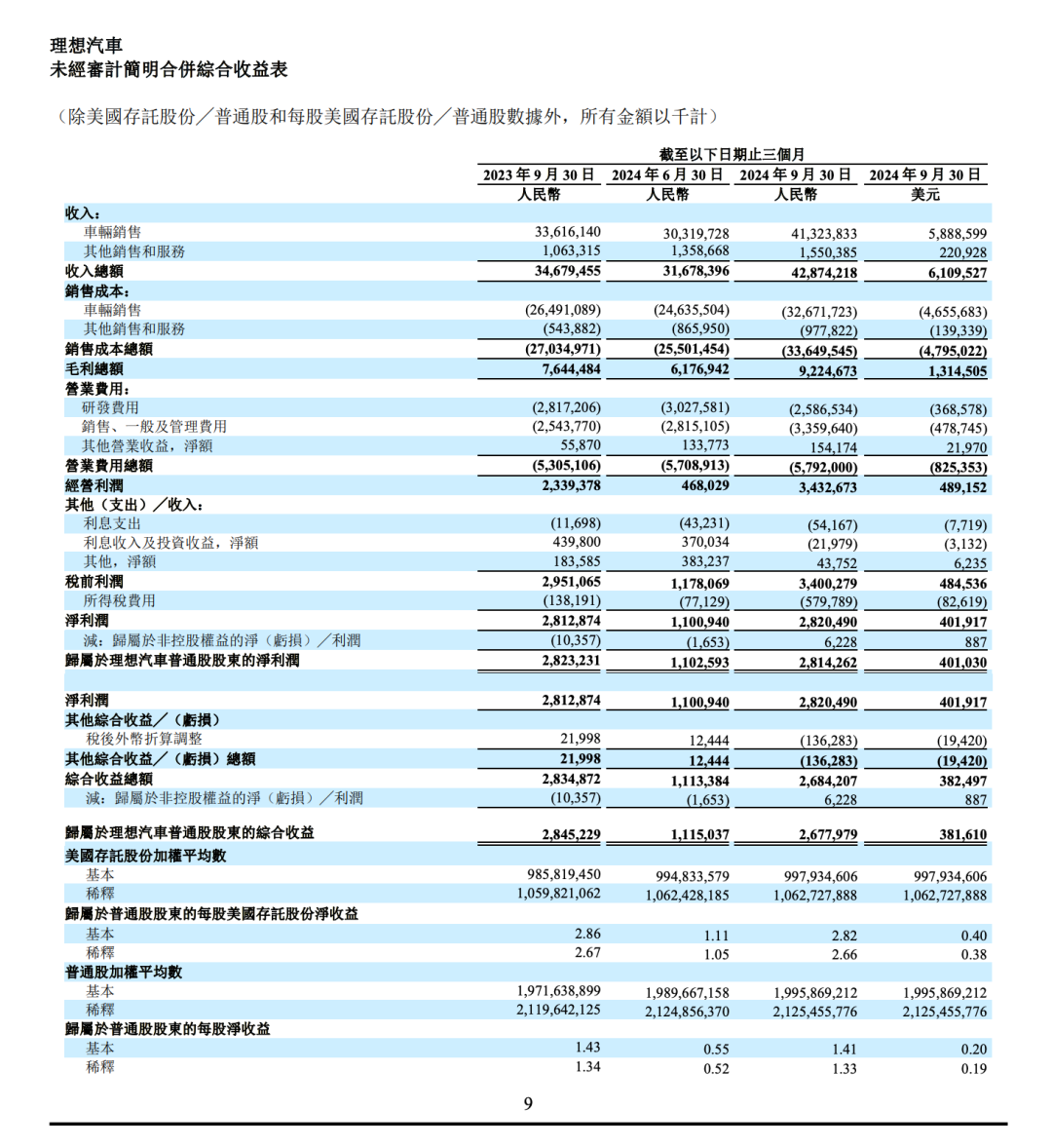

In the third quarter, 48,000 more vehicles were sold compared to the previous year, revenue increased by 23.6% year-on-year, and the gross margin of vehicles increased from 18.7% in the previous quarter to 20.9% - Li Auto still delivered a performance that exceeded market expectations.

However, similar to past quarters, after the financial report was released, Li Auto's share price fell sharply again. Last night (October 31), Li Auto's U.S. stock price fell by 13.58%. Today, at the opening of Hong Kong stocks, Li Auto's share price plummeted by over 9%. When the second-quarter report was released in August, Li Auto's U.S. stock price also fell by over 16%.

Market analysis attributes the share price decline to management's conservative guidance for the fourth quarter. Li Auto's sales guidance for the fourth quarter is 160,000 to 170,000 units, with year-on-year growth rate even lower than that of the third quarter, and the average selling price per vehicle will further decline.

Adding the vehicles delivered in the first three quarters, Li Auto's overall sales for this year will reach 500,000 to 510,000 units, basically in line with the adjusted annual sales target of over 500,000 units announced by management during the second-quarter financial report meeting. Over the past year, Li Auto's annual sales targets have been revised downward multiple times, with earlier targets being 800,000 units and 560,000 to 640,000 units, respectively.

However, the fourth quarter has not yet ended, and Li Auto has already urgently awarded its CEO a 593 million yuan equity incentive. This is an equity incentive plan for the CEO set by Li Auto in March 2021, divided into 6 phases. The first phase of equity incentives will be issued when Li Auto achieves consecutive monthly deliveries of over 500,000 units for 12 months.

Li Tie, CFO of Li Auto, explained during the earnings call that the company expects the cumulative deliveries of the first three quarters to meet the performance conditions for the first batch of equity incentives in the fourth quarter, namely, consecutive monthly deliveries of over 50 units for 12 months. Therefore, the company recognized an equity incentive expense of 593 million yuan in the third quarter, with an additional 42 million yuan expected in the fourth quarter.

Reflecting on the financial report, Li Auto's selling, general, and administrative expenses in the quarter surged by 32.1% year-on-year to 3.4 billion yuan. Coupled with factors such as a 21.98 million yuan investment loss in this quarter, Li Auto's net profit in the quarter only increased by 0.3% year-on-year. In the past two years, Li Auto has had positive investment income every quarter, especially in the first quarter of this year, when investment and interest income alone amounted to 1.069 billion yuan.

Excluding these factors, Li Auto's non-GAAP net profit for the quarter was 3.9 billion yuan, an increase of 11.1% year-on-year.

01 | Conservative Sales Guidance

Li Auto's third quarter was still impressive. During the quarter, Li Auto delivered a total of 152,831 vehicles, a year-on-year increase of 45.4%, driving a year-on-year increase in revenue of 23.6% to 42.9 billion yuan, a record high. In particular, the gross margin of vehicles increased from 18.7% in the previous quarter to 20.9%, not only exceeding the company's previous guidance but also significantly higher than the market expectation of 20.2%.

Li Auto was also cautious with its cost expenditures in the quarter, with operating expenses of 5.8 billion yuan, a year-on-year increase of only 9.2% and a quarter-on-quarter increase of only 1.5%. Research and development expenses were significantly reduced to 2.6 billion yuan, a year-on-year decrease of 8.2% and a quarter-on-quarter decrease of 14.6%. Li Auto explained that the decrease in R&D expenses was mainly due to the reduction in design and R&D costs for new products and technologies, and their layoffs in the first half of the year also helped reduce part of the salary expenses.

Li Auto 2024 Q3 Financial Report

However, management's conservative sales forecast for the fourth quarter has caused market confusion, and Li Auto's share price plummeted straight after the financial report was released.

During the earnings call, analysts were also particularly concerned about this issue. An analyst from Goldman Sachs pointed out that Li Auto's fourth-quarter sales guidance is only 10,000 to 20,000 units higher than that of the third quarter, while it was nearly 30,000 units higher in the fourth quarter of last year. With one more model this year, why is the overall sales guidance so conservative? Has there been an adjustment to this year's sales policy, and will there not be significant subsidies like last year?

Li Auto's management avoided the question. Zou Liangjun, Senior Vice President of Li Auto, merely reiterated the company's sales achievements, such as achieving 1 million deliveries and cumulative deliveries of over 139,000 units of the Li L6, without mentioning any plans for the fourth quarter.

Regarding specific sales policies, he only stated that the company had carried out marketing reforms in the second half of the year, giving local operations more autonomy, and emphasized that they would formulate targeted regional sales policies based on local conditions. He had also made similar remarks during the second-quarter earnings call.

Some market analysts attribute management's conservative expectations to the impact of Huawei HarmonyOS Intelligent Driving. AITO is currently Li Auto's biggest competitor in the L series, with cumulative orders for the AITO M9, which competes with the L9, reaching 160,000 units, continuously ranking first in monthly sales above 500,000 yuan in the Chinese market. The cumulative deliveries of the new AITO M7 this year have also surpassed 160,000 units, with market enthusiasm comparable to that of the Li L6, which was launched in April. According to Li Xiang's disclosure during the earnings call, the Li L6 has sold over 139,000 units in six months since its launch.

Next year, Li Auto will welcome the launch of new pure electric M-series models, and their sales models are expected to reach up to 8. Zou Liangjun stated that they hope Li Auto's sales growth rate can reach twice that of the new energy market with vehicles priced above 200,000 yuan next year. Li Xiang refused to disclose product information in advance, stating only that they are very confident in their subsequent pure electric models and will strive to make pure electric SUVs the first tier in the high-end market.

Perhaps learning from the previous failure of MEGA, Li Auto is actively building charging facilities and adjusting store planning to prepare for the launch of pure electric models. However, compared to their previous goal of building 2,000 charging stations within the year, they had only reached 1,000 by the end of October. Zou Liangjun delayed the goal of 2,000 charging stations to before the launch of pure electric models during the earnings call.

02 | 600 Million Equity Incentives

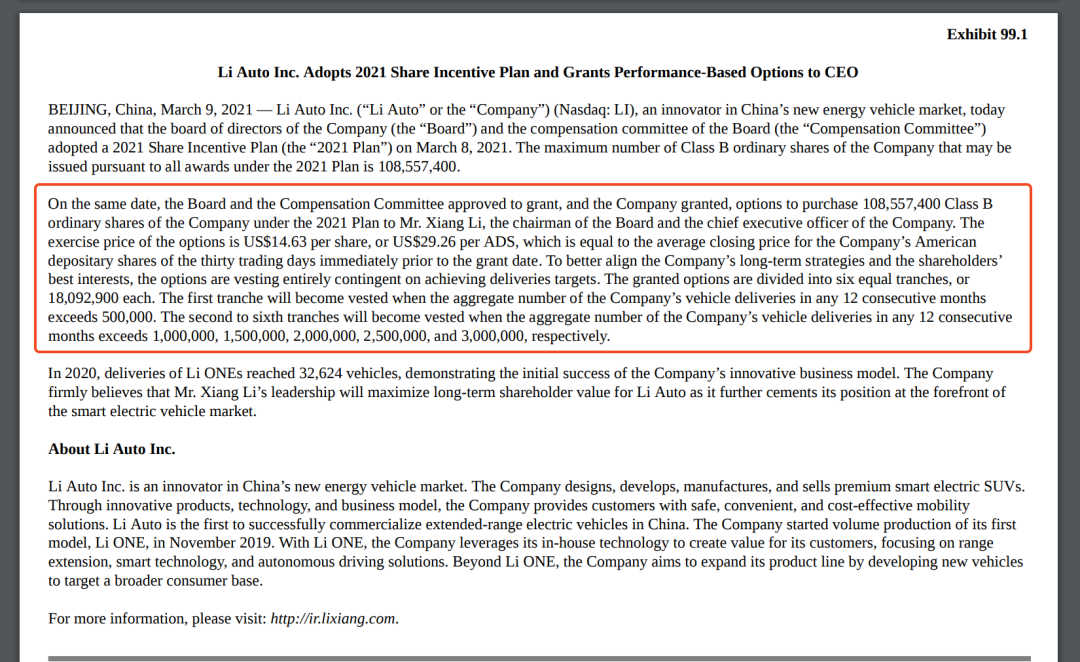

In March 2021, Li Auto approved a CEO stock option incentive plan, providing the company's founder and CEO, Li Xiang, with a total of 108.6 million Class B ordinary shares as equity incentives, with an exercise price of $14.63 per share, or $29.26 per ADS.

The equity incentives are divided into six phases, to be issued when Li Auto achieves consecutive monthly deliveries of 500,000, 1 million, 1.5 million, 2 million, 2.5 million, and 3 million units over 12 months.

Li Auto's CEO Stock Option Incentive Plan Announced in 2021

At that time, Li Auto only had one model, the Li ONE, on sale, with annual sales of just over 30,000 units. The target of 500,000 units was more than 15 times Li Auto's annual sales in 2020, seemingly unattainable. However, in just three short years, Li Auto's annual sales soared from 120,000 units to an estimated over 500,000 units this year.

According to Li Tie, CFO of Li Auto, during the earnings call, the company expects the cumulative deliveries of the first three quarters plus the fourth quarter to exceed 500,000 units, meeting the first phase incentive conditions. Therefore, they recognized a CEO equity incentive expense of 593 million yuan in the third quarter, with an additional 42 million yuan expected in the fourth quarter.

In the past, the more well-known equity incentives in the automotive industry came from Tesla. In 2018, Tesla approved a whopping 55.8 billion-dollar equity incentive plan, under which Musk needed to complete 12 objectives linked to market value and performance over a period of 10 years to potentially receive compensation. These objectives seemed harsh at the time, such as the initial market value requirement of 100 billion dollars, while Tesla's market value was only 50 billion dollars at that time.

Musk achieved the above objectives in 2022, but the plan subsequently faced opposition from shareholders. At Tesla's 2024 Annual Shareholders' Meeting in June this year, with the support of retail investors, Musk's whopping compensation plan was finally approved.

Li Xiang's equity incentive plan is currently only in its first phase. According to Li Auto's 2023 annual report released in April, Li Xiang holds 22.5% of the company's equity and 59.6% of the voting rights, making him the company's largest shareholder.

© Hill Copyright Reserved. Unauthorized reproduction is prohibited.