China's electric vehicles sell well in Mexico, while US EVs face uncertainty during the election

![]() 11/04 2024

11/04 2024

![]() 467

467

Compiled by Yang Yuke

Authored by Marianne Lavelle, Dan Gearino

Edited by Li Guozheng

Produced by Bangning Studio (gbngzs)

As the sales representative slowly removed the giant red bow and uncovered the car, Paulina Hernández began to carefully inspect her new car - a BYD King (Destroyer 05) plug-in hybrid sedan.

She noticed a small stain on the 'Time Grey' trim. Veronica Montoya, the sales representative, quickly grabbed a spray bottle and cloth and rushed over to her. For the next hour, Montoya answered Paulina's questions while carrying the spray bottle and cloth, ready to eliminate any trace or doubt that might jeopardize the deal.

Paulina, a 33-year-old classical dance instructor who lives in Mexico City's bustling Santa Fe district, commutes 38 miles daily to the neighboring city of Toluca, enduring Mexico City's notorious traffic congestion. She has been searching for a suitable commuting vehicle.

The BYD King has a pure electric range of 31 miles and a total range of 730 miles, priced at the equivalent of $24,940.

"My idea was to save money on gasoline and use it to pay for this car," Paulina said.

This is the BYD Santa Fe dealership in Mexico City, the first of 30 showrooms BYD opened across Mexico last year. Sales staff reported an "explosive" growth in customers, with Paulina being the latest addition to this buying spree.

BYD plans to open 20 more dealerships in Mexico this year and will soon announce the location of its Mexican factory, which will produce 150,000 electric vehicles annually in the future.

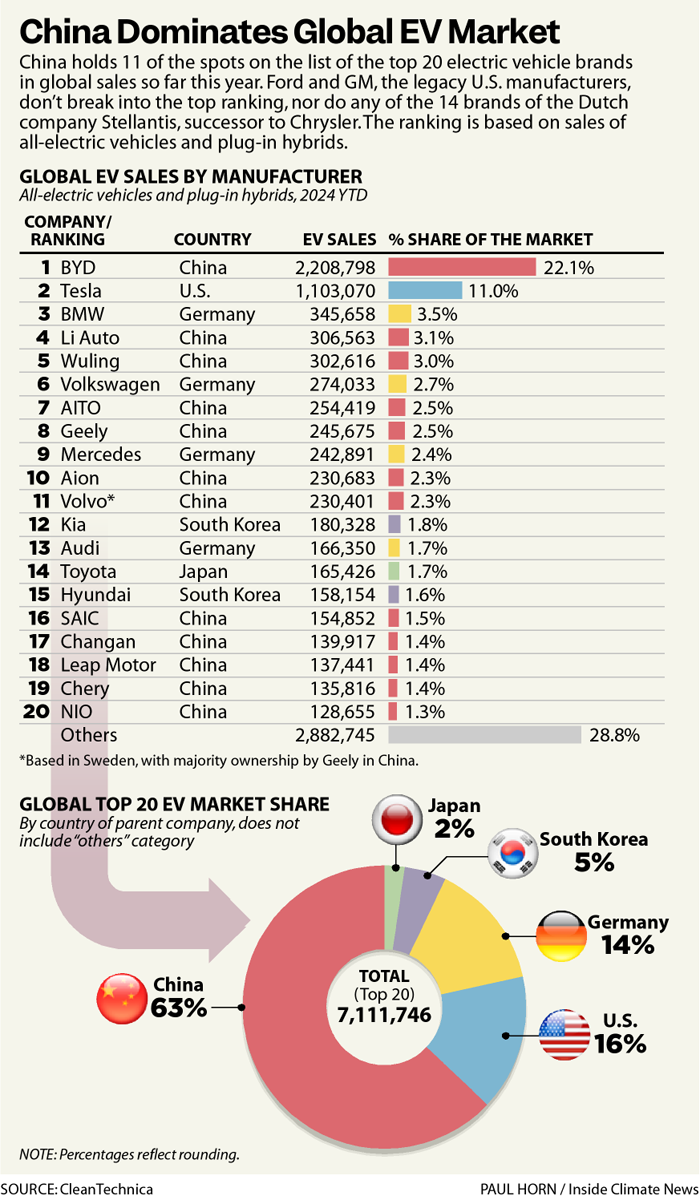

This rapid growth has enabled BYD to surpass US electric vehicle pioneer Tesla in 2022, becoming the world's largest electric vehicle manufacturer (including pure electric and plug-in hybrid vehicles). BYD now sells twice as many vehicles as Tesla.

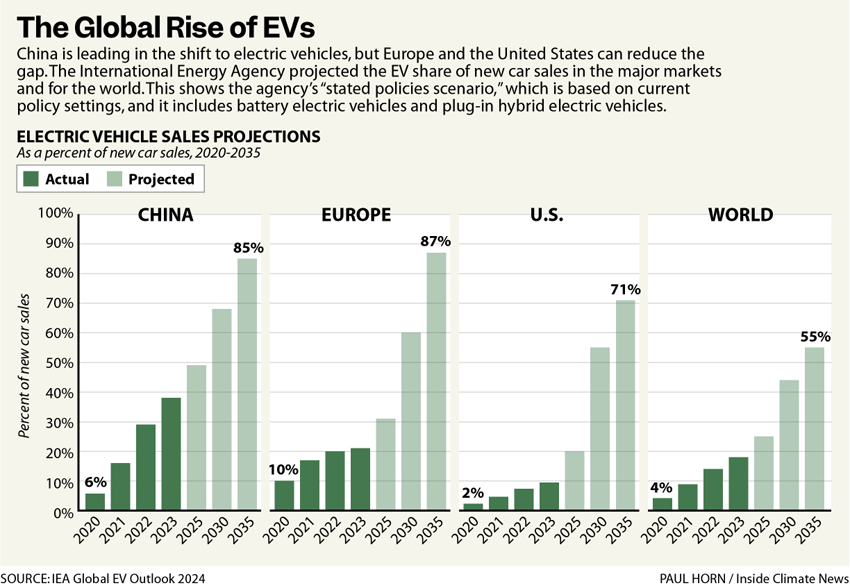

All signs point to the future of electric vehicles. BYD's aggressive expansion in Mexico vividly demonstrates how China positions itself to dominate the future of electric vehicles. In contrast, the upcoming US presidential election presents two different perspectives on electric vehicles, which will determine whether the US strives to narrow the gap with China or doubles down on fossil-fuel-driven transportation.

To this end, Inside Climate News spent a year examining the rise of electric vehicles from a US political perspective.

US President Joe Biden's climate law, the Inflation Reduction Act, has sparked a boom in electric vehicle factory construction.

US automakers welcome federal funding, hoping to expand their electric vehicle product lines to compete globally, creating a rift in the once-friendly alliance between the auto industry and the oil industry. Auto workers are watching these changes with trepidation and hope. Meanwhile, auto dealers are struggling to find ways to sell electric vehicles, especially in rural areas.

As more people realize that Chinese electric vehicles are on the horizon, tensions will intensify.

Vice President Kamala Harris may continue the Biden administration's policy of using tax credits to boost the US electric vehicle supply chain and emissions policies to steer automakers away from internal combustion engines, while using tariffs to block Chinese imports from entering the US market.

Former President Donald Trump, who dubbed himself "Mr. Tariff," proposed astronomical tariffs to block Chinese electric vehicles from entering the US.

Although Tesla CEO Elon Musk has become one of his campaign's super-donors, Trump, while claiming to love electric vehicles, believes they are only suitable for a "small segment" of the public. He has promised to repeal policies supporting domestic electric vehicle production.

Ed Kim, president and chief analyst at California-based research firm AutoPacific, said Trump could not stop the global transition to electric vehicles but could slow down the process in the US, "and the election results could have a very significant impact on the potential growth rate of electric vehicles in the US market."

While Trump repeatedly claims that his approach will save US automakers, the reality may be the opposite. "Eliminating incentives for electric vehicles will certainly shrink the US electric vehicle market, which in turn will significantly reduce the global competitiveness of many non-Chinese automakers such as Ford and GM," said Ed Kim.

Uncertainty in US Policy

Representatives from battery and automotive companies gathered at a recent industry conference in Columbus, Ohio, to discuss the drastic changes that will occur depending on who wins the election.

The uncertainty in US policy runs counter to the certainty automakers desire.

Michael Maten, GM's director of electric vehicle policy and regulatory affairs, said, "From an industry perspective, we often discuss this issue in industry associations. We just want certainty."

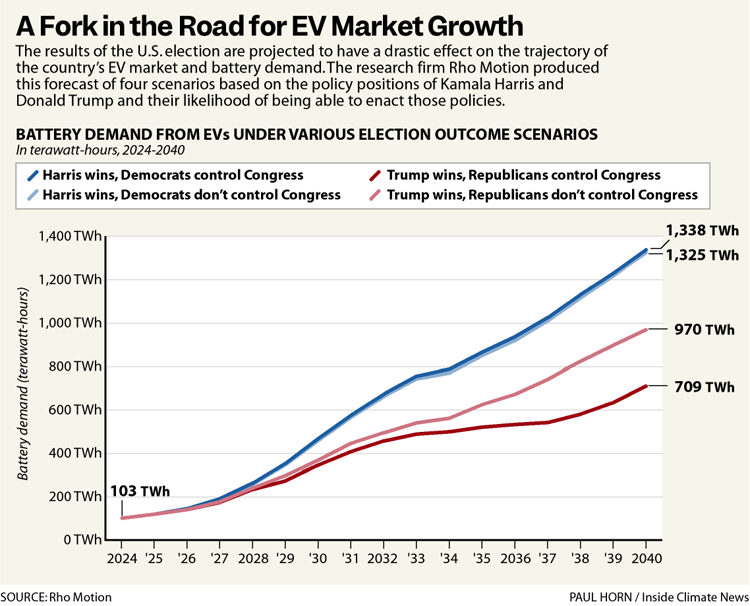

Rho Motion, a British research firm that organized the conference, quantified the impact of the election results on the electric vehicle market.

According to Rho Motion's forecast, if Trump wins and the Republicans control Congress, the demand for electric vehicle batteries in 2040 will be more than 40% lower than if Harris wins.

The main policy lever in this forecast data is the potential difference between Trump and Harris in handling emissions regulations, which do not require congressional approval. Harris is likely to continue Biden's policy of rapidly raising emissions standards. To meet these requirements, automakers are expected to increase the share of plug-in hybrid vehicles in their fleets.

Trump has criticized the pollutants policy of the "electric vehicle mandate," which he vowed to end on his first day of a second term. Harris said in a Michigan speech that she "wants to end all gasoline-powered cars."

Another significant divergence is the Inflation Reduction Act. Trump has said he wants to repeal the tax credits for consumers and manufacturers who purchase electric vehicles under the law.

Trump's running mate, J.D. Vance, described a $500 million grant received by GM as "crumbs from the table." The grant will transform a Cadillac factory in Michigan into an electric vehicle production facility, saving 650 jobs and creating 50 new ones.

Lower emissions standards and reduced Inflation Reduction Act incentives mean that the local demand for products from electric vehicle and battery factories currently being built by automakers will decrease in the future. Automakers that sell most of their products in the country will be in an awkward position: other major markets are developing faster, while the US is only slowly transitioning to electric vehicles.

William Roberts, a senior research analyst at Rho Motion, said in an interview, "If you transition at a slower pace than the rest of the world, you basically can't expect to be competitive on the global stage."

This is a significant departure from the US goal of becoming a global leader in the automotive industry.

Meanwhile, China has established an electric vehicle industry led by BYD, leaving other countries behind.

Due to Trump's tariffs on various goods from China, low-cost Chinese electric vehicles were kept out of the US. Both Trump and Biden have accused China of unfair practices that artificially deflate car prices.

This year, Biden raised tariffs on Chinese electric vehicles from 25% to 100% and proposed another potentially powerful trade barrier - banning the import or sale of vehicles containing specific types of hardware or software that the government says may allow foreign adversaries to collect sensitive data.

Analysts believe that if the US uses the breathing room gained from these measures to rapidly develop its own electric vehicle industry and supply chain, these measures may be helpful in the short term.

Wendy Cutler, deputy director of the Asia Society Policy Institute, said at a forum recently co-hosted by the institution that this could avoid losses similar to those suffered by the US solar component industry due to Chinese influence."Cutler, a former trade negotiator in the Barack Obama administration, said, "I think the government has learned from past unfulfilled efforts where actions against Chinese imports came too late, our industries were harmed, and... it couldn't be undone."

However, US tariffs will not stop the global transition to electric vehicles or prevent Chinese companies from entering the US. Hangzhou-based Geely Holding owns the Volvo and Polestar brands and sells these models in the US. As long as cars from these brands are not produced in China, they can be purchased tax-free. BYD has been producing electric buses in Lancaster, California, since 2013.

Analysts believe that without policies to vigorously develop the domestic electric vehicle industry, the US will fall further behind. BYD and other Chinese automakers have already begun to enter the American market.

"Doing my best" to protect the environment

Paulina had never heard of BYD before but began to notice many BYD cars in Mexico City's congested traffic. Her husband pointed out the BYD showroom near their home. When Paulina arrived at the BYD Santa Fe dealership, she encountered a cousin who was also interested in electric vehicles. In the end, this relative bought a BYD before Paulina.

High gasoline prices (recently $4.79 per gallon in Mexico City, 50% higher than the US average) were one of many reasons Paulina considered buying an electric vehicle.

By purchasing an electric vehicle, she saved on some road taxes and the cost of emissions inspections. Electric vehicles are also exempt from Mexico City's "restricted traffic" regulations, which prohibit certain cars from driving on certain days to reduce air pollution in the city's bowl-shaped geography.

"First, (my motivation is) to save money; second, to do my part for the environment," Paulina said.

According to the BYD Santa Fe sales team, Paulina's top concern - and that of most buyers - is range. Paulina felt that BYD's plug-in hybrid King, with a backup gasoline supply, could alleviate her fears of getting stuck far from a charging station. Eventually, she hopes to install a charging pile in the garage of her apartment building. "I have to find a way," she said.

Paloma Vargas, general manager of BYD Santa Fe, said BYD's plug-in hybrids have proven popular with customers like Paulina who need long commutes. Globally, about half of BYD's sales are hybrids, but this proportion is higher in Mexico, accounting for about 70% at BYD Santa Fe.

Oscar Hernández, product and training manager at BYD Mexico, said, "We will continue to have both power options because there is good market demand for them."

Hernández believes that the variety of products is what distinguishes BYD from Tesla. He worked at Tesla in Mexico City for six years before joining BYD last year. He added, "Our products are suitable for almost all types of customers - such as those with low incomes. We also have luxury cars. This is the breadth of our products, providing an electric vehicle suitable for all customers."

The threat from BYD

BYD's lowest-priced model in Mexico is the pure electric Dolphin Mini, priced at about $18,000, less than half the price of Tesla's lowest-priced model. In China, BYD has launched a pure electric Seagull priced at $12,000.

BYD said it can produce lower-cost cars in part because it manufactures its own components, especially its Blade Battery, which is based on lithium iron phosphate technology rather than expensive nickel or cobalt.

The Blade Battery is more durable and less prone to overheating than nickel batteries. Although it may theoretically lose some range, BYD has adjusted the size of the battery and vehicle platform to provide a competitive range.

30 years ago, BYD was founded in Shenzhen, the electronic industry hub of China, initially as a battery manufacturer. The company currently operates 30 industrial parks and production bases globally and is China's largest private employer with 900,000 employees. It boasts a 110,000-strong R&D department, larger than any other automaker in the world.

BYD's booming growth has been supported not only by the Chinese government but also by external investors, including Warren Buffett, who recently reduced his stake in BYD to address escalating China-US trade tensions.

The Wall Street Journal reported on Ford Motor CEO Jim Farley's visit to China in May this year, where he observed engineers dismantling a BYD car, showcasing "elegant, low-cost engineering." Farley reportedly told a colleague on Ford's board that BYD vehicles posed an "existential threat."

BYD is expanding globally, opening a factory in Thailand in July this year, building another in Brazil, and planning another in Hungary. Iannetta said BYD sees Mexico as a potential fertile ground. Chinese car sales have surged over the past three years, and analysts predict China will soon rank among the top 10 passenger vehicle sales countries.

According to the latest Mexican government data, electric vehicles still account for only a small portion of the Mexican market – around 2% of sales, excluding some key companies like BYD. Data shows that in the first nine months of 2024, sales of electric and plug-in hybrid vehicles were around 23,800, already 20% higher than the annual sales in 2023 and more than double those in 2022.

Yet, BYD alone expects to sell up to 50,000 vehicles in Mexico this year.

"We have great potential in Mexico due to high gasoline prices, government incentives, and market size. We have the potential to be one of the top players," said Iannetta.

US Politicians Focus on USMCA

BYD has repeatedly stated that it has no plans to ship vehicles from China or Mexico to the US market. Li Ke, CEO of BYD Americas, called the US market "complex" and "chaotic" due to political conflicts surrounding electric vehicles.

However, both Democrats and Republicans in the US Congress are unhappy about the prospect of BYD and other Chinese electric vehicle manufacturers producing in Mexico and exporting duty-free to the US under the United States-Mexico-Canada Agreement (USMCA). Mexico surpassed China and Canada last year to become the US's largest trading partner, with auto trade accounting for the largest share at 22%.

The Trump administration negotiated the current free trade agreement with Mexico, but Trump now proposes tariffs on vehicles from Mexico. Legal experts say this would violate the agreement and possibly other US laws.

On October 13, Trump said at the Detroit Economic Club, "I will impose any necessary tariffs – 100%, 200%, or even 1000%. They cannot sell any cars produced in these (Mexican) factories to the US."

Harris is expected to maintain Biden's policy of imposing a 100% tariff on electric vehicles made in China and the upcoming ban on vehicles with Chinese internet-connected software. Experts believe this will be an effective way to prevent them from entering the US through Mexico.

Analysts at the Baker Institute for Public Policy at Rice University wrote, "The new regulations could have a broad impact." They noted that these regulations, based on national security considerations, might withstand legal challenges.

Moreover, both Trump and Harris have indicated that they will use the 2026 window to renegotiate the trade agreement with Mexico. Harris was one of only ten senators who voted against Trump's USMCA.

However, some analysts in Mexico believe US politicians are focusing on preventing Chinese-made electric vehicles from crossing the border, neglecting a far more serious issue.

"The current situation is that Chinese-made cars are crushing competition in the Mexican market," said Enrique Dussel Peters, an economist at the National Autonomous University of Mexico (UNAM) and coordinator of the China-Mexico Research Center.

He further pointed out that currently, neither BYD nor any other Chinese company produces cars in Mexico (only JAC Motors, a Chinese automaker, has a small factory in Mexico that assembles cars from imported Chinese parts for sale in Mexico). Two years ago, Chinese cars were insignificant in the Mexican auto market, but by 2023, they accounted for nearly a quarter of total car sales in Mexico.

Tesla Factory That Will Never Be Built

Tesla's abrupt decision to halt its massive Mexico plans is an example of changes in the global market.

In March 2023, Musk announced that Tesla would make one of the largest automotive investments ever in Mexico – a new $5 billion Gigafactory in Nuevo León, bordering Texas. Musk received massive subsidies and infrastructure promises from Mexico. At Musk's invitation, Chinese parts suppliers began setting up factories nearby, according to Bloomberg.

But in July this year, after supporting Trump, Musk announced that Tesla's Mexico Gigafactory plans were "on hold" pending the US presidential election results. "Trump said he would impose high tariffs on cars made in Mexico," Musk said. "If that's the case, it doesn't make sense to invest heavily in Mexico. We'll see how things develop politically."

Some observers doubt Tesla's plans will continue regardless of who wins the US presidency. Tesla's global factory capacity already exceeds vehicle sales. Although the company recently reported strong profits due to sales of large-scale energy storage systems and other factors, its vehicle sales in the first three quarters of 2024 declined by 2% compared to the same period in 2023.

BYD's sales grew by 30.7% over the same period, partly thanks to its new business in Mexico.

Mexican economist Dussel Peters predicts that Tesla's Nuevo León factory "will never be built." "From March 2023 to today, Tesla's situation has changed dramatically. Competition with Chinese producers is fierce. If they want to build another Gigafactory to produce 1 million electric vehicles, I don't know where they will sell the cars," he said.

China's 15-Year Lead in Electric Vehicles

Industry experts say China's global dominance will continue to grow as the world transitions to electric transportation, as China has invested heavily in building the electric vehicle industry and supply chain – an estimated $230.9 billion from 2009 to 2023, according to the Center for Strategic and International Studies.

John Bozzella, CEO of the Auto Innovators, a major US auto industry organization, said at a recent forum hosted by the Asia Society Policy Institute, "China is about 15 years ahead in transformative technologies and supply chains related to electric vehicles. We are in the midst of a transformation in the US that will require hundreds of billions of dollars."

Bozzella said, "I think the problem now (in the US) is how policymakers view the need to create a competitive auto industry." Although he did not comment on the election results, it is clear that the most critical investments in the US electric vehicle transition will be at risk during the presidential campaign.

According to the Clean Investment Monitor, of the public and private investments triggered by the Inflation Reduction Act so far, $58.4 billion has gone to battery manufacturing and $171.1 billion to zero-emission vehicle manufacturing.

Harris has made it clear that she intends to continue driving investments. "I will ensure that the US – not China – wins the competition of the 21st century," Harris said at a rally in Flint, Michigan, on October 4. "We will ensure that the next generation of breakthroughs, from advanced batteries to electric vehicles, are not only invented in the US but also made in the US by American union workers."

Addressing Trump's speech in Michigan, Harris said, "Contrary to what my opponent implies, I will never tell you what kind of car to drive."

"But I will take some action," she said. "I will invest in communities like Flint, which helped build the auto industry and the United Auto Workers union. We will retrofit existing factories, recruit local employees, and work with unions to create high-paying jobs."

Trump described the pursuit of electric vehicles as a losing proposition for the US auto industry. He recently said at a rally in Detroit, "If I don't win (the election), there will be no auto industry in the US in two to three years. You won't have any manufacturing plants. Because of electric vehicles, China will take over all these markets."

Since partnering with Tesla's Musk, Trump has somewhat softened his anti-electric vehicle rhetoric. Musk donated at least $118.6 million to his re-election campaign. "I support electric vehicles," Trump said at a rally in Atlanta in August. "I have to because Elon is very supportive of me."

But in his speech at the Detroit Economic Club, he reiterated his view that electric vehicles are for "a certain crowd" and not for those who need to travel long distances. Trump pointed out that most of the profits for US automakers come from pickup trucks. He said he plans to boost sales of all pickup trucks and cars by exempting auto loan interest from taxation.

"We have more oil and gas, more liquid gold under our feet," Trump said. "So why do we need batteries? China has battery materials, and we have liquid gold."

"Vote for Trump, and the gasoline engine will be here for a long, long time," Trump said.

At the BYD Santa Fe showroom, the sales team plans personalized celebrations for each electric vehicle delivered to a new owner. They play the customer's favorite song, offer their favorite cookies, or invite family members to a surprise party at the showroom.

For Paulina, the ceremony included a bouquet of pink orchids with a note inside that read, "You'll enjoy driving your BYD King even more than 'Surya Namaskar' (a set of yoga poses)."

Paulina placed the flowers on the passenger seat as she practiced charging, used the rotating navigation screen, and tried saying, "Hi, BYD!" to activate the voice control system.

"I think it's important to try this (voice) technology, which can replace old things and make driving better. We have to give it a try," Paulina said happily.

(Part of this article is based on Inside Climate News reports, and some images are from the internet)