Musk Turns Left, Wang Chuanfu Turns Right

![]() 11/04 2024

11/04 2024

![]() 586

586

Introduction

Introduction

There are many paths to success, but only those that are walked through are the true ways.

"For any automaker, every choice is actually a high-stakes gamble. Win, and you may embrace the vast ocean of stars; lose, and you may face the abyss."

Having been in the industry for five years, I deeply agree and firmly believe in the opening paragraph of this article. At this moment, as the wave of electrification transformation rages through the Chinese auto market, it seems that no one can remain untouched. This includes the protagonists of today's article - Tesla and BYD.

Both are undoubtedly recognized as the "big bosses" in the new energy sector. Sometimes, it's interesting to string together and analyze continuous information.

Recently, through their consecutive third-quarter financial reports, one can clearly read a completely contradictory message, making people feel: "Tesla turns left, BYD turns right."

In other words, the former has somehow "given up" on growing into a traditional new energy vehicle giant; the latter, on the other hand, is rapidly transforming into the Toyota or Volkswagen of the new era. Undoubtedly, Musk is gambling, and so is Wang Chuanfu.

Such divergence cannot be judged as right or wrong. As for where Tesla and BYD will eventually climb to, only time can provide feedback and answers.

In the following sections, I would like to share some of my thoughts.

"Don't wait, the cheap cars are gone"

In terms of Renminbi, the market value surged by over a trillion overnight.

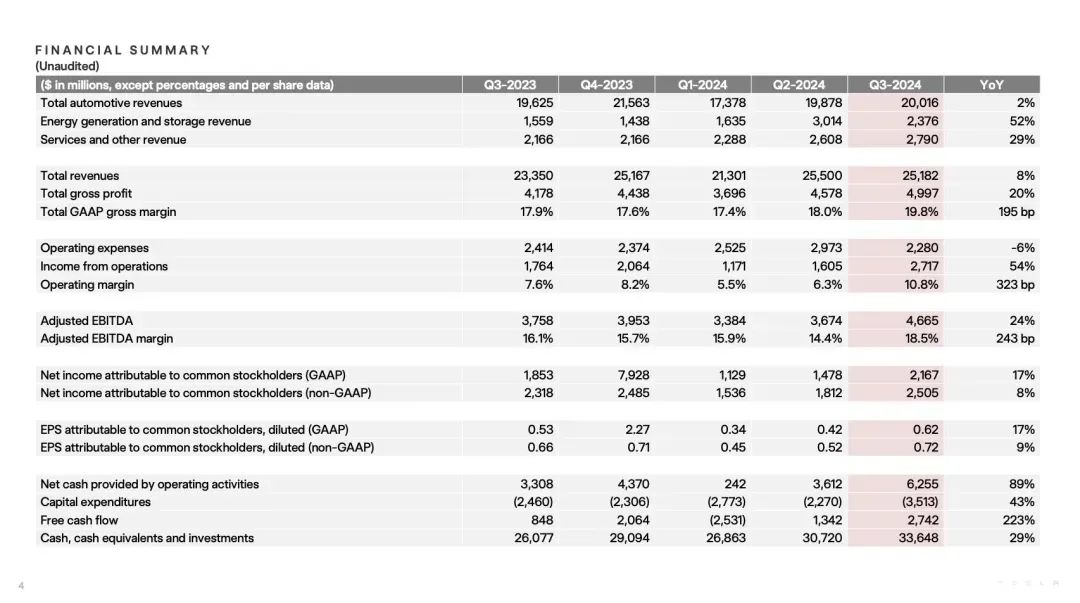

Frankly, it has been a long time since Tesla has demonstrated such a strong performance in the capital market. What is the "catalyst"? It's simple - a surprisingly good third-quarter financial report and an enticing "pie in the sky" during the subsequent conference call.

Specifically, throughout July, August, and September, this American new energy automaker failed to meet outside expectations of $25.37 billion in total revenue, but both net profit and gross margin outperformed "analysts'" expectations.

Regarding the reason for the profit, Tesla's official explanation is, "We reduced the sales cost per vehicle to an all-time low of approximately $35,100. Compared to the same period last year, the cost per vehicle decreased by about $2,000."

In other words, more extreme cost reduction.

However, this claim has sparked controversy. After all, it cannot be ignored that throughout the third quarter, Tesla benefited from selling carbon credits to other automakers, generating a net profit of $739 million. This is the second-highest in history, second only to the $890 million in the second quarter.

In addition, automotive services, including paid charging, non-warranty after-sales, used cars, and car insurance, also contributed what they could.

In contrast, the profit-generating efficiency of its entire vehicle segment is continuously declining. The pain points exposed are concentrated on the slowing growth of deliveries and the failure of volume-for-price strategies.

Whether acknowledged or not, the stage of Tesla dominating sales is over.

Even during the conference call after the third-quarter financial report was released, Musk confidently promised: "In the best-case scenario next year, our sales will increase by 20%-30% year-on-year."

But can it really be achieved?

At least for me, referring to Tesla's poor output so far this year, there is undoubtedly much uncertainty. Especially this week, Musk personally announced, "A new car priced at $25,000 needs to be paired with L4 to maintain the company's image. A purely low-cost electric product is meaningless and foolish for Tesla."

Perhaps many readers don't understand what he's saying, "Wake up! The Model 2 you've been eagerly awaiting is gone." The so-called "Tesla available for just over a hundred thousand yuan" has completely disappeared from rumors.

As a result, next year, the American new energy automaker's product line will likely remain largely unchanged, except for the long-awaited refresh of the Model Y. For some reason, I feel that with Tesla's current hand, facing increasingly aggressive competitors pushing out new products, the odds are stacked against them.

So, surely someone will be curious, what will the protagonist of this paragraph use to support the aforementioned sales growth? Including preventing the huge market value bubble from bursting?

Actually, the answer is obvious.

According to Musk's own words: "Our development trajectory is very clear, focusing on autonomous driving technology." In his view, only through innovation and revolution in this dimension, advancing the company's development and thereby driving the industry forward is the right path.

The output during the third-quarter earnings call was the helmsman's expectation: "The self-driving taxi Cybercab will achieve mass production in 2026, with a goal of producing at least 2 million units annually. In 2025, we will launch a ride-hailing business in Texas and California, pending regulatory approval."

In short, one needs to understand: Simply becoming a traditional new energy automaker is no longer Tesla's goal. The official announcement of the cancellation of the low-cost car project is a sign of farewell.

Of course, over the past decade or so, Musk has proven his ability in selling cars. Switching tracks will be his latest high-stakes gamble.

But the question is, has Tesla really laid a solid foundation? Is the slightly aggressive choice really the right one? Can the provisions accumulated in the automotive business support its huge ambitions? Can the bet on autonomous driving immediately disrupt the industry?

Everything is full of unknowns. And once the arrow is shot, there is no turning back; one must press on despite the difficulty...

"I Want to Become Volkswagen, Toyota"

First, it needs to be clarified that the fundamental purpose of writing this article is definitely not to "step on one and praise the other."

The drive in Tesla is still worthy of applause. However, rationally and objectively speaking, if we only consider "selling cars" this year, the protagonist of this paragraph is indeed more eye-catching.

On the evening of October 30, Beijing time, the news that "BYD's quarterly revenue surpassed Tesla for the first time" suddenly hit Weibo's trending topics. Instantly, it sparked heated discussions.

But I'm not surprised.

After all, considering this player who has long called themselves the "global leader in new energy vehicles," their sales throughout July, August, and September, and the state of "stopping at nothing," it feels more like a natural progression.

Following the trend, looking at the scorecard, BYD achieved revenue of 201.125 billion yuan in the third quarter, a year-on-year increase of 24.04%, with quarterly revenue exceeding 200 billion yuan for the first time; net profit attributable to shareholders was 11.607 billion yuan, a year-on-year increase of 11.47%; and net profit after deducting non-recurring gains and losses was 10.877 billion yuan, a year-on-year increase of 12.67%, with net profit after deducting non-recurring gains and losses exceeding 10 billion yuan for the first time in a single quarter.

In addition, the gross margin was 21.89%, an increase of 3.2 percentage points from the previous quarter.

As of the end of the third quarter, BYD's research and development expenses reached 33.3 billion yuan, a year-on-year increase of 33.6%. In summary, the performance was exceptionally outstanding. Even the net profit is quickly narrowing the gap with Tesla.

It's not self-congratulatory; the point of full catch-up may not be far off.

Borrowing a phrase from a netizen, "Nowadays, BYD is more like a high-margin, high-investment technology company, while Tesla, which should play that role, is struggling."

Although somewhat exaggerated, the trend does not lie.

According to relevant statistics from Weibo blogger "Sun Shaojun," "There were about 110,000 new orders last week. As of the 27th, the cumulative order volume has exceeded 460,000. This month, BYD's orders alone have exceeded 500,000."

In other words, during the ongoing fourth quarter, the protagonist of this paragraph will only continue to sprint more fiercely. The set sales target of 3.6 million vehicles for the entire year is a done deal. Aiming for 4 million vehicles is undoubtedly BYD's biggest aspiration.

From 451,000 vehicles in 2019, to 426,000 in 2020, to 730,000 in 2021, to 1.868 million in 2022, to 3.024 million in 2023, and now.

Throughout history, no domestic brand has achieved such explosive growth for a long time. Even globally, using monthly sales as the criterion, BYD has surpassed Volkswagen and is second only to Toyota.

And just last night, the protagonist of this paragraph announced its sales for October. To everyone's surprise, it was expected that there would be a slight sequential increase from the nearly 420,000 units in September.

However, the result was that BYD directly surpassed the 500,000-unit mark, selling a total of 500,526 new energy passenger vehicles. From January to October this year, a total of 3,236,927 new energy passenger vehicles were sold.

Exaggerated, really too exaggerated.

So far, it's still the same viewpoint I've raised multiple times: "BYD, which insists on the dual-track approach of plug-in hybrids and pure electrics, relies on a saturated attack to build an overwhelming wall in various sub-markets below 200,000 yuan in the Chinese auto market, occupying absolute discourse power and initiative."

And it is foreseeable that it will continue to consolidate and strengthen this position. Of course, this is also the "moat" that it relies on to maintain its leading edge, which must not be compromised.

In fact, as the helmsman, Wang Chuanfu is also gambling, choosing to take "selling new energy vehicles" to the peak until transforming into the Volkswagen or Toyota of the new era.

Of course, it's worth noting that the giants recognized by everyone are necessarily powerful in all dimensions, multi-faceted, and all-encompassing.

At this moment, once BYD cuts into the segment above 200,000 yuan, there is undoubtedly much room for improvement. And after leveraging favorable timing, geography, and harmony to win the first half of the electrification battle, in the second half focusing on intelligence, BYD has not yet demonstrated the same fierce firepower as before.

These two points are precisely its shortcomings that need to be addressed urgently.

In addition, it should be noted that whether it's Volkswagen or Toyota, they have reached their current heights only after decades of deep cultivation and layout, stepping over unavoidable pitfalls and paying painful prices.

BYD aims to stand on an equal footing with them and transform into a truly global automaker; it will not be easy, and there is still a long way to go.

At this point, the article is gradually approaching its conclusion. Finally, I would like to emphasize: "As an automotive media, I am very grateful to be able to witness the completely different life experiences of these two big bosses. Nowadays, when Tesla chooses a different path, when BYD becomes increasingly extreme, when Musk gambles, and when Wang Chuanfu also gambles, one turns left, and the other turns right, undoubtedly giving us the best anchors to observe the changes and development of this industry."

Which is better is neither here nor there. Anyway, they will all leave a profound mark in the long river of history. There are many paths to success.

Walking through them is the true way...