Over 80% of listed companies are profitable, BYD's revenue exceeds Tesla's

![]() 11/04 2024

11/04 2024

![]() 515

515

Reviewing the auto stocks of the week, observing the diverse landscape of the automotive market.

As October comes to an end, 5,353 A-share listed companies have disclosed their third-quarter financial reports for 2024, with 4,115 companies reporting profits. Furthermore, 2,469 companies achieved year-on-year growth in net profit, indicating a positive overall trend.

After more than a month of sustained strength since the 924 market rally, A-shares finally cooled down in November.

As of Friday's close, the Shanghai Composite Index fell slightly by 0.24% to 3,272.01 points, the Shenzhen Component Index dropped by 1.28% to 10,455.50 points, and the ChiNext Index declined by 1.88% to 2,133.74 points. The total trading volume for the two markets exceeded RMB 2.2 trillion, remaining flat with the previous day. Over 4,100 stocks fell, with 159 stocks hitting their daily limit down.

Faced with market corrections, major funds sold heavily, resulting in a net outflow of RMB 131.828 billion. Although northern funds attempted to support the market, their strength was limited, with RMB 29.545 billion in buying. Despite heavy investments in East Money Information, CITIC Securities, and CATL, it was still difficult to resist the overall market trend.

Overall, the profitability of A-share listed companies has declined. The 5,354 companies that disclosed financial reports collectively achieved revenue of RMB 52.41 trillion, a year-on-year decrease of 0.87%, and net profit attributable to shareholders of listed companies totaled RMB 4.41 trillion, a year-on-year decrease of 0.54%.

The overall decline in profitability has not affected individual stock performance. According to statistics, 542 listed companies doubled their net profit, and six companies saw increases exceeding 100 times, demonstrating considerable profitability.

Among them, Changying Precision ranked first in growth. As a component supplier for leading global consumer electronics brands, it achieved revenue of RMB 12.097 billion in the first three quarters, a year-on-year increase of 23.56%, and net profit attributable to shareholders of listed companies reached RMB 594 million, a year-on-year increase of 38,159.10%.

This growth is not only due to traditional consumer electronics but also closely related to Changying Precision's development in precision components for new energy vehicles. Relying on the rapidly growing market for new energy vehicles in China, Changying Precision has also seized greater business opportunities.

Returning to the automotive industry, the third-quarter financial reports of listed automotive companies have been released. Notably, BYD, the leading domestic new energy vehicle manufacturer, stands out in its financial performance.

On October 30, BYD released its third-quarter financial report for 2024, reporting revenue of RMB 201.1 billion, a year-on-year increase of 24%. Its revenue also surpassed that of Tesla, making it the largest new energy vehicle company globally in terms of revenue.

Surprisingly, on the second day after the financial report was released, BYD's share price fell below the RMB 300 mark, closing at RMB 290.31 on Friday, almost returning to its level from a month ago. Over the past month, BYD's share price had surged to a high of RMB 338.04, with its market capitalization nearing the RMB 1 trillion mark. The current fall below RMB 300 is quite disheartening.

In contrast, despite volatility, Tesla's market capitalization remains at USD 802 billion, seven times that of BYD. According to the latest sales figures, BYD sold 500,000 vehicles in October alone, while Tesla delivered only 463,000 vehicles globally in the third quarter.

The asymmetry in sales and share prices reflects different attitudes towards the new energy vehicle industry in eastern and western capital markets. In the capital market, it is not always necessary to win to drive up share prices.

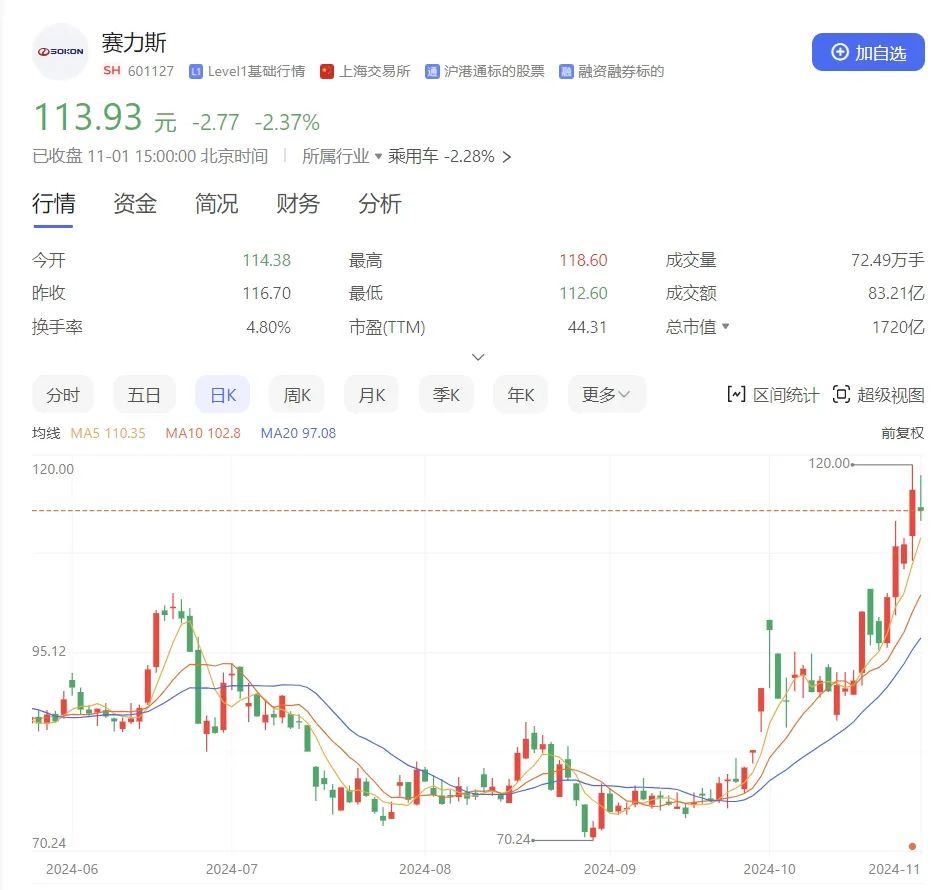

For some automakers, good financial reports can indeed boost share prices. Thalys, which collaborates with Huawei on vehicle manufacturing, is one such lucky company. As one of the earliest automakers to partner with Huawei, Thalys is now one of the hottest in China and is also making waves in the stock market.

This week, Thalys' share price witnessed a four-day rally, surging from an opening price of RMB 102.47 to RMB 120 per share and finally closing the week at RMB 113.93, once again surpassing the RMB 100 mark.

On October 30, Thalys released its third-quarter financial report, reporting revenue of RMB 106.6 billion for the first three quarters, a year-on-year increase of 5,329.24%, propelling it to the fifth position among listed companies. Its revenue scale is comparable to that of Changan Automobile and even surpasses GAC Motor.

Meanwhile, Thalys' profitability is also impressive. With its golden signboard, AITO, Thalys achieved a net profit attributable to shareholders of RMB 4.038 billion in the first three quarters, a year-on-year increase of 276.02%, realizing rare profitability among new forces and becoming the third new energy vehicle company after BYD and Lixiang to achieve positive profitability.

Driven by such favorable news on multiple fronts, Thalys' share price surge is indeed justifiable. The latest sales data shows that Thalys sold 36,011 vehicles in October, a year-on-year increase of 104%, and its cumulative sales for the year have reached 350,000 vehicles, a year-on-year increase of 310%.

In the domestic market, besides Huawei, Xiaomi is another prominent player in cross-industry vehicle manufacturing. On October 29, Xiaomi held its autumn product launch event. Since entering the automotive industry, the topic of cars has become indispensable at Xiaomi's launch events. Lei Jun once again spoke about Xiaomi's cars, but unlike before, Xiaomi unveiled a heavyweight model this time - the Xiaomi SU7 Ultra.

Unlike the previous cost-effective SU7, the SU7 Ultra follows a high-end route with a pre-sale price of RMB 814,900, making it almost the most expensive product under the Xiaomi brand. Although Lei Jun compared it favorably, many netizens still felt that Xiaomi had become too ambitious, as it is difficult for ordinary consumers to understand the significance of 1,500 horsepower and a 0-100km/h acceleration of 1.9 seconds.

Regarding Xiaomi's cars, Lei Jun announced at the conference that Xiaomi delivered over 20,000 vehicles in October and is expected to meet its annual sales target of 100,000 vehicles by November. For its first model, Xiaomi has once again set a new record in the Chinese automotive market.

In addition to the strong market response, investors have also expressed their attitudes with real money in the stock market. Starting from October 30, Xiaomi Group's share price has witnessed a three-day rally, closing at HKD 27.30, with a weekly increase of over 5%. From a longer-term perspective, since the debut of Xiaomi's cars, its share price has been on the rise, increasing from HKD 15 at the beginning of the year to the current HKD 27.

Currently, vehicle manufacturing can be considered Xiaomi's most correct decision, not only identifying a new business growth point but also rescuing Xiaomi's long-sluggish share price.

The market is always unpredictable. Looking back three or four years, it would be hard to imagine that Huawei and Xiaomi would become two new catalysts in the Chinese new energy vehicle market. However, reality is magical, much like buying stocks - it is difficult to predict whether prices will rise or fall. As the saying goes, what is meant to be will be, and what is not meant to be should not be forced.

Note: Some images are sourced from the internet. Please contact us for removal if there is any infringement.