Going overseas, setting new records, and surging growth: domestic new energy vehicles left Europeans scrambling in October

![]() 11/04 2024

11/04 2024

![]() 583

583

Data Analysis of New Energy & Auto

Tariff measures cannot change corporate competitiveness.

Total words in this article: 5465

Estimated reading time: 25 minutes

"Anti-subsidy tariffs will weaken an industry's competitiveness in the long run. Free trade and fair competition will bring prosperity, growth, and innovation to all parties."

This was the statement made by the Chairman of the Management Board of Volkswagen Group in October.

The EU anti-subsidy duties were the most eye-catching event in the new energy vehicle market in October, but in reality, they may have been the least noteworthy.

On the path of the rise of China's new energy vehicles, these obstacles were foreseeable and could not hinder the overall trend.

#

Vol.1/ Continuing the Surge

'Golden September, Silver October' are usually crucial months for domestic automakers in terms of sales growth.

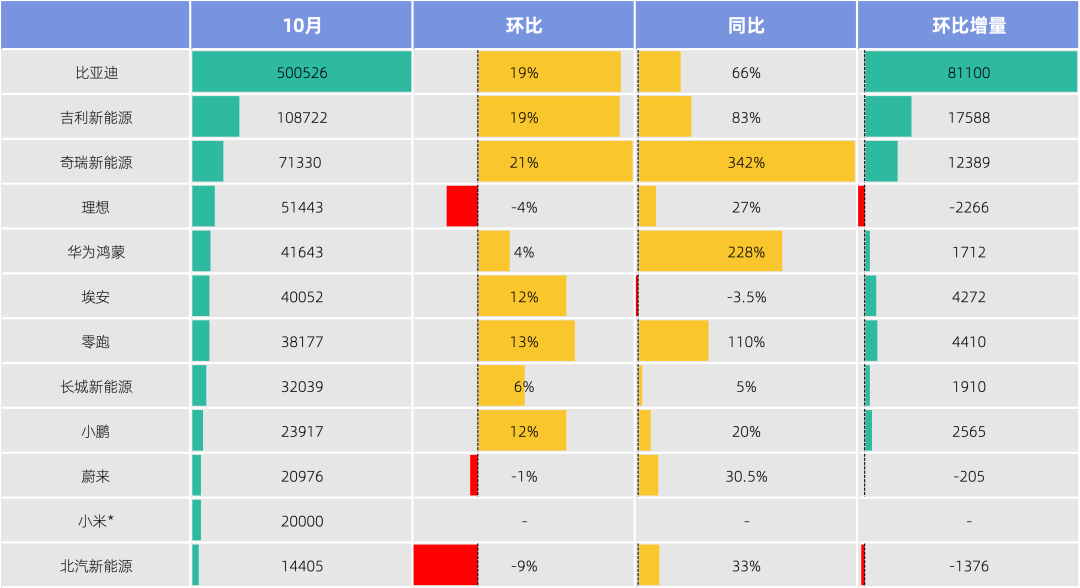

Sales in September were already 'crazy,' and they continued to grow in October. This month, almost all 12 mainstream automakers that have announced their sales figures have shown year-on-year and month-on-month growth. The average sales of these 12 automakers reached 80,269 units, a significant increase of 11,358 units from the previous month. Based on median statistics, sales in October were 39,114 units, an increase of 6,340 units from September, with a growth rate even more impressive than that of September.

Among them, BYD, Geely, Chery, NIO, Great Wall Motors, and XPeng all set new sales records. This growth is based on the premise that multiple automakers set new sales records in September, and the rapid growth trend of automakers continues.

The threshold for automaker competition continues to rise. Last month, two automakers had sales below 20,000 units. This month, Nezha did not announce its sales figures, leaving BAIC as the only automaker with sales below 20,000 units. Xiaomi's deliveries exceeded 20,000 units for the first time, now comparable to those of NIO and XPeng. The last-place elimination mechanism is already pressuring mainstream automakers, making competition increasingly fierce.

Adding to the pressure on automakers is the impact from leading platforms. This month, the top three automakers—BYD, Geely New Energy, and Chery New Energy—all set new sales records, and their month-on-month growth rates were also among the top three among the 12 automakers. BAIC, which ranked lower, saw a month-on-month decline, and Nezha even failed to announce its sales figures, clearly indicating a lag.

The internal competition among automakers is intensifying. On the one hand, scrapping and replacement subsidies provide convenience for new energy vehicles. The number of applications for national scrapping and replacement subsidies has reached 1.57 million. On the other hand, the price war continues. According to data from the China Passenger Car Association, the profit rate of the automotive industry from January to September was 4.6%, at a relatively low level; data from the National Bureau of Statistics shows that the price of new energy passenger cars fell by 6.9% in September.

If automaker competition in previous years was like sailing against the current, this year can be described as 'leaping over the dragon's gate'—one must fly to obtain an entry ticket.

#

Vol.2/ Half of Annual Targets Face Significant Pressure

Specifically for each brand, most brands have maintained month-on-month growth, consistent with the overall sales trend of the company.

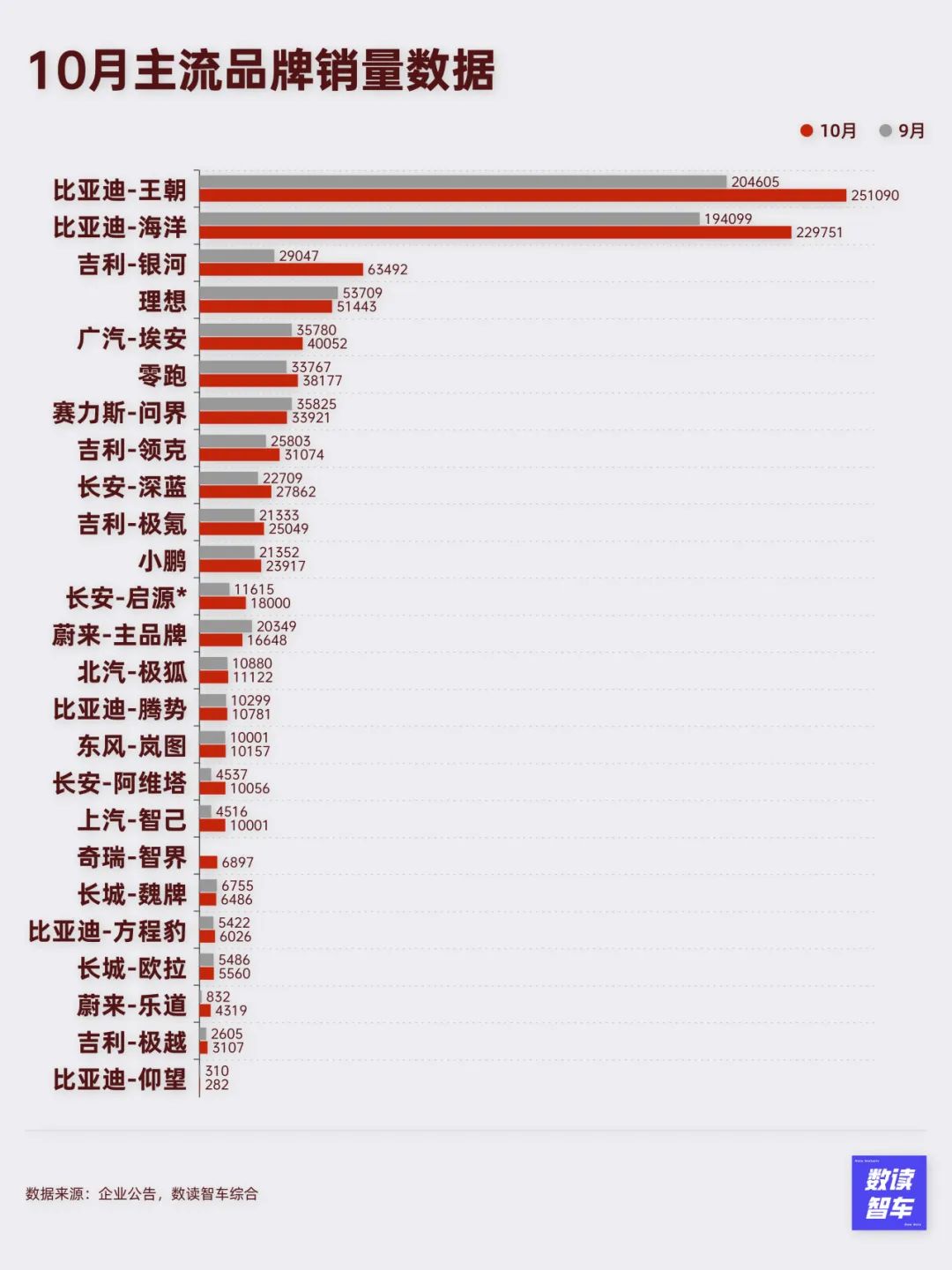

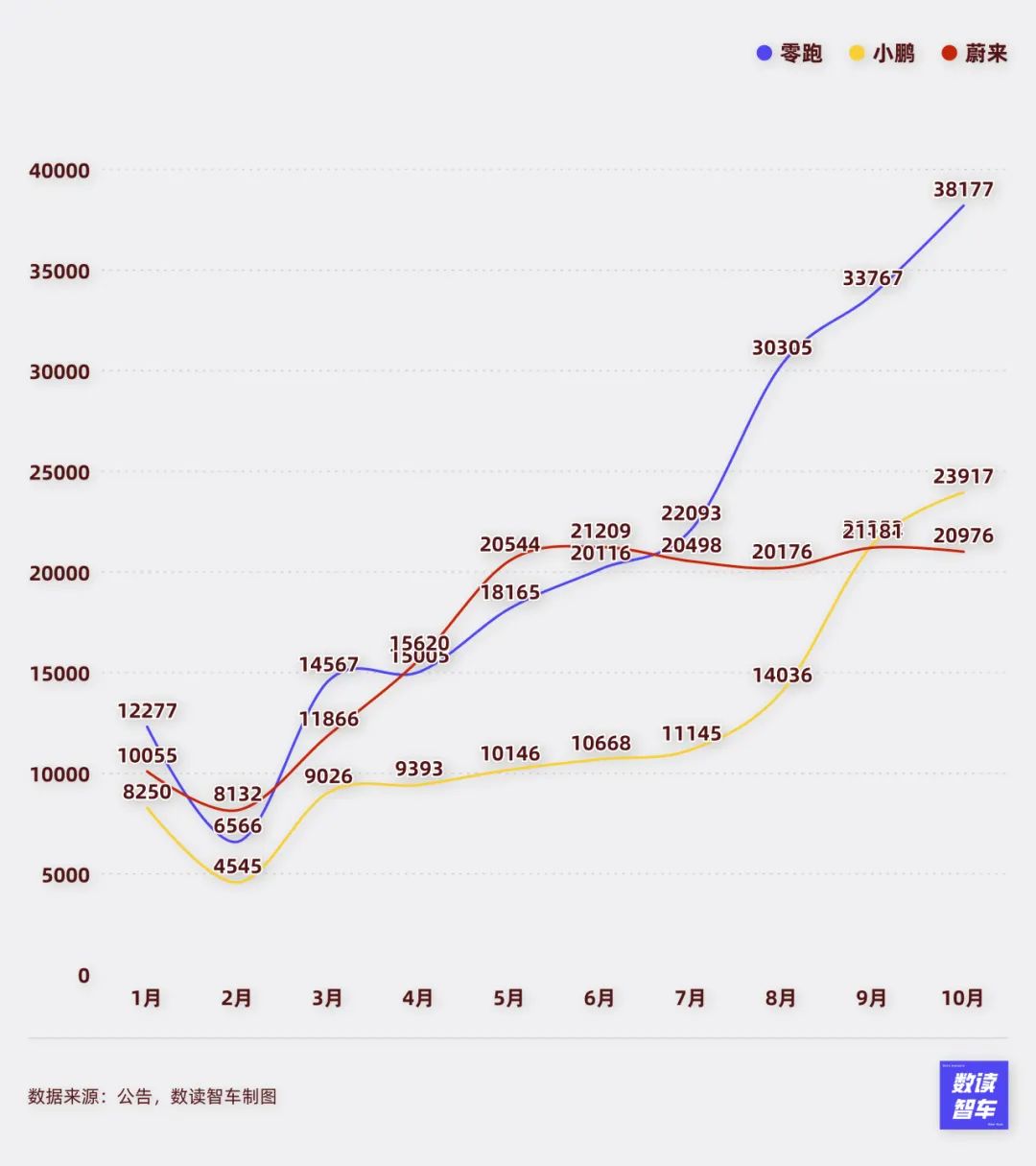

Multiple brands have set new sales records. BYD Dynasty and Ocean series, Geely's Zeekr, Yinhe, Lynk & Co, and Geely Auto's Qiyuan, Avatar, and Shenlan, as well as NIO, Zero Run, IM Motors, Voyah, and ARCFOX, all set new sales records.

The most prominent performers are the leading brands. BYD Dynasty and Ocean series are far ahead, and their growth rates continue to break through. The monthly sales of these two brands exceeded 200,000 units.

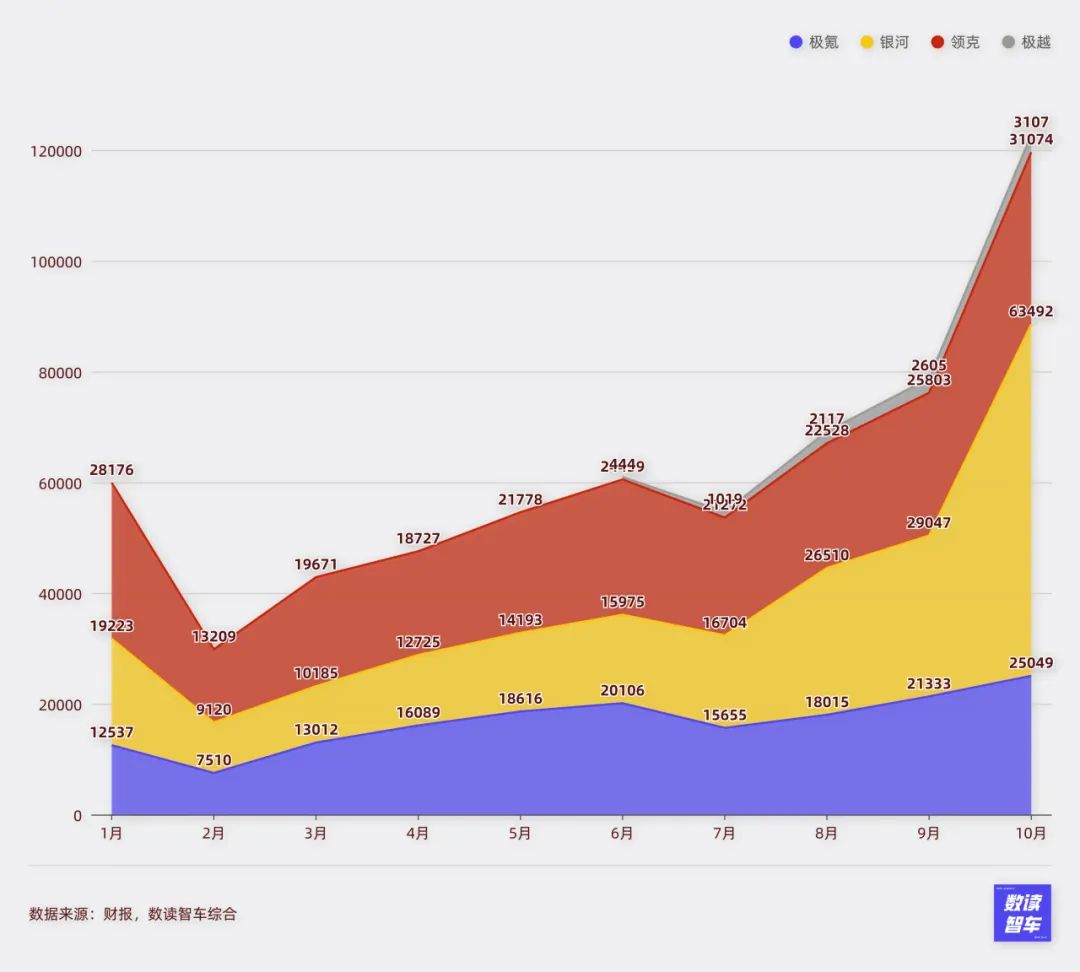

The threshold for the second tier can be set at 30,000 to 70,000 units. The number of brands in this segment continues to increase, with two more brands added in October compared to September. Among them, Geely's Geometry series was merged into the Yinhe series, whose sales crossed the 60,000-unit threshold. Lynk & Co also surpassed the 30,000-unit mark.

The third tier includes brands with sales exceeding 10,000 units, currently totaling 10, the same as in September. This tier is growing rapidly. Except for the main NIO brand, all others showed significant month-on-month growth.

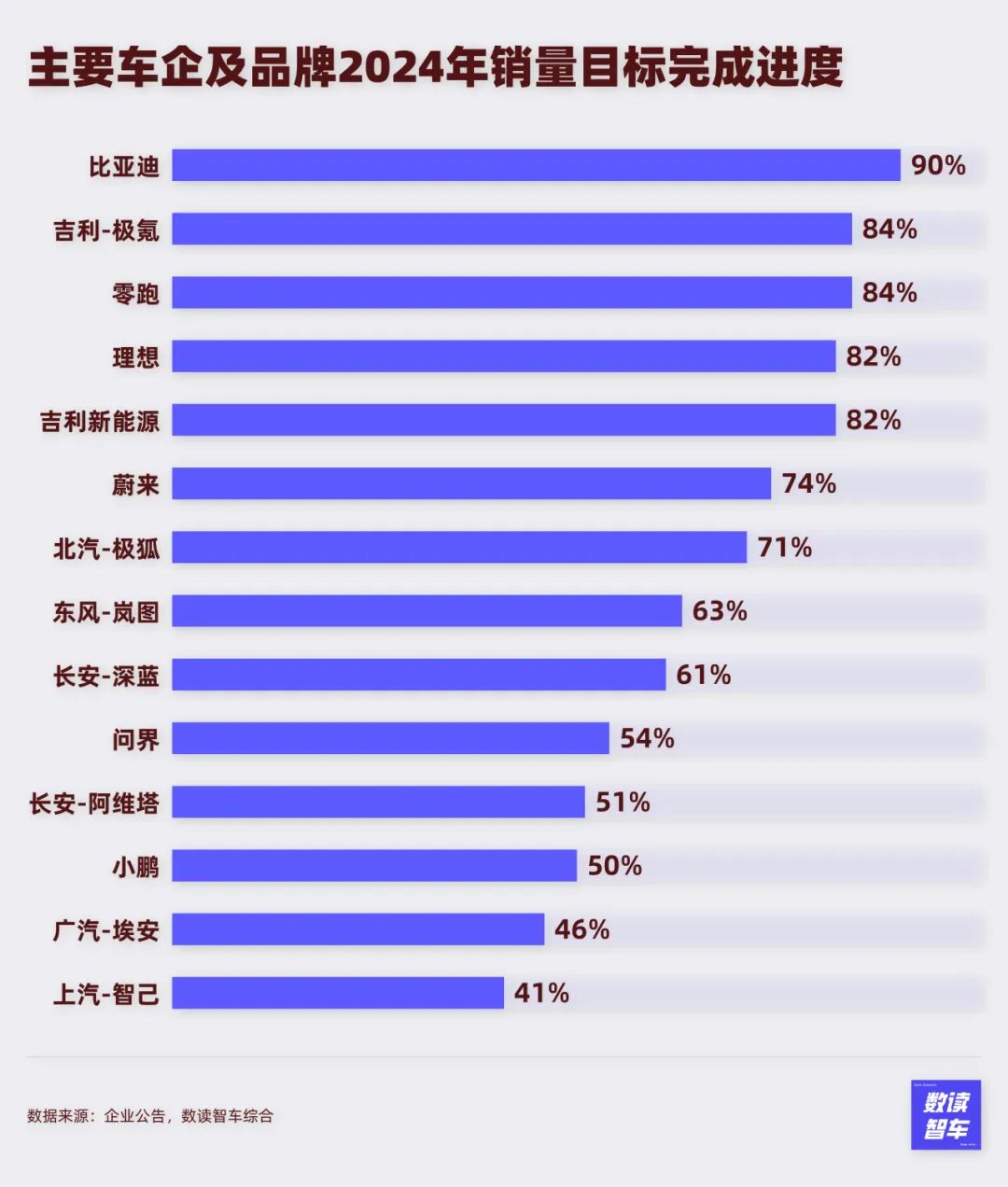

Due to the strong performance of most brands in October, progress towards sales targets has generally made significant strides. Undoubtedly, BYD is the most optimistic. Due to its explosive performance in these two months, BYD has already completed 90% of its annual target and will likely complete it ahead of schedule in November.

Another company that completed its annual target ahead of schedule is Xiaomi. Lei Jun has stated on Weibo that Xiaomi expects to complete its annual delivery target of 100,000 units ahead of schedule in November.

The rapid growth in Zero Run's sales has also greatly accelerated progress towards its annual target. In April this year, Zero Run was significantly behind schedule, but in the past four months, it has consistently set new sales records, significantly accelerating its progress. It has now completed 84% of its target and is likely to achieve it for the full year.

NIO, Geely Auto as a whole, and Geely's Zeekr are all making steady progress, consistently completing over 10% of their targets each month. Achieving their targets is highly probable, and there is a possibility of exceeding them.

There is still a glimmer of hope for NIO and ARCFOX, which have progressed over 70%. If sales can be further increased, they still have a chance to achieve their targets.

In addition, Dongfeng Voyah, Changan Shenlan and Avatar, AITO, XPeng, Aion, and SAIC IM Motors are highly unlikely to achieve their annual targets. Some of these automakers have set overly ambitious targets, such as Aion, while others have been too slow in their progress, such as XPeng.

#

Vol.3/ A Small Month for New Car Launches

Many flagship models have been launched previously, and there were not many new models launched this month.

On October 8, Hon Hai, the parent company of Foxconn, announced the Model D MPV and Model U electric mid-sized bus, as well as the North American version of the Model C built for US partners. Notably, Hon Hai will not produce or sell this model under its own name. Foxconn will license the vehicle to other brands for direct or adjusted mass production.

On October 18, Changan Qiyuan launched the 2025 models of the A07, A05, and Q05, priced between 78,900 and 159,900 yuan.

In the middle and late part of the month, BYD launched its medium-sized hatchback Seal 06GT and the 2025 Tang DM-i.

Geely launched five models of the Xingrui Dongfangyao, priced between 99,700 and 138,700 yuan, and two new versions of the Xingyue L, priced between 147,700 and 179,700 yuan. On October 23, Zeekr launched its sixth model, the MIX, priced between 279,900 and 299,900 yuan.

On October 28, FAW Besturn launched the long-range version of its mini electric vehicle, the Besturn Pony, with two configurations priced at 36,900 and 39,900 yuan.

Moreover, the most noteworthy development was Xiaomi's launch of the SU7 Ultra production version, priced at a staggering 814,900 yuan. This high pricing strategy is undoubtedly a bold attempt. Lei Jun revealed that SU7 Ultra received over 3,680 small reservations within 10 minutes of its launch.

It can be seen that there were no major flagship model launches this month, and the new car market enjoyed a brief period of calm.

#

Vol.4/ The Story of Catching Up from Behind

The biggest challenge faced by domestic new energy vehicles in October was the EU anti-subsidy duties.

This policy was not surprising, as foreign automakers have little ability to compete with Chinese automakers.

In the six months to September this year, global production by Japanese automakers fell for the first time in four years due to compliance scandals at the Toyota Group and fiercer competition from Chinese competitors.

Additionally, European automakers such as Volkswagen, Stellantis, BMW, and Mercedes-Benz have all revised their earnings forecasts downward due to multiple challenges in their transition to electrification. In October, Volkswagen sought to close at least three German factories and reduce salaries by 10% for all employees. Porsche plans to reduce its dealer network in China.

This is a concentrated demonstration of the latecomer advantage. Dominant players in the era of internal combustion engines face significant resistance in their transition. Revolutionizing oneself is always difficult, as it involves abandoning advantageous businesses and facing long-term losses in new businesses, as well as organizational and management challenges.

Oliver Zipse, Chairman of the Board of Management of BMW Group, stated, "The European continent is not yet ready to abandon gasoline and diesel engines."

Akio Toyoda, Chairman of Toyota Motor Corporation, spoke out against electrification.

Chinese automakers that have emerged from domestic competition are the protagonists of overtaking in bends. Currently, these automakers are accelerating their overseas expansion, a trend that cannot be reversed.

According to data from market research firm Rho Motion, global new energy vehicle sales exceeded 1.7 million units in September, with China accounting for over six million units, or over 60%, with a growth rate of 47.9%. From January to August 2024, China accounted for 67% of the world's new energy vehicle market.

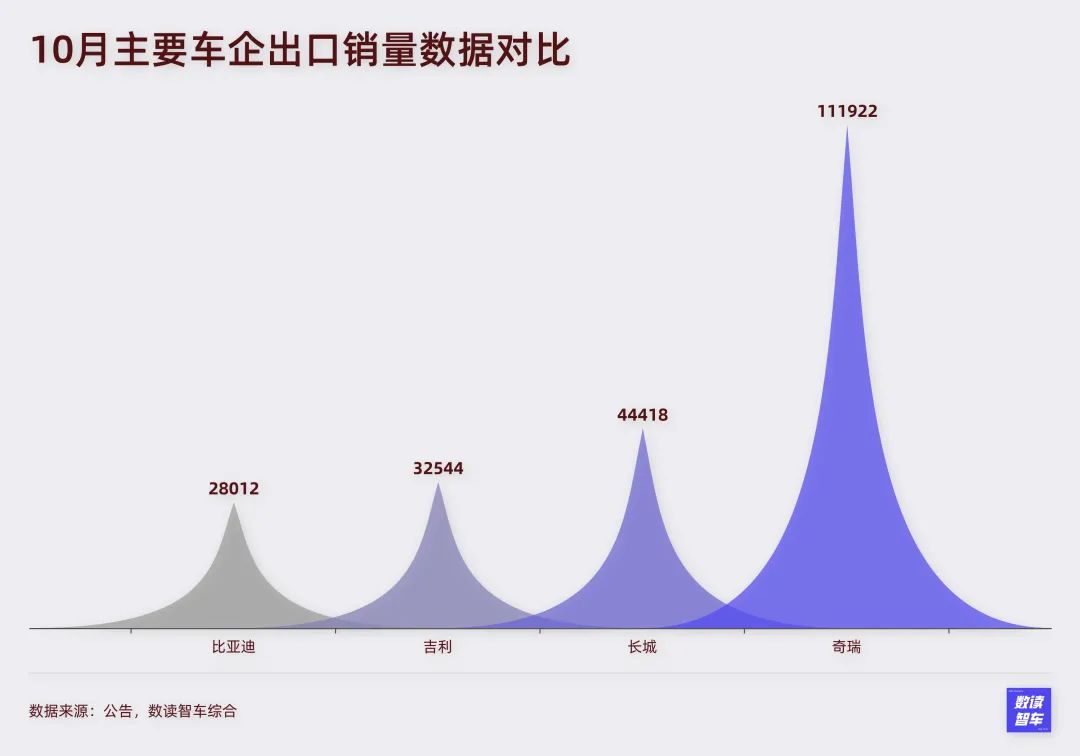

In October, Chery's overseas sales reached 111,900 units, setting a new record. Great Wall Motors sold 44,418 units, also setting a new record.

Chinese automakers are following a path of 'surrounding developed markets from the Third World.' Most companies are focusing their overseas expansion efforts on developing countries.

In the Middle East and North Africa, NIO announced its entry into these markets on October 5 and established a technology research and development center in the United Arab Emirates. Li Auto established a first-tier overseas expansion department in October, prioritizing the United Arab Emirates, Saudi Arabia, and other Middle Eastern and Central Asian countries, followed by Latin American countries. XPeng Motors officially entered the United Arab Emirates market and held a launch event for the G9 and G6 models in Dubai. It has now entered multiple countries in the Middle East and North Africa, including the United Arab Emirates, Israel, Egypt, Jordan, and Lebanon. BAIC signed a memorandum of understanding with Alkan Auto to assemble and produce electric vehicles in Egypt.

In the Latin American market, Zeekr entered the Colombian market, focusing on investments in charging facilities and technology development. BYD expects to sell 50,000 vehicles in Mexico this year, with sales doubling next year. Great Wall Motors' Ora Good Cat was launched in Ecuador, becoming the first pure electric vehicle model available in the country.

It can be said that although the EU has broken the rules, this cannot fundamentally improve the competitiveness of foreign automakers. At this stage, Chinese automakers are targeting markets with larger populations and faster development speeds, which are inherently the first stops for automakers expanding overseas. Tariffs will not hinder the progress of automakers.

In the European market, the product advantages of Chinese automakers will not disappear due to tariffs. Zero Run's C10 and T03 were officially launched in 13 European countries, with vehicles arriving at overseas stores for sale. Zero Run plans to expand its global sales network to 350 outlets (200 in Europe) in the fourth quarter and to 500 outlets in Europe by 2026.

BYD's first electric vehicle to be launched in Germany is expected to be priced between 25,000 and 30,000 euros. In terms of technology and products, it remains highly competitive.

As BYD stated, "EU tariffs will ultimately be paid by consumers."

This is a story of catching up from behind, and it has already begun to unfold, and it will not stop due to obstacles from adversaries.

#

Xiaomi: The Star of October

Xiaomi, which has been silent for a long time, became the star of October.

Early in the month, Lei Jun set a high goal of 'sprinting to 20,000 units.' On October 13, Lei Jun revealed that Xiaomi's daily deliveries exceeded 1,000 units. Ultimately, Xiaomi achieved its sales target, setting a new record since its launch. So far, Xiaomi has not missed any of its announced targets.

Concurrently, Xiaomi's intelligent driving system was also progressing. On October 30, Xiaomi's city NOA feature was fully rolled out. Xiaomi's intelligent driving system, equipped with end-to-end and vision-language large models, is expected to begin targeted invitation-only beta testing by the end of November and pioneer version rollouts by the end of December.

Xiaomi's production capacity will also accelerate further next year. According to reports, Xiaomi's second-phase factory is expected to be completed by mid-June next year. Based on planned capacity, Xiaomi will be able to guarantee deliveries of 300,000 units next year.

Judging from the current momentum, Xiaomi's only obstacle at present is production capacity. As a completely different entity, Xiaomi is likely to be the biggest variable in future automaker competition.

#

Li Auto vs. Huawei: Failure to Break Through the Bottleneck

The stalemate between Li Auto and Huawei has continued for a long time, with sales hovering between 40,000 and 60,000 units for the past five months.

After briefly surpassing Li Auto earlier this year, Huawei failed to maintain its lead and was soon overtaken by Li Auto, which has maintained its position. Although Huawei has released the AITO Askey S7 and R7, as well as the Enjoy S9, these models have not yet gained traction.

Li Auto's pure electric vehicle layout is still in its infancy. The failure of the MEGA project prompted Li Auto to undergo continuous internal organizational and management changes. The L series extended-range models provide strong support for Li Auto, which expects the L6 to reach a monthly production capacity of 30,000 units next year. However, for Li Auto to make further breakthroughs, it needs to launch more models and achieve comprehensive growth.

#

NIO, XPeng, and Zero Run: Starting to Accelerate

After a prolonged period of silence in the first half of the year, NIO, XPeng, and Zero Run have shown signs of improvement.

Among the three automakers, Zero Run has been the most impressive, surpassing 30,000 units for three consecutive months and approaching the 40,000-unit threshold, rivaling Huawei and Li Auto in sales. Although Zero Run's prices are lower than those of Huawei and Li Auto, it is constantly adjusting its product mix. CEO Zhu Jiangming revealed that the sales structure of Zero Run vehicles will change, with the proportion of low-priced T03 models falling to 21%.

Leapro has very big ambitions. Zhu Jiangming believes that Leapro Auto must achieve at least 300,000 monthly sales and 4 million annual sales to truly achieve its goals. This obviously requires Leapro to excel in cost-effectiveness.

Xpeng Mona M03 and NIO Lesso are the keys to the success of these two companies. These two low-priced models have successfully increased sales, exceeding 20,000 units each.

Increased sales further have a positive effect on automakers. The low-priced models have allowed NIO to obtain a new round of capital increase of 3.3 billion yuan in cash. On Xpeng's side, He Xiaopeng revealed that the Xpeng P7+ has performed exceptionally well and has already completed mass production. Meanwhile, Xpeng has deployed in areas such as low-altitude flight and Robotaxi.

Compared to other emerging forces, Nezha is already on the brink of collapse. This month, there were rumors that Nezha Auto would implement a salary reduction plan for all R&D personnel. Subsequently, Nezha stated that it would also implement a series of cost reduction and efficiency enhancement measures, including streamlining institutions, laying off redundant personnel, focusing on core businesses, and implementing flat management.

Not publishing sales data is an abnormal phenomenon, possibly implying very poor performance. Nezha already shows signs of withdrawing from competition.

#

Traditional Automakers: Comprehensive Evolution

Traditional automakers demonstrated strong growth potential in October.

After surpassing 400,000 sales last month, BYD did not stop and directly surpassed the 500,000 sales mark this month. In the third quarter of this year, BYD's quarterly revenue surpassed Tesla for the first time. At this rate, it is only a matter of time before BYD becomes the world's number one automaker.

Among BYD's products, the Dynasty and Ocean series remain the undisputed champions, with these two brands contributing to 12 models with sales exceeding 10,000 units. Among them, the Song, Qin, Yuan, Haiou, and Haibao models have monthly sales exceeding 50,000 units, truly realizing that one model can compete with an entire automaker.

Geely's new energy vehicle sales exceeded 100,000 units for the first time in October, and Geely is rapidly catching up with BYD to join the first tier. Geely has set new sales records for three consecutive months. Geely's growth is a comprehensive improvement across all models, with Zeekr, Yinhe, Lynk & Co, and Geometry all setting new historical highs this month. Especially for Geometry, after taking the lead in this model, its sales have been steadily increasing step by step.

Currently, Geely has three brands with monthly sales exceeding 10,000 units, giving Geely a very advantageous position in the competition.

Chery and Changan also have great potential to join the first-tier sales group.

After just surpassing 50,000 sales in September, Chery's new energy vehicle sales reached 71,330 units in October, directly surpassing 70,000 units. Although the goal of 80,000 units was not achieved, there has been a huge increase compared to before. According to Chery's goals, new energy vehicle sales will reach 100,000 units in December.

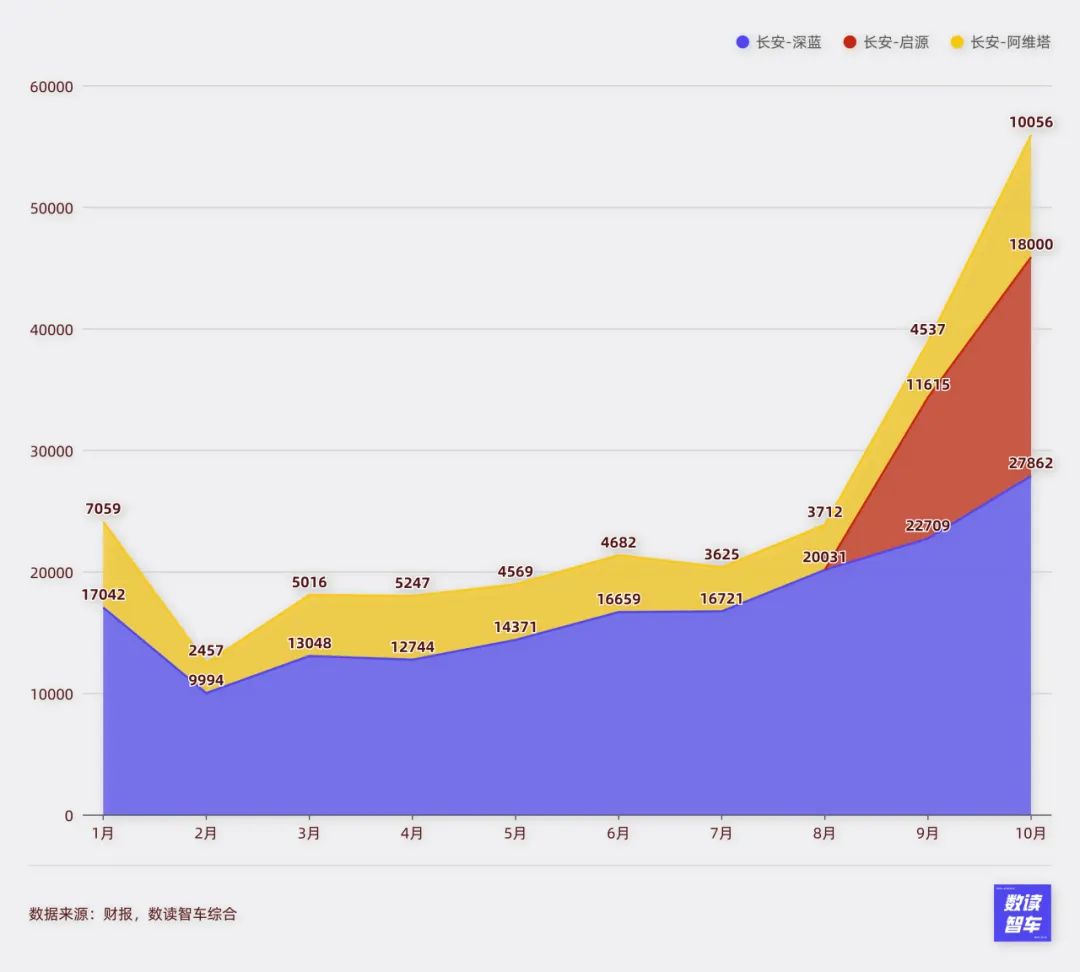

Changan Auto also performed impressively. Deep Blue, Qiyuan, and Avita all have monthly sales exceeding 10,000 units. Among them, Qiyuan continues its strong growth rate, with sales exceeding 18,000 units.

Deep Blue set a new historical high, with monthly sales approaching 30,000 units. There have even been cases where deliveries of the Deep Blue S07 could not keep up with orders. The Nanjing factory has adjusted from a single shift to a double shift, and the Chongqing factory will also start double-shift production.

The high-end brand Avita also achieved a breakthrough this month, with monthly sales reaching 10,056 units, exceeding 10,000 units for the first time in history. Avita's breakthrough is mainly attributed to its medium SUV Avita 07, where Changan no longer insists on pure electricity and instead provides an extended-range version, expanding user coverage. In the extended-range field, Changan intends to continue the price war. Changan Auto stated that there is still room for further reduction in the prices of extended-range models, which can meet future models priced around 100,000 yuan.

Benefiting from sales performance, Avita has launched a new round of financing, raising 10 billion yuan, with a post-investment valuation exceeding 30 billion yuan.

The combined efforts of the three brands make Changan's sales outlook even more optimistic.

In this competition, traditional automakers seem to be gradually gaining clarity. Relying on their well-established foundations and long-term brand appeal, they are gradually establishing competitive advantages in the market.

#

GAC: A Late Adjustment

Since the beginning of this year, GAC AION's performance has not been positive. Performance has continued to decline year-on-year, and it still has not been reversed in October. It can be said that this has been a year of stagnation for GAC AION.

The fundamental reason lies in the difficulties of product market competitiveness. After six months of consolidation, GAC Group initiated a major reform. For the management mode of its independent brands, GAC shifted from strategic control to operational control and simultaneously implemented related organizational reforms.

At the same time, perhaps to enhance coordination, GAC Group's headquarters will relocate from the Zhujiang New Town CBD to the Panyu Auto City, where GAC Trumpchi, GAC AION, and GAC Research Institute are located.

This late organizational management reform may be the key to GAC resuming growth.

In October, Chinese new energy automakers continued to evolve rapidly. In recent years, under fierce competition, Chinese automakers have continuously strengthened their competitiveness and optimized organizational management. Their competitiveness is increasing day by day, which is something that foreign automakers resting on past achievements do not possess. When the tide of electrification and intelligence comes, foreign automakers naturally have no way to withstand it.

'A thousand sails pass by the sunken ship, and ten thousand trees spring up before the sick tree.' Tariff measures are only a necessary choice, but they can never change an individual company's competitiveness or stop the wave of change.