Powered-up Li Bin may need to 'refuel' overseas

![]() 11/06 2024

11/06 2024

![]() 648

648

No change to domestic strategy

Author: Wang Lei

Editor: Qin Zhangyong

Recent news about NIO's range-extended vehicles has dominated headlines, but a closer look reveals that NIO's main strategy hasn't changed, and it has little to do with the domestic market.

The news comes from a Reuters report, stating that NIO will introduce range-extended hybrid products under its third brand, Firefly.

However, the report also clarifies that these hybrid models will primarily be marketed in overseas markets such as the Middle East, North Africa, and Europe, with a planned launch by the end of 2026 and deliveries starting in 2027.

It is emphasized that NIO will only sell hybrid models overseas, while in China, it will continue to support only battery-swapping electric vehicles.

Interestingly, Li Bin has previously responded more than once that NIO and NIO Life will adhere to battery swapping. However, this response is limited to China, and there has been no explicit denial regarding overseas model layouts. As of press time, NIO officials had not responded to this news.

Nevertheless, Ma Lin, Vice President of NIO Brand and Communications, tweeted that battery swapping stations are essentially range extenders for electric vehicles. "If battery swapping stations are available in every county, there's no need for range-extended vehicles."

This can be seen as an indirect response to speculation, confirming at least for now that NIO will not pursue range-extended vehicles domestically.

01 The investor's intention?

According to Reuters, the reason NIO has limited the sales market for this model to overseas markets including the Middle East, North Africa, and Europe is likely due to a proposal from CYVN Holdings, a major Middle Eastern investor in NIO.

CYVN is an investment institution majority-owned by the Abu Dhabi government in the United Arab Emirates. Established in 2022, the fund's strategic focus is on investing in industry leaders in the global smart mobility industry.

Last year, NIO and CYVN reached a strategic cooperation agreement, completing two investments totaling $3.3 billion in NIO. Today, CYVN is NIO's largest shareholder with a stake of approximately 20.1%, though Li Bin remains the controlling shareholder.

Just last month, NIO and CYVN reached another strategic cooperation agreement to establish an advanced technology research and development center in Abu Dhabi, UAE. Business operations will commence in the Middle East and North Africa in the fourth quarter of this year through a joint venture between NIO and CYVN, NIO MENA.

Notably, the cooperation agreement between NIO and CYVN includes a clause stating that they will jointly develop a new model tailored to local market demands, further expanding their product matrix to meet consumer preferences in the Middle East and North Africa.

This is intriguing. Combining the leaked information with the official announcement, it seems to align from market strategy to new model development. Therefore, it is highly likely that the overseas range-extended version of Firefly is a model exclusively for overseas markets, jointly developed by NIO and CYVN as stipulated in the agreement.

It's worth noting that in February this year, NIO agreed to license its electric vehicle technology to CYVN, allowing CYVN's subsidiary Forseven to use existing and future technical information, solutions, software, and intellectual property related to NIO's smart electric vehicle platform.

These technologies will be used for the research, development, manufacture, sale, import, and export of models sold or promoted under the Forseven brand. Of course, it's also possible that this exclusive overseas range-extended model could be sold or promoted under the Forseven brand.

In fact, before Reuters published this report, domestic media had already revealed that NIO's third brand, Firefly, would adopt range-extended hybrid technology, with related products expected to hit the market in 2026. For example, NIO is recruiting power NVH engineers, suggesting that it is recruiting professionals related to range extenders and internal combustion engines.

On the same day, NIO refuted this rumor: "NIO's third brand, Firefly, will continue to adopt the pure electric technology route of rechargeable, swappable, and upgradable batteries."

Shen Fei, Vice President in charge of NIO's energy replenishment network business, also commented on his Weibo account, "If we really go hybrid, what will I do?"

Moreover, Li Bin also seemingly responded on the same day, "Don't guess anymore. Battery swapping stations are available in every county, so there's no need for anything else."

However, based on current information, hybrid models are limited to overseas markets and will not be launched for sale in China. Regarding whether hybrid models will be introduced overseas, there has been "no response."

Furthermore, in a recent EP Club event hosted by Li Bin, he stated that the Firefly model is a global model with great flexibility, catering to the needs of the local market.

From the disclosed information, NIO will unveil the first model under the Firefly brand at the NIO Day on December 21. According to Li Bin, the Firefly brand is similar to the relationship between MINI and BMW but won't be pricier than a MINI. Positioned as a premium compact car, it is primarily intended as an additional purchase for existing NIO owners.

This also suggests that while there may be no reason for NIO's Firefly to adopt a range-extended route to boost sales in the domestic market, it doesn't mean there isn't a global strategy with multiple approaches. Moreover, developing other routes under its third brand won't affect NIO's main development trajectory.

02 Adapting to the overseas situation

NIO's decision to pursue range-extended vehicles overseas was not made lightly.

According to Reuters, the development of new hybrid models is due to the various challenges faced in selling pure electric vehicles in overseas markets, including trade barriers and inadequate charging infrastructure.

Currently, in addition to the base 10% import tariff, the European Union has imposed an additional tariff of over 20% on NIO vehicles sold in the region, which will significantly reduce the competitiveness of these models due to the increased cost.

However, this tax policy only applies to pure electric vehicles made in China and not to hybrid models, making hybrids a better choice for overseas markets.

Moreover, amidst sluggish demand for pure electric vehicles overseas, hybrid models have become popular. Automakers such as Ford, Volkswagen, Mercedes-Benz, and Stellantis have adjusted their electrification strategies, shifting towards the development of hybrid models.

Taking Mercedes-Benz as an example, it has revised its goal of electric vehicles accounting for 50% of total sales by 2025 to 2030, and has added hybrid vehicles to its lineup. Ola Kallenius, the company's global CEO, also stated that Mercedes-Benz will continue to improve its fuel engines.

Additionally, given NIO's business model, which emphasizes rechargeable and swappable batteries, significant capital investment is required. Abroad, it's challenging to even popularize charging stations, let alone battery swapping stations.

Taking the UAE in the Middle East as an example, it plans to build about 100 charging stations this year and install over 1,000 charging stations across the emirates by 2030.

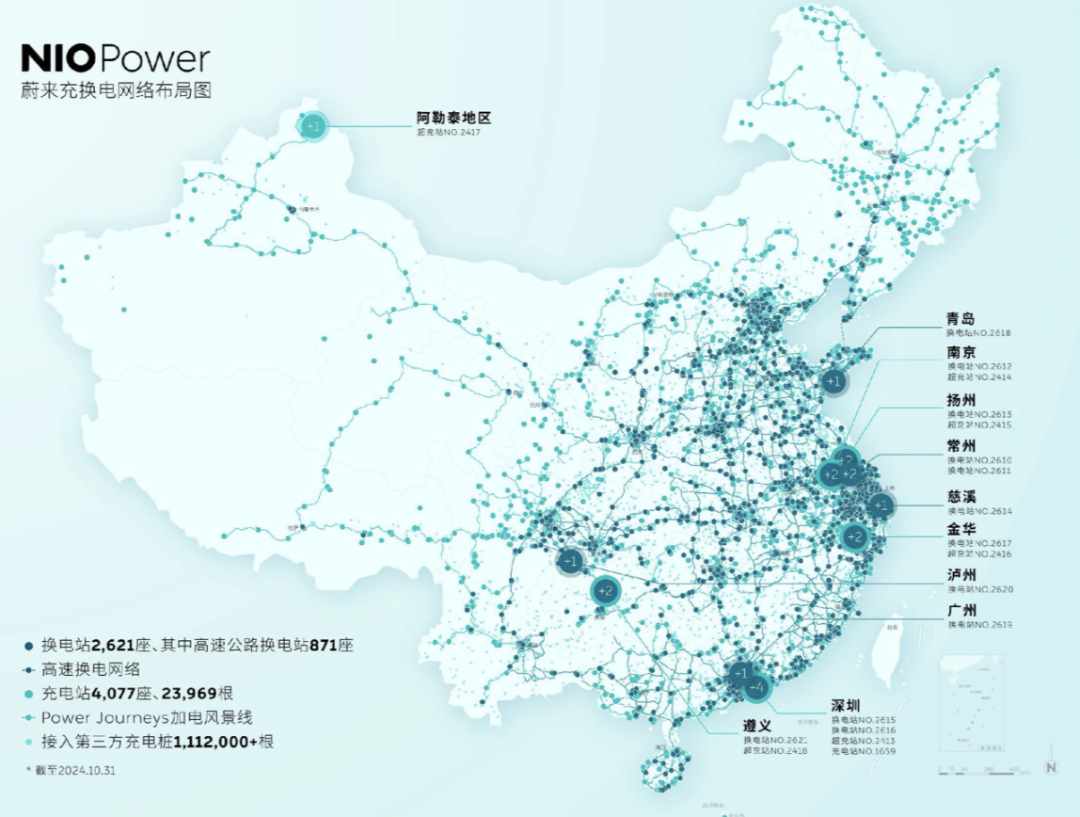

In contrast, as of October 28, NIO had deployed 2,601 battery swapping stations nationwide in China, including 868 expressway stations, and was on the verge of achieving county-wide coverage.

Furthermore, NIO has established 4,067 charging stations and 23,911 charging piles, as well as 1.1 million third-party charging piles, ranking first among domestic automakers in terms of both charging stations and piles.

Obviously, the scale of charging infrastructure in the Middle East cannot support the mass popularization of pure electric vehicles. Bringing battery swapping stations to the Middle East market, similar to Europe, would be an enormous expense for NIO and not a cost-effective option.

Moreover, the Firefly brand was positioned as a global model from the outset of its research and development, meaning its platform inherently has high compatibility. On this basis, it would not be difficult for NIO to add a fuel tank to Firefly models.

Considering the maturity of local energy replenishment infrastructure, there are reasons for NIO to introduce range-extended products overseas.

Domestically, pursuing a range-extended route can be seen as a means to ensure sales. Initially, only Li Auto adopted this route, but now Wenjie, Zero Run, AITO, ARCFOX, and others have followed suit, and their sales have generally been good.

For example, just in the past October, the first full delivery month for AITO's first range-extended model, the AITO 07, sales reached 10,056 units. In comparison, AITO's sales in September were only 4,527 units, representing a year-on-year increase of 150% and a month-on-month increase of 122.05%.

Although AITO has not disclosed specific sales figures for its range-extended version, the AITO 07, as the sole incremental model for AITO in October, clearly contributed significantly.

Li Auto and Wenjie need no introduction. Since Wenjie released its range-extended models, Thalys has taken off like a rocket. Relying on the popularity of its range-extended models, it has been competing with Li Auto for the top spots in the new force sales rankings for a long time. Taking Wenjie M9 as an example, it is currently the top-selling model priced above 500,000 yuan, with range-extended models being the absolute mainstay.

As the leader in range-extended vehicles, Li Auto delivered 51,443 new vehicles in October 2024, representing a year-on-year increase of 27.3%. It is also the first new force brand to achieve one million deliveries.

Meanwhile, Zero Run delivered 38,000 vehicles in October, setting a new record for five consecutive months, thanks to the popularity of its range-extended models, propelling it into the ranks of first-tier new forces.

From this perspective, NIO's decision to invest in range-extended vehicles is likely to increase sales significantly. However, there is a question: although the company is not producing them domestically, could they be introduced into China through parallel imports?