Forecasting 2025: Global EV Sales to Reach 19.4 Million, Trade Conflicts Hinder Transition Progress

![]() 11/06 2024

11/06 2024

![]() 459

459

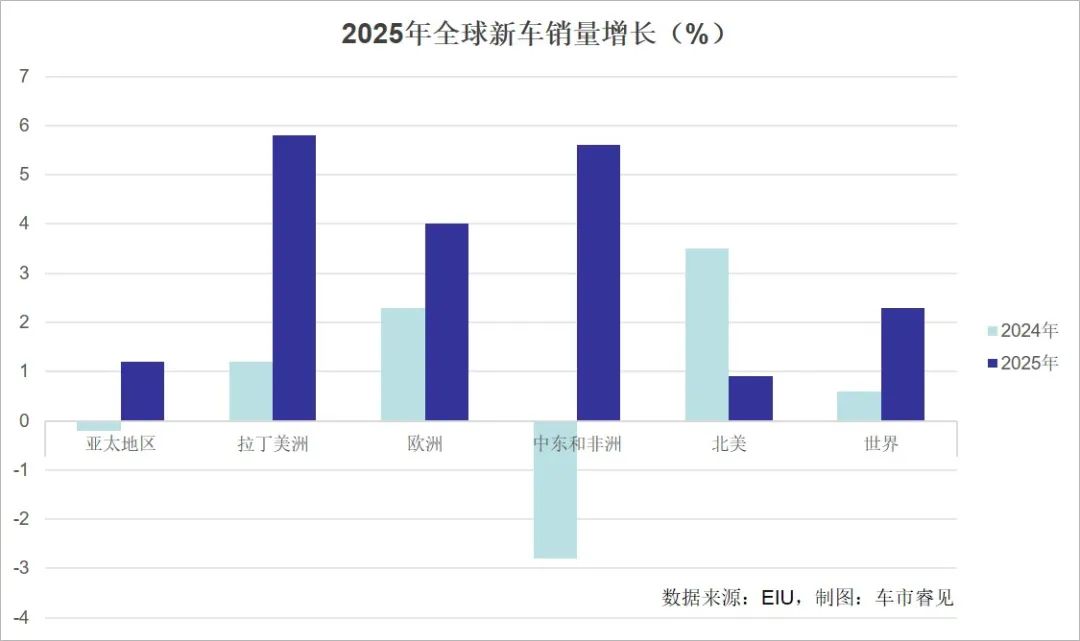

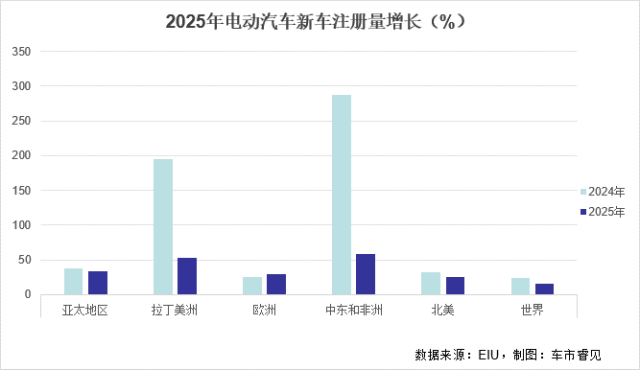

Recently, the Economist Intelligence Unit (EIU) released its outlook for the global automotive market in 2025, stating that the market will grow in a more benign manner, with global new car sales expected to reach 97.2 million, setting a new record. Electric vehicles (EVs) will continue to be the best-performing segment, with sales potentially increasing by about 16% to 19.4 million units.

○ Continued Growth, but at a Slower Pace

The subsidies and incentives provided by policymakers worldwide for EVs have fueled their rapid development. Their share of new car sales surged from 3.4% in 2019 to 21.8% in 2023. However, factors such as market saturation among early adopters, a shift towards less enthusiastic mass consumers, and a higher comparative base have restrained EV growth, leading to a flattening of the market. Nevertheless, government tax incentives for EV buyers and discounts offered by automakers will support EV sales growth, making the 2025 EV market still worth anticipating.

○ Trade Conflicts Impact Supply Chain Stability

EV development is influenced by factors such as technological innovation, cost control, and market demand, with trade barriers between China and the US, as well as China and Europe, posing obstacles to market growth. This negative force may intensify by 2025. In the US, requirements for local EV production are becoming stricter. According to the Inflation Reduction Act (IRA) passed in 2022, the US plans to exclude EVs manufactured using critical minerals from China from tax credits as incentives for buyers. Similar restrictions already apply to EVs and batteries from all "Foreign Entity of Concern" (FEOC) countries (China, Russia, Iran, and North Korea).

Additionally, the US and the EU have increased import tariffs on Chinese EVs. In May 2024, the Biden administration raised tariffs on Chinese EVs from 50% to 100% and on Chinese EV batteries from 0% to 25%. In August 2024, Canada followed suit with high tariffs. On October 29, 2024, the EU released its final anti-subsidy investigation report on Chinese EVs, announcing an additional 17%-35.3% anti-subsidy duty on Chinese EV imports for five years, on top of the existing 10% tariff. These measures will significantly increase sales costs for Chinese and Western EV manufacturers with production operations in China.

As a countermeasure, China may tighten export restrictions on critical minerals needed for EVs and batteries. In this global economic environment, the report believes that global EV manufacturers will face unstable and fluctuating input costs. Chinese and Western automakers will be forced to establish new vehicle or component production plants or leverage trade agreements with third countries to diversify supply chains and circumvent tariffs. In summary, the EV supply chain will continue to expand but faces the risk of further "fractures" due to geopolitical influences.

○ Increased Competition, but Improved Profitability

The risks of supply chain "fractures" and the trend of increasing input costs pose significant challenges to automakers, and industry competition remains intense. Western automakers continue to straddle old and new technologies, and foreign automakers in China, including Germany's Volkswagen, will continue to face declining market share in China by 2025 and beyond. Their losses in the Chinese market will also affect the realization of ambitious EV sales targets for some automakers.

For example, Volvo Cars originally aimed to achieve 50% EV sales by 2025 but only reached 16% in 2023. Meanwhile, Chinese EV manufacturers face rising trade barriers while continuing to expand overseas. BYD, for instance, plans to sell 1 million EVs outside China by 2025, supported by new factories in Brazil and Hungary.

The strong growth in global EV sales, combined with declining commodity prices for battery raw materials like lithium, is driving EVs towards profitability. Traditional automakers are likely to join the profitable ranks by 2025. As early as 2022, BMW's financial chief stated that its EV profitability would surpass that of internal combustion engine (ICE) vehicles by 2025, though this milestone may now be achieved in 2026. General Motors and Stellantis expect to achieve EV profitability by the end of 2024. However, even then, EV profitability will remain lower than that of ICE vehicles, as investments required for the EV transition will burden the financials of many automakers in 2025.

○ Accelerated Integration of AI and Automobiles

By 2025, artificial intelligence (AI) will accelerate its deep integration with automobiles. Mercedes-Benz will introduce AI-based "super assistants" in every vehicle it produces; Kia's new models will feature new voice assistants based on ChatGPT; Volkswagen has integrated ChatGPT into its IDA voice assistant to help drivers control infotainment systems, navigation, and air conditioning or answer basic questions; and BMW is testing a personal assistant powered by the Alexa Large Language Model (LLM), which can explain vehicle functions to occupants.

Meanwhile, automakers continue to develop subscription services, aiming to have owners pay monthly for features like smartphone integration, assisted driving, and in-car temperature control. Audi's upcoming A3 model in 2025 will offer subscription services ranging from one month to three years; Mercedes-Benz and Volkswagen will seek to provide subscription services for heated seats, advanced autonomous driving features, and even additional EV power. However, whether owners will be willing to pay for these services remains another question.

Typesetting | Zheng Li

Source | EIU