Beijing Hyundai: Tonight, the grand banquet ends, leaving behind absurdity everywhere?

![]() 11/07 2024

11/07 2024

![]() 658

658

It is hard to believe that in just a few years, Chinese consumers no longer admire joint venture automakers or agree with the inherent logic of the automotive industry's development.

Under the impact of industry development, regardless of what joint venture automakers do, market feedback from the terminal is always unsatisfactory. How to stay in China with dignity has become the most critical issue, and even the word 'dignity' can be omitted. Extending this issue, let's talk about Beijing Hyundai. At this year's Chengdu Auto Show, besides launching the all-new fifth-generation Santa Fe, Beijing Hyundai surprisingly used a group of handsome fitness models to attract attention for the first time on its booth, but as we both know, it was to no avail.

Since the beginning of this year, Beijing Hyundai has faced one crisis after another, including layoffs, declining sales, factory sales, and dealer pressure. According to relevant data, in the first half of this year, its cumulative retail sales were only 104,349 vehicles, compared to 123,000 vehicles sold in the same period last year. This represents a year-on-year decline of 25.16%, with a market share of only 1.4%.

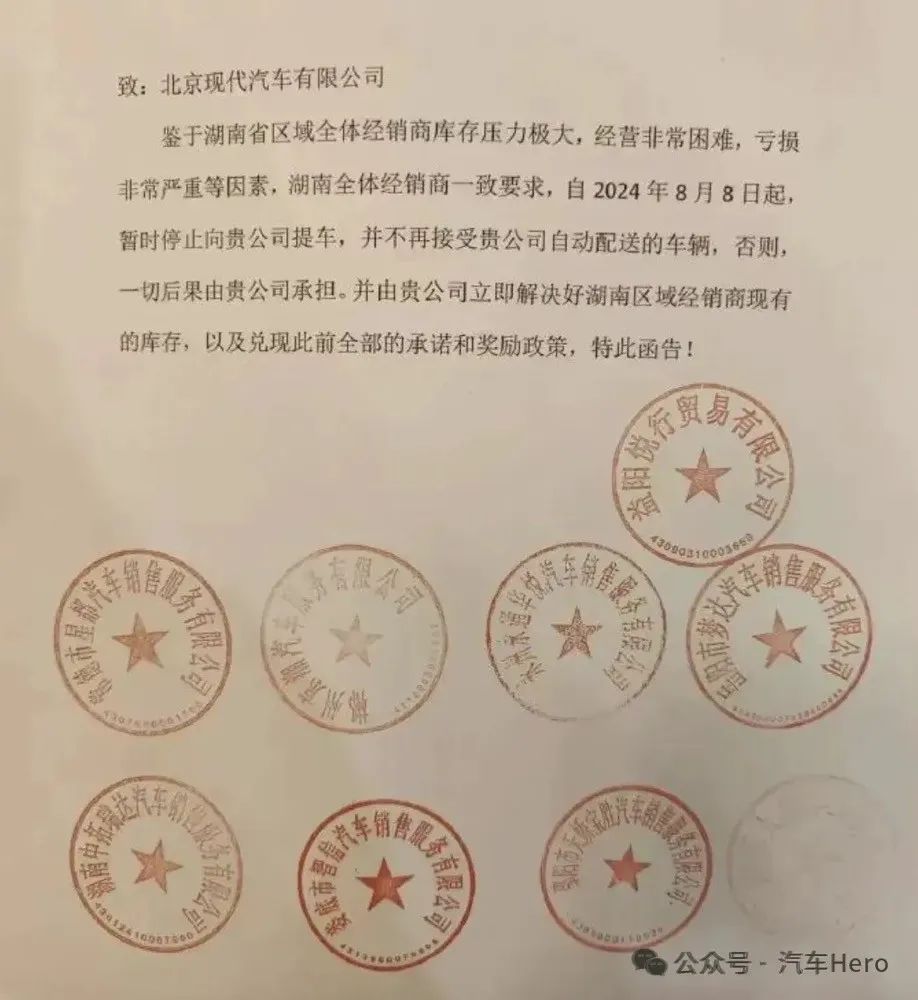

Some dealers have even bluntly stated: "Given the extreme inventory pressure faced by all dealers in Hunan Province, the difficult operating conditions, and the severe losses, all dealers in Hunan unanimously request that vehicle deliveries from your company be temporarily suspended starting from August 8, 2024, and that we will no longer accept vehicles automatically distributed by your company." Theoretically speaking, if it has come to the point of issuing an official letter with a seal, it is basically not false, which proves that Beijing Hyundai has entered the third stage of its brand's decline: the manufacturer's inventory sales projections have collapsed, and desperate dealers are frantically demanding the return of previously promised rebates. It is evident that Beijing Hyundai is currently under not only sales pressure but also significant inventory pressure. Amid the fierce competition in the automotive industry, Beijing Hyundai is the only joint venture automaker that has publicly clashed with its dealers.

However, both you and I are aware that Beijing Hyundai has had its glory days. The Elantra was launched in December 2003 and sold over 100,000 units in 2004, becoming the annual sales champion for a single sedan model in China and the undisputed "King of Family Cars". In 2016, Beijing Hyundai had its high point, with annual sales reaching 1.14 million. However, by 2017, Beijing Hyundai's sales began to plummet. Factories were successively halted, and sales fell below 300,000 units in 2022. Such a scene prompts one to sigh, 'Tonight, the grand banquet ends, leaving behind absurdity everywhere.'

Conclusion: Therefore, Beijing Hyundai, which is currently mired in development difficulties, is firmly shackled by its ingrained perceptions. As a result, its achievements and highlights in overseas markets cannot be leveraged to increase sales in China. After all, times have changed. More crucially, there have been rumors in recent months that Gong Yueqiong, the former Deputy General Manager of BAIC Group and Chairman of Beijing Hyundai, has left BAIC to take up a new position at Chery. Given such circumstances, what hope does Beijing Hyundai have left?