NIO is no longer betraying its early adopters

![]() 11/08 2024

11/08 2024

![]() 490

490

Author | Zhang Wen

Editor | Jiang Jiao

Cover | Unsplash

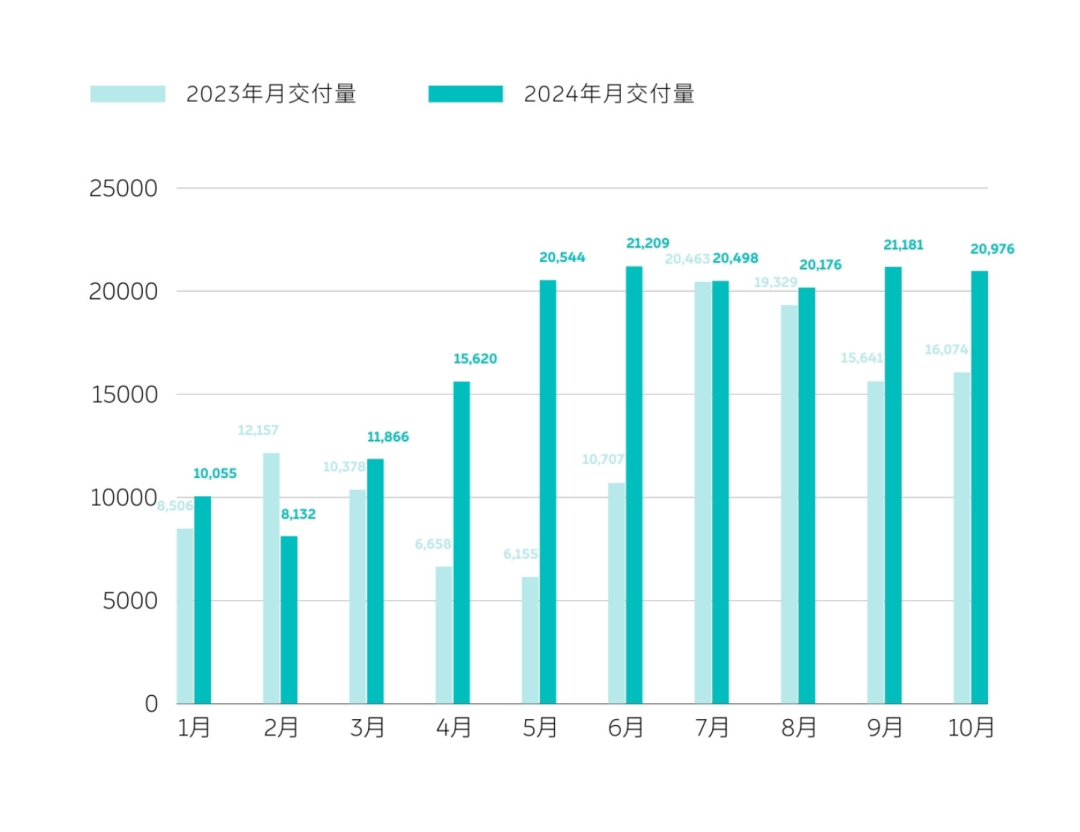

The second brand Lido has not significantly contributed to NIO's monthly deliveries yet. October was Lido's first full month of deliveries, but NIO's total deliveries decreased instead of increasing, dropping by over 200 units compared to September.

The direct reason is the significant decline in NIO brand's monthly deliveries. Excluding Lido's 4,319 sales, NIO brand delivered 16,657 new vehicles in October, a month-on-month decrease of over 18%, almost returning to the same level as last year. Prior to this, NIO brand had maintained a record of over 20,000 deliveries for five consecutive months.

These records were partly built on NIO's various terminal discounts. Even though Li Bin has repeatedly emphasized that NIO does not participate in price wars, NIO continues to offer terminal discounts. Unlike other automakers that openly advertise price cuts, NIO's discount measures are more complex and concealed. They rarely publicize these discounts, and you can often only learn about more detailed discount measures from salespeople, such as bulk discounts or discounts on available vehicles.

Comparison of NIO's monthly delivery data / Source: NIO

In the past few months, to maintain monthly sales of 20,000 vehicles, NIO often introduced more significant preferential policies at the end of the month. The most notable performance was in September, the end of the quarter, when NIO temporarily increased discounts on some models from 20,000 yuan to 30,000 yuan, causing dissatisfaction among some car owners. A Jiangsu car owner who purchased a NIO ES6 in early September said that the price dropped by 10,000 yuan just a week after taking delivery, which was unacceptable. "You never know what price you'll face tomorrow!"

The launch of Lido has eased NIO's sales pressure, and they no longer need to rely on frequent preferential adjustments at the end of the month to stimulate sales. After October, NIO's preferential policies stabilized, and the large discounts at the end of September were withdrawn, with no major adjustments since then. "The Hill" learned from different channels that NIO held a special meeting internally in October, where Qin Lihong, President of NIO, emphasized to the sales team that policies would not be frequently adjusted thereafter.

In the second quarter of this year, NIO's gross margin for complete vehicles was 12.2%. Li Bin stated during the earnings call at that time that optimizing gross margins would be an important task for the next stage, and they hoped to increase the gross margin for complete vehicles to 15% by the end of the year.

01 | Also to boost sales

In the past, Li Bin has been one of the fiercest opponents of price wars in the automotive industry. He has repeatedly emphasized that NIO does not participate in price wars and refuses malicious competition.

However, in the current fiercely competitive automotive industry, Li Bin can no longer afford to consider too much. Last year, they achieved a system-wide price reduction of 30,000 yuan by stripping some equity, which was once seen as a compromise to the price war. But the price reduction had a significant effect, and NIO's sales exceeded 20,000 units for the first time the following month, setting a new record.

The competitive pressure faced by NIO in 2024 has only increased. This year is a relatively slow year for NIO in terms of product launches; apart from the second brand Lido, NIO has not introduced any new models throughout the year, adding to the pressure.

Li Bin is still trying to uphold NIO's pricing system, and they have adopted another method of "price reduction." In March, NIO launched a revised BaaS battery rental service with a significant reduction in monthly rental prices. Qin Lihong said that this is a more reasonable discount measure than a direct price reduction, "even harsher than a general price reduction.""

The discounted BaaS plan received support from most car owners. Li Bin said in September that NIO's BaaS penetration rate had exceeded 80%, reaching up to 90%. Before the price reduction, NIO's BaaS penetration rate was only about 30%. Starting from May, NIO's monthly sales stabilized above 20,000 units.

This does not mean that NIO does not have promotional policies. In fact, over the past six months, NIO has introduced multiple preferential policies every month, with gradually increasing discounts. However, compared to other automakers, NIO's promotional policies are more complex, including but not limited to discounts on available vehicles (selling available vehicles as display models), discounts for repeat purchases by car owners, free intelligent driving years, mall points, and bulk discounts.

The automotive industry consulting agency JLR has compiled statistics on NIO's terminal promotional policies, pointing out that NIO's promotional policies are complex, changeable, and opaque. "While ensuring sales volume through promotions, it has not significantly negatively impacted the satisfaction of existing customers, as these promotional contents are difficult to clarify." JLR stated in an article investigating NIO's pricing system.

NIO's descriptions of price reductions are also vague. For example, in the official NIO November car purchase discounts, car owners who place an order can enjoy up to 20,000 yuan in optional fund discounts. However, in actual store experiences, salespeople often say that they can directly provide a 20,000 yuan discount on available vehicles. "We can basically match available vehicles, and they are all newly produced vehicles from the factory production line." A NIO salesperson in Beijing said that if an available vehicle cannot be matched, a 20,000 yuan optional fund is also available.

There are many posts on social media platforms sharing car purchase prices by NIO car owners, and the prices often vary. Among car owners, there is a joke about "buying a NIO at the end of the month," implying that discounts are greater at the end of the month. Many car owners even directly post their vehicle configuration lists on social media platforms, asking for a "FL (Fellow, NIO salesperson)" and bidding for quotes, with the lowest bidder winning.

Zhu Kai, General Manager of JLR, told "The Hill" that NIO's preferential policies are mostly "hidden" and difficult for people who are not intentionally purchasing a car to know. "On the one hand, it does not allow the outside world to perceive that its pricing system has frequent promotions, which does not harm the brand style, but it can stimulate potential car buyers."

However, with the development of social media platforms, NIO's continuous preferential measures have also caused dissatisfaction among some car owners, especially in September when quarterly sales targets were being pursued. At the end of the month, in addition to the 20,000 yuan cash discount on some available vehicles, NIO additionally offered up to 10,000 yuan in cash discounts, increasing the official discount to 30,000 yuan.

The above-mentioned Jiangsu car owner who purchased a NIO ES6 in early September could not understand and went to question NIO sales after seeing the latest car purchase discounts for other car owners on social media platforms. The salesperson also felt helpless and said they did not know about it beforehand, as the policy was suddenly issued in the middle of the night. She consecutively complained to NIO's official customer service but received no response. Later, NIO tightened its preferential policies, and the matter was dropped.

Frequent price adjustments can also affect potential car buyers' willingness to purchase. A car owner in Chengdu who experienced the NIO ET5T in the store on September 30 and decided to place an order during the National Day holiday said that after just one day, the discount he enjoyed decreased by 10,000 yuan, making him very angry and considering canceling his car purchase plan.

He is an early adopter of NIO and blindly purchased an EC6 as early as 2020, with great recognition for the NIO brand. He has always believed that NIO's pricing system is very transparent and does not change much, but the frequent discount adjustments in the past few months have exceeded his expectations.

'It was also to boost sales at the time.' Another NIO salesperson in Beijing said that they needed to reach 20,000 sales at the end of the month, which was actually achieved by reducing profit margins. Now that the sales target has been achieved, profit will be the priority in the future. He said that an internal company meeting had previously mentioned that when the discount reached 30,000 yuan, there was almost no profit margin left for the ES6.

02 | Sales are solved, but production capacity is not

Lido is one of the reasons why NIO dares to relax the sales growth of its main brand.

In Li Bin's plan, NIO's main brand will maintain its presence in the high-end pure electric market above 300,000 yuan, while the Lido brand will focus on the mainstream market of 200,000 to 300,000 yuan. Li Bin previously stated during an earnings call that NIO would prioritize gross margins thereafter, while Lido's primary task would be to prioritize sales, "without initially pursuing gross margins.""

Lido received positive market feedback initially. Although NIO does not have the habit of announcing large order data, on the evening of the Lido L60 launch event, Li Bin said during a media interview that the company's backend server had been expanded by five times, "L60 is indeed oversold.""

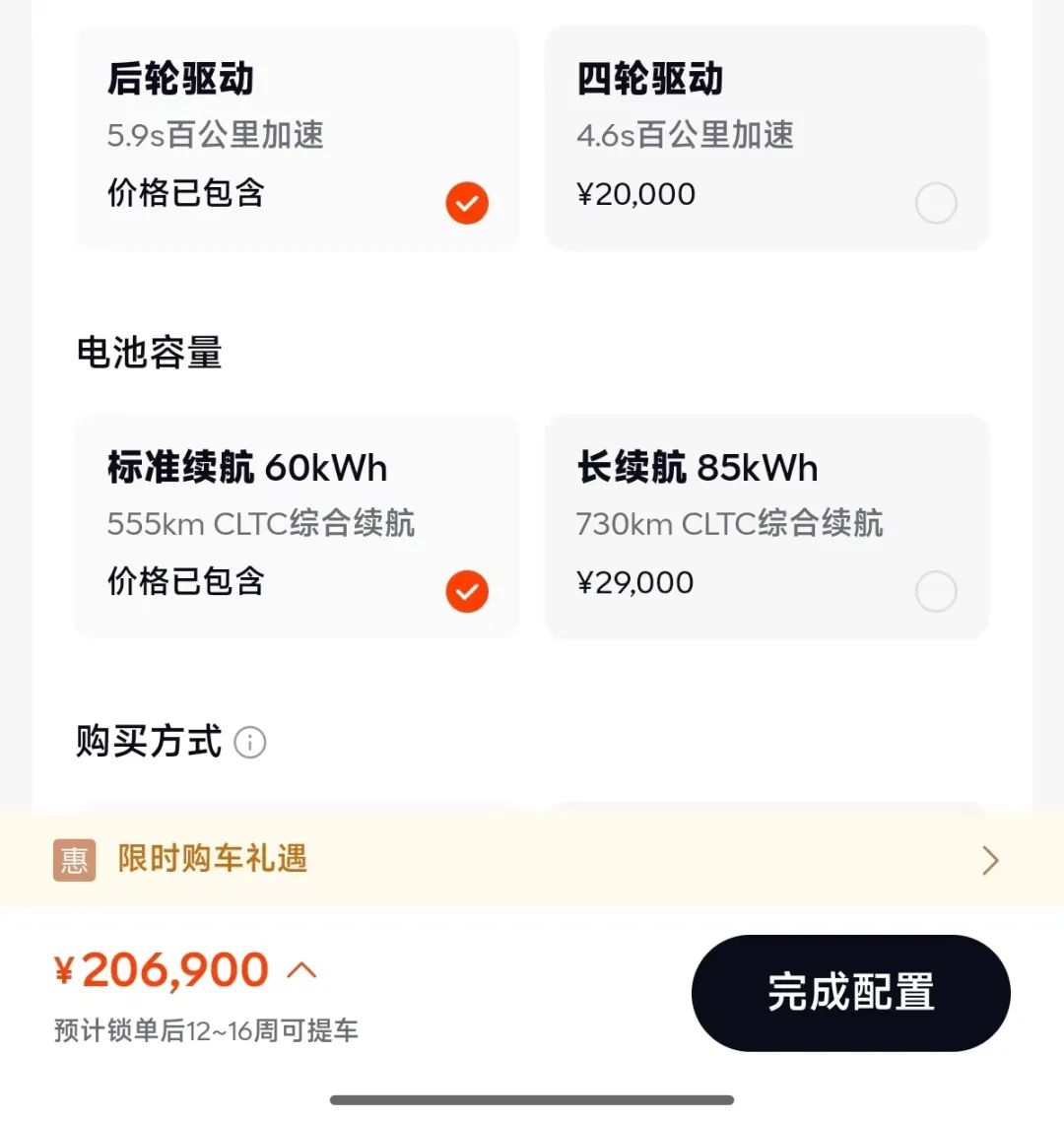

The pricing of the Lido L60, which is benchmarked against the Tesla Model Y, is lower than market expectations. Its starting price is only 206,900 yuan, 43,000 yuan lower than the Model Y. Purchased using the BaaS battery rental service, the starting price is as low as 149,900 yuan, directly entering the 150,000 yuan price range dominated by the Xpeng MONA M03.

Lido L60 purchase plan / Source: Lido Automobiles

However, the price advantage is only one of the reasons for Lido's overselling. A more prominent role comes from the brand reputation and service system accumulated by NIO over the past ten years. Xia Qinghua, head of user operations and service operations at Lido, previously analyzed the reasons for Lido's overselling in a podcast. Apart from the product itself, the other two reasons are related to NIO, such as the basic service facilities accumulated by NIO and the influence of the NIO brand.

Zhu Kai, General Manager of JLR, believes that if Lido L60's monthly sales do not reach 10,000 units, it can even be considered a failed product. He said that Lido is no longer a new brand but is established under NIO's mature system, including a complete battery swapping and charging network, updated technological advantages, and is positioned in the most mainstream market, targeting the most mainstream price range. If it still cannot sell 10,000 units per month, it will not make a positive contribution to the company.

However, similar to Xpeng MONA M03, which is also currently limited by production capacity issues, Lido is also plagued by production capacity problems. Within the Lido Auto App, the delivery period has been extended to 12-16 weeks, meaning that current car owners will have to wait until at least January next year to take delivery and will not be able to enjoy the end-of-year replacement subsidies.

Screenshot of the Lido Auto App

A Lido salesperson in Beijing told "The Hill" that when Lido was first launched in late September, store test drives were popular, and many customers visited the store during the National Day holiday. However, after the National Day, the number of store visitors decreased sharply. Apart from the cancellation of founder's edition benefits, more reasons were related to production capacity. "The factory's current production capacity can only meet previously placed orders.""

NIO has suffered from production capacity issues with the ET5 model in the past, but it seems that there are still inadequacies in the initial production capacity planning for Lido. The Lido L60 is produced at NIO's second factory in Hefei, sharing production lines with some NIO models. Li Bin previously stated that the Lido L60 has already started double-shift production, with a projected production capacity of 10,000 units in December and an increase to 20,000 units by March next year.

Compared to the Zhiji R7, which is also benchmarked against the Model Y, Lido's production capacity seems to be more insufficient. Zhiji R7 began its first batch of deliveries on October 15 and announced 4,730 deliveries within 16 days. Lido began its first batch of deliveries on September 28 and had delivered a cumulative total of 5,151 new vehicles by the end of October.

In Li Bin's plan, there will be no conflict between Lido and the NIO brand. However, some automotive industry insiders told "The Hill" that there may be mutual encroachment between the two brands.

The above-mentioned Chengdu car owner who placed an order for the NIO ET5T said that he initially planned to purchase the Lido L60. However, when visiting the Lido store, he was "intercepted" by NIO salespeople in the same mall. The NIO salesperson recommended the ET5T to him, and with various preferential measures such as repeat purchases by car owners and end-of-month discounts, the price of the ET5T was only about 30,000 yuan more expensive than the Lido L60.

In the actual car purchase process, there can also be behavior where Lido and NIO salespeople "undermine" each other. For example, Lido salespeople told him that NIO's models still use the older NT2.0 platform and only have a 400V architecture, but the Lido L60 already uses the NT3.0 platform with a standard 900V fast charging system. NIO salespeople emphasized to him that NIO models have 4 NVIDIA OrinX chips and more battery swapping stations than Lido.

Due to production capacity constraints, Lido will probably only contribute about 30,000 sales to NIO this year. Without further promotional discounts, based on October's sales data, it may be difficult for the NIO brand to return to monthly sales of 20,000 units within the year.

Compared to other new energy vehicle makers, NIO still has sufficient ammunition to face competition. As of the second quarter of this year, NIO's cash and cash equivalents, restricted cash, short-term investments, and long-term time deposits totaled 41.6 billion yuan. In September, NIO China also received a capital increase of 3.3 billion yuan from strategic investors such as Hefei Jianheng, Anhui High-tech Investment, and SDIC Venture Capital.

At the end of the year, NIO's third brand, FIREFLY, will soon be launched. Coupled with Lido's second model scheduled for release next year, as well as the NIO ET9 and several model refreshes, NIO is about to usher in an unprecedented product year. The latest news indicates that NIO may launch a hybrid model of the FIREFLY overseas. NIO has not publicly responded to this matter yet.