Avita's IPO plan exposed: backed by three major investors, the surge in sales of extended-range vehicles boosts its confidence

![]() 11/11 2024

11/11 2024

![]() 595

595

Recently, the Shanghai United Assets and Equity Exchange published information promoting Avita's capital increase project and mentioned Avita's plan to go public in 2026. Prior to this, Changan had repeatedly stated that Avita would go public, but the timing would be flexibly adjusted based on sales and market conditions. This information exposure has made Avita's listing more certain.

Screenshot: Shanghai United Assets and Equity Exchange

Public fundraising through an IPO can replenish funds for automakers and elevate their performance to the next level. Looking at the new energy automakers that have already gone public, except for Evergrande, XPeng, NIO, Li Auto, ZEEKR, and others currently have relatively impressive sales data.

However, the automotive industry is highly competitive, and without robust product capabilities and the support of more consumers, it is difficult for automakers to gain recognition from the capital market even after going public. In late June, NIO submitted an IPO application to the Hong Kong Stock Exchange, but is now plagued by rumors such as "unpaid wages" and "unpaid supplier payments". Forget about a smooth IPO; even survival is in question.

According to media reports, in the two and a half years since Avita's first product entered the market, the brand has accumulated losses of 7.103 billion yuan, and as of the first half of this year, the brand's asset-liability ratio reached 94.46%. Under such circumstances, can Avita successfully complete its IPO in two years?

Surge in sales of extended-range vehicles boosts Avita's confidence

At the end of September, Avita 07 officially went on sale. This model is the brand's first to be equipped with extended-range power and is also the brand's entry-level product. Compared to the other two models in the Avita family, Avita 07 has two major advantages: a more affordable price and no range anxiety.

Previously, relying solely on the Avita 11 and Avita 12 models, Avita's monthly sales were generally between 1,000 and 5,000 vehicles, a significant gap compared to new forces like NIO and Li Auto. Due to the launch of Avita 07, Avita's sales in October soared, with 10,056 vehicles sold, marking the first time monthly sales exceeded 10,000 units.

Source: Avita Motors Official Website

In addition, Avita has quickly applied extended-range power to other models. The extended-range version of Avita 12 went on sale on November 2, and the extended-range version of Avita 11 is also confirmed to be launched this year. With the addition of extended-range power, Avita has even more room for sales growth.

According to the official definition, Avita is a high-end smart electric vehicle brand that brings together the advantages of Changan, Huawei, and CATL in their respective fields. This means that the development paths of Changan, Huawei, and CATL will determine the future of Avita.

Changan primarily provides support for Avita in vehicle research and development and manufacturing. From a technical standpoint, the Kunlun extended-range system used by Avita has a fuel-to-electricity conversion coefficient of 3.63kWh/L, meaning that burning one liter of fuel can generate 3.63kWh of electricity, achieving top-tier fuel-to-electricity conversion efficiency in the industry. Moreover, Changan is a supporter of extended-range power, and as a high-end sub-brand under the Changan Automobile Group, Avita will inevitably apply the latest extended-range technology.

Source: Avita Motors Official Website

Huawei is primarily responsible for Avita's intelligent vehicle solutions. It goes without saying that Huawei's HarmonyOS cabin and Qiankun intelligent driving system are among the best in the smart vehicle field, and Huawei continues to invest in these two areas, essentially ensuring that Avita does not lag behind its competitors in the smart vehicle field.

CATL provides battery technology and energy solutions for Avita. Deng Chenghao, CEO of Changan Deep Blue, stated that "whether extended-range has a future mainly depends on breakthroughs in battery technology." CATL will mass-produce its XiaoYao battery for extended-range hybrid vehicles, enabling vehicles to have a pure electric range of over 400km and 4C ultra-fast charging capabilities.

Before applying extended-range technology, Avita did not fully leverage the unique advantages of Changan and CATL. After taking the first step towards extended range, Avita is backed by Changan, which insists on extended-range technology; CATL, which introduces extended-range batteries; and Huawei, which ranks among the best in the smart vehicle field. This trio will escort Avita's future sales, giving Avita the confidence to pursue an IPO.

Of course, whether Avita can successfully go public will also depend on comprehensive factors such as "right timing, right place, and right people," and seizing opportunities is crucial for taking off.

How to recover from a 7.1 billion yuan loss? An IPO is a major path

Chen Zhuo, President of Avita, revealed that the primary purpose of Avita's IPO is to improve the company's governance structure through listing management requirements and facilitate the brand's transformation into a smart, low-carbon mobility technology company.

However, the fundamental goal of any company is still profitability. From 2021 to 2023, Avita completed a round of financing each year, with the total amount of these three rounds of financing approaching 8 billion yuan. In the past two and a half years, Avita has accumulated losses of 7.103 billion yuan, and the three rounds of financing are nearing exhaustion, with the company's debt ratio even reaching 94.46%. Moreover, Avita invested 11.5 billion yuan directly this year to acquire shares in Huawei's subsidiary, Yinwang.

Currently, Avita is conducting its C round of financing, which will undoubtedly reduce the company's debt ratio. To provide more investment confidence to the capital market, Avita is attempting to achieve profitability before the IPO. Chen Zhuo revealed the brand's plan to "strive to achieve break-even in the third and fourth quarters of 2025."

Source: Harmony Intelligent Mobility

In addition to the support of Changan, CATL, and Huawei, the gradual expansion of Yinwang's "circle of friends" can also bring more revenue to Avita.

Since last year, the frequency of cooperation between traditional automakers and technology companies has gradually increased, especially with Huawei. Brands like Dongfeng's Voyah, MSHAUTO Tech, and GAC Trumpchi have all started cooperating with Huawei in the intelligent vehicle field. Huawei has retreated to the second tier of the automotive industry, pouring all its technology and resources in intelligent driving and intelligent cabins into Yinwang.

It is often said that "the second half of the automotive industry is intelligence." Recognizing this early on, Avita was the first to invest in Yinwang. Electric Vehicle News believes that the demand for intelligence in the domestic automotive market is gradually increasing, and Huawei is a leader in the intelligent field. The market value of its subsidiary brand, Yinwang, may gradually increase. Nowadays, there are already many capable players in the intelligent driving race, and most have announced the rollout of mapless intelligent driving this year. Competition in the intelligent driving field will only intensify next year. It is foreseeable that more automakers will cooperate with Yinwang in the future, and the revenue Avita obtains from this will only increase.

Source: Huawei Intelligent Automotive Solutions Official Website

Of course, to make up for the 7.1 billion yuan loss, Avita must rely on its high-volume products. According to the plan, in addition to the Avita 11 extended-range version, Avita will also launch the Avita E16 (internal code name) and brand-new large five-seater and six-seater SUVs. Among them, the Avita E16 is positioned as a mid-size sedan and also offers both pure electric and extended-range power options. Referring to the price of the Avita 12, the Avita E16 is likely to compete with mid-to-high-end new energy sedans like the ZEEKR 001 and Tesla Model 3.

There is little information about the new large five-seater and six-seater SUVs, but based on market demand, Electric Vehicle News speculates that these two new models are likely to compete with the main models under Li Auto and AITO. New sedans and large-volume SUVs are mainstream products in the current new energy market. If Avita's sales reach the level of Li Auto and AITO next year, a smooth IPO should not be a big problem.

Entering the mainstream high-end market is key to Avita's IPO

Judging from its product tonality, Avita is unlikely to follow the affordable route like Neta and Leap Motor, as this field already belongs to Changan Automobile and Deep Blue Automobile.

Since Avita has decided to take the high-end route while also aiming to achieve profitability as soon as possible, it must meet high standards in aspects that mainstream consumers value, such as intelligence, energy consumption, materials, and configuration.

Source: Avita Official Website

The sales data of Avita 07 have already started to show signs of Avita's transformation towards the mainstream high-end market. The next major consideration for Avita is how to secure a place in the mainstream high-end market.

If one were to point out any deficiencies in Avita's current products, Electric Vehicle News believes that there are few issues with the product's technical foundation. The main issues lie in product design and brand influence.

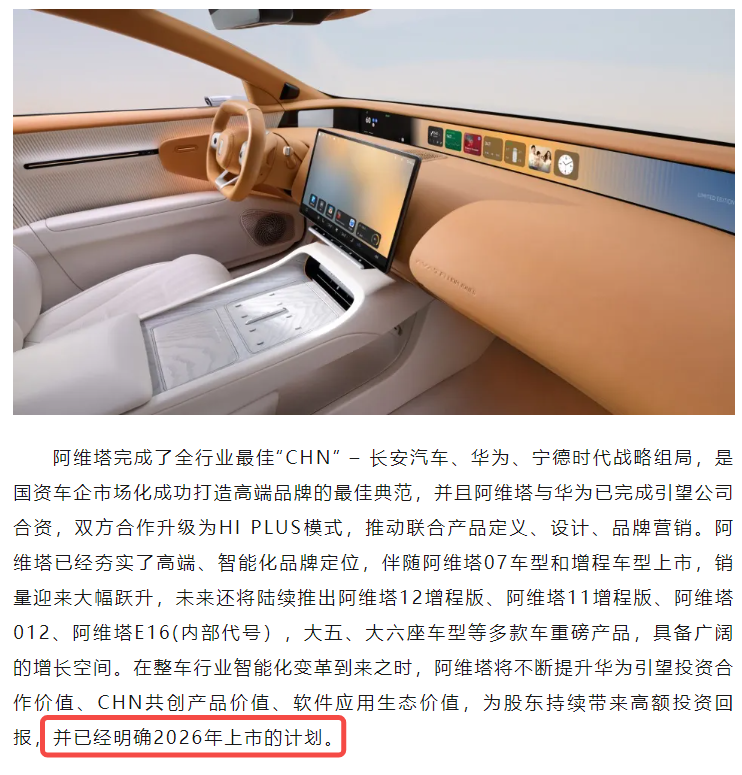

Looking at Avita's products alone, it's easy to feel the ingenuity of the designers, such as the visually spacious cabin design and the bold application of long, narrow screens and ambient lighting, which are not found in other models. However, Avita's design language may be too avant-garde for many users, as best-selling products tend to feature a minimalist design. This may cause Avita to lose some potential customers.

More importantly, there is the aspect of brand influence. Although Avita is backed by the technology of three major investors, and Avita Technology Co., Ltd. was established as early as July 2018, not much later than other new-force brands, Avita's official naming only occurred in May 2021, just over three and a half years ago. It will take more time to form a significant influence.

Of course, Electric Vehicle News believes that robust product strength is the foundation for brand development and the key to Avita's successful IPO.

(Cover image source: Avita Motors Official Website)

Source: Leitech