Sales Decline for Four Consecutive Years, Is Dongfeng Honda Losing Its Appeal?

![]() 11/11 2024

11/11 2024

![]() 650

650

In the years when second-tier joint venture brands gradually faded out of the market, first-tier joint venture brands maintained robust market competitiveness. At that time, many people believed that first-tier joint venture brands would continue to thrive gracefully. However, in just a few years, even first-tier joint venture brands have shown signs of decline.

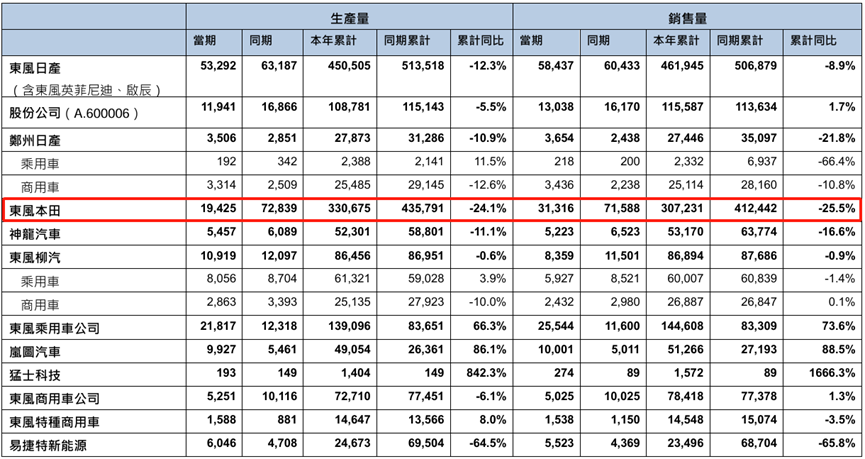

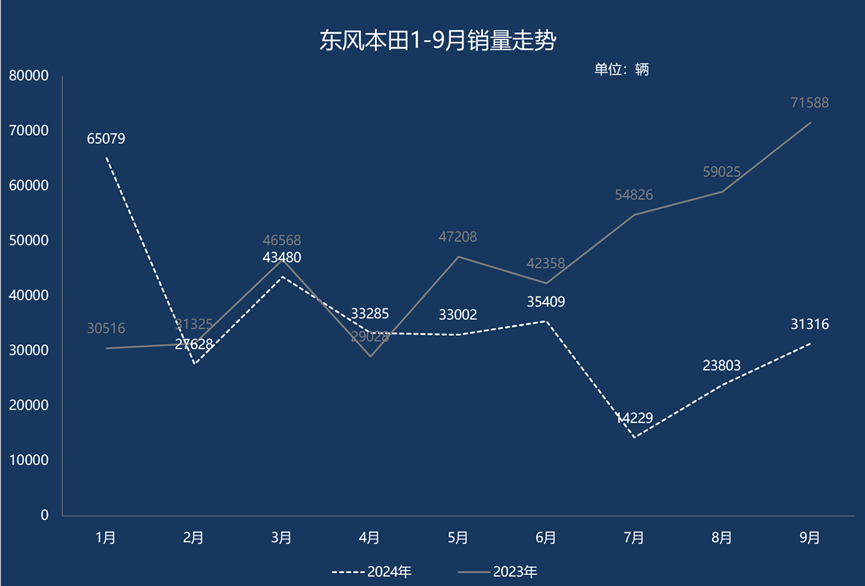

Over the past two years, sales of Volkswagen, Nissan, and Honda's joint ventures in China have all declined. Among them, Dongfeng Honda has experienced the steepest decline. According to production and sales data released by Dongfeng Motor Corporation, in September this year, Dongfeng Honda sold 31,316 new vehicles, a year-on-year decrease of 56.26%; from January to September this year, Dongfeng Honda sold a total of 307,231 vehicles, a year-on-year decrease of 25.5%.

In the first nine months of this year, Dongfeng Honda saw year-on-year sales growth in only two months. Since May, Dongfeng Honda's sales have declined for five consecutive months. From July to September, Dongfeng Honda experienced sales declines of over 50% for three consecutive months. In July, Dongfeng Honda sold only 14,229 vehicles, a year-on-year decline of up to 74%. "The Chinese automotive market competition intensified in 2024, accompanied by a further increase in the penetration rate of new energy vehicles. The automotive industry structure is undergoing rapid changes, impacting the sales of many automakers." Dongfeng Honda euphemistically explained the reason for the sales decline in 2024 to "Consumer Reports". However, 2024 was not the first year that Dongfeng Honda's sales declined. Prior to that, Dongfeng Honda had experienced three consecutive years of decline.

Data disclosed by Dongfeng Motor shows that in 2021, Dongfeng Honda sold a total of 762,000 vehicles throughout the year, a year-on-year decrease of 10.4%. In 2022, Dongfeng Honda's annual sales declined to 661,000 vehicles, a year-on-year decrease of 13.2%. In 2023, Dongfeng Honda's sales further declined to 605,000 vehicles, a year-on-year decrease of 8.54%. By 2024, the decline in Dongfeng Honda's sales had significantly widened.

However, on the other hand, during the years when Dongfeng Honda's sales declined, Chinese automakers such as BYD, Chery, and Geely all achieved rapid growth. The rise of electrification has been a driving force behind this. Over the past few years, electrification and intelligentization have developed rapidly in China, and new energy vehicles have become increasingly popular among consumers. Chinese automakers have acted swiftly, actively expanding their electrified product lines to cater to market trends and consumer demand. To gain a competitive edge, major Chinese automakers are engaging in fierce competition in design, smart cabins, autonomous driving, and even gimmicks, while continuously lowering prices while equipping vehicles with fridges, TVs, and large sofas.

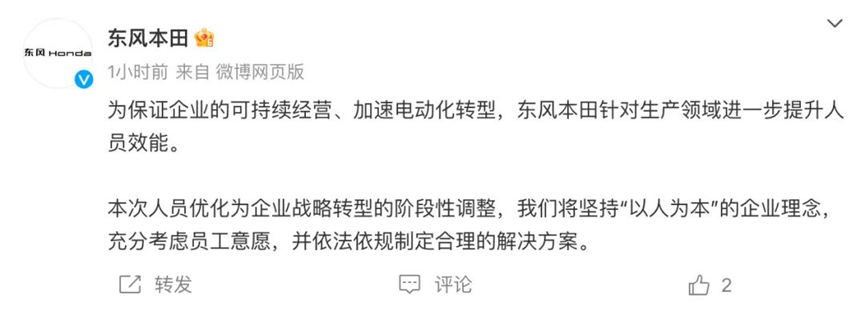

Consequently, traditional Chinese automakers like BYD, Geely, Changan, Chery, and Wuling, as well as emerging Chinese automakers like Li Auto, XPeng, NIO, Wenjie, and Zeekr, have all become key players in the market, leading new trends in consumer demand in the automotive market. The mechanical quality and driving comfort once celebrated by traditional joint venture brands are gradually being overshadowed by consumers, reducing their presence in the market. Dongfeng Honda is one of them. Although Dongfeng Honda has also been forced to initiate a significant price reduction sales model due to the "price war" pressure, its market competitiveness is no longer apparent in the face of various Chinese electric vehicles with better configurations and higher cost-effectiveness, leading to a decline rather than an increase in sales. Faced with persistent sales sluggishness, Dongfeng Honda has also begun to make adjustments. In September this year, Dongfeng Honda was reported to be planning a large-scale layoff, aiming to reduce its workforce by over 2,000 employees. This follows an announcement on July 26th that the second factory production line of Dongfeng Honda would suspend production in November 2024. "With sales declining, we are indeed facing the issue of overcapacity," said a source close to Dongfeng Honda.

At its 20th anniversary celebration, Dongfeng Honda announced that it would ensure that the proportion of electrified models reaches over 50% by 2025; by 2027, it will no longer launch traditional fuel vehicles; and by 2030, it will launch at least 10 pure electric models. On September 26th, Dongfeng Honda's new compact sedan, the Lingxi L, officially went on sale. The first product of Ye, a new electric brand created specifically for the Chinese market, the Ye S7, will also be launched soon.

It is still uncertain whether Dongfeng Honda's new electrified products will achieve the expected results. However, it is known that the monthly sales of Dongfeng e:NS1 have dwindled to just two digits. Since its launch, the monthly sales of e:NS2 have peaked at just over 200 units. Among Dongfeng Honda's two plug-in hybrid models, the monthly sales of the Inspire New Energy are less than 100 units, while the monthly sales of the CR-V New Energy have hovered around 300 to 400 units. Currently, the sales of Dongfeng Honda's electrified products already on the Chinese market are generally low. Especially when compared to local Chinese products of the same level from brands like BYD, NIO, and Changan, Dongfeng Honda's electrified products lack a strong market presence.

However, Dongfeng Honda's accelerated launch of electrified products still sends a positive signal. This means that Dongfeng Honda will further align with the development trends and consumer demand of the Chinese automotive market, striving to connect with consumers.

In summary, Dongfeng Honda's decline once again demonstrates that even powerful first-tier joint venture brands have been unable to withstand the challenges brought about by adjustments in the Chinese automotive market and changes in consumer demand. Driven by the wave of electrification and intelligentization, Chinese automakers have generally performed strongly in the market, while joint venture brands have all fallen into a slump. Their once-proud mechanical quality, driving comfort, and even strong brand appeal have lost their allure. To maintain its market position, Dongfeng Honda not only needs to keep up with trends in the Chinese automotive market but also compete on an equal footing with local Chinese manufacturers.