Trump's Big Gift: Tesla Soars 32%, Musk's Net Worth Hits $304 Billion

![]() 11/11 2024

11/11 2024

![]() 591

591

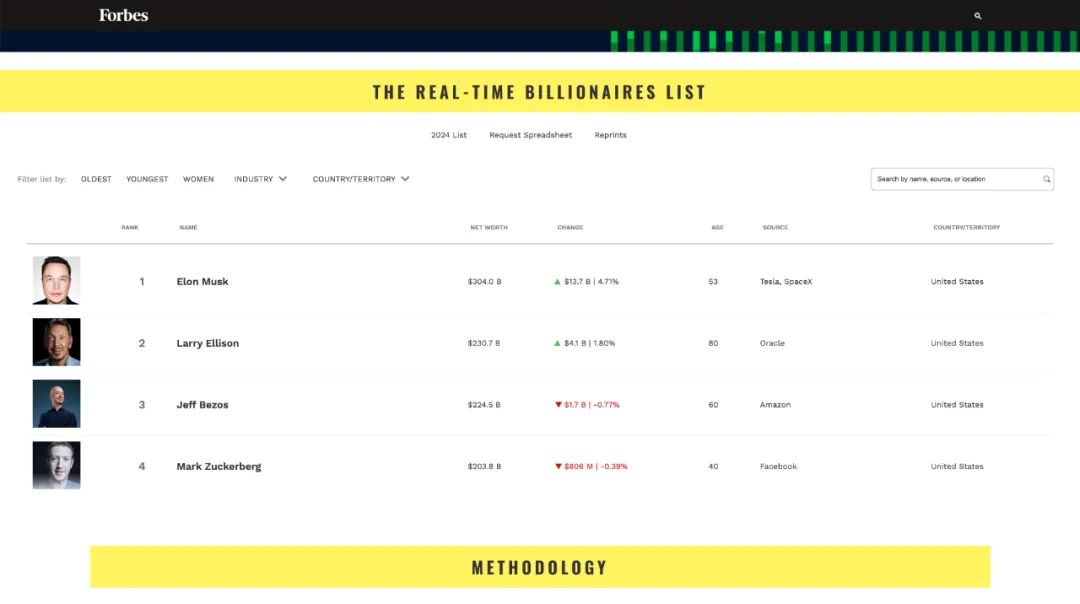

On November 9, Beijing time, Tesla continued to surge more than 10% during the trading session. Since first breaking the $1 trillion mark in November 2021, Tesla's market value has once again surpassed $1 trillion. After the US stock market closed, Tesla's closing price was $321.22, with a market value stabilizing above $1 trillion, reaching $1.03 trillion, and a closing gain of 8.19%. After four consecutive days of cumulative gains exceeding 32%, it returned to a market value of $1 trillion. With Tesla's surge, according to the "Forbes Real-Time Billionaires List," Musk's net worth reached $304 billion, solidifying his position as the world's richest person.

This is the first big gift Musk, the "number one contributor," received after Trump's confirmed victory and return to the White House.

In the eyes of investors, with Trump returning to the White House in January 2025, Tesla will benefit because Trump has indicated that he may revoke the previous $7,500 federal electric vehicle tax credit implemented by the Biden administration. Since the implementation of this tax credit policy, Tesla's market share has been shrinking. According to data from the automotive services and data group Cox Automotive, Tesla's share of the US electric vehicle market fell below 50% for the first time in the second quarter of 2024, dropping to 49.7%, a decrease of 9.3 percentage points compared to the same period in 2023. Why is the revocation of the tax credit policy actually beneficial to Tesla? Wedbush Securities analyst Dan Ives believes that Tesla's scale, technology, and pricing advantages in the electric vehicle industry are unparalleled, making it easier for Tesla to gain a significant competitive advantage in an environment without electric vehicle subsidies, similar to before the introduction of the $7,500 federal electric vehicle tax credit policy. However, can Tesla's electric vehicles still dominate the pure electric market as they once did? This will be verified by the market.

Currently, Musk is presenting two AI-related visions to Tesla investors: 1. FSD and Robotaxi; 2. Humanoid robot Optimus. The Robotaxi will utilize the unsupervised version of FSD. At the October 10 event, Musk announced that starting in 2025, unsupervised FSD testing will begin in California. During the Q3 2024 earnings call, Musk stated that he would leverage his influence with the government to establish a federal approval process for autonomous vehicles. Currently, approvals are conducted at the state level, with players like Waymo and Cruise going through approval processes in various states. We are familiar with processes in California, such as licenses issued by the California Department of Motor Vehicles (DMV) and the California Public Utilities Commission (CPUC) for different stages of autonomous vehicle and Robotaxi testing, operation, and charging. With Trump's election, Musk's push for a federal approval process for autonomous vehicles will greatly assist Tesla in advancing unsupervised FSD testing and subsequent operations. This can save a significant amount of time and testing costs and aid in the large-scale commercialization of Tesla's Robotaxi model, the Cybercab, equipped with the unsupervised version of FSD. At the October 10 event, Musk stated that the Cybercab could enter mass production as early as 2026.

Now, with his significant contributions, will Musk accelerate the testing and deployment of the unsupervised version of FSD during Trump's term, thereby speeding up the mass production of Tesla's Robotaxi model, the Cybercab? If so, this could also drive the commercialization process of the Robotaxi industry. However, federal regulations in the United States require approval from both the Senate and the House of Representatives, which involves a strict process. Previously, legislation related to autonomous driving in the US stalled in the House of Representatives. Lobbying is necessary for legislation in the US. For example, reports indicate that between 2021 and 2023, two leading autonomous driving companies in the US, Waymo and Cruise, spent over $2.3 million on lobbying and supporting elections to influence California legislators. This is just one state; there are over 50 states in the US. Therefore, Musk is attempting to address the legislative issues of autonomous driving at the federal level.

Regarding the humanoid robot Optimus, the latest news is that Tesla plans to apply Optimus to production lines in 2025, with a scale of thousands of units. However, Musk has repeatedly emphasized that the market for humanoid robots is much larger, ten times the size of the automotive market. In the future, there will be 20 billion humanoid robots active in various aspects of human production and life. At Tesla's Annual Shareholder Meeting in June 2024, Musk stated that Tesla's future market value could reach ten times that of the world's most valuable company at the time, potentially reaching $33 trillion. Famed investor Cathie Wood and her investment firm ARK published a report predicting that Tesla's stock price could soar 12.5 times within five years, reaching $2,600, with a market value exceeding $8 trillion. As Trump begins a new four-year term in the White House in January 2025, how far can Musk, the chef, go with his two big visions for Tesla - Robotaxi and Optimus? According to Cathie Wood, within five years, corresponding to Trump's term, will Tesla really soar to exceed $8 trillion in market value?