Tesla Killer is killed, and Volkswagen can't save the shattered Rivian?

![]() 11/11 2024

11/11 2024

![]() 579

579

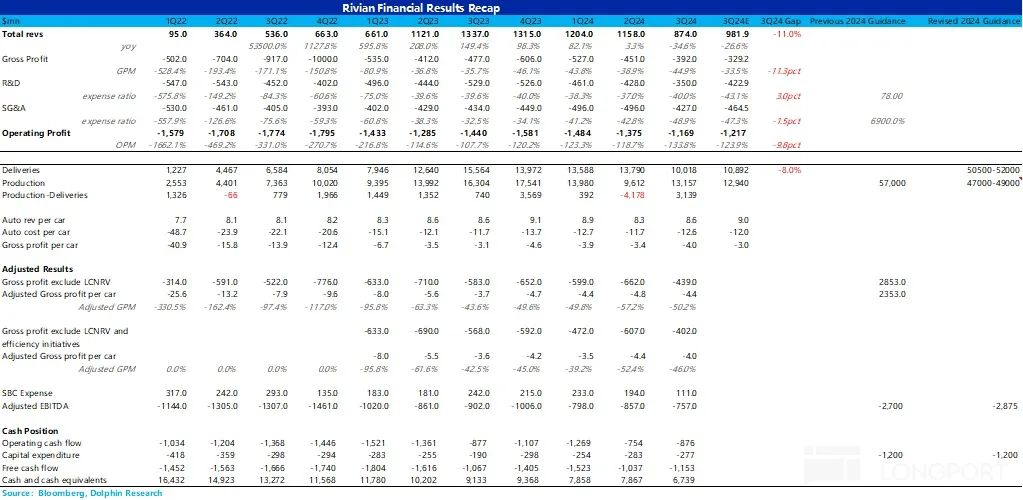

$Rivian.US released its Q3 2024 financial report after the U.S. market closed on August 6, 2024. Let's look at the key information:

1) Revenue fell short of market expectations: Despite the delivery of the 2025 R1, revenue per vehicle in this quarter still fell short of market expectations. However, according to Dolphin Insights, since the 2025 R1 production sequence is from low-priced to high-priced models, the proportion of high-priced new R1 models in this quarter was relatively low, leading to a smaller-than-expected increase in revenue per vehicle.

2) Gross margin continued to decline and also fell short of expectations: The gross margin for Q3 was -45%, continuing to decline from -39% in Q2 and falling short of market expectations of 34%.

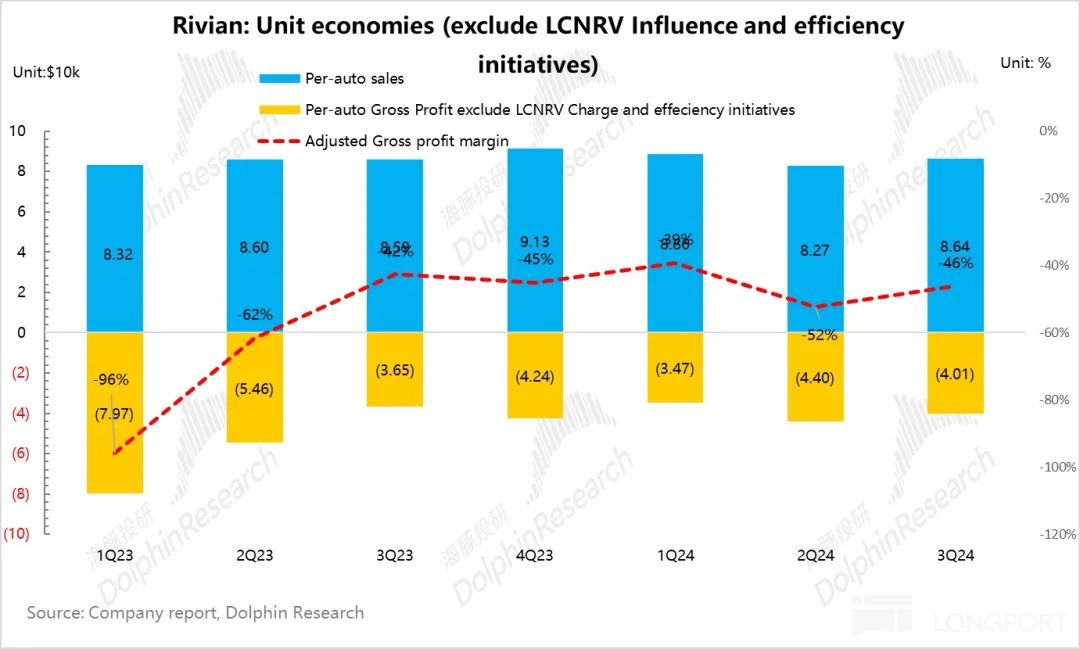

However, Dolphin Insights is more concerned about the actual vehicle sales gross margin (excluding the impact of LCNRV-inventory and contract impairment, as well as one-time costs related to supplier changes). The actual vehicle sales gross margin increased from -52% in the previous quarter to -46% in this quarter. Despite the delivery of the 2025 R1 aimed at cost reduction in Q3, this gross margin improvement was still lower than Dolphin Insights' expectations.

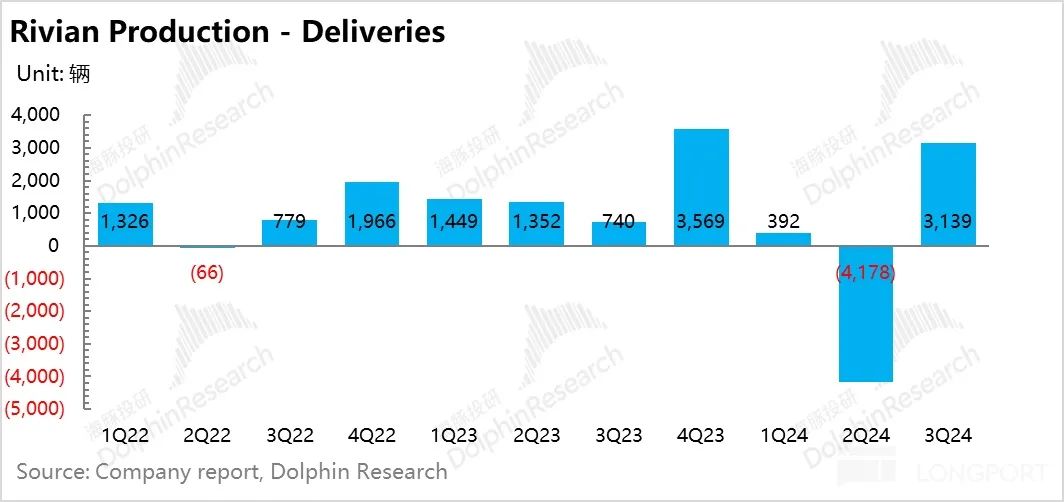

3) Supply chain disruptions led to a downward revision of full-year production and Adjusted EBITDA forecasts: Due to supply chain shortages of Enduro-driven components, Rivian is experiencing production disruptions that are expected to continue at least until Q4. Based on this, Rivian has revised downward its full-year production forecast from 57,000 vehicles to 47,000 vehicles in Q4.

Due to the revised production forecast, Rivian expects it will be difficult to reduce fixed costs related to existing plants. Consequently, Rivian has also revised downward its full-year Adjusted EBITDA forecast from -$2.7 billion to -$2.875 billion.

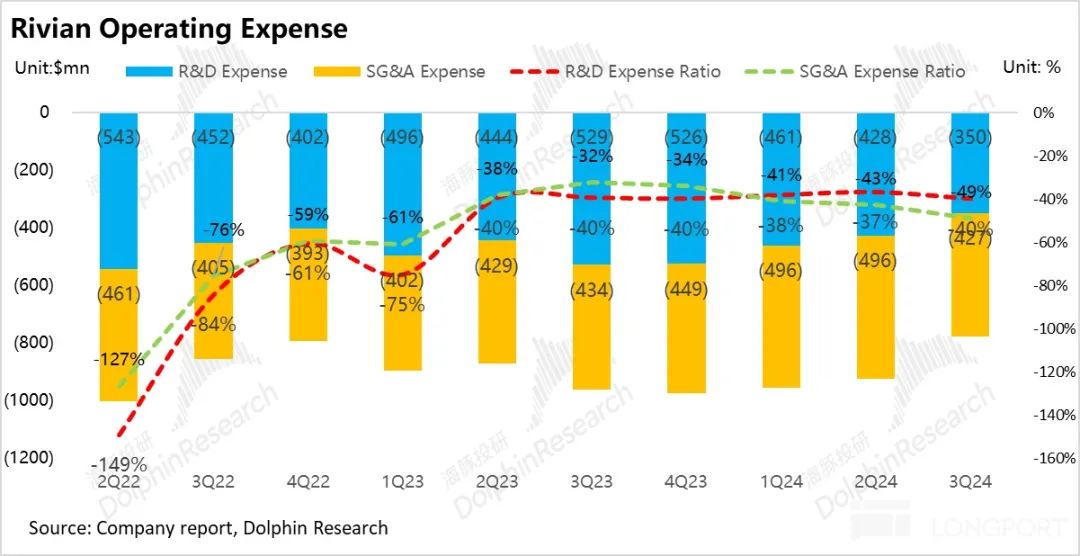

4) Gross margin improvement is challenging, so cost control is used to protect cash flow: R&D and selling expenses in this quarter were significantly lower than market expectations, with large sequential declines. This was partly due to reduced SBC expenses and partly due to the completion of the R1 upgrade, which reduced related technical expenses. The slow expansion of new stores also reflects Rivian's strategy of strictly controlling expenses to protect cash flow when gross margin improvement is difficult.

Dolphin Insights' Overall View: Overall, Rivian's Q3 performance fell short of expectations, with both revenue and gross margin lower than market forecasts.

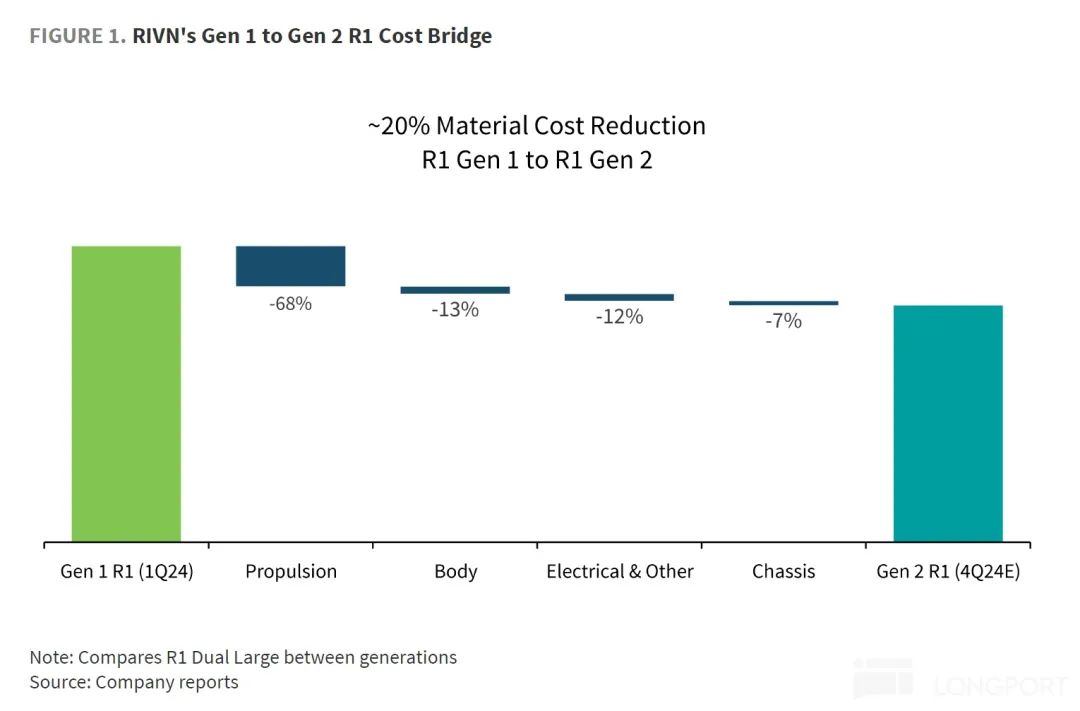

If the smaller-than-expected increase in unit price is due to production sequencing: from low-priced to high-priced models, the proportion of high-priced new R1 models in this quarter was relatively low. However, even after the delivery of the 2025 R1, the actual gross margin in this quarter still increased only slightly, which may indicate that the reduction in variable costs per vehicle after the R1 upgrade was likely lower than expected (the actual variable cost in Q3 was almost flat compared to Q1 before the R1 upgrade), not achieving the 20% reduction in variable costs per vehicle previously mentioned by management.

Management still reiterates the plan to turn positive the gross margin in Q4, but Dolphin Insights believes this is merely a cosmetic adjustment to the reported gross margin (including a $140 million positive contribution from LCNRV write-backs and a $280 million contribution from large regulatory credits to be recognized in Q4, totaling a positive contribution of approximately $32,000 per vehicle in Q4, and also achieved by increasing the proportion of high-margin EDV trucks). However, the true vehicle manufacturing gross margin, especially with the largest cost reduction item - variable costs - falling short of expectations, is almost impossible to turn positive (Dolphin Insights expects the true vehicle manufacturing gross margin in Q4 to remain around -30%, even with the increased contribution from the higher-margin EDV proportion).

Management has revised downward the full-year production and Adjusted EBITDA forecasts based on production halts. This makes Dolphin Insights question the execution capabilities of Rivian's management and raises concerns about slowing demand for Rivian, especially as the production-sales gap (production - sales) in this quarter was still 3,139 vehicles, the second highest in history, which is unrelated to the slowdown in production.

If it is difficult for the upgraded high-priced R1 to achieve a positive true vehicle manufacturing gross margin, turning positive the gross margin for the $45,000 starting price R2 will only be a "bigger pie in the sky" for investors.

As we move towards 2025, Rivian faces even more severe challenges and will likely have another blank year (with R2 production not starting until 2026). Currently, there are already signs of slowing demand, and the rise of Donald Trump to power is not favorable for the U.S. new energy vehicle industry. IRA subsidies are likely to be weakened or canceled, which may further negatively impact demand.

With further slowing external demand and management's execution capabilities being questioned by the market, Rivian's current situation is not optimistic. If the gross margin does not turn positive as scheduled in Q4, the market will find it difficult to believe the "pie in the sky" of turning positive the gross margin for the lower-priced R2, and the share price will further decline, with significant risks remaining.

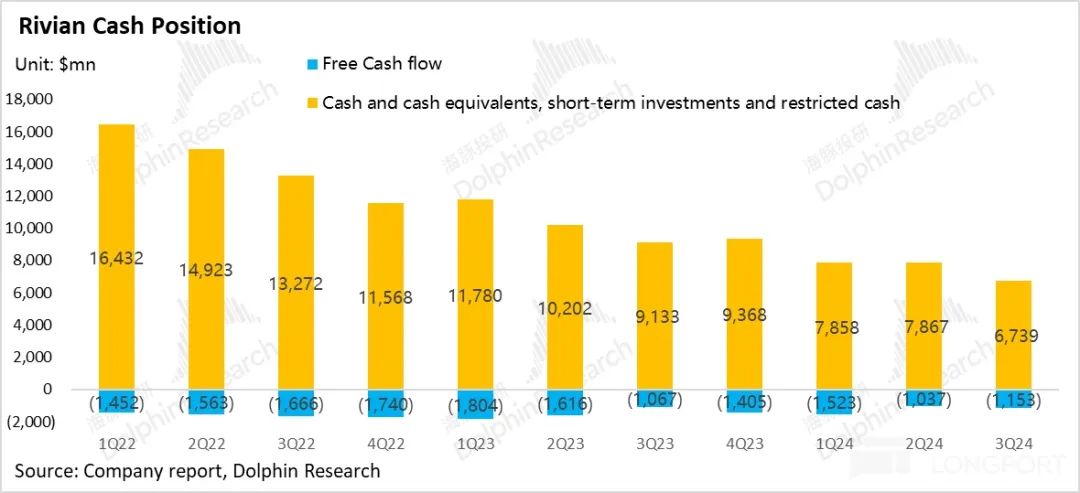

Although Rivian currently has financial support from Volkswagen, with a cash flow that can last at least until 2026, Rivian's current share price corresponds to a P/S multiple of 2.3-2.4 times for the next year, indicating a still high valuation and significant downside risk for the share price.

Specifically:

1. Q3 gross margin fell short of expectations, with low actual variable cost reduction

Rivian's reported gross margin declined sequentially from -39% in the previous quarter to -45% in this quarter. However, Dolphin Insights is more concerned about Rivian's true gross margin (excluding the impact of LCNRV-inventory and contract impairment, as well as one-time costs related to supplier changes).

The actual vehicle sales gross margin increased from -52% in the previous quarter to -46% in this quarter. Despite the delivery of the cost-reducing 2025 R1 in Q3 (though not a full delivery quarter), this gross margin improvement was still lower than Dolphin Insights' expectations.

From a breakdown of the unit economics (excluding the impact of LCNRV and one-time costs), the true gross margin increase was still lower than expected, mainly due to the low reduction in actual variable costs per vehicle:

a) Average vehicle price: increased by $4,000 sequentially

Excluding the impact of carbon credits, the average vehicle price was $86,000 in this quarter, up $3,700 sequentially from the previous quarter but lower than market expectations of $90,000.

The market believes the increase was mainly due to the delivery of the 2025 R1 series in this quarter:

① The starting price of the 2025 R1 series will be higher (e.g., R1S).

② To clear inventory of the first-generation R1 vehicles in Q2, discounts were offered on the first-generation R1 models. However, as sales of the 2025 R1 began in Q3, the proportion of sales of previous-generation R1 inventory vehicles is expected to decrease.

③ The 2025 R1 series introduced max/large battery versions and a three-motor version, improving the sales mix.

However, according to Dolphin Insights, although deliveries of the 2025 R1 began in this quarter, production sequencing started with lower-priced versions, so the proportion of higher-priced 2025 R1 series models in this quarter was still relatively low: starting with the standard version (lower-priced LFP version), followed by the large battery version, with the three-motor version only starting production towards the end of Q3 and the beginning of Q4.

b) Vehicle cost: the true vehicle cost remained largely flat from the previous quarter

The true vehicle cost in Q3 was $127,000, basically flat from the previous quarter. Breaking down variable and amortization costs:

1) Vehicle amortization costs increased: due to a 27% sequential decline in sales in this quarter, vehicle amortization costs instead increased by $3,800 sequentially.

2) The decline in variable costs per vehicle was lower than expected: variable costs per vehicle declined by $4,000 to $108,000 in this quarter. Despite the delivery of the cost-reducing 2025 R1 in this quarter (though not a full delivery quarter), the decline in variable costs was still relatively small, falling short of Dolphin Insights' expectations.

c) Vehicle gross profit: the true vehicle gross profit increased by $3,900

With the average vehicle price increasing by $4,000 sequentially after the delivery of the 2025 R1, and the vehicle cost remaining largely flat from the previous quarter, the true vehicle gross profit increased by $4,000. The actual gross margin increased from -52% in the previous quarter to -46% in this quarter, but the increase was lower than expected.

2. Severe supply chain disruptions led Rivian to revise downward its full-year production forecast

In Q3, Rivian delivered only 10,000 vehicles, a 27% sequential decline. Rivian attributed this to supply shortages from a single supplier of Enduro-driven components, leading to production disruptions. The impact of supply shortages began in Q3 this year, worsened in recent weeks, and is still ongoing.

Based on this, Rivian has revised downward its full-year production forecast from 57,000 vehicles to 47,000 vehicles in Q4.

Dolphin Insights questions the management and execution capabilities of Rivian's management for two reasons. First, as automotive supply chain issues have largely stabilized in the U.S. over the past year, supply chain issues are becoming increasingly rare in the industry. However, Rivian's Enduro-driven components rely solely on a single supplier, lacking alternative solutions for immediate component supply (no backup suppliers), raising concerns about Rivian's management and execution capabilities.

Second, recalling Rivian's major supply chain transformation aimed at cost reduction in Q2 (involving changing most suppliers), Dolphin Insights worries that the new suppliers may not be reliable. Dolphin Insights is also concerned about Rivian's demand issues. Although vehicle production was affected by production disruptions in this quarter, the decline in sales seemed unrelated to supply issues. The production-sales gap (production - sales) in this quarter reached 3,139 vehicles, the second-highest quarter since Rivian began deliveries, still reflecting a weakening demand trend.

According to Dolphin Insights' calculations, Rivian's inventory of finished vehicles (calculated as inventory of finished goods / vehicle cost) increased from approximately 5,700 vehicles in the previous quarter to 7,800 vehicles in this quarter.

3. It will be difficult to achieve the plan to turn positive the true gross margin in Q4

Rivian still emphasizes its plan to turn positive the gross margin in Q4 2024. However, Dolphin Insights believes that the gross margin turnaround mentioned by management is merely a cosmetic adjustment, based on accounting adjustments (to adjust the impact of LCNRV) and large regulatory credit contributions. However, it will be almost impossible to turn positive the true vehicle sales gross margin in Q4:

① The reduction in variable costs may fall short of expectations

Rivian previously attributed the primary factor for turning positive the gross margin to the reduction in variable costs: According to previous guidance from Rivian, the 2025 R1 was expected to reduce raw material costs by 20% compared to the first-generation R1 (requiring a real reduction of $22,000 in variable costs per vehicle compared to Q1). This was mainly due to: ① In-house research and development + downsizing; ② Switching to cheaper suppliers (about 50% of parts and materials were updated).

However, after delivering some 2025 R1 vehicles in this quarter (not a full delivery quarter), the true variable costs only declined by $4,000 sequentially. Compared to the pre-update R1 (compared to Q1), variable costs were almost flat, raising questions about whether the reduction in variable costs for the updated 2025 R1 may fall short of expectations.

Dolphin Insights closely examined Rivian's updated guidance. Besides still stating that the 2025 R1 update would reduce variable costs, it also indicated that the proportion of EDV trucks would increase in Q4, which would also contribute to reducing variable costs (EDV has inherently low production costs, and EDV has already achieved a positive gross margin). Dolphin Insights believes this may still imply that the reduction in variable costs for the updated R1 may not meet expectations.

② Due to the downward revision of production forecasts, the expected reduction in fixed costs will still be minimal:

As Rivian is experiencing supply chain disruptions expected to continue at least until Q4, the revised production forecast implies that production in Q4 will be only 10,000-12,000 vehicles, a further decline from Q3. Therefore, the expected reduction in vehicle amortization costs will still be minimal.

③ The increase in average unit revenue is expected to be hindered:

Dolphin Insights is also concerned about the weakening demand for Rivian. Although Rivian's average unit price in Q4 may benefit from an improved sales mix - the overall average price of the 2025 R1 will be higher, and the high-priced three-motor version will be launched in early Q4 - Rivian will also increase the proportion of lower-priced EDV trucks in Q4.

Rivian's full-year sales forecast of 50,500-52,000 vehicles implies Q4 sales of 13,000-15,000 vehicles. Based on the current weakening demand trend for Rivian, Dolphin Insights expects Q4 sales of only 11,000-12,000 vehicles (full-year deliveries of 49,000 vehicles). If Rivian fails to meet its sales targets, it may still adopt price reduction promotions, and demand for higher-priced versions may be eroded by lower-priced versions.

Regarding some accounting adjustments: the remaining LCNRV write-backs (positive contribution to gross margin) in this quarter are only $140 million, contributing approximately $10,000 per vehicle if fully written back. Meanwhile, Rivian's guidance indicates that regulatory credits will contribute $300 million for the full year, implying $275 million in Q4, contributing approximately $21,000 per vehicle to gross profit. These two adjustments together contribute a total of $31,000 per vehicle to reported gross profit. With these adjustments, the reported gross margin may turn positive after "cosmetic" adjustments, but the true gross margin will still struggle to achieve breakeven (Dolphin Insights expects the true vehicle sales business gross margin to be around -30%).

IV. Gross margin is difficult to improve, so Rivian aims to reduce costs and protect cash flow

1) R&D expenses: This quarter, Rivian's R&D expenses were only $350 million, a decrease of $80 million from the previous quarter and lower than the market expectation of $420 million. This is also the lowest R&D expense in Rivian's history.

The decrease in R&D expenses is due to a reduction of $40 million in SBC expenses related to R&D, and the completion of the R1 platform upgrade, which has reduced engineering, design, and development costs associated with the R1 platform's design and technology upgrades.

2) Selling, general, and administrative expenses: This quarter's selling, general, and administrative expenses were $430 million, a decrease of $70 million from the previous quarter and lower than the market expectation of $460 million.

The reduction in these expenses is partly due to a $30 million decrease in SBC expenses related to sales and administration, and partly due to Rivian's slow expansion of offline stores, with only 4 new service centers and service spaces added this quarter. The reduction in these expenses also reflects that while Rivian is struggling to improve its gross margin, it is protecting its cash flow by strictly controlling operating expenses.

V. Operating loss rate continues to widen

This quarter, Rivian incurred an operating loss of $1.17 billion, with an operating loss rate of 134%. Although the operating loss decreased by $200 million from the previous quarter, the operating loss rate increased, mainly due to the decline in gross margin and the quarter-over-quarter decline in sales, which failed to release operating leverage.

In terms of cash flow, Rivian had $6.7 billion in cash on hand this quarter, a decrease of $1.1 billion from the previous quarter. Free cash flow was negative $1.15 billion, a decrease of $120 million from the previous quarter, mainly due to the continued expansion of cash losses this quarter. Capital expenditures were $280 million this quarter, almost unchanged from the previous quarter.

Dolphin's in-depth research and follow-up comments on Rivian include: In-depth analysis on December 6, 2023, "Rivian: Cybertruck Sentenced to Death? Being Born Disabled is the Real Killer"; In-depth analysis on December 4, 2023, "Rivian (Part 1): 'Disabled Before the Battle,' Will the Tesla Killer Be Killed?"; In-depth analysis on July 7, 2022, "'Amateur' or 'Superman'? The Dilemma of the Tesla Killer Rivian"; In-depth analysis on March 8, 2022, "Little Superman's Pickup: Rivian's Ambition"; Earnings commentary on August 7, 2024, "Will the 'White Angel' Volkswagen Be the Savior of the 'Tesla Killer' Rivian?"; Earnings commentary on May 8, 2024, "Will the Affordable R2 Be the Savior of the 'Tesla Killer' Rivian?"; Earnings commentary on February 22, 2024, "Under Pressure on Both Gross Margin and Sales, Can the 'Tesla Killer' Rivian Survive the Deadly Struggle?"; Earnings commentary on November 8, 2023, "Rivian Exceeds Expectations Again, Can the 'Tesla Killer' Cross the Deadly Line?";

- END -