Q3 becomes a nightmare, why can't many auto companies make money anymore?

![]() 11/11 2024

11/11 2024

![]() 457

457

Auto giants take turns to lament

Author | Wang Lei, Liu Yajie

Editor | Qin Zhangyong

This is a chilling cold snap.

It seems that multinational auto companies have lost their financial prowess overnight. Judging from the third-quarter financial reports released in clusters, net profits have almost all seen cliff-like declines.

Volkswagen, which is relatively aggressive towards electrification, saw a 64% decline in net profit in the third quarter. Even Toyota, which has pushed cost control to the extreme, saw a 55% decline in net profit. Other Japanese brands have also experienced year-on-year declines, especially Nissan, which saw a staggering 94% drop in net profit.

Subsequently, auto companies have resorted to cost-cutting measures, attempting to address deep-seated issues through layoffs and salary reductions.

Nissan's operating profit margin for the first half of fiscal year 2024 was only 0.5%. To save itself, Nissan plans to cut global production capacity by 20% and lay off 9,000 employees worldwide. Notably, the CEO has set an example by voluntarily reducing half of his monthly salary, demonstrating a willingness to sacrifice.

Other auto companies are either laying off employees and closing factories or lowering their annual expectations, all aiming to climb out of the trough as soon as possible.

The national auto industry is experiencing a cold snap. Why can't auto companies, which used to make easy money, make money anymore? Can the past glory be restored simply by cost-cutting measures?

01 Layoffs, production cuts, salary reductions

The terrifying aspect of this storm lies in its indiscriminate attack—even BBA is struggling to make money.

BMW has taken a significant hit, with third-quarter revenue decreasing by 15.7% year-on-year to €32.406 billion. Mercedes-Benz saw a decline of 6.7% to €34.528 billion, which is its lowest single-quarter figure in nearly three years. Audi's revenue was relatively the lowest at €15.322 billion, but it also experienced a 5.5% decline.

Compared to revenue, net profits have also declined significantly, with double-digit drops across the board.

For example, BMW's net profit was approximately €476 million, a year-on-year decline of 83.8%. Mercedes-Benz's net profit fell by 54% year-on-year to €1.719 billion. Audi's operating profit plummeted by 91% in the third quarter to only €106 million.

After the financial report was released, Audi was also reported to be laying off thousands of positions, resulting in about 4,500 job losses in Germany. Foreign media reported that Audi aims to cut about 15% of its workforce.

Overall, the profit declines of BBA were all higher than their revenue declines. Poor sales and high costs are the main factors contributing to the unfavorable financial data.

Ola Källenius, CEO of Mercedes-Benz, stated that Asian consumers have become "very cautious" when purchasing luxury items such as luxury cars, particularly affecting the sales of Mercedes-Benz's highly profitable S-Class models in China.

Looking solely at the third quarter, Mercedes-Benz sold 170,700 vehicles in China, a year-on-year decline of 12.9%, marking the largest sales decline in a single market for that quarter.

Moreover, the GLC, C-Class, and E-Class models still account for over 70% of Mercedes-Benz's sales in China. Under the impact of the rise of domestic brands competing in the high-end market, more premium models like the S-Class and Maybach are less competitive than before.

Not only BBA but also Volkswagen, one of the world's largest automakers, is facing historic layoffs.

According to media reports, to reduce costs and improve competitiveness, Volkswagen plans to close at least three factories in Germany and lay off tens of thousands of employees. The board also hopes to reduce the monthly salaries of all employees by 10% and implement two rounds of salary freezes, resulting in no salary increases in 2025 and 2026.

The latest financial report shows that German automaker Volkswagen's net profit plunged by 63.8% in the third quarter, and its operating profit decreased by 41.7% year-on-year to €2.86 billion.

Since April this year, Volkswagen's global monthly sales have declined year-on-year. This year, Volkswagen's quarterly operating profits have shown a year-on-year decline, suggesting that drastic measures may be the fastest way to see results currently.

With sluggish sales of German cars, Japanese cars, which have dominated the auto industry for years, are also forced to embark on the path of layoffs and salary reductions.

Nissan, one of the Big Three Japanese automakers, recently announced that it will lay off 9,000 employees worldwide and cut 20% of its production capacity. Meanwhile, CEO Makoto Uchida voluntarily gave up 50% of his monthly salary starting from November 2024, and other executive committee members will also voluntarily reduce their salaries accordingly.

These actions are aimed at improving the deteriorating financial situation. Data shows that Nissan incurred a net loss of ¥9.34 billion in the second fiscal quarter of fiscal year 2025 (July-September 2024), far below the expected earnings of ¥49.07 billion.

In terms of sales, Nissan has also encountered significant challenges. Especially in the Chinese market, Nissan sold a total of 558,200 vehicles in China, including passenger vehicles and light commercial vehicles, in the first ten months of this year, a year-on-year decline of 9.98%.

In addition to Nissan, Honda's sales also declined by 42.2% year-on-year to 75,440 units in October this year, marking the ninth consecutive month of decline. Toyota's sales decreased by 0.4% year-on-year to 172,300 units, also marking the ninth consecutive month of decline.

02 Profit margins hit rock bottom

It's not just overseas auto companies that are struggling; the situation in China is even worse.

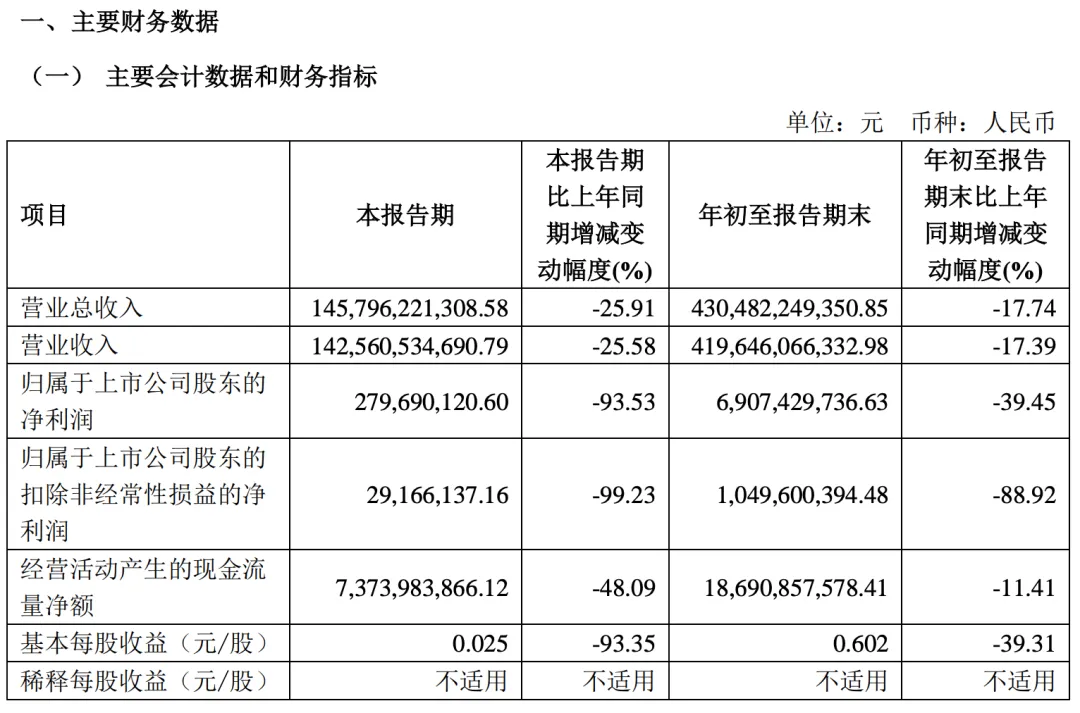

As the once largest automaker in China, SAIC Motor reported revenue of RMB 142.56 billion in the third quarter, a year-on-year decline of 25.58%, but its net profit was only RMB 280 million, a year-on-year decline of 93.53%. For the first three quarters of this year, Guangzhou Automobile Group's net profit was only RMB 120 million, a year-on-year plunge of 97.34%, with a profit margin of less than 1%.

Similarly, Changan Automobile also found itself in a dilemma of "increasing revenue without increasing profits" in the first three quarters. In the first three quarters of 2024, Changan Automobile's revenue was RMB 110.959 billion, a year-on-year increase of 2.54%; its net profit was RMB 3.579 billion, a year-on-year decline of 63.78%.

The shadow of "difficulty in making money" looms over the entire traditional auto industry. According to data from the China Passenger Car Association (CPCA), the profit margin of the auto industry in the first three quarters of this year was only 4.6%, the lowest in nearly a decade. Compared to the average profit margin of 6.1% for downstream industrial enterprises, the auto industry is still on the low side.

Why is it so difficult for these auto companies to make money?

It is not difficult to see that the sharp decline in revenue for domestic traditional auto groups is directly related to the decline in sales of their joint venture models, which account for the majority of their production capacity and revenue.

Taking SAIC as an example, its three major profit drivers—SAIC Volkswagen, SAIC GM, and Wuling Motors—have all performed poorly. The worst performer was SAIC GM, with cumulative sales of 278,485 units from January to September, a year-on-year decrease of 61.55%.

The only model that didn't decline was SAIC Intelligence Auto's R Auto, with cumulative sales increasing by 147.96% year-on-year to 37,492 units from January to September. However, this growth rate is insignificant in the context of the group's overall performance.

Moreover, these struggling multinational auto companies share a common trait: their performance in the Chinese market is generally poor.

For example, among the BBA camp, BMW has the highest sales, but its cumulative sales in the domestic market reached 524,000 units in the first nine months, with a decline of 13.1%, the largest decline among all markets. Mercedes-Benz sold a total of 512,200 units in China in the first three quarters, a year-on-year decrease of 10.2%. Audi sold 477,000 units in China, a decline of 8.5%.

In contrast, newcomers like Li Auto and AITO often overshadow BBA in weekly rankings, while BYD sold over 500,000 units in October alone.

On the other hand, price wars are also contributing to the struggles of these auto companies.

According to CPCA data, from January to September this year, the number of passenger car models with price reductions nationwide has reached 195, surpassing the 150 models in all of 2023 and the 95 models in 2022.

However, the current price wars have not achieved the expected "trade-off between price and volume". Instead, they have come at the cost of eroding auto companies' profitability, and the industry's "blood loss" continues.

Amid price wars, the profit per vehicle in the auto industry is also being continuously squeezed.

CPCA data shows that from 2017 to 2022, the profit per vehicle in the domestic auto industry remained above RMB 20,000, declining to RMB 17,000 in 2023. In the first nine months of this year, the profit per vehicle in the domestic auto industry has fallen to RMB 16,000, with only RMB 11,000 in September.

When brand premium is eroded and people no longer pay for the logo, auto companies reduce prices to clear inventory, and dealers follow suit to survive, ultimately leading to a continuous decline in the overall industry's profits.

Under the current "price war" that is raging like wildfire, if auto companies want to maintain their profit margins by sticking to price lines, they may face the risk of shrinking market share or even being marginalized in the market. Once they choose to "trade-off price for volume" and expand scale at the cost of pain, they also need to bear the possibility of declining profits or even losses.

As Li Bin put it, traditional fuel vehicles are entering a vicious cycle and can only maintain market share through price reductions. However, price reductions harm dealers' profitability, brand value, and the residual value of used cars.

In Li Bin's view, both pure electric vehicles and plug-in hybrids will accelerate the replacement of traditional fuel vehicles in the market.

03 Make what the market needs

Although losses are increasing, some new energy auto companies are thriving. Since the beginning of this year, their sales have surged, turning losses into profits, and their performance has soared.

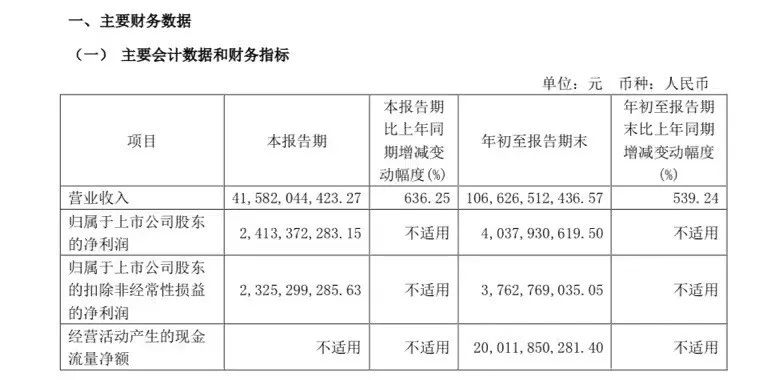

The most prominent company is Thalys, which has invested in new energy vehicle manufacturing for four years and incurred losses of approximately RMB 10 billion. After achieving its first mid-year profit, Thalys has witnessed a surge in performance.

Its revenue in the third quarter reached RMB 41.582 billion, a year-on-year increase of 636.25%. The net profit attributable to shareholders of the listed company was RMB 2.413 billion, turning losses into profits compared to the same period last year. Moreover, the profit for a single quarter surpassed the profit scale of RMB 1.625 billion in the first half of this year.

Accompanying the soaring performance and sales is the performance of the capital market. The financial report release was followed by several trading halts. As of press time, Thalys' total market value reached RMB 211.8 billion.

Compared to Thalys, BYD is even more profitable.

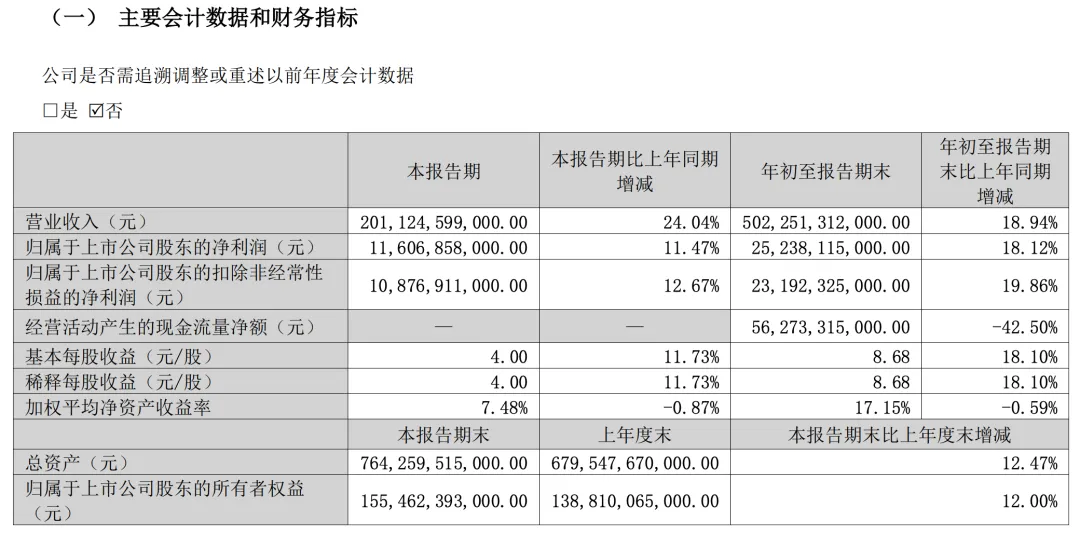

BYD's revenue in the third quarter increased by 24.04% year-on-year to RMB 201.125 billion, with quarterly revenue surpassing Tesla for the first time. Its net profit reached RMB 11.607 billion, a year-on-year increase of 11.47%, and its gross margin reached 20.8%.

In the first three quarters of this year, BYD remained the most "money-making" auto company among independent brands, with revenue of RMB 502.251 billion, a year-on-year increase of 18.94%; and net profit of RMB 25.238 billion, a year-on-year increase of 18.12%.

In addition, Li Auto has also performed steadily, with revenue in the third quarter reaching RMB 42.9 billion, a year-on-year increase of 23.6%; and net profit reaching RMB 2.8 billion, marking eight consecutive profitable quarters.

However, the joys and sorrows of new energy auto companies are not uniform. Many new energy auto companies are still teetering on the brink of survival.

Nevertheless, a review of these profitable new energy auto companies reveals that hybrids are becoming a driving force behind the growth of new energy vehicles. In particular, extended-range vehicles, once criticized as "outdated technology," have become saviors for many new energy auto companies.

Li Auto is undoubtedly the most forceful player in promoting extended-range vehicles. Its monthly sales exceeded 50,000 units, a feat that many new auto companies can only aspire to. Leaping Auto's monthly sales exceeded 30,000 units, making it the third auto company after Li Auto and AITO to achieve this milestone, also thanks to the launch of extended-range vehicles.

This year, ZEEKR, AITO, R Auto, AION, and others have also announced the launch of extended-range vehicle products. In particular, Xpeng Motors officially announced its entry into the extended-range field not long ago, with products to be released in 2025. NIO has also been reported to be developing extended-range models for overseas markets.

The entry of domestic auto companies into the hybrid market is driven by market demand and aligns with the global new energy trend. Overseas demand for electrification is sluggish, prompting overseas auto giants to postpone their electrification processes and instead develop hybrid models with internal combustion engines.",