Can't we survive without extending range?

![]() 11/12 2024

11/12 2024

![]() 527

527

Introduction

Introduction

With range extension dominating, no one can go against market trends.

As 2024 draws to a close, we should be able to summarize some relatively definite directions regarding the overall development trend of China's auto market. Firstly, amidst widespread price competition, the remaining new forces in vehicle manufacturing have undergone their final round of major consolidation due to fluctuations in consumer demand. Secondly, the market penetration rate of new energy vehicles (NEVs) continues to soar, which is one of the most evident trends.

Interestingly, it was widely believed that the focus of NEV development this year would still be on pure electric vehicles (BEVs). However, it seems that Chinese consumers simply cannot do without vehicles with fuel tanks. Most new NEVs that sell well, excluding those with extremely low prices, are invariably plug-in hybrid electric vehicles (PHEVs) or range-extended electric vehicles (REEVs) that utilize both oil and electricity.

As the most typical representatives in this market, Lixiang and Wenjie enjoy high recognition in the terminal market. Conversely, the sales proportion of their EV models is extremely low.

Witnessing an increasing number of consumers supporting Lixiang L6/7/8/9 and Wenjie M7/M9 with real money, emerging brands such as AITO, Avitar, and Lantu are highly enthusiastic about launching new range-extended vehicles.

Certainly, the subsequent market feedback has met the expectations of these brands. After achieving monthly sales exceeding 10,000 units, these automakers have become even more decisive in increasing R&D investment in new range-extended vehicles.

In fact, at this stage, for automakers increasingly interested in range-extended vehicles, it's not because these vehicles align with their market plans. Ultimately, it's all about survival.

How severe the market is this year can be perceived from various details. Since NEVs with engines can please consumers, why persist in manufacturing BEVs? As such behaviors continue to spread in the auto market, it's no wonder no one can resist such temptation.

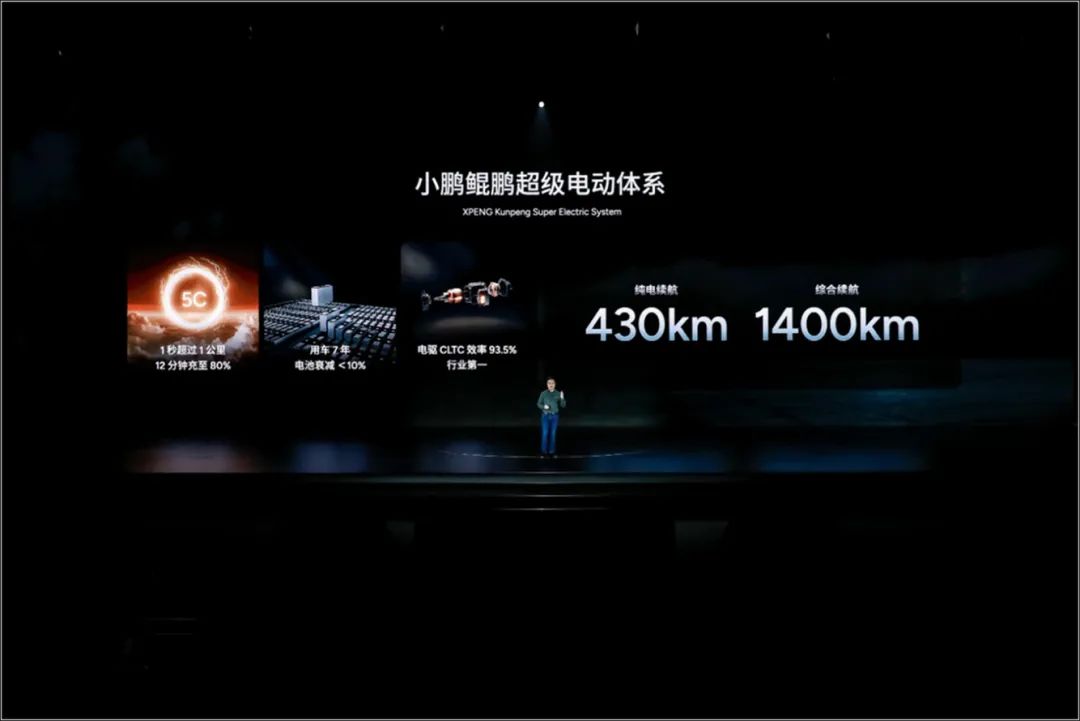

Previously, CATL released the Xiaoyao Super Range-Extended Battery, aiming to capture the entire range-extended vehicle market. Just a couple of days ago, regardless of whether NIO's third brand, Firefly, will ultimately adopt hybrid technology, as speculated online, to address the sluggish growth of BEVs, He Xiaopeng, CEO of XPeng Motors, also announced the "Kunpeng Super Electric System" at XPeng AI Tech Day, officially joining the range-extended vehicle brigade.

Even more astonishingly, according to its specifications, XPeng Motors' future range-extended vehicles can achieve a pure electric range of 430km, the longest among current range-extended vehicles. This range even rivals many entry-level BEVs, with a combined range of up to 1400km when fully fueled and charged.

Alas, it was expected that with the improvement of the refueling system and the development of ultra-fast charging technology, the refueling anxiety and range anxiety that once plagued BEVs would ease. Instead, automakers have comprehensively and multi-dimensionally addressed consumers' demands for both having and wanting when purchasing NEVs.

It's unclear whether this trend aligns with the original trajectory of the new energy transition. However, against the backdrop of the state's green license plate policy, which is unlikely to pressure NEVs with engines in the short term, weaker automakers must follow the trend to survive, even if they are reluctant to do so.

On the same day XPeng officially announced its plans to manufacture range-extended vehicles, Aion, another Guangzhou-based automaker, also indicated that it would join the range-extended vehicle brigade in due course when its new model, Aion RT, was officially launched. Gu Huinan, the general manager, reiterated this during an interview, stating that manufacturing range-extended vehicles is not a difficult task.

In addition, the range-extended version of IQI R7 also debuted in the latest batch of vehicle models announced by the Ministry of Industry and Information Technology. Obviously, with Wenjie reaping significant profits from range-extended vehicles, Huawei intends to replicate this success with IQI. The SUV model, IQI R7, serves as the best vehicle for this purpose.

Given the current situation, it's evident to all that the development of new energy is overly far-fetched when framed as a means to prevent over-reliance on fossil fuels or for environmental protection. In the eyes of these enterprises, making money is ultimately the primary goal, or at least a means to survive in the short term.

While Chinese automakers have cleverly found the best approach to penetrate the market amidst favorable policies, it's incredibly challenging for joint ventures to respond swiftly.

Over the past two years, they have struggled to launch pure electric vehicles (BEVs) tailored to the Chinese market amidst calls for electrification. Before they could even gain momentum, the core of the NEV market shifted to how to incorporate oil into electricity. How embarrassing!

To address the issue of unsold electric vehicles, joint ventures can currently only offer steep discounts and expedite sales to consumers. Last month, MINI launched a surprise attack by lowering prices below 150,000 yuan, achieving some success. Today, it's no surprise that Volkswagen (Anhui) adjusted its official prices for its ID. and other models by reducing them by 40,000 yuan.

In conclusion, the changes in China's auto market are always bizarre. Beneath the fiercely competitive market surface, no one adheres to their own plans for development. Despite shouting about industry transformation and portraying the development of BEVs as a mission for the future, the market has instead embraced a nationwide range-extension movement. Well, as an observer, I won't comment further but only wish for the best.