Avatar plans IPO in 2026: Valuation doubles in half a year, multiple new models unveiled

![]() 11/12 2024

11/12 2024

![]() 658

658

State-owned automakers' new brands from major factories have finally entered the IPO season. On November 10, the Shanghai United Assets and Equity Exchange mentioned in a tweet promoting the capital increase project of Avatar Technology (Chongqing) Co., Ltd. that Avatar has clarified its plan to go public in 2026. This is also the first new brand of a state-owned automaker to clearly set an IPO timeline. This also means that Avatar will need to start preparing for its listing from at least 2025.

Like other new brands, Avatar has also disclosed its listing plans before. "IPO is a solution to financing issues, but we also want to improve the company's governance structure through IPO and several management requirements to make it more compliant and standardized. This is our primary goal," Chen Zhuo, President of Avatar Technology, previously said. However, regarding the timing of the IPO, Avatar said the company has no specific timeline for the IPO and will consider it flexibly based on sales and market conditions.

Currently, among the new brands from major factories, SAIC Motor's IM Intelligence, GAC Aion, Changan's Avatar, and Dongfeng's VOYAH have all expressed their intentions to go public. Among the new forces, NIO Auto is currently aiming for an IPO. Besides Avatar, VOYAH's senior management previously stated that the company would start preparing for the IPO once monthly sales reach 10,000 units. Currently, VOYAH has already met this standard, which may indicate that its IPO process has already begun.

GAC Aion's initial plan was to "strive to achieve IPO by 2023" and later changed it to "not earlier than 2024." Currently, this timeline has become even more vague, with the official statement being that it "depends on the progress of the review and the state of the capital market." The senior management of IM Intelligence has never disclosed specific plans for going public. They only said in a previous interview with the media that there is a very complete plan for financing and listing, with subsequent A, B, and C round financing plans, as well as a very clear listing plan.

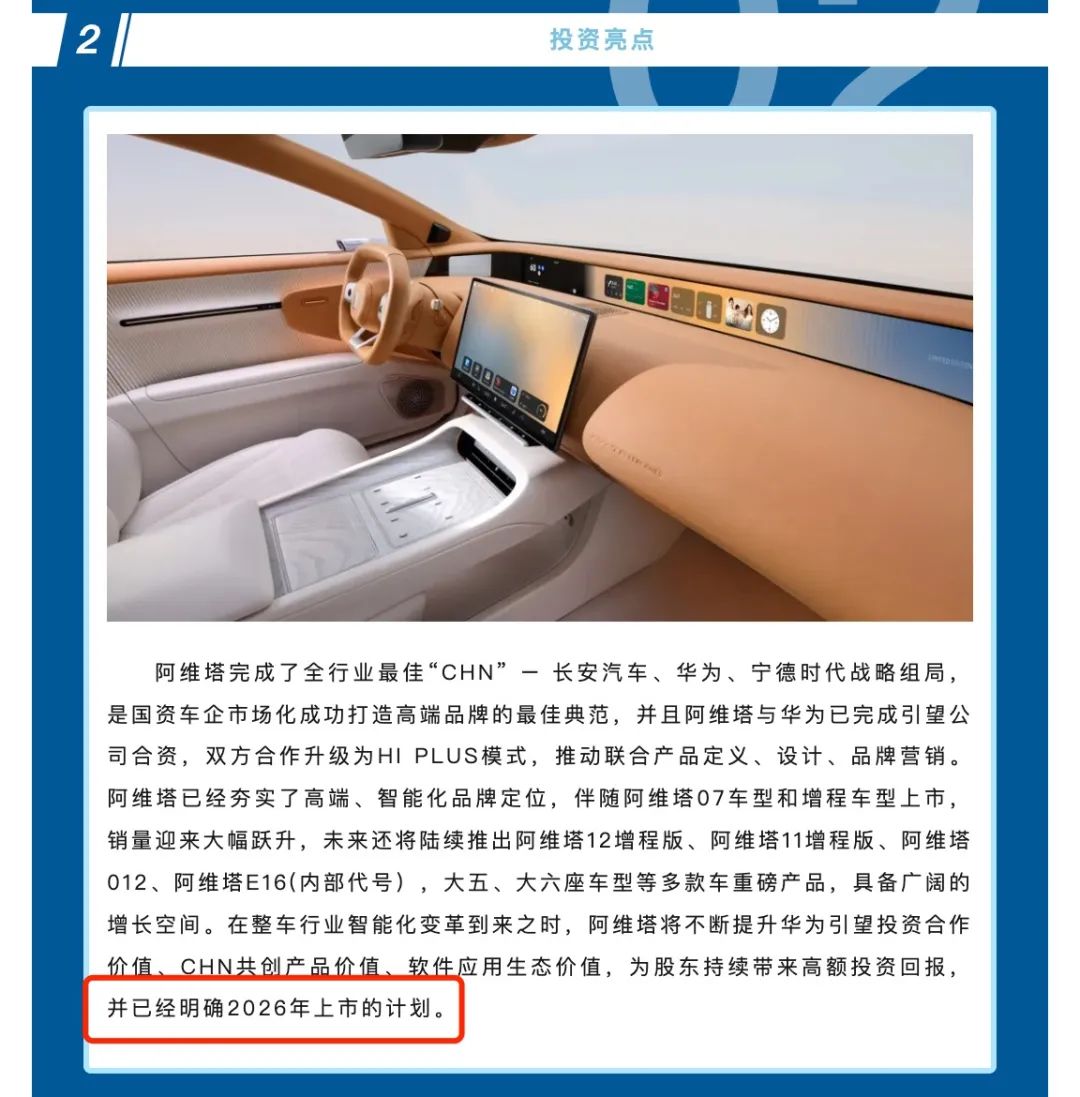

From this perspective, among the new brands of several major state-owned automakers, there is currently fierce competition to be the first to go public. Besides the IPO, the capital increase project disclosed by the Shanghai United Assets and Equity Exchange also mentioned Avatar's subsequent product plans, including the Avatar 12 Extended Range Version, Avatar 11 Extended Range Version, Avatar 012, Avatar E16 (internal code), and multiple other Heavy weight products such as large five-seater and six-seater models.

According to the official website of the Shanghai United Assets and Equity Exchange on October 22, Avatar's capital increase project was listed, but the total amount of funds to be raised was not disclosed. Chen Zhuo mentioned at a key supplier partner communication meeting on October 11 that Avatar is currently conducting its C round of financing, raising funds of up to 10 billion yuan, with a post-investment valuation exceeding 30 billion yuan.

01

Avatar: Changan's most costly business

Although the latest performance of Avatar was not disclosed in the aforementioned capital increase project, when Avatar invested in Huawei Intelligent Driving Shenzhen Yingwang Company earlier this year, it did not clearly disclose its operating performance as of the first half of this year.

Data shows that in 2022, Avatar's annual revenue was only 28.34 million yuan, with a net loss of up to 2.015 billion yuan. Although revenue surged to 5.645 billion yuan in 2023, the net loss further expanded to 3.693 billion yuan. In the first half of this year, Avatar achieved a revenue of 6.152 billion yuan and a net loss of 1.395 billion yuan. In two and a half years, the company's cumulative net loss exceeded 7.1 billion yuan, with a debt ratio of 94.46%.

In terms of financing, Avatar completed three rounds of financing from 2021 to 2023, raising a total of approximately 8 billion yuan. In 2024, Avatar will conduct its C round of financing, raising an estimated 10 billion yuan. After completing the C round of financing, Avatar's total cumulative financing will reach 18 billion yuan. As financing continues, Avatar's valuation is also increasing, with significant growth in 2024.

The valuation was disclosed as 788.2 million yuan when it was first publicly listed for capital increase and share expansion on November 5, 2021; subsequently, in 2022, Avatar announced a new round of valuation growth to 6.26 billion yuan; in 2023, its valuation was 14 billion yuan. In April of this year, Avatar's senior management stated that its valuation was "close to 20 billion yuan." On June 18, 2024, Avatar's senior management stated that its valuation reached 2.425 billion dollars (17.4 billion yuan), which doubled compared to four months ago in October.

The change in valuation may be related to two factors: first, Changan will inject the 11.5 billion yuan equity of Huawei Intelligent Driving into Avatar; second, Avatar's sales have significantly increased in the past six months, improving its operating conditions. In October, Avatar sold 10,056 units, exceeding 10,000 units for the first time. Prior to that, Avatar's average monthly sales ranged from 4,000 to 5,000 units, with little significant improvement. Of course, whether Avatar can stabilize its valuation depends on whether its subsequent sales can be maintained.

While sales are the first step, funding remains a crucial issue for Avatar. Secondly, Avatar does not have many highlights in terms of going public, so it needs to quickly turn around its financial performance. Among the new brands from major factories, Geely's Zeekr and Aion are two typical representatives. Zeekr's losses narrowed rapidly before its listing: Financial reports show that Zeekr's 2023 revenue reached 51.636 billion yuan, a year-on-year increase of 62%, with a net loss of 1.135 billion yuan, a decrease from the previous year. The loss was 800 million yuan in the first half of the year and 300 million yuan in the second half.

Another new brand, Aion, has also focused on achieving profitability as its unique selling point for its listing after years of growth. In GAC Group's 2023 interim report, GAC Aion achieved profitability for two consecutive months in June and July 2023. Although no data was disclosed, GAC's senior management stated that it would become profitable in the second half of 2023. However, Aion's sales actually declined in the second half of last year, potentially dashing hopes of profitability, which was one of the critical reasons why Aion failed to list successfully last year.

02

What is the value of new brands from state-owned enterprises?

Among the new brands, NIO, XPeng, Lixiang, and Zero Running have completed their listings. Although Zeekr is also a new brand from a major factory, Geely's status as a private enterprise makes its market response different. For new brands from state-owned enterprises, only five brands have gradually scaled their sales: VOYAH, IM Intelligence, ARCFOX, Avatar, and Aion. Among them, ARCFOX is the core brand of BAIC BluePark and has no plans for a spin-off listing, leaving the other four as the main players for future listings. Besides Aion, whose sales have stabilized above 30,000 units, the remaining three brands have all achieved monthly sales exceeding 10,000 units. Among them, Avatar's sales performance is actually the worst.

From the overall sales trend, IM Intelligence's monthly sales have exceeded 10,000 units multiple times after the launch of LS6 and L6, while ARCFOX and VOYAH have basically achieved stable monthly sales exceeding 10,000 units this year. Only Avatar has surpassed the 10,000-unit mark for the first time. Although the growth is significant, the sustainability of these sales is questionable. After all, to develop stably in the market, at least one popular main product is needed. Among them, VOYAH's Dreamer and IM Intelligence's LS6 are the main products, while Avatar's products need further observation due to their recent launch.

If we look at sales volume, NIO, XPeng, and Lixiang were very small when they listed in 2020, and the capital market was very enthusiastic about new car companies at that time, so comparing them to these companies may not be very meaningful. Zero Running and Zeekr listed in 2022 and 2024, respectively, during periods when the capital market was less enthusiastic about new energy vehicles, and the automotive market was relatively mature, making the comparisons more relevant.

Zeekr sold 118,685 vehicles in 2023. According to official data, the average selling price of Zeekr vehicles in 2023 was 331,000 yuan. Zero Running sold 111,168 vehicles in 2022, with the T03 accounting for half of the sales. In 2021, the year before the listing, sales were 43,121 units. After listing, Zero Running's market value approached 40 billion Hong Kong dollars. Zeekr's market value on its listing day on the NYSE was close to 50 billion yuan. From a positioning and target audience perspective, Zeekr is more relevant for comparison. Zeekr's current market value is 49 billion yuan, remaining stable.

If Avatar can stabilize its monthly sales above 10,000 units in 2024, equivalent to annual sales exceeding 100,000 units, its listing is expected to be smoother. With the support of holding shares in Huawei Intelligent Driving, Avatar can gain more attention. The financial report of Shenzhen Yingwang Company shows that in 2022 and 2023, Huawei's automotive BU lost 7.587 billion yuan and 5.597 billion yuan, respectively, with corresponding revenues of 2.097 billion yuan and 4.7 billion yuan. However, in the first half of 2024, revenue reached 10.435 billion yuan, turning a profit with a net profit of 2.231 billion yuan and a net profit margin of 21.38%. It is estimated that for the entire year of 2024, Yingwang may earn a profit of around 5 billion yuan, with a valuation of 115 billion yuan, equivalent to a PE ratio of 23 times. Yingwang can provide Avatar with a segment with stable growth expectations in terms of performance and profitability.

Of course, the core issue is whether Avatar can achieve sustained sales growth and turn around its losses. After all, from Changan's financial report, it has become the biggest burden on Changan's performance. Achieving self-sufficiency and then going public will be a win-win step for both Changan and Avatar.