Behind the 'Silver September and Golden October': Profits Not Rising, Exports Being 'Blocked'

![]() 11/12 2024

11/12 2024

![]() 516

516

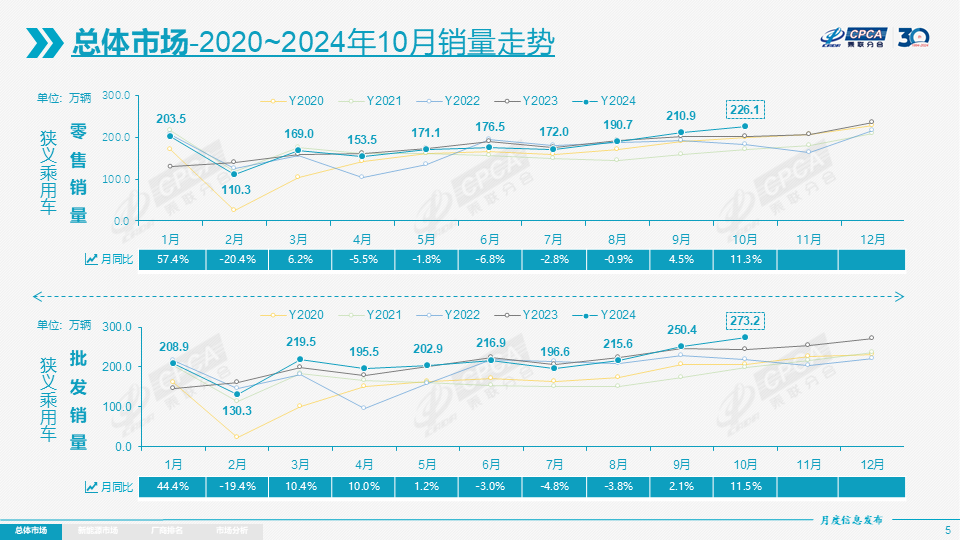

According to sales data for October released by the China Passenger Car Association, it is a picture of thriving prosperity! In October, 2.261 million narrow-sense passenger vehicles were retailed nationwide, marking an increase of 11.3% year-on-year and 7.2% month-on-month. Therefore, sales in October have surpassed those in September, realizing the unusual automotive market trend of 'Silver September and Golden October' seen in previous years.

The strong sales in October this year are mainly driven by the automobile replacement subsidy policy. The subsidy amounts per vehicle are considerable, and gradually "bottoming out" pricing has prompted car owners to replace their vehicles, especially driving the strong growth of the entry-level pure electric vehicle and narrow-sense plug-in hybrid markets. Even retail sales of fuel vehicles in October achieved a month-on-month growth of 8.1%.

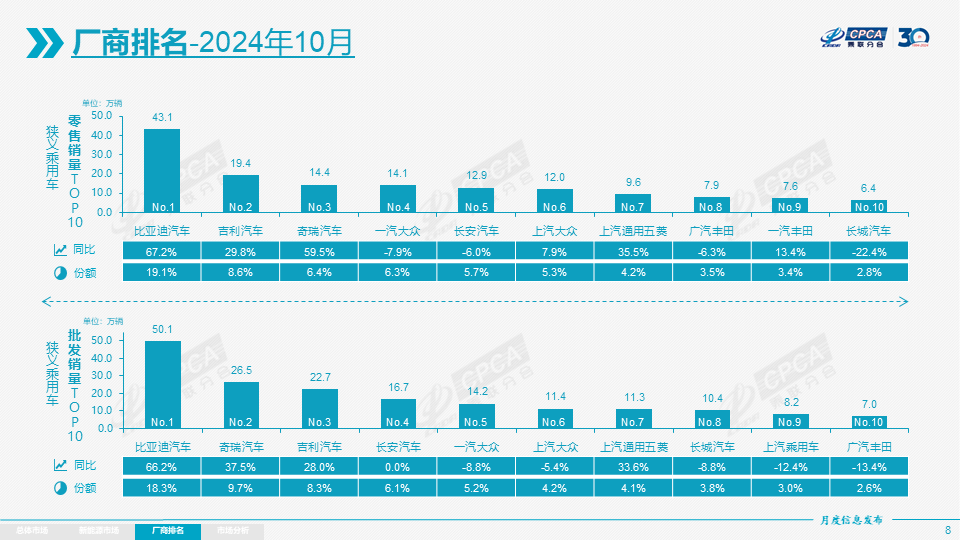

In reality, the "blockbuster" sales figures cannot conceal the many problems currently facing the automotive market. From the perspective of automakers, the overall sales growth in the automotive market is not universal. Judging from the sales rankings of automakers, except for BYD, Chery, Geely, and SAIC-GM-Wuling, sales for other top ten automakers, whether independent or joint ventures, have generally declined year-on-year.

This indicates that the concentration of automotive sales has further increased, and the overall sales growth of the automotive market has not reduced the competitive pressure on most automakers. Additionally, the decline in profits and exports has become a dangerous signal for the automotive market's conclusion.

Profits Not Rising

The automotive market is booming this year, welcoming a strong sales trend during the traditional peak sales season. However, automakers and dealers are not having an easy time. Automaker financial reports show a significant drop in profits, and news of layoffs, optimizations, and dealer bankruptcies frequently emerges, casting a shadow over the sales data growth.

According to data from the China Passenger Car Association, the automotive industry's revenue for January-September 2024 was 7.3593 trillion yuan, an increase of 3% year-on-year; costs were 6.4531 trillion yuan, an increase of 3%; profits were 336 billion yuan, a decrease of 1.2% year-on-year; and the profit rate of the automotive industry was 4.6%. Compared to the average profit rate of 6.1% for downstream industrial enterprises, the profit rate of the automotive industry remains low.

During the peak sales season in September, the automotive industry's revenue was 945.3 billion yuan, a decrease of 1% year-on-year; costs were 832.3 billion yuan, an increase of 0.4%; profits were 32.4 billion yuan, a decrease of 28.5% year-on-year; and the profit rate of the automotive industry was 3.4%. Therefore, despite the increase in sales, the overall pressure on automakers' profits is increasing.

In contrast to the overall low profit rate of automakers, the profit of green manufacturing industries such as lithium-ion battery manufacturing has increased by 58.8%. Currently, the profits of the automotive industry mainly come from exports and upstream industrial chain profits. Leading battery enterprises enjoy substantial profits, while most other vehicle manufacturers experience sharp declines in profitability, and some face increased pressure to survive.

Therefore, for automakers, merely focusing on low-priced, high-volume sales may lead to severe operating difficulties and losses. In addition to increasing exports, automakers should also create high-positioning and high-premium vehicle models through high intelligence and high configuration. Thus, intelligent driving capability has become an important competitive arena for automakers.

Exports Being 'Blocked'

2024 is entering the final two months of the year, but most automakers have not yet shaken off their operational difficulties, especially joint venture automakers. Recently, many international automakers have successively released their third-quarter operational reports, and most have reported significant declines in profits, mainly due to poor performance in the Chinese market. Despite mentioning the transition to new energy for a year, results are still not evident.

From the perspective of product competitiveness, there is still a significant gap between joint venture automakers' new energy vehicle models and independent brands, and this situation is unlikely to change significantly in the short term. For joint venture automakers, on the one hand, they try to maintain their foothold in the fuel vehicle market, and on the other hand, they continue to expand their export markets.

For independent brands, although their market share in the domestic market is gradually increasing, improving profitability and accelerating the construction of overseas markets and sales networks are also inevitable trends. However, recent export data show a noticeable slowdown in growth rates.

According to customs data: In October, automobile exports were 585,000 units, an increase of 11% year-on-year but a decrease of 4% month-on-month. Meanwhile, passenger vehicle exports (including complete vehicles and CKD) in October were 441,000 units, an increase of 13% year-on-year and 2% month-on-month; independent brand exports reached 371,000 units, an increase of 16% year-on-year and 3% month-on-month; and joint venture and luxury brand exports were 70,000 units, a decrease of 4% year-on-year.

From January to September 2024, markets such as Australia, Thailand, Ecuador, and the Netherlands experienced significant declines; Central Asia and the Russian market performed relatively strongly, and the Brazilian and Russian markets also became core markets for growth. In the Southeast Asian market, there is already an oversupply trend for Chinese automakers setting up factories and exporting vehicle models. To achieve breakthroughs in exports, the North American and European markets are the "big players," and both of these markets will invariably impose high tariffs on Chinese automakers. Therefore, for Chinese automakers to achieve substantial growth in exports in the future, more breakthroughs are needed.

Overall, even though China's automotive market has experienced a 'Silver September and Golden October,' the operating conditions of most automakers have not significantly improved. In the coming two months and even next year, the domestic automotive industry will remain in a difficult situation. As the trade-in subsidy gradually diminishes, automotive sales will also remain flat, posing even greater challenges for automakers.