Ranking of automakers' profits in Q3: BYD exceeds RMB 10 billion in a single quarter, Thalys has the highest gross margin

![]() 11/12 2024

11/12 2024

![]() 627

627

When it comes to which domestic automaker earns the most, the answer is undoubtedly BYD. In Q3 this year, BYD achieved revenue of RMB 201.125 billion, a year-on-year increase of 24.04%; its net profit attributable to shareholders was RMB 11.607 billion, a year-on-year increase of 11.47%. If averaged daily, BYD's daily net profit is approximately RMB 129 million.

This is the first time that BYD has surpassed Tesla in quarterly revenue after surpassing it in sales volume. For comparison, in Q3 this year, Tesla's revenue was USD 25.182 billion (approximately RMB 179.4 billion); its net profit was USD 2.167 billion (approximately RMB 15.4 billion), a year-on-year increase of 17%.

From January to September this year, BYD's revenue reached RMB 502.251 billion, a year-on-year increase of 18.94%; its net profit attributable to shareholders was RMB 25.238 billion, a year-on-year increase of 18.12%. In contrast, Tesla's revenue for the first three quarters of this year was USD 72 billion (approximately RMB 513 billion), a year-on-year increase of 0.5%; its net profit was USD 4.82 billion (approximately RMB 34.3 billion), a year-on-year decrease of 31.4%. BYD's cumulative revenue and net profit for the first three quarters of this year are catching up to Tesla's, and it is possible for BYD to surpass Tesla by the end of the year.

The revenue surpass is mainly attributed to the rapid growth in BYD's sales volume. In September, BYD's new energy vehicle sales reached 419,400 units, a year-on-year increase of 45.91%, making it the first new energy automaker globally to exceed 400,000 units in monthly sales. In the first three quarters of this year, BYD's cumulative sales volume was 2.748 million units, a year-on-year increase of 32.1%. Maintaining such high-speed growth despite such a large sales volume is remarkable.

01

Who earns the most?

Among domestic automakers that have released their Q3 financial reports, BYD leads the pack in terms of sales volume, revenue, and net profit, far outpacing other companies and making comparisons unfair. If we only consider Q3 net profit, BYD's figure alone exceeds the combined total of Great Wall, Li Auto, Thalys, Changan, FAW, JAC, and six other companies.

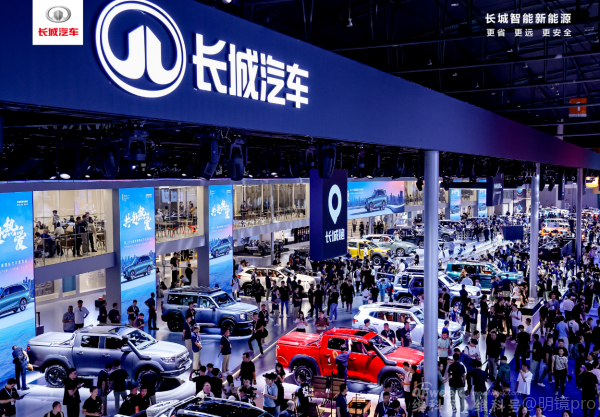

Great Wall Motors ranks second in terms of profit in Q3. Although its sales volume is smaller than Changan's and its sales growth is not outstanding, its revenue and profitability have always been known for stable growth. In Q3 this year, its revenue was RMB 50.825 billion; its net profit attributable to shareholders was RMB 3.35 billion. In the first three quarters of this year, Great Wall Motors' revenue was RMB 142.254 billion, a year-on-year increase of 19.04%, reaching a record high; its net profit was RMB 10.429 billion, a year-on-year increase of 108.70%. This is related to Great Wall Motors' high-quality business strategy of avoiding price wars.

As newcomers, Li Auto and Thalys, which has partnered with Huawei, have continued to maintain high sales growth this year. In Q3, they surpassed many leading automakers such as Changan Automobile and Guangzhou Automobile Group in terms of revenue and net profit. In terms of net profit alone, Li Auto and Thalys even surpassed FAW Group and Guangzhou Automobile Group.

Since Li Auto and AITO models are in roughly the same market segment, the delivery volumes, revenue, and net profit figures of Li Auto and Thalys are close. However, Li Auto still outperforms Thalys in Q3 data. In the first three quarters of this year, Li Auto's cumulative sales volume was 341,800 units, a year-on-year increase; Thalys' cumulative sales volume was 316,700 units, a year-on-year increase of 364.23%.

Reflecting on the financial report data, in Q3 this year, Li Auto's revenue was RMB 42.9 billion, a year-on-year increase of 23.6%, reaching a record high; its net profit was RMB 2.8 billion, a slight year-on-year increase of 0.3%, marking its eighth consecutive quarter of profitability. From January to September this year, Li Auto's cumulative revenue was RMB 100.186 billion, a year-on-year increase of 22%; its net profit was RMB 4.513 billion, a year-on-year decrease of 25.50%.

In contrast, Thalys' revenue in Q3 this year was RMB 41.582 billion, a year-on-year surge of 636.25%; its net profit was RMB 2.413 billion, a year-on-year surge of 354%. For the first three quarters of this year, Thalys' revenue was RMB 106.627 billion, a year-on-year increase of 539.24%, RMB 6.4 billion higher than Li Auto's; its net profit was RMB 4.038 billion, a year-on-year surge of 276%, achieving a year-on-year turnaround from loss to profit.

Automobile BYD Thalys