Chinese Electric Vehicles Enter European and American Markets: How to Crack the Tariff Policy?

![]() 11/13 2024

11/13 2024

![]() 601

601

On October 31, the European Union decided to impose anti-subsidy tariffs on electric vehicles imported from China for five consecutive years on top of the existing 10% tariff.

How can Chinese electric vehicle enterprises move forward under trade protection policies?

In response to readers' demands, 'Wall Street Tech Eye' has launched the 'Tech Eye · Viewing the World' column. This column presents business activities, technological landscapes, and local customs and practices around the world, including China, through images and handwritten notes shared by overseas correspondents. This column will meet readers every weekend, allowing relaxing visual content to accompany readers throughout each weekend.

Text/Guo Chuyu

Editor/Hou Yu

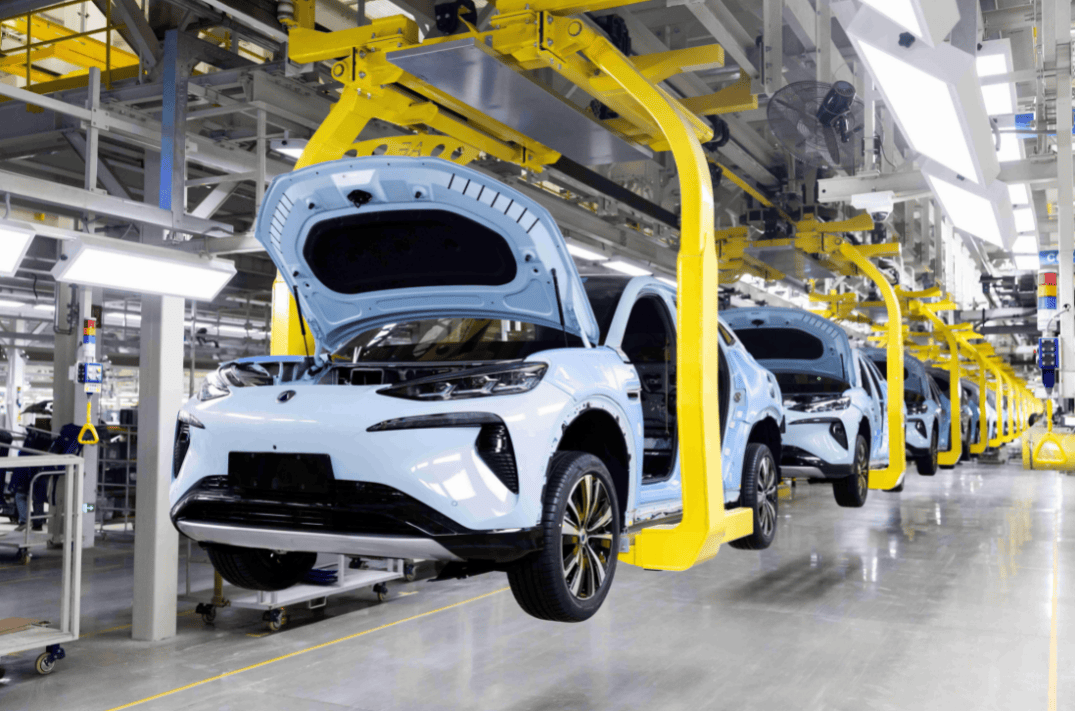

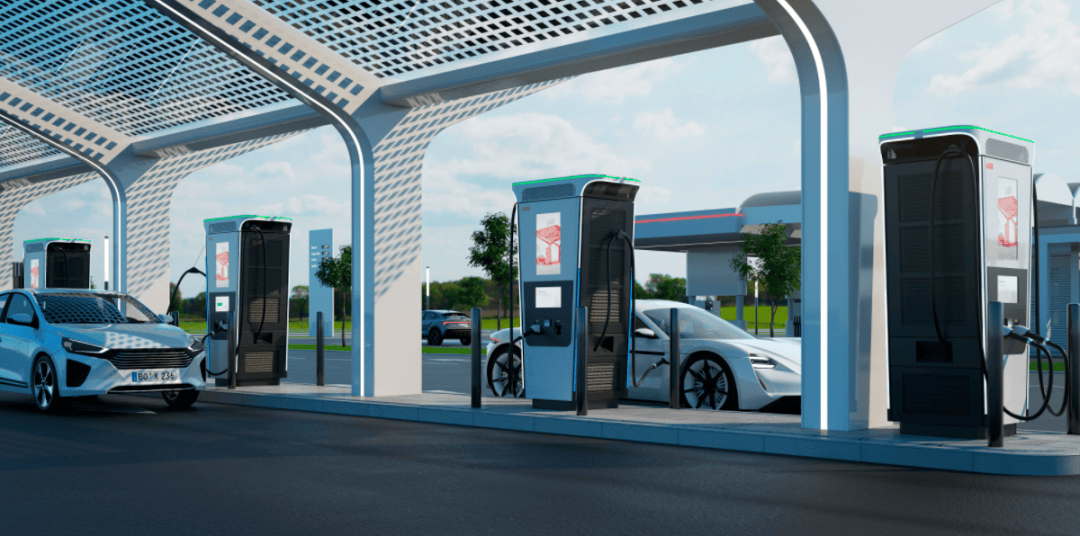

Globally, Chinese automakers have now established a vast electric vehicle empire. To date, China has established a large number of public charging networks worldwide, covering over 10 million charging piles and serving over a billion customers. More than 100 automotive brands, including BYD, NIO, XPeng, Lixiang One, and others, are part of this network.

However, tariff policies targeting Chinese electric vehicle enterprises have been introduced in the global market. In the United States, the transition to electric vehicles has been slow due to factors such as supply chain constraints, inadequate electric vehicle infrastructure, and local cultural influences. Meanwhile, to protect American automakers, the United States has increased tariffs on Chinese electric vehicles.

In contrast, Germany, with world-class automotive manufacturing technology, has also seen slow progress in its transition to electric vehicles. As Chinese electric vehicles gradually replace internal combustion engine vehicles, German automakers are striving to launch electric vehicle products to capture the market. According to foreign media reports, Volkswagen, Mercedes-Benz, and BMW have collectively invested 35 billion euros (approximately $38 billion) in the electric vehicle sector.

Recently, these three manufacturers have reported declines in sales in China during the third quarter. For example, according to sales figures released by BMW Group on October 10, global deliveries of BMW vehicles were 540,882, a decrease of 13% from the same period last year. Cumulative deliveries for the first three quarters of 2024 were 1,754,158, a year-on-year decrease of 4.5%. Notably, the decline in the Chinese market was the most significant, with only 147,691 vehicles sold, a year-on-year drop of 29.8%.

The enormous scale of overseas expansion and the substantial sales volume reflect the prosperity of the Chinese electric vehicle market, positioning Chinese electric vehicle manufacturers at the forefront globally. Industry data from July and August 2024 showed that over half of total Chinese automobile sales were electric or hybrid vehicles.

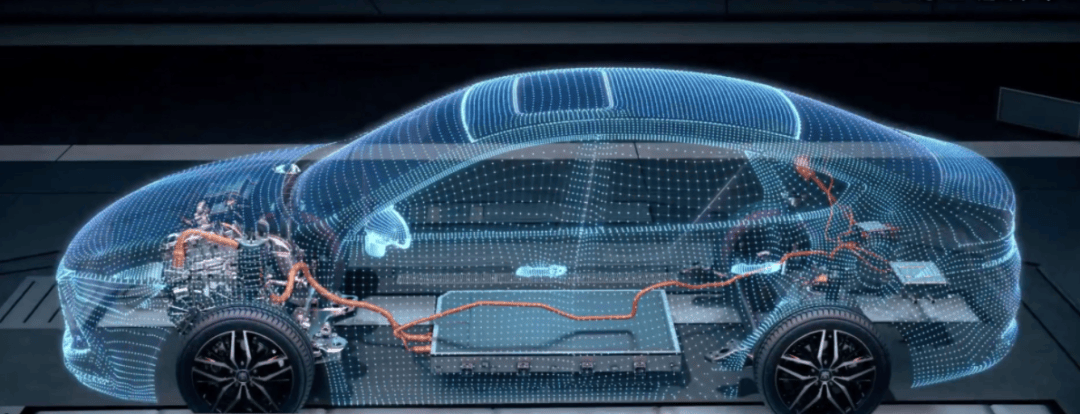

How did Chinese electric vehicles 'seize the initiative'?

The transformation of Chinese electric vehicles is the result of both technology and strategy. From 2009 to 2022, the government provided subsidies to public transportation and individual consumers, stimulating electric vehicle purchases. Additionally, the introduction of Tesla sparked competition among domestic automakers, driving technological innovation and strategic upgrades among domestic brands. Product innovation has increased, and infrastructure coverage has expanded. According to data from the National Energy Administration's press conference on July 31, the total number of charging piles nationwide reached 10.244 million by the end of June this year, a year-on-year increase of 54%.

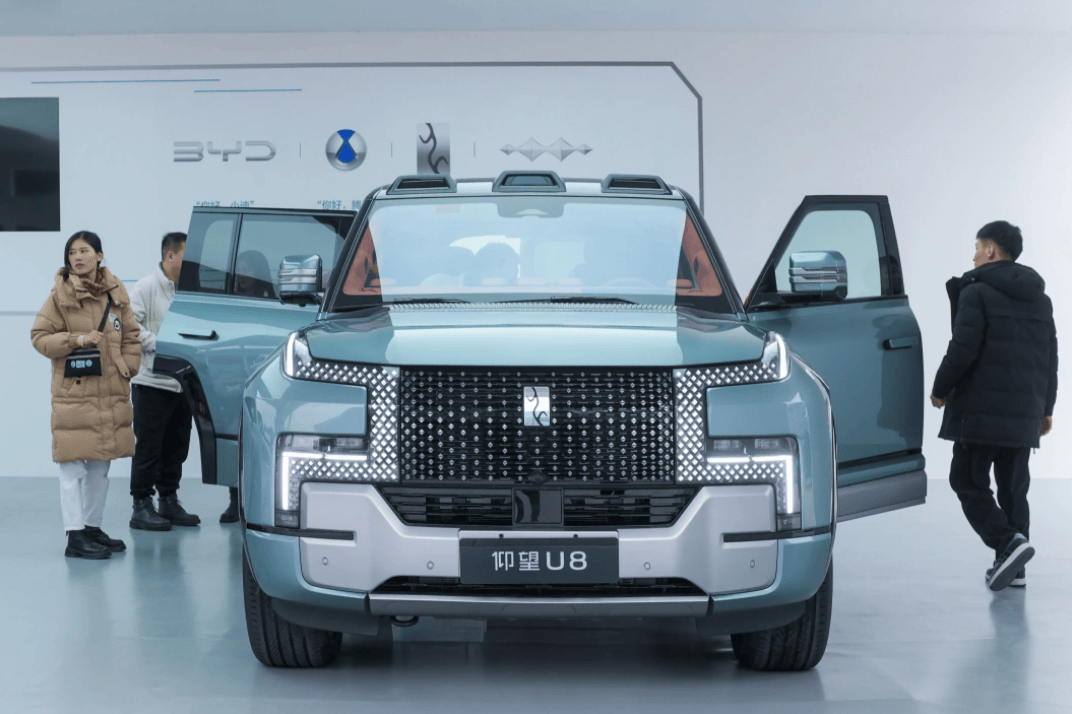

Taking BYD as an example, as the world's largest electric vehicle manufacturer, it has penetrated local markets in multiple countries and regions. On October 15, Bloomberg News reported that German manufacturers still control nearly 15% of the Chinese automobile market, but their share in the electric vehicle market is less than 10%. The combined market value of the three major German automakers, Volkswagen, Mercedes-Benz, and BMW, is less than half that of BYD.

In addition to Europe, BYD has also delivered impressive results in Asia.

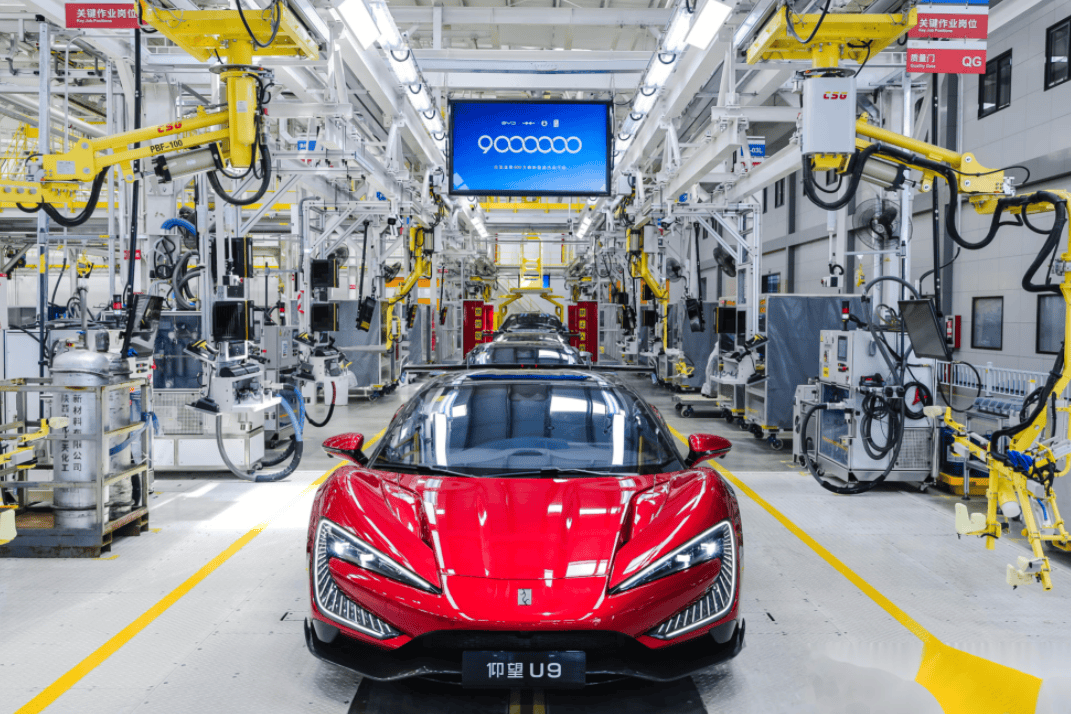

According to Counterpoint Research, BYD's electric vehicle brand is gaining increasing influence in Southeast Asia, accounting for nearly half of the market share. In Vietnam, although BYD lags behind local brand VinFast in sales due to charging pile coverage and pricing strategies, since its launch on July 18, BYD's electric vehicle sales in Vietnam have increased by 400% year-on-year in sales data for the first quarter of this year. Last year alone, BYD sold over 3 million vehicles globally. By September of this year, BYD's cumulative global sales of new energy vehicles had surpassed 9 million, achieving a monthly sales record of 400,000 vehicles.

This year, BYD's overseas expansion has significantly accelerated. As of July, overseas sales exceeded 233,000 vehicles. Currently, BYD's new energy vehicles are available in 88 countries and regions, covering over 400 cities worldwide.

Crisis for Chinese Electric Vehicles Going Abroad

Faced with the threat posed by Chinese electric vehicles to local markets, many countries have implemented increased tariff policies. In May this year, the United States increased tariffs on Chinese electric vehicles from 25% to 100%; in July, the European Union imposed provisional anti-subsidy tariffs of up to 37.6% on electric vehicles imported from China. Starting from October 31, the European Union decided to impose anti-subsidy tariffs on electric vehicles imported from China for five consecutive years on top of the existing 10% tariff.

Although domestic electric vehicles have strong price and cost advantages, tariff policies still significantly impact their overseas expansion. To mitigate losses due to such policies, many automakers have increased investments in factories in other regions. On July 4, BYD held a ceremony for the offline production of its 8 millionth new energy vehicle, the 'Dolphin,' in Thailand, marking the official launch of the Thai factory. Additionally, BYD has established passenger vehicle production bases in Brazil, Hungary, Uzbekistan, and other countries. In July, NIO also invested in the construction of its first overseas factory in Hungary for the production of battery swap stations to provide better battery swapping services. This factory is expected to become NIO's European manufacturing center for battery charging products.

Reuters reported that earlier this month, EU member states barely supported imposing import tariffs of up to 45% on electric vehicles produced in China, aiming to counter what Brussels described as unfair subsidies from the Chinese government to Chinese manufacturers.

However, despite facing high tariffs, Chinese electric vehicle brands have not yet raised prices to offset tariff losses.