Chinese electric two-wheelers go global: reshuffle, pressure, and challenges

![]() 11/14 2024

11/14 2024

![]() 600

600

Written by | Mantis Observer

Electric two-wheelers are going crazy overseas.

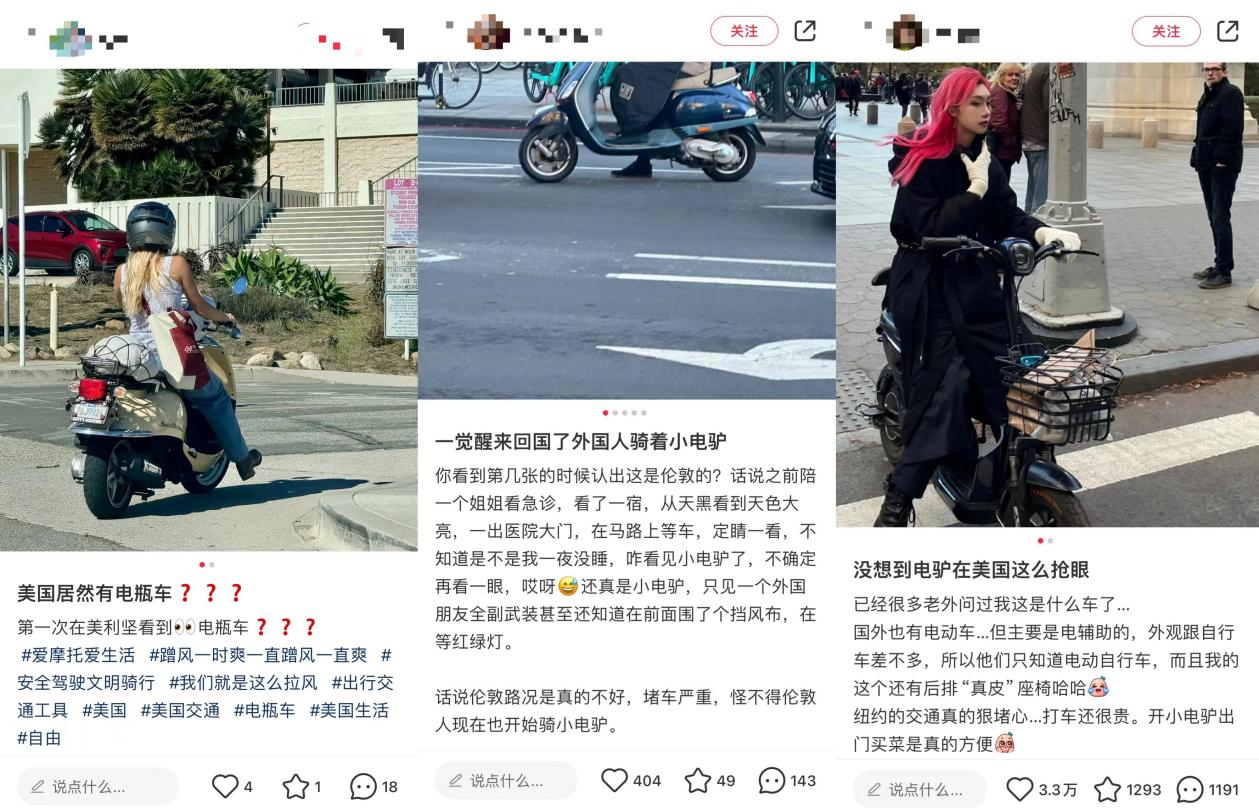

On social media platforms like Xiaohongshu, more and more overseas users are sharing pictures of foreigners riding electric bikes in New York, London, and other places. They express surprise, saying it feels like they have been instantly transported back to the streets of China.

(Image source: Xiaohongshu)

Even more surprising is that many of these popular overseas "little electric donkeys" are made in China. Chinese electric donkeys have quietly carved out a bloody path in the international market.

Collective "going overseas" of electric two-wheeler manufacturers

From January to July this year, China's electric two-wheeler exports reached 20.63 billion yuan, an increase of over 9% year-on-year. China has become the world's largest exporter, manufacturer, and consumer of electric two-wheelers.

Among domestic electric two-wheeler manufacturers Domestic two wheeled electric vehicle manufacturers expanding into overseas markets , they can be broadly classified into traditional brands represented by Yadea, Aima, Tailg, and Sunra; up-and-coming brands represented by Niu, Ninebot; and cross-border players such as DJI, which has announced its entry into the E-bike market, and Hello, which has deployed shared electric bikes overseas.

The main reason these brands have chosen to "go overseas" and expand their territories is that the "trade-in" bonus period has ended, and the domestic market is already fully saturated.

On April 15, 2019, the "Electric Bicycle Safety Technical Specifications (GB17761-2018)" were officially implemented, requiring electric bicycles to have pedals, bear the 3C mark on the entire vehicle, motor, and charger socket, and have a speed limit of 25 km/h.

After the implementation of the new national standard, which strictly regulates product parameters and management qualifications, non-compliant electric bicycles will be banned from the road, or fines and vehicle impoundment will be imposed. This has led to the elimination of a large number of small brands and non-compliant brands, while established brands like Yadea and Aima, as well as new forces like Niu and Ninebot, have risen rapidly due to their scale advantages and technological innovation capabilities.

However, the "bonus period" will eventually end. In 2022, as most older electric two-wheelers were gradually replaced, over 80% of the replacement demand under the new national standard was met, and market demand weakened.

According to research data from iResearch, sales of electric two-wheelers in China were approximately 55 million units in 2023, a decrease from the previous year. HC Securities also predicts that the compound annual growth rate of industry sales will decline from 18% in 2019-2022 to 5%-10% in the next three years.

This trend has directly affected the performance of domestic electric two-wheeler companies. The latest earnings report shows that Aima Technology achieved revenue of 6.873 billion yuan from July to September, a year-on-year decrease of 5.05%, and net profit attributable to shareholders of listed companies was 603 million yuan, a year-on-year decrease of 9.02%.

Aima, an established player, saw a decline in both revenue and profit in the third quarter. As the biggest beneficiary of the "trade-in" policy, Yadea, which has the highest market share, is also struggling.

According to the disclosed mid-year report for 2024, Yadea Holdings achieved revenue of 14.414 billion yuan in the first half of the year, a year-on-year decrease of 15.4%, and profit attributable to shareholders of the company was 1.034 billion yuan, a year-on-year decrease of 12.9%.

This is the first year-on-year decline in Yadea Holdings' semi-annual performance since 2020. Facing a "depressed" domestic market with declining sales and performance, it is no wonder that domestic electric two-wheeler companies have chosen to collectively "go overseas."

In fact, finding new growth opportunities in overseas markets is indeed an opportunity comparable to the introduction of the new national standard for domestic electric two-wheeler manufacturers.

On the one hand, according to the report of overseas research institution MRFR, the global electric two-wheeler market size will exceed $100 billion by 2030, with a compound annual growth rate of 34.57% from 2022 to 2030.

With a relatively low penetration rate and a huge market size, the overseas electric two-wheeler market is clearly an untapped "gold mine."

On the other hand, carbon emission reduction has become a global consensus, and many countries have successively adopted subsidies to encourage residents to switch from purchasing cars to purchasing electric two-wheelers.

In March 2023, the U.S. government resubmitted the E-bike Act bill, proposing a 30% tax credit for the purchase price of new electric two-wheelers. In August, the French government increased subsidies for trading in gasoline vehicles for electric bicycles to 4,000 euros per person.

Southeast Asian countries have also introduced relevant policy subsidies. Indonesia and Thailand have decided to provide subsidies of more than RMB 3,000 per electric motorcycle starting this year. The Philippines has proposed to exempt import tariffs on electric motorcycles, electric two-wheelers, and their components for the next five years starting this year...

However, despite the overseas market appearing to be a "gold mine" waiting to be explored, domestic electric two-wheeler brands still need to overcome numerous challenges to rise again in this blue ocean.

Difficult to overcome "difficulties" with overseas markets

While the domestic electric two-wheeler market is experiencing contraction and slowing growth, the overseas market is showing robust growth. The going-global strategy has quietly become a "required course" for domestic electric two-wheeler manufacturers.

However, to steadily move forward on this path and successfully "graduate," three major "mountains" must be crossed.

The primary challenge lies in the fact that electric two-wheeler products are highly dependent on offline experiences and service networks.

Although brands can attract customers and facilitate transactions through online marketing, offline channels still play an irreplaceable role in core aspects such as model selection, vehicle pick-up services, subsequent maintenance, and repairs.

However, the operating costs of overseas stores, including rent, labor, and storage fees, are significantly higher compared to the domestic market.

Although brands like Niu and Ninebot have entered international e-commerce platforms like Amazon and eBay to expand sales channels, most consumers still prefer to make decisions after experiencing the product in person, making offline stores a crucial bridge to reach target customers.

Therefore, how to effectively integrate online and offline resources while controlling overseas store costs has become one of the urgent issues that domestic electric two-wheeler manufacturers need to solve.

Secondly, the demand for electric two-wheelers varies across different regional markets globally. The European and American markets prefer mid-to-high-end electric motorcycles and e-bikes that serve both commuting and leisure purposes; the Southeast Asian market focuses on cost-effectiveness, with low-to-mid-end lightweight models dominating; and in South American countries with complex terrains, high-power electric motorcycles are more popular...

Faced with these cultural differences, electric two-wheeler brands need to leverage intelligent technology to reshape their product lines and provide customized services for different regions to steadily advance on the path of internationalization.

Finally, while domestic competition is fierce, competition in overseas markets is equally intense.

Not only do domestic traditional brands, up-and-coming brands, and cross-border players each have their advantages, but many overseas forces have also begun to compete for a share of the market.

Last January, the CEO of Harley-Davidson announced that the entire brand would move towards electrification. Honda launched a new electric two-wheeler brand, "Honda e:". The American automaker Ford also collaborated with the electric brand N+ to launch two new electric bicycles, the Bronco and the Mustang, with the Bronco being particularly suitable for off-road riding on rugged terrain.

Given the relatively low technical threshold and limited application scenarios of electric two-wheelers, homogenization is severe. Many brands have turned to betting on the high-end market in hopes of breaking the deadlock.

In recent years, Yadea has launched its premium sub-brand VFLY series, priced between 6,999 yuan and 19,800 yuan. Aima has also launched its premium sub-brand Xiaopa Electric, targeting high-end urban white-collar workers. The entry-level Vitality Edition is priced at 4,999 yuan, while the Prestige Edition is priced at 9,999 yuan.

High product pricing aims to attract high-end consumers. However, while a high-end market strategy can increase profit margins, it may also increase the burden on enterprises, and market acceptance is questionable.

Taking Niu as an example, it not only engages in intelligent innovations such as in-car large screens and smart interactions but also pursues top-tier component configurations, even using the same Panasonic batteries as Tesla.

Despite its relentless efforts in intelligence and component configuration, it has failed to effectively translate this into profitability. According to its interim report, Niu, which has gone all-in on configurations, reported a net profit of -79.7161 million yuan, an increase of over 17 million yuan in losses compared to the same period last year.

Moreover, intelligent competition is becoming increasingly fierce. Nowadays, features such as App activation, GPS positioning, all-weather vehicle monitoring, and OTA systems have almost become standard for domestic electric two-wheelers. To create a gap, major manufacturers may need to develop more intelligent and higher-quality electric two-wheelers to enhance product and enterprise competitiveness.

In summary, domestic electric two-wheeler manufacturers, which started with the support of policies, have collectively entered a period of "seeking change" and are actively seeking solutions to break the deadlock. Going global has become a crucial battleground for industry reshuffling. For industry leaders who have suffered double blows to their performance and valuation, seizing the opportunity to achieve a second leap may help them weather the winter and usher in a new spring.

*All images in this article are sourced from the internet