Geely should have merged Zeekr and Lynk & Co. long ago

![]() 11/19 2024

11/19 2024

![]() 565

565

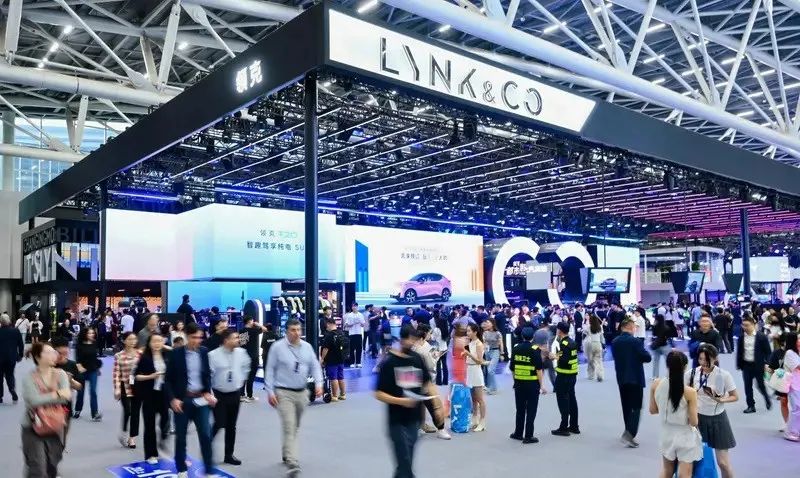

Zeekr takes control of Lynk & Co., and Geely wants to tell a new story.

Produced by | Xinpinlue Finance

Author | Wu Wenwu

Recently, there was a major news in China's automotive industry. A leading automaker decided to merge its two well-known automotive brands.

Xinpinlue Finance noticed that on November 14, Geely Holdings announced that it would transfer a 20% stake in Lynk & Co. to Zeekr for 3.6 billion yuan. At the same time, Volvo would transfer a 30% stake in Lynk & Co. to Zeekr for 5.4 billion yuan. After the transfer, Zeekr would subscribe to an additional registered capital of 367 million yuan in Lynk & Co.

In other words, by investing 9.367 billion yuan, Zeekr will hold a 51% stake in Lynk & Co. After the transaction is completed, Zeekr will become the controlling shareholder of Lynk & Co. In this acquisition, the valuation of Lynk & Co. is approximately 18 billion yuan.

Zeekr took control of Lynk & Co., and the capital market quickly gave feedback. When the acquisition news spread, Zeekr's share price, which was affected, once rose by more than 12%, with a market value of 7.2 billion dollars. After the acquisition news was confirmed, Zeekr's share price fell sharply by 23.68%, and its market value shrank to 5.5 billion dollars.

As everyone knows, both Zeekr and Lynk & Co. are automotive sub-brands under the Geely Group. In the view of Xinpinlue Finance, this transaction is, to be precise, a capital market move by Geely to lead the integration of internal corporate sub-brand business assets.

From an external corporate perspective, this transaction will not stir up too much commotion in the current Chinese automotive industry and new energy vehicle market, but it will still attract some attention and heated discussion.

So, why did Geely merge Zeekr and Lynk & Co. at this time? Can Zeekr rest easy after the merger?

01

Lynk & Co. and Zeekr each have their own missions

China's automotive industry is constantly evolving. At different stages of industry development, automakers often adopt different market strategies.

Lynk & Co. and Zeekr are the market behaviors of Geely at different stages of industry development. Lynk & Co. and Zeekr each have their own missions.

The time goes back more than a decade. At that time, China's automotive industry was dominated by joint ventures. Domestic automakers such as Geely, Great Wall, BYD, and others could barely make it to the "table" and could only engage in minor activities.

To enhance its brand image and access better automotive technology resources, Geely acquired Volvo Cars from Ford for no less than 1.8 billion dollars in August 2010, staging a "snake swallowing an elephant" acquisition in the history of the global automotive industry.

After acquiring Volvo, Geely further integrated Volvo and Geely's businesses during the era of fuel-powered joint ventures. Starting in 2013, Volvo and Geely jointly developed the new-generation Compact Modular Architecture (CMA) and related components.

In 2016, Geely and Volvo established the joint venture brand Lynk & Co., positioning it as a high-end brand for the new era. The purpose of establishing Lynk & Co. was for Geely to create a joint venture brand, aiming to make breakthroughs and compete with other joint venture automakers.

To put it more bluntly, the Lynk & Co. brand carries Geely's dream of a joint venture automaker. In fact, Lynk & Co. later made a big splash. Its first SUV model became an instant hit, and Lynk & Co. was very popular at the time.

Xinpinlue Finance once went for a test drive of a Lynk & Co. car. At that time, the service attitude of Lynk & Co. employees was even more arrogant than that of joint venture automakers. Lynk & Co. reached its peak sales volume of 220,500 units in 2021.

Just as Lynk & Co. was thriving, China's automotive industry accelerated its entry into the new energy vehicle era. New forces in carmaking such as NIO, XPeng, and Li Auto emerged. Tesla entered the Chinese market and later directly built a superfactory in Shanghai.

Geely also saw that the era of new energy vehicles was coming. Lynk & Co. established an electric vehicle business group, and in April 2021, the Lynk & Co. ZERO CONCEPT concept car was unveiled, becoming Zeekr 001. In September 2021, Zeekr began operating independently, becoming a sub-brand alongside Lynk & Co. under Geely.

In the fiercely competitive new energy vehicle market, Zeekr 001 became an instant hit. Some young friends around Xinpinlue Finance chose Zeekr 001 over Tesla Model 3 and Lexus ES.

In the first three quarters of this year, Zeekr's sales volume approached 150,000 units. In October of this year, Zeekr's sales volume exceeded 20,000 units, ranking it on the list of new forces in carmaking.

Unlike Lynk & Co., Zeekr supports Geely's dream of a high-end pure electric vehicle brand. Lynk & Co. and Zeekr each have their own missions and have each completed their initial development missions.

02

Geely should have merged Zeekr and Lynk & Co. long ago

Although both Lynk & Co. and Zeekr belong to the Geely Group, if placed in market competition, they are also competitors. When two sons fight each other, the father, Geely, naturally cannot sit still.

In the past year or two, Lynk & Co. has also been focusing on the new energy sector and launched the EM-P super-range extension solution in 2023. In September of this year, Lynk & Co. entered the pure electric field and released its first pure electric model, the Z10. Although sales did not meet expectations, it demonstrated Lynk & Co.'s confidence in developing its new energy vehicle business.

What is even more embarrassing is that both Lynk & Co.'s pure electric models and Zeekr's pure electric models are based on Geely's HAO Architecture. They not only share the same platform but also have many similar design languages, and their price ranges overlap.

Unlike Volkswagen Group's Audi, which focuses on luxury vehicles, and the Volkswagen brand, which targets mass consumers, Geely has the luxury automotive brand Volvo under its umbrella. However, both Zeekr and Lynk & Co. have too many overlapping aspects, whether in terms of brand positioning or later models.

Lynk & Co. started with fuel-powered vehicles, then moved on to plug-in hybrids, later focused on range extenders, and finally entered the pure electric field. Zeekr mainly focuses on pure electric vehicles and has secured a place in the market. Now there are rumors in the market that Zeekr also plans to launch range extender models, further increasing the overlap between the two.

When the two core business sub-brands under Zeekr and Lynk & Co. compete with each other, or even fight each other in the market, it is not good for Geely. It will result in a waste of substantial funds and internal and external resources in various aspects such as vehicle design, manufacturing, and customer service.

It is evident that Geely has seen the drawbacks of competition between its two beloved sub-brands, Zeekr and Lynk & Co. Merging them can allow the limited resources and funds to be used more effectively, with resources being more concentrated. The two sub-brands can share resources such as business and after-sales services, maximizing the combined effect.

Lynk & Co. was a winner in the traditional fuel-powered vehicle era and the joint venture era, but now that the new energy vehicle era has arrived, Lynk & Co.'s sales have actually declined since 2021. The market environment has forced Lynk & Co. to transition to the new energy vehicle business, which inevitably leads to competition with Zeekr. Moreover, in the new energy vehicle era, Zeekr's brand presence has overshadowed Lynk & Co.'s.

From a capital market perspective, Geely is a master of capital operations. Zeekr has already gone public, and Zeekr's controlling stake in Lynk & Co. also tells a new story to the capital market.

After media reports of Zeekr's controlling stake in Lynk & Co., a Zeekr car owner told Xinpinlue Finance that the purpose of Lynk & Co. controlling Zeekr is to increase market value.

Polestar, backed by Volvo and Geely, has lost 14.1 billion yuan in the past three years with declining deliveries and dismal domestic sales. Some media have even commented that Polestar may delist. From another perspective, Geely certainly does not want a repeat of Polestar's experience in the capital market.

It can be seen that, whether considering the current market environment, the internal resource integration needs of the enterprise, or the needs of the capital market, Geely should have integrated Zeekr and Lynk & Co. long ago. In the view of Xinpinlue Finance, the merger should have been completed even before Zeekr's IPO.

03

Merged Zeekr still cannot rest easy

So, now that Zeekr has taken control of Lynk & Co., can the "fatter" Zeekr rest easy in the future?

Judging from Zeekr's development since its inception, it is a very successful move by Geely. Zeekr made a big splash right after its launch and carved out a path in the fiercely competitive new force market. Its achievements are commendable.

Data shows that in the first three quarters of this year, Zeekr delivered a total of 143,000 units, a year-on-year increase of 81%. From the data, it is evident that Zeekr's sales have grown significantly and have not lagged behind.

However, beneath Zeekr's impressive delivery performance, one cannot ignore its multifaceted, and even negative, aspects.

From the financial report data, Zeekr is still losing money, and the losses have even expanded.

Zeekr's financial report shows that in the first three quarters of 2024, Zeekr achieved revenue of 53.13 billion yuan, with revenue growth exceeding 50%. However, the net profit attributable to shareholders of the parent company was a loss of 5.43 billion yuan, and the loss even expanded by nearly 100 million yuan.

From the perspective of market sales, Zeekr's deliveries have increased significantly compared to the same period last year, relying on a sea of models. Zeekr's current sales volume is supported by its six models currently on sale.

Zeekr's previous sales were mainly supported by the 001 model. However, now the market halo effect of the Zeekr 001 is not as strong as before. In October of this year, the monthly sales of Zeekr 001 were less than 6,000 units, compared to over 14,000 units in June of this year.

Unlike the doll strategy of the Li Auto L series models, which have similar appearances to cover different consumer groups with varying purchasing power, Zeekr's models are more dispersed, targeting different consumer groups with different models, making them less attractive than the Li Auto L series.

It can be seen that the key reason for Zeekr's rapid development in the past was the strong sales performance of the 001 model. However, now that the sales of the Zeekr 001 model are declining, Zeekr urgently needs a successor to the 001 model, and future sales will still face significant challenges.

In the era of new energy vehicles, the sea of models strategy adopted by traditional automakers is no longer as effective. Nowadays, it is not about the number of models but their quality. Moreover, there must be long-term popular models and sales pillar models.

What is even more embarrassing is that, compared to the earlier mostly positive corporate brand image and voice, Zeekr's market brand image now seems to have turned negative or even fragmented. Zeekr has had at least two major " Overturning " (lit. "overturned") incidents this year.

First, the Zeekr 001 model released three new versions in one year, angering older car owners. I previously saw a short video online where a Zeekr 001 owner directly hung a bunch of leeks on the back of their car.

Later, in October of this year, Zeekr Vice President Yang Dacheng posted a video on social media of having hot pot in a Zeekr MIX, promoting the efficient fresh air system and claiming that having hot pot in the car is a "new camping experience." This marketing stunt that defied common sense "overturned," failing to add points for Zeekr.

Before taking control of Lynk & Co., Zeekr had mixed fortunes and could not rest easy, with potential problems and challenges increasing. Taking control of Lynk & Co. does not solve these problems. Recently, there have even been market rumors that Polestar may also face integration in the next step and will eventually be integrated with Zeekr and Lynk & Co.

Zeekr not only needs to accelerate the replication of the next 001 model but also needs to address shortcomings in areas such as model update and iteration strategies and customer service. It cannot afford to be complacent.

Zeekr still has a long way to go and faces many challenges. It not only needs to address current short-term concerns but also needs to plan ahead.