BYD Loses Early Lead in "Intelligent Driving", How to Break Through the "Second Half" with Competition Looming?

![]() 11/19 2024

11/19 2024

![]() 696

696

By Qin Nan

Source: Bowang Finance

In the first half of the new energy vehicle era, BYD is undoubtedly the biggest winner. Its third-quarter revenue reached RMB 201.1 billion, a year-on-year increase of 24%, surpassing Tesla for the first time to become the world's highest-revenue new energy vehicle company.

However, as the saying goes, 'the last leg of a journey is the hardest.' Although BYD is the winner of electrification in the first half, other players are not far behind, gradually stepping up their efforts in intelligence to seize the initiative in the second half.

Since the second half of 2023, with the popularity of AITO under HarmonyOS Intelligent Driving, and the subsequent mass production of models like M7 and Vision Van, the most mysterious "fourth realm" M9 was also unveiled at the recent Guangzhou Auto Show. Compared to Huawei's "Four Realms" model, BYD has lost the early lead in "intelligence." Even Xpeng Motors has gained fame with the Xpeng MONA M03 as "the only high-end intelligent driving car under RMB 200,000."

What big move is BYD planning with its various "relatively lagging" performances?

In terms of R&D investment, BYD invested over RMB 33 billion in the first three quarters, with a research team of 100,000 people. The intelligent driving team alone has reached a scale of 5,000 people, making it one of the most lavish new energy vehicle manufacturers.

At the beginning of this year, Wang Chuanfu stated, "We will invest RMB 100 billion in intelligence. Breakthroughs in intelligent driving technology will be one of BYD's core development directions for this year and next."

As 2024 draws to a close, BYD has partnered with Huawei to launch the Fangchengbao B8 equipped with Huawei's Kunpeng Intelligent Driving ADS 3.0 system. However, relying on external forces is clearly inconsistent with BYD's long-standing approach and R&D investment. So, what exactly is BYD doing in intelligent driving?

01

Losing the Early Lead in Intelligent Driving

In 2023, BYD officially launched the Yangwang brand and a series of high-end brands like Denza and Fangchengbao. However, the rapid rise of HarmonyOS Intelligent Selection and AITO has advanced the "second half of intelligence" battle.

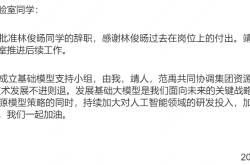

This has hindered BYD's expansion into the high-end market. Sales of the Yangwang U8 fell from nearly 2,000 units per month from the end of last year to fewer than 300 units in October. Although this is still considered good for a million-yuan luxury vehicle, the decline rate has exceeded expectations.

Simultaneously, BYD's high-end brand Denza is also in a lukewarm state, with sales of the Denza D9 and Denza N7 declining month by month, falling short of expectations. Much of the problem lies in intelligent driving.

A recent McKinsey survey revealed that Chinese car buyers generally believe that models priced above RMB 200,000 should be equipped with intelligent features represented by intelligent driving, which has become an indispensable part of the product. Even if consumers do not use them, they must be present.

So, what is the current market situation for intelligent driving in automobiles?

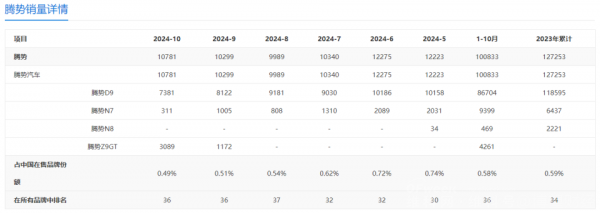

Overall, China's current automotive intelligent driving technology is still in the initial stage of "chaotic competition," with multiple so-called "industry firsts." Regardless of manufacturers' claims, they are all Level 3 or below autonomous driving, which only achieves autonomous driving under specific conditions, such as partial autonomous driving. It is not true autonomous driving.

Meanwhile, from a third-party perspective, intelligent driving technology still depends on data accumulation and the extent of its use among consumers.

In terms of data accumulation, Tesla undoubtedly has a significant advantage, with a single-day cumulative mileage of up to 30 million kilometers. However, considering that most of this data comes from the United States, where road systems are much less complex than in China, direct comparison is difficult.

In the domestic market, Li Auto, with its high sales over the past year, ranks first in intelligent driving mileage in China, exceeding 80 million kilometers during the National Day holiday alone. Meanwhile, Huawei, leveraging its Intelligent Selection and supplier model, has shown remarkable growth in data, completing over 500 million kilometers of intelligent driving from May to October this year, with a daily average increase of over 3 million kilometers. Manufacturers like Xpeng, NIO, and Zeekr are in the second tier due to their lower sales and data accumulation.

From the perspective of the practical application of intelligent driving technology, Huawei and Xpeng are currently leading in China, with intelligent driving mileage accounting for over 20% of total mileage.

Therefore, considering both the experience and mileage, Huawei and Xpeng are currently in the first tier of intelligent driving technology.

BYD's intelligent driving products did not take a substantial step forward until its partnership with Huawei. On August 27, BYD's Fangchengbao B8, jointly developed with Huawei, was officially unveiled.

The B8 is equipped with Huawei's Kunpeng Intelligent Driving ADS 3.0 system, enabling autonomous driving assistance from the parking spot, with the vehicle independently handling various complex scenarios like toll booths, roundabouts, and narrow turns. Functions like smart parking and remote maneuvering can be controlled through a mobile phone. However, this collaboration model inevitably leads to a higher product price. The B8 was released on November 12 with a starting price of RMB 379,800. At this price and model, it is difficult to shake the position of the first-tier intelligent driving technology.

For BYD, which has been "fully engaged" in the first half, relying solely on Huawei's strength and giving away the "soul" is difficult, whether for high-end brands or intelligence. So, what is BYD's game plan in intelligent driving?

02

BYD's "Vehicle Intelligence

To some extent, BYD's external cooperation is mainly led by Huawei. If the partnership with Huawei is the icing on the cake, then the in-house high-level intelligent driving solution - Tianshen Zhiyan (Divine Eye) - must be the focus of BYD's research and development.

According to available information, models equipped with the Tianshen Zhiyan solution include the Denza N7, Yangwang U8, BYD Han, BYD Seal, and Denza Z9 GT.

However, whether based on light maps or no maps, from high-speed piloting to urban NOA, BYD's Tianshen Zhiyan intelligent driving solution is essentially not different from Huawei's approach. Both utilize technologies like LiDAR, high-speed NOA, urban NOA, and valet parking to meet user needs. Although there are differences in technical details, the functions are similar.

After losing the early lead in intelligence compared to Huawei, BYD has an advantage that Huawei lacks in catching up with intelligent driving: vehicle intelligence.

If Huawei's intelligent driving solution and BYD's Tianshen Zhiyan are both technologies that mimic "human driving," then vehicle intelligence with chassis intelligence added is "superhuman driving.""What is "superhuman driving"? BYD calls it BAS 3.0+. This involves adding nearly 100 types of sensor signals to the perception end and integrating them with resolver sensors, tire pressure sensors, etc., to achieve real-time monitoring of various vehicle operating data. On the execution end, it integrates with BYD's three-motor, four-motor, CloudRide, and other systems to create an intelligent driving system encompassing the chassis, sensors, motors, and the entire system.

This "superhuman driving" is evident in the recently released Denza Z9 GT.

The BAS 3.0 intelligent driving system in the Denza Z9 GT is divided into two parts: narrow intelligent driving, similar to Huawei's solution, and broad intelligent driving. Broad intelligent driving focuses more on the vehicle's perception, power freedom control, and chassis stability control to achieve safer and more comfortable handling and driving experiences, especially with independent three-motor drive technology, independent rear dual-motor steering technology, and VMC vehicle motion control technology.

With the synergistic effect of these three technologies, the Denza Z9 GT offers five core functions: extreme steering, compass turning, low-adhesion road stability enhancement, and smart crab walking. With the support of intelligent driving, the vehicle can also achieve functions like high-speed tire blowout stability control, radar active avoidance, and easy three-party parking.

Therefore, Denza has achieved a deep integration of electrification and intelligence through its easy three-party vehicle intelligence control technology, which is what BYD calls vehicle intelligence.

Wang Chuanfu boasts, "Only BYD can achieve vehicle intelligence at present." He adds, "It is necessary to plan at the enterprise strategic level and achieve vertical integration of full-stack resources to enable all systems to work together and integrate."

03

Xiaomi Enters the Fray

While BYD is advancing vehicle intelligence, other manufacturers are also active. For Huawei, it is essential to consolidate its advantages established in the ADS 3.0 intelligent driving system. Yu Chengdong stated at the 2024 World Intelligent Connected Vehicle Conference that Huawei's ADS 4.0 is expected to be launched in 2025, realizing the commercialization of high-speed L3 autonomous driving and the pilot of urban L3 autonomous driving. The recently unveiled M9 at the Guangzhou Auto Show, which directly competes with Maybach, is rumored to be equipped with Huawei's ADS 4.0 technology.

While Huawei refines its ADS 4.0 technology, Xiaomi, to some extent, follows BYD's path.

On November 14, Xiaomi Automotive detailed four core technologies in its pre-research on intelligent chassis technology: fully active suspension, super four-motor system, 48V brake-by-wire, and 48V steer-by-wire.

Notably, the four-motor system enables independent and precise vehicle control on all four wheels, suitable for demanding scenarios like in-place turns and extreme cornering.

Meanwhile, 48V brake-by-wire achieves precise control of various actuators on the vehicle chassis through the coordinated work of the Electronic Control Unit (ECU) and sensors. In this process, Xiaomi Automotive eliminates mechanical connections and uses electrical signals for transmission, achieving human-machine decoupling. This allows driving operations to be completed without driver input in some intelligent driving scenarios.

Technically, Xiaomi's chassis pre-research is another "easy three-party" platform that pays homage to BYD's intelligent driving approach.

At this point, the paths of various players in the "intelligent" second half of China's new energy vehicle era have gradually become clear. Huawei's ADS iteration focuses on its unique bionic brain technology, enabling the intelligent driving system to make more complex decisions and respond quickly in changing traffic environments. BYD, on the other hand, focuses more on integrating intelligent driving systems with vehicle (chassis) intelligence. Xiaomi, meanwhile, learns from the strengths of both.

Regardless of the path chosen, the core of the "intelligence" competition in the second half ultimately comes down to how to penetrate as many vehicles as possible with the most cost-effective intelligent driving solutions, leveraging sufficient data and user feedback for iteration. Only then can intelligent driving technology advance to Level 4 or even Level 5. From this perspective, although BYD has lost the early lead in intelligent driving competition, with its gradually established complete supply chain and relentless investment in intelligent driving, it remains the biggest wild card in the future intelligent driving tier. Nevertheless, this "blooming" of intelligent driving will ultimately lead China's automotive industry to build a sufficiently wide "moat.