Spending 9.4 billion! Zeekr 'swallows' Lynk & Co

![]() 11/21 2024

11/21 2024

![]() 556

556

Author | Lu Shiming

Editor | Da Feng

Driven by the wave of new energy, the transformation of the automotive industry is intensifying. Recently, the merger of Geely's brands Zeekr and Lynk & Co has become the focus of industry attention. It is reported that Zeekr will acquire a total of 50% equity in Lynk & Co by purchasing the shares held by Geely Holdings and Volvo, and will obtain an additional 1% share through capital increases to Lynk & Co. Looking back, Lynk & Co, as an important piece in Geely's move towards high-end markets, has carried high expectations since its inception. Zeekr, on the other hand, emerged amidst the new energy wave, quickly making a name for itself in the high-end pure electric market with its outstanding product capabilities and market strategies.

Lynk & Co 01 Source: Lynk & Co official website

Now, Geely is promoting the merger of Zeekr and Lynk & Co, aiming to create a more competitive "new Zeekr" that is better adapted to market changes through resource sharing, technology integration, and brand synergy. However, it should be noted that this merger is not a simple integration of resources but a strategic layout by Geely Group based on the current market competition environment after careful consideration.

From operating independently to merging into one, "new Zeekr" will also face fiercer market competition, especially in the main battlefield of the new energy vehicle market—the price range of 200,000 to 300,000 yuan, where it will face more competitors. How to find a breakthrough and achieve rapid sales growth? This will be a question that "new Zeekr" needs to ponder deeply.

"Transformation" and "backlash"

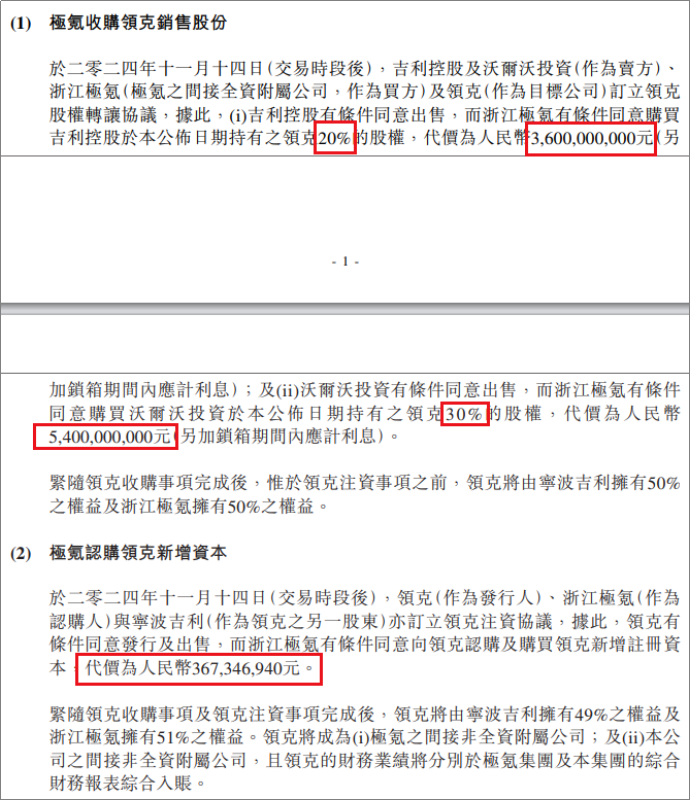

The merger of Zeekr and Lynk & Co is not a simple and Rough and rough process, and Geely has also conducted a series of capital operations. Specifically, in Lynk & Co's original equity structure, Geely Automobile, Volvo Cars, and Geely Holdings held 50%, 30%, and 20% shares, respectively. According to Geely's announcement, the independent valuer determined the valuation of 100% equity of Lynk & Co Group on the valuation date using the market approach to be 18.328 billion yuan. In this transaction, Zeekr will purchase the 20% equity of Lynk & Co held by Geely Holdings from it at a cost of 3.6 billion yuan.

In addition, it will also acquire the 30% equity of Lynk & Co held by Volvo at a cost of 5.4 billion yuan. On the day Geely's announcement was released, Volvo, as a shareholder of Lynk & Co, also issued an announcement confirming the matter and stated that the consideration would be paid in cash, with 70% of the amount paid upon completion of the transaction and the remaining 30% plus interest paid one year after the completion of the transaction. The transaction is expected to be completed in the first quarter of 2025. In addition to acquiring shares, it is reported that Zeekr will also subscribe to the newly increased registered capital of Lynk & Co at a cost of 367 million yuan. At present, after the completion of the acquisition and capital injection, Zeekr will own 51% of Lynk & Co's shares, becoming its largest shareholder.

Source: Geely Holdings Announcement

Looking back at the development history of the two brands, Lynk & Co was established in 2016 and undertook the important task of Geely's move towards high-end markets that year. In the second year of its establishment, the first model of Lynk & Co, the Lynk & Co 01, was launched with a selling price of 158,800 yuan, comparable to mainstream joint venture automotive brands.

In 2018, Lynk & Co achieved an annual sales volume of 120,000 units, completing Geely's "high-end" mission to a certain extent. At the same time, amidst the wave of new energy, Lynk & Co also began its transformation and successively launched multiple PHEV models based on its original fuel vehicle products. Unfortunately, due to the overall technological development not keeping pace with the times, Lynk & Co's sales volume declined for the first time in 2022, and sales of new energy products were sluggish. Based on this, Lynk & Co established an electric vehicle business group and launched the concept car Lynk & Co ZERO. However, considering the new high-end pure electric vehicle market and brand development freedom, this model was released under the name of Zeekr 001, and the Zeekr brand was also announced.

Following the "heat" of new energy, the Zeekr brand has enjoyed the most resource support within the Geely Group in recent years, and brand leader An Conghui has a very high say internally. Of course, Zeekr's performance has also been excellent. In 2023, Zeekr's total sales volume was 118,685 units, a year-on-year increase of 65%. From January to October of this year, Zeekr delivered a cumulative total of 167,922 units, a significant year-on-year increase of 82%, topping the list of China's high-end pure electric vehicle sales champions and maintaining a monthly sales volume of over 20,000 units consecutively. More importantly, Zeekr has completed its listing on the US stock market in just three years since its establishment. "Transformed" from Lynk & Co and yet "backlashing" against it, what considerations does Geely have in mind?

"Contradiction" and "focus"

As mentioned earlier, the Lynk & Co brand has clearly focused on plug-in hybrid models to form differentiated competition with the Zeekr brand. However, this year, Lynk & Co launched its first pure electric sedan, the Z10, with a price range of 180,800 to 313,800 yuan, which has led to obvious overlap between Lynk & Co and Zeekr in product lines, especially direct competition with models such as the Zeekr 001 and Zeekr 007. Unfortunately, two months after the launch of the Z10 model, the total delivery volume was less than 5,000 units, and market performance was unsatisfactory.

Lynk & Co Z10 Source: Lynk & Co official website

Lin Jie, general manager of Lynk & Co Automobile Sales Company, has publicly stated that although Lynk & Co's pure electric products will face internal and external competition, the brand will strive to maintain its uniqueness. He emphasized that Zeekr focuses more on leading technical parameters, while Lynk & Co focuses more on embodying lifestyle, aiming to compete with new carmaking forces.

Although this is the theory, it is not difficult to see from the relevant content on major automotive media websites that consumers' questions about Lynk & Co's pure electric products are highly similar to their questions about Zeekr vehicles, and there is a clear cognitive blur regarding the differences between the two brands' products. At the same time, the Zeekr brand has also announced that it will venture into the hybrid vehicle sector amid sales bottlenecks. For example, at Geely Automobile's 2024 interim results conference, An Conghui, CEO of Zeekr Intelligence Technology, revealed that Zeekr's large flagship SUV model will be equipped with two power forms, including pure electric and super electric hybrid, and is expected to be released in the fourth quarter of 2025. This decision undoubtedly further exacerbates the internal friction between the two brands, and a merger clearly becomes the best way to solve the problem.

In fact, before the official merger of the two, there had always been rumors within Geely, especially after Geely issued the "Taizhou Declaration" in September this year, making the merger of the two brands appear more realistic. It is understood that in the "Taizhou Declaration," Geely clearly proposed the five strategic directions of "strategic focus, strategic integration, strategic synergy, strategic robustness, and strategic talent." Subsequently, the Geometry brand was merged into Yinhe, and it was also rumored that Polestar would be integrated under Zeekr.

Picture: Li Shufu releasing the "Taizhou Declaration"

Compared to brand mergers, the integration of Geely's R&D system came earlier.

Previously, Interface News reported that in August this year, Zeekr conducted a large-scale organizational restructuring and reporting process change internally, aiming to integrate business departments and develop towards a platform approach, preparing for integration into Geely's Central Research Institute. It is understood that there is duplicate business development between Geely's Central Research Institute and the Zeekr R&D team, and the merger will reduce internal friction. As for the objects participating in the integration, they include teams behind Geely's Central Research Institute and various sub-brands such as intelligent driving, cockpit, electronic and electrical architecture, electric power, and vehicle platforms, as well as backend procurement and supply chains. From strategic focus to brand and technology mergers, this series of actions clearly shows that Geely is preparing to respond to increasingly fierce market competition in a more powerful state.

"Space" and "pressure"

It should be noted that although merged, Geely has also made it clear that the Lynk & Co brand will be retained. An Conghui stated at Geely's Q3 2024 financial results conference that Zeekr and Lynk & Co will maintain a dual-brand strategy, relatively independent and distinct from each other. After the merger, Zeekr and Lynk & Co will conduct a comprehensive product review and planning to avoid conflicts and form a synergistic effect. In the future, Zeekr will focus on mid-to-large vehicles, while Lynk & Co will focus on small-to-medium vehicles. In terms of energy forms, Lynk & Co's small vehicles will focus on pure electric, while medium vehicles will be equipped with hybrids; Zeekr's medium vehicles will focus on pure electric, and large vehicles will be equipped with hybrids. In terms of technology, Zeekr and Lynk & Co will achieve the greatest degree of platformization in electronic and electrical architecture, mechanical architecture, cockpit, intelligent driving, and three-electric technologies within 2-3 years, moving from operating independently to a unified pace. In terms of channels, Lynk & Co will maintain its dealer model, while Zeekr will continue to adopt the direct sales model of Zeekr Homes, but the after-sales and logistics systems can be shared. In terms of administrative management, Zeekr and Lynk & Co will achieve further integration, optimize organizational structure, and improve system efficiency.

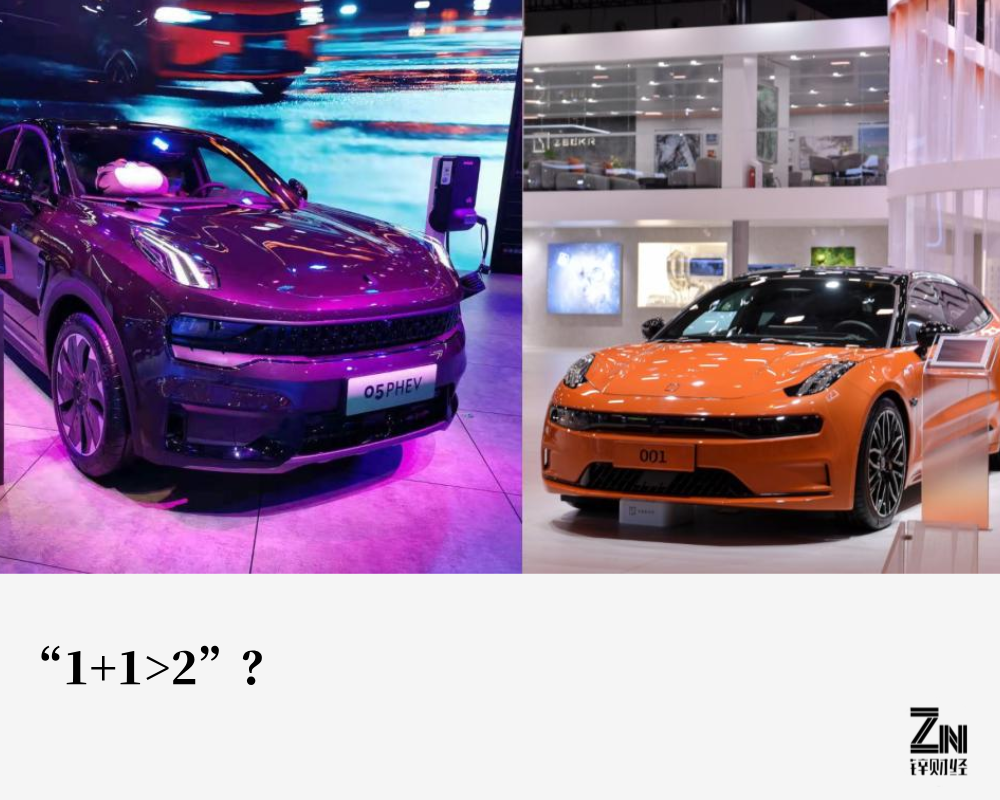

Overall, in the Chinese passenger vehicle market, Zeekr's market share in the 250,000-500,000 yuan range is 18.7%, while Lynk & Co's market share in the 150,000-350,000 yuan segment accounts for 35.3% of the entire market. This means that after the merger of Zeekr and Lynk & Co, new products can cover about 60% of China's automotive market segments, giving "new Zeekr" more room for imagination. However, doing so will also expand the competitive scope of "new Zeekr," increasing the pressure. Currently, Zeekr's main competitors include NIO, Xpeng, Li Auto, Xiaomi, etc. In terms of specific models, the Zeekr 001 needs to compete with models such as Xiaomi SU7, IM Motors L6, NIO ET5T, and IM Motors R7, while the Zeekr 009 will face competition from models such as BYD Denza D9, Voyah Dreamer, and Xpeng X9...

Zeekr 001 Source: Zeekr official website

If the price range expands to 150,000-200,000 yuan after the merger with Lynk & Co, then it will also have to "compete for food" from traditional manufacturers' models such as BYD Han, Deep Blue S07, and Xingji Yuan ET, as well as new force models like Leapmotor C11. Nowadays, competition in the new energy vehicle market has intensified, and the price range of 200,000 to 300,000 yuan has always been considered the main battlefield for automakers and will be the most competitive price segment. As the new energy vehicle market continues to expand, future competition will become more diversified and intelligent. Not only will competition between traditional fuel vehicles and new energy vehicles intensify, but various plug-in hybrid models will also enter this market segment. So, can "new Zeekr" find a breakthrough in such a market environment, achieve rapid sales growth, and achieve a "1+1>2" effect? We will wait and see.