To make electric cars, one still has to rely on the 'big brands'; overseas giants are again 'seeking help' from Chinese automakers

![]() 11/27 2024

11/27 2024

![]() 732

732

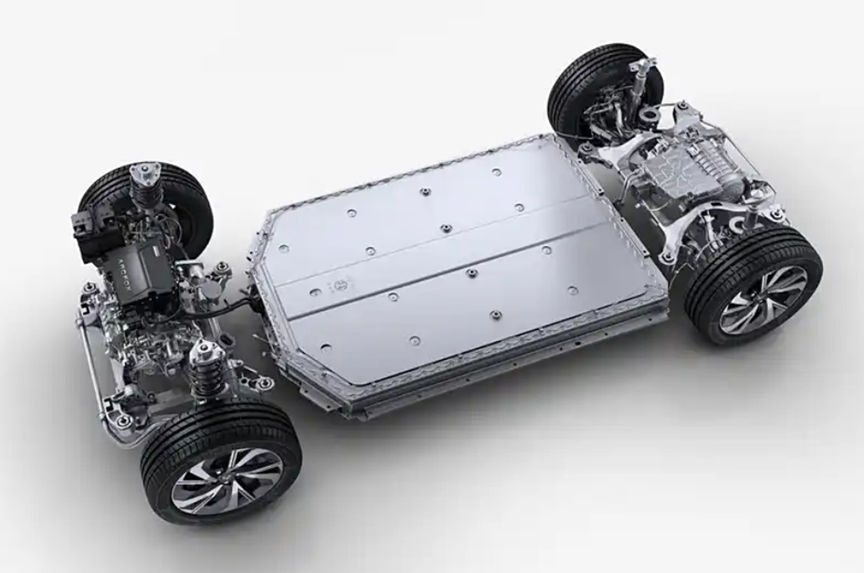

Once upon a time, joint venture cars were many people's dream cars. Nowadays, with the surge of electrification, even luxury joint ventures like BBA have become 'off-brand,' indicating that traditional overseas automotive brands are facing considerable difficulties. As we all know, the core of new energy vehicles lies in batteries, motors, and electronic controls. These new three components bypass the technical barriers of the old three components of fuel vehicles. The first-mover advantage accumulated by traditional overseas automotive brands is no longer effective, and domestic independent brands have taken advantage of electrification to overtake directly.

Traditional overseas giants have obviously been taken aback by the speed of electrification transformation among domestic independent brands. By the time they realized their market share was being devoured by new forces, it was already too late for them to adjust. One step behind leads to steps behind, and overseas automakers have found themselves unable to compete with domestic independent brands in new energy within a short period. Therefore, 'reverse joint ventures' have become the only option for many overseas traditional automakers. In fact, many automakers have already started cooperating with Chinese brands. Chang'an Mazda uses the Deep Blue platform to manufacture the Mazda EZ-6, while Smart has created multiple classic models based on Geely's SEA architecture. The Volkswagen Group has also collaborated with XPeng and Leap Motor in various ways. Additionally, Nissan, Hyundai, and Audi are all rushing to launch new energy vehicle models on a large scale, seeking development from Chinese brands.

It is rumored that Nissan will use Dongfeng's platform to make cars: At the Guangzhou Auto Show, the new car exhibited at the Dongfeng Nissan booth caused quite a controversy. One netizen pointed out sharply, 'The wheelbase of the N7 is the same as that of the Dongfeng eπ 007. I dare to guess blindly that the two cars may come from the same platform.' Upon hearing this, Zhang Jinhua, the Minister of the User Operations Center at Dongfeng Nissan Automobile Sales Co., Ltd., immediately retweeted and commented, 'It's just a coincidence; the two cars are not from the same platform at all.' Subsequently, a blogger posted that 'there are rumors that variants of the Yipai 008 and even RDI will follow, so it doesn't matter whether they are from the same platform or not. At least Nissan is starting to pay attention to the new energy trend in the Chinese market. Change is always better than stagnation, and as long as they stop relying on old methods to make cars, it's progress.' By the 2026 fiscal year, Nissan plans to launch eight new energy vehicle models specifically for the Chinese market, including five Nissan-brand models, with the N7 being just an appetizer.

There are rumors that Hyundai will build cars based on the BE21 platform:

In an interview at the Beijing Auto Show in April this year, Wu Zhoutao, Executive Deputy General Manager of Beijing Hyundai, revealed that Hyundai would develop pure electric or hybrid models on the shared product platform of Beijing Automotive Group. Rumors suggest that the car is expected to share the BE21 platform with Beijing Automotive Group, which has already launched two models, the ARCFOX Alpha T and Alpha S. According to Beijing Hyundai's 'New Plan for 2025,' to achieve the transformation towards electrification and intelligence, Beijing Hyundai will first fully hybridize its existing fuel vehicles. Based on the second-generation TMED hybrid technology, Beijing Hyundai will build a hybrid product matrix of 'one MPV + two sedans + three SUVs,' aiming to achieve annual sales of 300,000 units. In addition, the Hyundai Motor Group plans to launch an extended-range electric vehicle model with a single-charge range of over 900 kilometers in China by the end of 2026.

Audi uses the SAIC E1 platform to make cars: In July 2023, Audi signed a strategic memorandum with the SAIC Group, and the two parties made it clear that they would develop a new localized platform to launch new electric vehicle models. The cooperation is divided into two phases. The first phase involves modifying the platform, and the two parties have already made relevant modifications to the SAIC E1 platform to ensure that the products can not only integrate Audi's DNA but also blend with SAIC's advanced intelligent electrification. The E1 platform is expected to launch a total of three models, and the concept car AUDI E, which debuted at the Guangzhou Auto Show, will go into mass production in mid-2025. It is worth mentioning that the entire IM series currently comes from the SAIC E1 platform. Secondly, Audi and SAIC are jointly developing a new platform, the ADP platform, and plan to start launching new models in 2027. In other words, at least the three AUDI models launched before 2027 will have a touch of 'IM' flavor.

Conclusion: The joint venture relationship has undergone a rapid role reversal since the rise of independent brands. Current overseas giants are cooperating with domestic independent brands in various ways. If nothing unexpected happens, the 'reverse joint venture' model will provide a reference for more overseas giants. In the Chinese market, the presence of overseas giants has been continuously weakened, and independent brands have become the undisputed mainstream. Whether reverse joint venture brands can gain recognition remains to be tested by market performance.

(Images are sourced from the internet; please delete if there is any infringement)