What makes Thalys, a young company, so charming to be included in the four major stock indices?

![]() 12/02 2024

12/02 2024

![]() 534

534

Produced by | Bullet Finance

Designed by | Xing Jing

Reviewed by | Song Wen

In the field of financial investment, Warren Buffett's investment philosophy is widely admired, and his works are considered a bible by many investors. The core of Buffett and Munger's investment philosophy is to find companies that perform exceptionally well in the capital market. They advocate buying high-quality companies at reasonable prices rather than ordinary companies just because they are cheap.

Investors screen companies with sustained competitive advantages and good growth potential by deeply analyzing their financial status, market positioning, management teams, and industry prospects.

Various indices provided by the capital market can usually reflect a company's industry influence, profitability, and growth potential. Behind these indices lie complex calculations and the consensus of institutional investors. Therefore, indices serve as a reference for investors to choose good companies.

Take the latest news as an example. On November 29, the Shanghai Stock Exchange and the China Securities Index Co., Ltd. announced the periodic adjustment results for indices such as the CSI 300 and SSE 50. Thalys, as a representative of new energy vehicles, was included in the four major indices and became the only Chongqing company in the SSE 50 Index. This change marks the recognition of Thalys' important position in the capital market.

Thalys' inclusion was not accidental. It reflects the market's optimism about the new energy vehicle industry and its recognition of Thalys in terms of technological innovation, market performance, and brand influence. This is in line with the efficient market hypothesis in economics, which states that market prices reflect all available information, and Thalys' rise is the market's affirmation of its value.

For investors, following the indices can reduce the difficulty of choosing companies. By studying the performance of index constituent stocks, investors can indirectly understand whether their investment strategies are effective and adjust their investment directions accordingly.

Thalys' case shows that the capital market can identify and reward companies that truly have value, and what investors need to do is find these companies and grow with them.

1. Criteria for Good Companies in the Capital Market

In 2022, Michael Hartnett, known as the most accurate analyst on Wall Street, published an article stating that his criteria for selecting high-quality enterprises are whether they invest heavily in research and development in the long term and have a stable and reliable profit model.

This criterion not only emphasizes the importance of technological research and development but also highlights the sustainability of profitability.

Now, his view is based on deep insights into market trends and a profound understanding of economic principles.

The "innovation theory" in economics tells us that technological innovation is the core driving force for economic growth and enterprise development. Companies that can continuously invest in technological research and development and continuously launch innovative products often gain a competitive edge in the market and achieve higher profits.

This is particularly evident in the performance of the capital market. Data shows that companies that invest heavily in technological research and development in the long term typically outperform their peers by 20% to 30% in stock prices, with more stable profitability. Therefore, in the long run of the capital market, only companies that can achieve sustained profitability can survive the cycle.

Referring to the evaluation criteria of the capital market, Thalys' inclusion in the four major indices can be understood. After all, the company's development trajectory in recent years is a vivid illustration of this criterion. Its third-quarter financial report data and sales performance are remarkable. According to the latest financial report data, from January to November this year, Thalys sold a total of 389,566 new energy vehicles, a year-on-year increase of 255.26%. In the first three quarters, it achieved revenue of 106.627 billion yuan, a year-on-year increase of 539.24%; and a net profit attributable to shareholders of listed companies of 4.038 billion yuan.

The AITO series jointly developed by Thalys and Huawei is deeply loved by users and recognized by the market.

In the 11 months since the launch of the AITO M9, cumulative orders have exceeded 180,000 vehicles, making it the sales champion of models priced above 500,000 yuan in the Chinese luxury market for eight consecutive months, continuously leading the new pattern of technological luxury. The AITO new M7 series delivered over 180,000 new vehicles in 2024, setting a new record for China's new energy luxury brands.

What's more worth mentioning is that Thalys continues to invest heavily in research and development, with annual R&D investment accounting for over 10% of operating revenue. In 2023, R&D investment was 4.438 billion yuan, accounting for 12.38% of operating revenue, a year-on-year increase of 42.90%. This not only demonstrates Thalys' firm commitment to technological innovation but also shows its far-reaching layout for future development.

By continuously increasing R&D investment, Thalys continuously launches competitive new products, meeting the diverse needs of the market and further consolidating its leading position in the industry. Moreover, Thalys' R&D investment is not achieved overnight but is continuous. This long-term investment strategy ensures continuous innovation of its products and provides solid support for the steady growth of profitability.

The trend of the capital market is clear: long-term investment in technological research and development to achieve stable profitability is the core criterion for measuring whether a company is good. For investors, choosing such companies for investment will undoubtedly be a wiser choice. The rise of companies like Thalys is a vivid portrayal of the capital market's survival of the fittest and the selection of the best under this criterion.

2. Why Thalys?

Thalys' inclusion in the four major indices of the Shanghai Stock Exchange demonstrates the recognition of Thalys' performance and health by the Chinese stock market. Among them, R&D investment and long-term profitability are key factors.

First, the third-quarter report shows that Thalys has begun to achieve stable profitability.

The data shows that Thalys achieved operating revenue of 106.627 billion yuan in the first three quarters of 2024, a significant year-on-year increase of 539.24%. The net profit attributable to shareholders of listed companies was 4.038 billion yuan, turning losses into profits year on year. In particular, Thalys' operating revenue in the third quarter was 41.582 billion yuan, a year-on-year increase of up to 636.25%; and the net profit attributable to shareholders of listed companies was 2.413 billion yuan, a significant year-on-year increase. This data indicates that Thalys has achieved remarkable results in cost control and market expansion, realizing a transformation from loss to profit.

Sales have also developed beyond imagination. In the first eleven months of this year, sales growth exceeded 255%, with over 380,000 new energy vehicles sold. Such growth has surpassed the expectations of all market observers.

Secondly, behind this rocket-like growth rate is actually the continuous improvement of Thalys' R&D capabilities and product strength. Under the cross-border cooperation model with Huawei, Thalys has gradually formed a development path suitable for itself. Like Huawei, Thalys is well aware of the importance of R&D and invests substantial resources in technological research and development to build its own development advantages in the new energy vehicle field. This emphasis on R&D is not only reflected in capital investment but also in the introduction and cultivation of technical talents.

In Thalys' technological accumulation, the extended-range system is undoubtedly a highlight. Data shows that Thalys' extended-range system ranks first in domestic shipments, occupying more than 40% of the domestic market share, and has established a solid technological foundation.

Thalys' newly released super extended-range system achieves three industry-leading advantages: silent and imperceptible operation, high integration, and high efficiency.

Thalys possesses domestically leading production technologies in the field of extended-range technology, such as the country's first cross-platform flexible flat wire stator production line and the country's first automatic module packaging line. The application of these advanced technologies makes Thalys' extended-range system efficient, reliable, and stable, meeting the market demand for high-performance extended-range systems.

Finally, through the transfer of trademarks and the acquisition of an automated factory from Huawei, Thalys has consolidated its development foundation.

The latest news shows that Thalys plans to purchase 100% of the equity of Longsheng New Energy through the issuance of shares, with a transaction price of 8.164 billion yuan. This means that Thalys will obtain the ownership of Longsheng New Energy's smart electric vehicle factory. According to Thalys' disclosure, after the acquisition, the company will obtain the ownership of the super factory, ensuring the safety, stability, and autonomy of the company's production end, and improving the integrity and control of the company's important business assets.

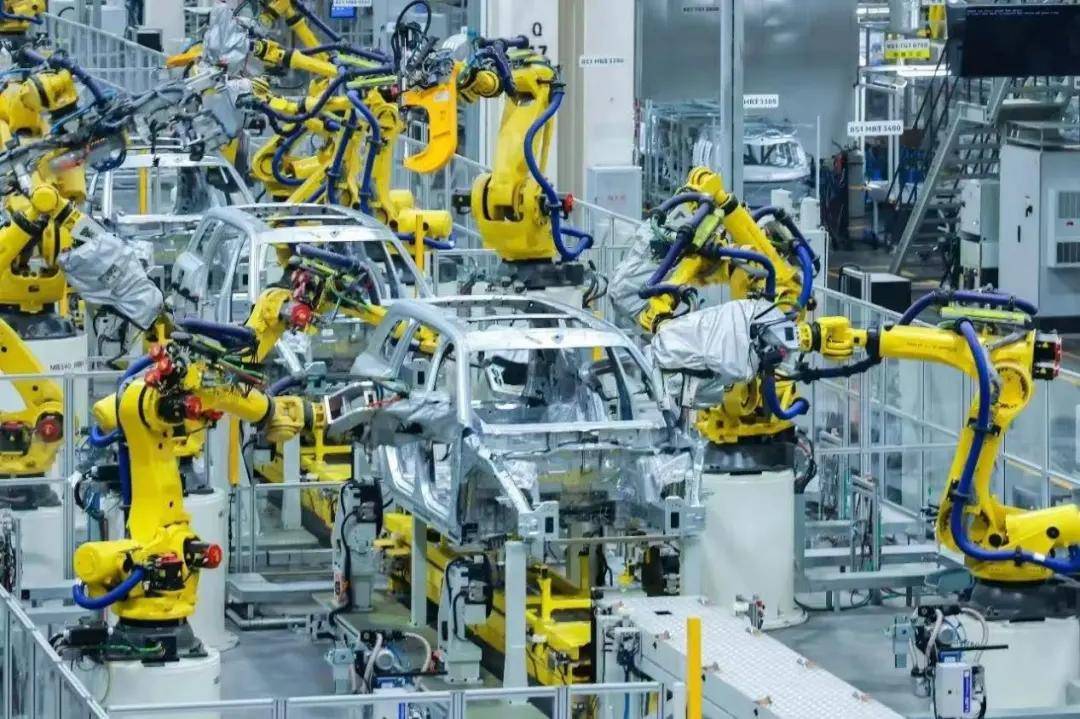

This factory adopts a "four-in-one" intelligent manufacturing architecture, possesses advanced intelligent terminals, achieves highly automated production, and has built an advanced Internet of Things platform in the industry. It can achieve intelligent coordination of over 3,000 robots, 100% automation of key processes, and 100% quality monitoring and traceability through automated quality testing technology.

Two months ago, Huawei, an important partner of Thalys, transferred the AITO series trademark to Thalys for 2.5 billion yuan, not only providing Thalys with an important guarantee for market development but also deepening its cooperation with Huawei. Almost at the same time, Thalys announced its investment and joined Huawei's shareholders, becoming a founding shareholder of this top Chinese automotive technology enterprise.

Based on this, Thalys' inclusion as a constituent stock in the four major indices is a testament to its long-term heavy investment in research and development in smart and new energy vehicles, as well as its business performance.

Financial analyst Xu Yi believes that Thalys' inclusion in the indices will undoubtedly enhance investors' confidence and attract more attention in the capital market, which is not only conducive to enhancing Thalys' influence but will also bring Thalys the privilege of "not being short of money," which is a huge benefit for Thalys, which insists on investing heavily in research and development in the long term.

3. What does being included in the four major indices mean?

What does Thalys' inclusion in the CSI 300, SSE 50, CSI A500, and SSE 180 indices mean?

It is important to know that the four major indices play a pivotal role in the A-share market. The CSI 300 Index is known as the "barometer" of the A-share market, covering about 60% of the market value of the Shanghai and Shenzhen markets and serving as an important reference for investors to measure market performance.

The SSE 50 Index represents the 50 most representative stocks with large scale and good liquidity in the Shanghai securities market. The CSI A500 Index focuses on small- and medium-cap stocks, reflecting the overall performance of small- and medium-cap companies. The SSE 180 Index is a collection of 180 stocks with large scale, good liquidity, and strong industry representativeness in the Shanghai securities market. Thalys' inclusion in all four major indices is undoubtedly a high recognition of its performance in the capital market.

(Image / Shutterstock, based on the VRF agreement)

This recognition is first reflected in the boost to capital confidence. Recently, the A-share market has experienced violent fluctuations, and investor sentiment has been volatile. Thalys' inclusion in the four major indices is like a strong shot in the arm, injecting a stabilizing force into the market.

Passive investment products such as index funds and ETFs need to be allocated according to index constituent stocks. Thalys' inclusion will attract a large amount of passive capital inflows, thereby boosting its stock price and market value. This not only brings tangible cash flow support to Thalys but also sends a clear signal to the market: the A-share market is actively embracing technological innovation and supporting the development of the new energy vehicle industry, a sunrise industry.

From an economic perspective, Thalys' inclusion in the four major indices is actually a manifestation of the "signaling effect."

The signaling effect theory states that certain information or events in the market can serve as signals, influencing investors' expectations and decisions. Thalys' inclusion in the four major indices is a strong positive signal, indicating that its leading position in the new energy vehicle field and strong growth potential have been widely recognized by the market. This recognition will attract more investors' attention and investment, further enhancing Thalys' market influence.

At the same time, Thalys' inclusion will also provide strong support for its robust business development. As one of the leading enterprises in the new energy vehicle industry, Thalys has always been committed to technological innovation and product research and development. However, technological innovation often requires substantial capital investment and time accumulation. After being included in the four major indices, Thalys will more easily attract the attention of investment institutions and the allocation of stock funds, thereby providing sufficient financial support for its long-term investment in technological innovation.

In addition, Thalys' inclusion in the four major indices will also help increase its stock price and market value. In the capital market, stock price and market value are important indicators for measuring a company's value. After being included in the four major indices, Thalys will attract more investors' attention and investment, thereby boosting its stock price and market value. This will not only bring Thalys more financing opportunities and lower financing costs but also enhance its brand influence and market competitiveness.

At the same time, this will help Thalys maintain its leading position in the new energy vehicle field, continuously improve product quality and technology content, and become a good automotive industry company that generates long-term profits and influences the world.

Zhang Xinghai, Chairman (Founder) of Thalys, once said publicly, "Entrepreneurship is about perseverance, perseverance, and more perseverance; innovation, innovation, and more innovation." This is not only Zhang Xinghai's belief but also the principle of Thalys' strategic formulation.

He also said in public statements that behind Thalys' cooperation with Huawei, "every seed can grow into a towering tree." This is not because Thalys is smarter than others but "because we are more focused, and we prefer to constantly think about what opportunities belong to us and what don't."

This is Thalys' understanding of development. Fortunately, with its inclusion in the four major indices, Thalys' development is continuously proving the correctness of this understanding.