The battery replacement cost for a 250,000 yuan electric car is 120,000 yuan! Where do the first batch of electric car owners go from here?

![]() 12/03 2024

12/03 2024

![]() 531

531

Recently, news about the first batch of new energy vehicle owners replacing their batteries has trended on social media.

A Tesla Model S owner said their car has been owned for 8.5 years. At the end of September this year, due to a malfunction, they were informed that the battery needed to be removed for inspection. The inspection fee alone was seven to eight thousand yuan. Due to battery aging, the repair cost would be 160,000 yuan, while replacement would cost 220,000 yuan. The owner lamented that the current residual value of the Model S cannot even fetch 160,000 yuan.

Similarly, an expense statement shared by an owner of a Yiwu-based Mercedes-Benz EQC showed a total battery replacement quote of over 226,000 yuan.

"I spent 250,000 yuan on buying the car, and the battery replacement costs 120,000 yuan, which is almost half the price of the car," complained an owner at an officially authorized service outlet for new energy vehicles in Shanghai, who needed to replace the traction battery due to an accident.

An owner of a domestic new energy vehicle had just passed the eight-year mark and spent 79,000 yuan on battery replacement. Should they sell the used car due to the high cost? A car originally priced at 160,000 yuan could not even be sold. With insufficient funds for a new car, they had no choice but to grit their teeth and replace the battery.

With the rapid development of the new energy vehicle industry, early adopters of new energy vehicles now face many challenges. On the one hand, the service life of traction batteries is approaching or has exceeded eight years, highlighting the issue of battery replacement. On the other hand, the national standard "Inspection Regulations for the Operational Safety Performance of New Energy Vehicles," which will be implemented on March 1, 2025, poses new challenges, putting new energy vehicle owners in a dilemma.

01 Battery Replacement Dilemma for New Energy Vehicle Owners

As the number of new energy vehicles continues to rise, related issues are gradually emerging. High maintenance costs, especially the exorbitant cost of battery replacement, have become a pain point for many new energy vehicle owners.

Currently, some new energy vehicles have reached the 8-year or 150,000-kilometer mark, while others face a situation where the capacity retention rate of the traction battery is below 40%, indicating a battery capacity decay of over 60%. This forces them to consider battery replacement. However, the cost of replacement is astonishingly high, as evidenced by cases like "250,000 yuan for the car, 120,000 yuan for battery replacement" and "160,000 yuan for the car, 70,000 yuan for battery replacement," which are common occurrences that deter many owners.

Different owners face varying dilemmas.

Most new energy vehicle manufacturers offer an 8-year or 150,000-kilometer warranty for their batteries, electric motors, and electronic control units (referred to as the "three electrics"). By 2025, nearly a million vehicles will be out of warranty. Private car owners facing battery issues after the warranty period must bear the high costs themselves, and the after-sales market is inadequate, making it difficult to obtain satisfactory solutions.

Even worse off than ordinary private car owners are those who bought cars from bankrupt manufacturers. Since 2018, over 400 new energy vehicle manufacturers have declared bankruptcy, affecting over 160,000 existing car owners (according to the China Automobile Dealers Association). After a manufacturer goes bankrupt, original equipment parts become hard to find, and third-party companies cannot repair the "three electrics" without authorization, making it difficult for owners to repair their cars, which may even be scrapped due to irreparable damage.

Furthermore, some manufacturers exclude commercial vehicles from the "three electrics" warranty. For example, BYD's warranty for online car-hailing vehicles is 6 years or 600,000 kilometers, a significant reduction from the lifetime warranty for private car owners. Commercial vehicles have high usage frequencies and rapid battery wear, leading to high battery replacement costs that compress owners' profit margins.

Faced with the high cost of battery replacement, some owners may choose to continue using vehicles with significantly reduced performance, enduring issues like shortened driving range and insufficient power. This not only impairs the driving experience but also poses potential safety hazards. Others may consider selling their cars, but the reduced battery performance significantly devalues the car, making it difficult to sell at a desirable price.

02 Why Is It So Expensive?

There are three main reasons for the high cost of battery replacement.

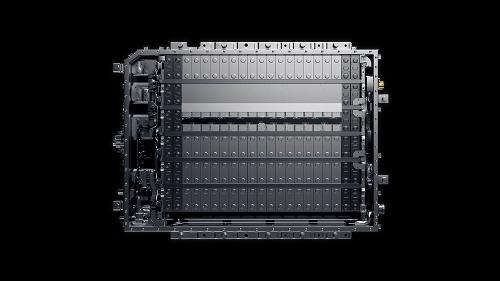

First, the battery accounts for a significant portion of the cost: While the engine and transmission of traditional fuel vehicles account for about 25% of the total cost of vehicle components, the traction battery of new energy vehicles accounts for about 50%. According to data from the China Insurance Research Institute, among the 59 pure electric new energy vehicle models sampled, the average single-part-to-whole ratio of traction battery packs is 50.96%, and the average unit energy price of battery packs is 1604.92 yuan per kilowatt-hour. The high cost of batteries inherently determines the high price of battery replacement.

Second, the complex structure of batteries necessitates entire replacement: To improve driving range, new energy vehicles have continuously innovated battery pack installation structures, from integrated cell and battery pack designs to integrated battery and vehicle body designs. When a fault occurs, it is difficult to remove the cells individually, necessitating the replacement of the entire battery pack, which increases the cost and difficulty of battery replacement.

Third, market monopoly and lack of competition: New energy vehicle manufacturers monopolize the after-sales market and pricing power, requiring "three electrics" system maintenance to be conducted at designated locations. Despite the decline in the price of lithium carbonate, battery replacement costs remain high, and the market lacks incentives for price reductions.

Apart from the cost issue, the difficulty of car repairs is also a significant pain point for new energy vehicle owners.

On the one hand, there is a shortage of maintenance personnel for new energy vehicles. Professional new energy vehicle mechanics must at least hold two certificates: an automobile mechanic certificate and an electrician certificate. However, such talent is scarce in the market. On the other hand, most maintenance and service centers of new energy vehicle manufacturers adopt a direct sales model, with a significantly lower network density compared to traditional car dealerships, resulting in longer waiting times for car repairs and maintenance. Additionally, as the core technologies of batteries, motors, and electronic control systems (the "three electrics") of various new energy vehicle brands are not open to the public, general traditional auto repair shops struggle to obtain maintenance authorization from manufacturers and cannot repair vehicles with "three electrics" system faults.

Unlike traditional fuel vehicle owners who can choose third-party repairs, the development of third-party repairs for new energy vehicles faces numerous challenges.

First, to participate in this market, high costs are incurred.

Unlike fuel vehicle repair facilities, third-party companies that want to undertake "three electrics" system repairs must equip themselves with safe, compliant, and temperature- and humidity-controlled spaces for battery storage and vehicle placement, additional testing tools such as diagnostic computers, decoders, and battery chargers, and fire-fighting equipment and fire detection sensors. The initial investment is much higher than that for fuel vehicle after-sales maintenance.

Second, unlike many fuel vehicle parts that are compatible with multiple models, the technical standards for traction batteries are not unified. As a highly customized product, the research and development directions and standards of battery suppliers vary, leading to inconsistencies in battery density, structure, and dimensions. This results in different batteries being used by different manufacturers and even different models within the same manufacturer. For older new energy vehicles, battery accessories may no longer be in production, forcing third-party companies to set up separate after-sales production lines, which are costly and time-consuming.

Lastly, apart from facilities, the talent shortage is also a significant factor contributing to the high cost of battery replacement and maintenance for new energy vehicles.

According to data from the China Automobile Maintenance and Repair Industry Association, there are fewer than 100,000 people engaged in new energy vehicle maintenance in China, of which only 24.7% are skilled workers capable of battery inspection and maintenance, and less than 5% understand assisted or autonomous driving but cannot perform maintenance work. The proportion of personnel qualified for new energy vehicle maintenance is low, making it difficult to meet the demand for maintenance skills.

Most qualified personnel are signed up by vehicle manufacturers even before graduation, preventing them from working in auto repair shops and exacerbating the plight of third-party maintenance.

Moreover, as the "three electrics" system involves core intellectual property, vehicle manufacturers are reluctant to delegate authority to third parties, creating an insurmountable entry barrier for them.

03 Who Should Bear the Responsibility for Battery Issues Under the New Standard?

The national standard "Inspection Regulations for the Operational Safety Performance of New Energy Vehicles," which will be implemented on March 1, 2025, is significant for enhancing vehicle safety and promoting industry standardization. However, it also poses new problems for vehicle owners. As vehicles age, battery performance declines, potentially leading to substandard inspection results. This not only makes it easy for disputes to arise over vehicle responsibility but also increases the economic burden on owners who need to spend more on repairs or battery replacements to meet standard requirements.

The new regulations set higher requirements for the "three electrics" systems of new energy vehicles. Specifically, when the capacity retention rate of the traction battery is below 40%, indicating a battery capacity decay of over 60%, the vehicle will be deemed unqualified.

If a vehicle fails the annual inspection, especially due to issues with the "three electrics" system, the repair or replacement costs will be high. Battery cells are often only replaced and not repaired, and ordinary repair shops cannot handle such work. If a third-party repair shop handles the repair, the vehicle will lose its warranty.

Although the new regulations clarify inspection items and technical means, the inspection results are mostly suggestive, and the definition of responsibilities between owners and manufacturers is unclear, which can easily lead to disputes.

Apart from the clear stipulation that manufacturers must replace batteries free of charge if the battery performance decay does not exceed 20% during the warranty period, the responsibility for vehicles that fail the annual inspection is vague.

Additionally, some vehicle models have poor adaptability. The traction battery charging inspection in the new regulations is not applicable to vehicles without DC charging ports, such as the Wuling Hongguang MINI EV. The method for inspecting the battery health of these models during the annual inspection is unclear.

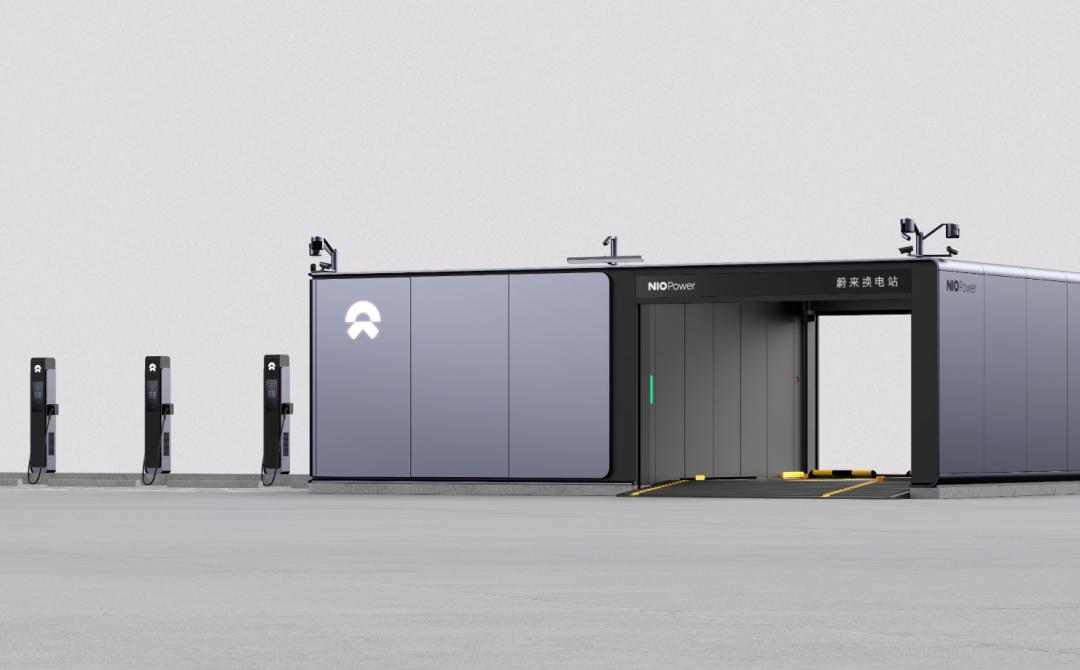

04 Could NIO's Battery Swap Model Be the Biggest Winner?

Since September 24, 2024, NIO's battery swap service has adopted a pay-per-kWh model. The formula for calculating the cost of a single battery swap is: Single battery swap cost = (electricity cost + service fee) × swapped kWh. When the swapped kWh is less than 20 kWh, a service fee is charged for 20 kWh, while the electricity cost is calculated based on the actual kWh swapped.

Taking the battery swap station in Beijing as an example, the overall unit price, including the service fee, ranges from approximately 1.27 to 1.94 yuan. The average comprehensive unit price for battery swaps is 1.59 yuan. Assuming the car has a remaining battery level of 25% before the swap and replaces it with a fully charged 100 kWh battery (95% charged), the swapped kWh is 100 × (95% - 25%) = 70 kWh. Based on a comprehensive battery swap cost of 1.59 yuan, the cost for one swap is 111.3 yuan. Assuming a swap is performed once a week, the annual cost under normal usage would be 5342.4 yuan, and the cost for battery swaps over eight years would be over 40,000 yuan, which is significantly lower than the replacement costs of 80,000 yuan or more for other new energy vehicles when their batteries reach the end of their lifespan.

Moreover, the battery swap model significantly reduces the impact of battery decay on annual inspection pass rates. Once battery decay exceeds the limit, NIO is obligated to replace it with a compliant battery, and owners do not need to bear the risk.

Does this mean that only NIO should be considered? Not necessarily. Contemporary Amperex Technology Co. Limited (CATL), Geely Automobile, Autoliv New Energy, GCL-Poly Energy Holdings Limited, State Grid Corporation of China, China Southern Power Grid, and others are actively investing in the battery swap sector. In the future, major new energy vehicle manufacturers will adopt battery swap models. Additionally, NIO, XPeng, Geely, and BAIC BJEV have each launched vehicle-to-battery separation rental models, although prices and reviews vary, providing consumers with more options for new energy vehicles.

Apart from the battery swap and rental models, it is recommended that owners be cautious when purchasing vehicles, pay attention to the after-sales service policies of manufacturers, and choose brands with good reputations and comprehensive after-sales service systems. For those who have already purchased vehicles, it is advisable to strengthen routine maintenance, use batteries reasonably, and extend their service life.

Furthermore, vehicle manufacturers and relevant departments should prioritize issues in the after-sales market, promote the establishment of a reasonable pricing system and maintenance standards within the industry, encourage manufacturers to open up maintenance technology and parts supply channels to break monopolies, strengthen cooperation between universities and enterprises, improve professional curriculum settings and textbook compilation based on the development needs of the new energy vehicle industry, and cultivate more professional maintenance personnel to provide human resources support for the after-sales market.

In summary, as the battery challenge approaches, the issues faced by new energy vehicle owners urgently need to be resolved. It requires the joint efforts of the government, enterprises, industry associations, and owners to promote the healthy and sustainable development of the new energy vehicle industry and prevent owners from becoming the "cost of development."