Carlos Tavares Steps Down Early, “Cost Killer” Drama Ends Abruptly

![]() 12/03 2024

12/03 2024

![]() 501

501

Introduction

Carlos Tavares, who earned the highest annual salary among global automaker executives and had not yet given up on saving the group's operations, was still abandoned by Stellantis.

“The resignation takes effect immediately.”

On December 1 local time, the Stellantis Group Board of Directors issued an official statement accepting Carlos Tavares' (Carlos Tavares) resignation as CEO of the group.

Surprisingly, this official announcement of his departure took effect immediately, leaving no room for mitigation. The group will soon establish a new interim executive committee chaired by Chairman John Elkann. The process of appointing a new CEO is progressing smoothly, and Carlos Tavares' replacement is expected to be finalized in the first half of next year.

In the second half of this year, rumors about Carlos Tavares' "early dismissal" were rampant, and Stellantis Group later officially announced his retirement in early 2026, with the company already looking for a new leader. However, the abrupt departure of the "cost killer" was still too sudden in the group's latest announcement.

Senior Independent Director Henri de Castries said in a statement that disagreements had emerged in recent weeks between the group's major shareholders, the board of directors, and Carlos Tavares, with diverging views growing wider. This was the spark that led to Carlos Tavares' early resignation. Beyond this, the group's spokesperson did not provide additional information on his resignation.

There is a lot of pressure, and everyone knows it tacitly. After announcing a record net profit for fiscal year 2023, Carlos Tavares, as the group's helmsman, experienced a high point before quickly falling from grace. Looking back, Carlos Tavares faced numerous setbacks throughout 2024.

These challenges mainly included: a near-halving of group profits in the first half; lagging electric vehicle and intelligent innovation R&D and new business initiatives; excessively high costs and a lack of popular models; tense dealer relationships in the U.S. market; and inventory pressure and declining sales in core markets.

Louis XIV once said, "I am the state";

For the former automotive world, Carlos Ghosn was Nissan.

Judging from the current situation, Carlos Tavares' confrontation with the group's board of directors and early departure follows a similar path as Carlos Ghosn's at Stellantis. As the main initiator and supporter of the Stellantis Group's cooperation with Zero Run, what impact will Carlos Tavares' departure have on subsequent cooperation?

Farewell, Cost Killer

Carlos Tavares has been the most controversial foreign CEO besides Elon Musk in the past five years. At the Stellantis Group Investor Conference earlier this year, the voting moguls approved Carlos Tavares' €36.5 million compensation package with an approval rate of up to 70%, setting a record for the highest salary among automotive industry executives.

This figure far exceeds that of Mary Barra at $29 million, Jim Farley at Ford at $21 million, and European leaders such as Ola Källenius at Mercedes-Benz and Herbert Diess at Volkswagen Group, who cannot compete with Carlos Tavares.

Carlos Tavares deserves such compensation.

As the leader of a super automotive group with 14 brands, he achieved record core performance for the group in 2023 through cost reduction and efficiency enhancement, with net revenue of €189.5 billion, a year-on-year increase of 6%; and net profit of €18.6 billion, a year-on-year increase of 11%.

It is worth mentioning that such impressive figures did not come from sales growth. On the contrary, the group's global sales in 2023 decreased rather than increased (6.14 million vehicles in 2021, 6.34 million in 2022, and nearly 6.17 million in 2023). Carlos Tavares' cost control prowess is evident.

In the automotive industry, both Carlos Tavares and Carlos Ghosn have been labeled as "cost killers," adhering to the management philosophy of "profit above all else" and excelling at meticulous planning and prioritizing cash flow. Carlos Tavares once bluntly stated in front of the media,

“I learned how to do business from Carlos Ghosn.”

Carlos Tavares learned the business logic of "cash is king" from Carlos Ghosn, first turning PSA around quickly and then bringing Stellantis Group's performance to its peak. However, after taking drastic cost-cutting measures, new imbalances emerged within the group. Entering 2024, performance took a sharp downturn, and the other side of the "cost killer" began to emerge.

A Stellantis China executive told Auto Society that Carlos Tavares also experienced high pressure and dominance during Carlos Ghosn's era, but when he took the helm of Peugeot and the group, Carlos Tavares played the role of a "tough guy" even more thoroughly.

However, like Carlos Ghosn, Carlos Tavares felt that his once-successful strategies were gradually becoming insufficient in the final stage of his career. Just half a year after his high-salary highlight moment, he found himself facing news of his contract expiration and the initiation of a new CEO election process upon entering the spotlight again.

Now, leaving early, Carlos Tavares leaves behind a whirlpool of contradictions between core markets and the group's board of directors, as well as a mixed career. His experience, like Carlos Ghosn's, evokes the line from a poem – "Since ancient times, beautiful women and great generals have not been allowed to grow old gracefully."

Carlos Tavares is 66 years old this year.

This is the age when most European automaker leaders choose to retire. Even globally, one of the previous limits was Alan Mulally, the automotive legend born in 1945, who led Ford from 2006 to 2014, aged 61 to 69, which can only be considered average in terms of seniority.

As the pace of evolution in the automotive industry accelerates and new directions such as electrification and intelligent connectivity muddy the waters, the energy and receptiveness to new things of helmsmen will face more stringent requirements.

The Board Tears Off the “Band-Aid”

It is reported that after issuing the worst half-year report in history, Carlos Tavares once gave up his vacation and flew to the United States to try to salvage the operating difficulties in that market, openly acknowledging his mistakes. Various indications show that the 66-year-old CEO was still striving to extend his career.

Now, leaving in a hurry, he leaves behind a sigh.

Carlos Tavares, who earned the highest annual salary among global automaker executives and had not yet given up on saving the group's operations, was still abandoned by Stellantis.

“In fact, abandoning Carlos Tavares at this critical juncture is equivalent to the group tearing off its own band-aid. This has indeed been a disastrous year for Stellantis.” An industry insider close to the group told foreign media that Carlos Tavares' early departure was a crucial step for the Stellantis management to take faster action and try to turn the situation around.

A while ago, the French newspaper Les Echos sharply criticized Carlos Tavares, pointing out four major mistakes during his tenure at Stellantis, using harsh words without any mercy. As an influential mainstream media outlet in France, this was the first time Les Echos had criticized Carlos Tavares in his career.

Mistake 1: Failure in the U.S. Market

In the first half of 2024, Stellantis' adjusted operating profit was €8.5 billion, a year-on-year decline of €5.7 billion, with the decline in North American operations being the main drag. In terms of new vehicle shipments, the North American market sold a cumulative of 838,000 vehicles in the first half, a decrease of 18.5% year-on-year.

The United States has always been a profit cow for the group, with an operating profit margin of 15.4% in its most glorious year, 2023. Carlos Tavares must not have expected that the Waterloo in the North American market would be the last straw that broke the camel's back of his career.

Les Echos analyzed that starting at the end of 2023, Stellantis began to accumulate inventory in the United States. In the first half of this year, the group has been working to digest this inventory, resulting in a profit margin reduction to 11.4%, with a high likelihood of falling below 10% in the second half. It is worth mentioning that this achievement is the first since the merger of Fiat Chrysler and PSA.

Mistake 2: Extreme "Savings"

Les Echos revealed that behind Stellantis' previously high profit growth lay tremendous pressure on employees and extreme cost control. "In the automotive industry, all extreme cost reductions may lead to another extreme, turning into greed and sin, or exploitation of a certain group."

Mistake 3: Iron-Fisted Rule

Regarding the impact of Carlos Tavares on the group's senior management, this French media outlet used a metaphor – the turnover of Stellantis Group's senior management was as dizzying as a waltz. Carlos Tavares put too much pressure on senior executives, and once targets could not be achieved, these managers faced only relocation or resignation.

It is reported that the group currently has a total of 32 senior management team members, but there have been a total of six position changes and three senior executive departures announced officially since the beginning of the year. In the past 2023, the turnover of the management team was even more frequent, with no fewer than 15 changes and at least four official announcements of senior executive departures.

Mistake 4: Failure in the Chinese Market

In 2012, Peugeot Citroen's net loss exceeded €5 billion, and in 2013, it was €2.3 billion. The French government allocated €7 billion to "put out the fire," but to no avail.

It was not until Dongfeng Group and Peugeot Citroen embarked on a new round of capital reorganization that PSA received €800 million from China's Dongfeng Group with a 14.1% equity stake, allowing it to catch its breath and slowly return to normal operations after huge losses.

In 2014, Carlos Tavares officially took over PSA, and the Chinese market was the brand's best-performing region, bar none. This year was PSA's peak in China, and its subsequent performance has been bumpy, never returning to the highs of 2014.

In the first half of this year, Stellantis' main performance support has shifted to North America, Europe, and South America, with the group selling only 47,000 vehicles in China. According to the group's disclosed financial report data, revenue from China, India, and the Asia-Pacific market totaled €2.152 billion, accounting for only 2.5% of its total revenue.

The Untamable "American Beast"

Carla Bailo, President of SAE International, told Detroit media that no matter what plan Carlos Tavares proposed, it would not be enough to quickly resolve the realities of dealers, unions, suppliers, and outdated product matrices.

“He achieved reform results in the European market, cut costs, and prioritized profitability, which proved his talent over the past few years. However, it is worth noting that the United States is another beast entirely.” Carla Bailo said that one cannot use a short-term perspective and operational model to try to control certain aspects of dealers and partners, which is not a reasonable way for a global automaker to conduct business.

“He likes to control everything.”

“Moreover, he does not have a strong support behind him.”

In fact, after repeated setbacks in 2024, the North American market has been resentful of Carlos Tavares' decisions. In the months and even years to come after Carlos Tavares' departure, the group will still struggle in North America. The board needs to find an expert in turning losses into profits to resolve tense relationships with dealers and suppliers, as well as issues with its product matrix and sales volume.

First, dealers are unhappy.

What was once a hot commodity now has a rapidly shrinking market share. The chairman of the North American Dealers Association condemned Carlos Tavares in an open letter. The "condemnation letter" stated that Carlos Tavares was overeager for success and made many wrong decisions to achieve a record profit in 2023, directly dealing a devastating blow to the U.S. market.

“It couldn't be worse”

Dealers told The Detroit News that he and his fellow dealers felt relieved about Carlos Tavares' resignation. An early dismissal is a punishment for this iron-fisted leader, as new car inventories in North America are piling up, and brands like Dodge, Ram, Jeep, and Chrysler are suffering significant losses.

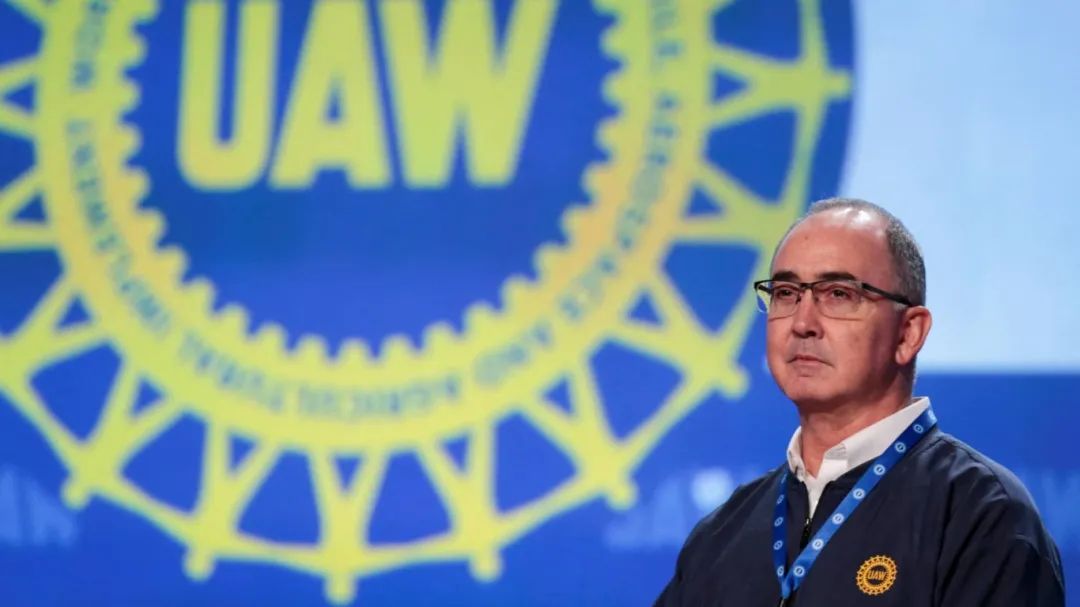

Second, labor unions are unhappy.

The dissatisfaction of the United Auto Workers (UAW) primarily focuses on the commitments made during last fall's contract negotiations, including Stellantis' plan to transfer production of the Dodge Durango from the Detroit Assembly Plant to Ontario, Canada.

In recent months, the UAW has escalated its criticism of Carlos Tavares, even going so far as to publish videos on public websites calling for his direct dismissal from the group. On the day of the official announcement of Tavares' resignation, UAW President Shawn Fain bluntly stated that Tavares' departure was good news, representing an important step in the right direction for the group and a positive development for the North American market.

In fact, Stellantis has already experienced significant executive turnover in the US market, with noticeable rifts between management and the group's headquarters. Revenue in the third quarter of this year declined by 42%, while new vehicle sales dropped by 36%.

During his reforms this year, Carlos Tavares stated that the group is currently experiencing a period of Darwinism in the automotive industry, with the strategic core being survival of the fittest, adapting to do better than competitors, and preparing for the future. Many employees within the group describe Tavares' corporate philosophy as "Darwinism" -

Profit-driven, meticulous, and ultra-realistic.

Everything should be done in moderation. As a business manager, moving too fast often leads to failure; moving too slow, on the other hand, can lead to excessive conservatism, lacking the decisiveness to act promptly, and falling behind in the race. Division and discontinuity, idealism and reality, moving fast does not necessarily mean going far.

Many insiders told Auto Society that Tavares' cost-cutting and control measures have reached an extreme level. He has consistently emphasized continuous budget cuts to protect profitability, but cost reductions are limited.

Tavares' early departure also tells us that there are two sides to every coin. In recent years, he has been rushing towards the B side, forgetting to look back and realize that the A side is the source of long-term projects and revenue streams.