Has the era of internal combustion engines returned after years of new energy development?

![]() 12/04 2024

12/04 2024

![]() 645

645

After years of new energy development, has the era of internal combustion engines returned?

In recent years, domestic vehicles have relied on new energy technologies, posing a significant challenge to traditional gasoline-powered vehicles in the mainstream market. However, recently, Guo Shougang, Deputy Director of the Equipment Industry Department of the Ministry of Industry and Information Technology, mentioned, "While vigorously developing new energy vehicles, we should also promote the development of internal combustion engine technology simultaneously."

Image source: Society of Automotive Engineers of China

Because of this statement, the online sentiment quickly shifted from "gasoline-powered vehicles are about to exit the historical stage" to "gasoline-powered vehicles won't die out." Additionally, during this year's Guangzhou Auto Show, Yao Fei, Deputy General Manager of Chery Brand Marketing Center, stated, "Gasoline-powered vehicles will not disappear and will still account for 30%-40% of the market share in the future."

Officially encouraging the development of internal combustion engine technology seems beneficial to the development of gasoline-powered vehicles, but Diantuche believes that this will further weaken the market share of gasoline-powered vehicles.

Internal combustion engines transition from primary to auxiliary

Don't forget that besides gasoline-powered vehicles, plug-in hybrid and extended-range hybrid vehicles also use internal combustion engines.

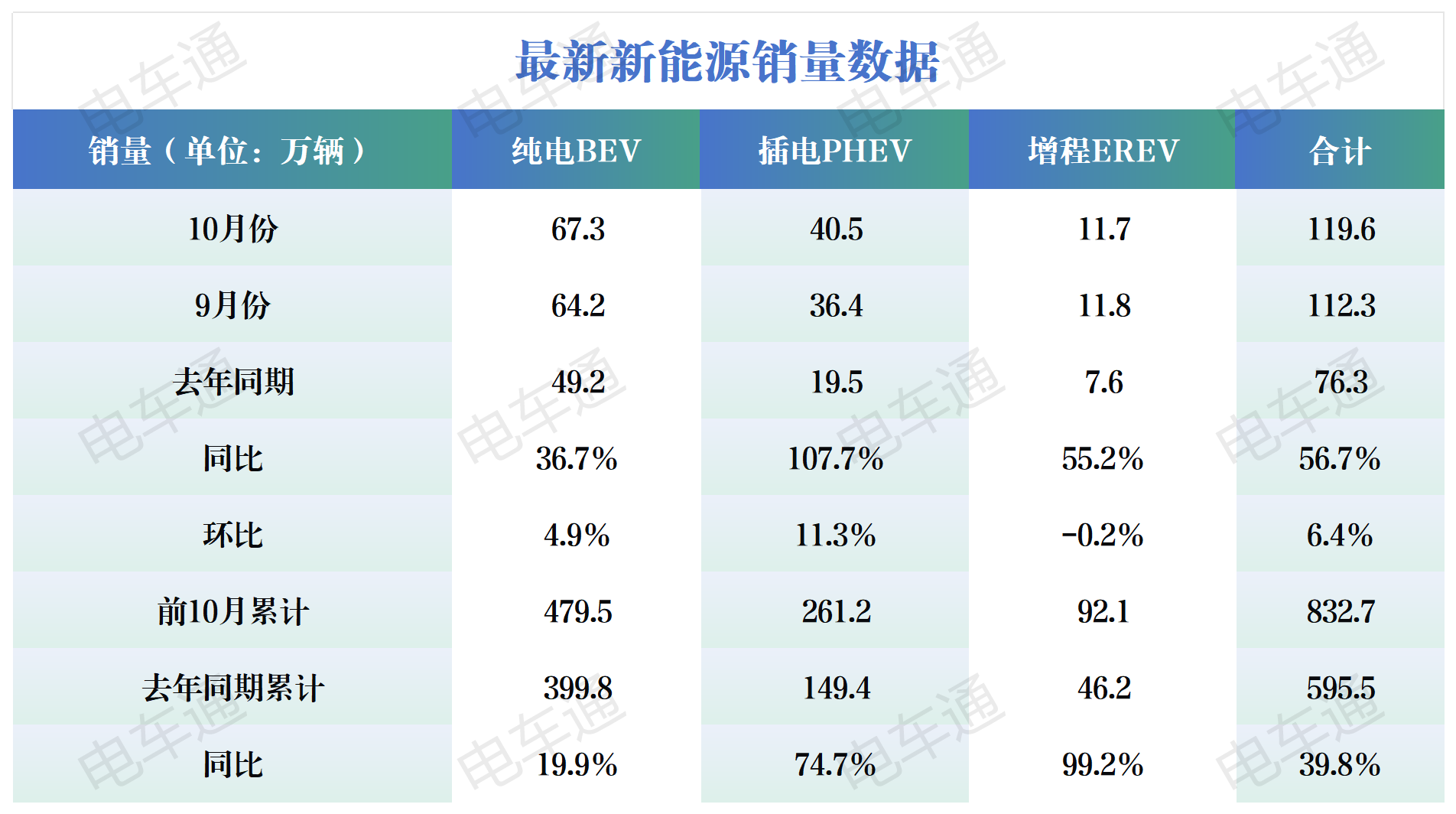

According to data released by the Passenger Car Association, in October, plug-in hybrid and extended-range hybrid vehicles accounted for 43.72% of total new energy vehicle sales, compared to only 35.52% in the same period last year, a sharp increase of 8 percentage points.

Data source: Passenger Car Association | Produced by Diantuche

Additionally, in October, domestic sales and exports of new energy vehicles showed year-on-year and month-on-month growth, setting a new monthly production and sales record. Monthly new energy penetration rate again exceeded 50%, marking the third consecutive month above this threshold.

Since the implementation of the new energy subsidy policy in 2009, the domestic new energy market has developed for 15 years. Combining the data, in these over ten years, new energy technology has developed to the point where consumers trust it. Pure electric is indeed the future trend, but before the issue of range anxiety is completely resolved, extended-range hybrids and plug-in hybrids, considered transitional technologies, are gradually becoming the mainstream in the market, with an 8% year-on-year increase being the best proof.

If automakers want to respond to policy calls, they must focus on the domestic mainstream market to quickly recoup funds. Nowadays, most domestic consumers have recognized the high energy efficiency advantages of hybrid vehicles. If automakers want to promote the development of internal combustion engine technology and invest in research and development for hybrid engines or range extenders in hybrid systems, this will undoubtedly be their first choice.

In other words, internal combustion engines will not exit the historical stage soon. Pure gasoline-powered vehicles can still be further improved in key parameters like thermal efficiency. However, from the perspective of consumer demand, pure gasoline-powered vehicles are difficult to compete with hybrid vehicles with higher energy efficiency. Consumers willing to choose pure gasoline-powered vehicles just for the smell of gasoline will gradually decrease, and the role of internal combustion engines will transition from primary power output to auxiliary power output.

Image source: HarmonyOS Intelligence

As a result, the market development trend is that the market share of pure gasoline-powered vehicles is gradually decreasing, while the sales of plug-in hybrid and extended-range hybrid vehicles will gradually increase.

Perhaps you think the advantages of hybrid vehicles are obvious, with low refueling costs, high energy efficiency, and excellent acceleration capabilities, but their shortcomings are also apparent.

Based on Diantuche's previous test drive experience, the driving quality of hybrid vehicles in a depleted state is significantly different from that in a fully charged state. Finding ways to improve the energy efficiency of dedicated plug-in hybrid engines or the oil-to-electricity conversion efficiency of range extenders is undoubtedly an urgent issue for automakers. Additionally, compared to gasoline-powered and pure electric vehicles, hybrid vehicles have more complex maintenance and repair procedures, resulting in relatively high maintenance costs that still need to be optimized by automakers.

Few pure electric vehicle enterprises remain

Looking back at 2024, many new energy vehicle enterprises that only offer pure electric vehicles have plans for extended-range hybrid models, such as AITO's AITO 07 equipped with Kunlun range extender and IM Motors' upcoming IM R7 with an extended-range version. Regarding the announced plans, XPeng has already announced its entry into the extended-range hybrid market, while IM Motors plans to release its first extended-range SUV in the first quarter of next year. GAC AION has confirmed that it will launch extended-range models, including AION and Hyper.

NIO plans to launch its first extended-range model in 2026, but this model is specifically designed for overseas markets such as the Middle East and North Africa and will not be sold in China. Even Xiaomi, which currently only offers the Xiaomi SU7 pure electric vehicle, has been rumored to be entering the extended-range market, with the large SUV codenamed N3 expected to compete directly with Lixiang L9 in the future.

In summary, it seems that only Tesla can truly be called a pure electric vehicle enterprise.

Image source: XPeng Motors

Why have hybrid vehicles, considered transitional technologies, become popular among pure electric vehicle enterprises? The answer is simple: extended-range hybrid models from Lixiang and IM Motors have gained sales recognition. New energy vehicle enterprises with little say in the pure electric field can only share the pie by timely transformation.

New energy vehicle enterprises' focus on hybrid systems aligns perfectly with the official encouragement to "vigorously develop new energy vehicles while simultaneously promoting the development of internal combustion engine technology."

Meanwhile, some forward-thinking battery suppliers have already launched hybrid-specific batteries tailored for hybrid vehicles to match the power demands of extended-range hybrid models as much as possible, such as CATL's Xiaoyao extended-range hybrid-specific battery and Ruipu Energy's GREEN BANK series of plug-in hybrid-specific batteries. These batteries address issues like short driving range, slow charging, and reduced performance in low temperatures through technological innovation. Suppliers are expected to launch more hybrid-specific batteries next year.

Image source: CATL

Diantuche has noticed that joint venture new energy brands, primarily Toyota, are still adhering to the gasoline-electric hybrid technology route. During GAC Toyota's Technology Open Day on June 28th of this year, GAC Toyota emphasized, "Making the fuel tank larger is a trick; making the battery smaller is technology," highlighting their strength in hybrid technology.

Indeed, Toyota's hybrid system only carries a 1.8kWh battery pack, while domestic hybrid models generally have battery pack capacities between 15kWh and 40kWh. While Toyota has maximized the potential of its engine by "downsizing" the battery pack, its hybrid models cannot compete with domestic hybrid models of the same class in terms of fuel economy and comprehensive driving range. Comparing fuel consumption in a depleted state, Toyota's fifth-generation hybrid technology consumes 4.07L/100km, while BYD and Geely can achieve below 4L/100km.

Diantuche wants to point out that promoting the development of internal combustion engine technology has indeed become the main trend in the current automotive market, but we should not overlook the importance of vigorously developing new energy vehicles. From the consumer's perspective, vehicle performance, energy consumption, and driving range are top priorities. Automakers must continuously optimize key hardware such as internal combustion engines, drive motors, and battery packs to continuously approach the optimal solution.

Internal combustion engines won't die, but pure gasoline-powered vehicles are uncertain

Pure electric vehicles are the future, but as transitional products, hybrid vehicles will not exit the historical stage for a long time until the charging infrastructure for pure electric vehicles can fully meet the travel needs of pure electric vehicle owners.

Diantuche has noticed that many classic pure gasoline-powered vehicles from joint venture brands offer significant discounts to maintain their sales figures. Models like the Lavida, Sylphy, Passat, and Camry, with the Nissan Altima being particularly notable, have a guide price of around 200,000 yuan. After various terminal discounts, the starting price has dropped to 127,800 yuan, a price that could only buy a new compact joint venture sedan in the past.

Indeed, times have changed, and the impact of new energy on the pure gasoline-powered vehicle market has forced automakers to rely on price wars to attract consumers. It cannot be denied that joint venture brands inherently have higher market recognition, and attracting users with lower prices will work for some time. However, for automakers, forcibly lowering prices without technological upgrades is only a "loss-making publicity stunt" and not a sustainable development strategy for the enterprise.

Sticking to the pure gasoline-powered vehicle market is not wrong, but failing to introduce "electronic flavor" in time will ultimately lead to elimination by the market.

(Cover image source: XPeng Motors)

Source: Lei Technology