From BYD to Geely Zeekr, Japan is "addicted" to dismantling Chinese cars

![]() 12/05 2024

12/05 2024

![]() 506

506

Introduction

At this stage, Japan's focus on Chinese electric vehicles (EVs) has gradually shifted from "low price and low cost" to the core competitiveness of key components.

Japan's interest in Chinese EVs began with the "national miracle car" Wuling Hong Guang MINI EV.

Back in 2021, Japan's NHK television station made a special report on the popularity of this car. Professor Masayoshi Yamamoto from Nagoya University publicly dismantled a Hong Guang MINI EV, attempting to uncover the secrets behind its low-cost popularity, which attracted over a hundred spectators, including media.

This action sparked a wave of dismantling Chinese cars in Japan. As the Chinese automotive industry leads in new energy and intelligent technology, more and more influential models have attracted attention in Japan. Nikkei BP even compiled the dismantling process and results of the BYD Seal into a book for public sale.

Initially, Japan's focus on Chinese EVs, much like the dismantling of the Hong Guang MINI EV, was primarily on "cost control." This was the first stage of Japan's EV dismantling efforts, where they sought to understand how these globally popular EVs achieved such attractive prices through "extreme cost reduction."

In the second stage, Japan's focus gradually shifted from "low price and low cost" to the core competitiveness of key components.

This year, Nikkei XTECH and Nikkei BP Research Institute dismantled the Geely Zeekr 007. Although this model is not very well-known in Japan and has not yet entered the Japanese market, industry insiders agree that it is the first sedan from a Chinese brand to come standard with an integrated die-cast aluminum rear body. It is equipped with an 800V high-voltage fast-charging platform, 4C battery cells, and dual NVIDIA Orin-X chips, among other features.

A detailed dismantling of the car's core components reveals the intelligent and electric technology advantages of the "Geely version of Lexus."

The secret of extreme cost reduction

The Japan Management Association (JMA) is a social organization dedicated to researching and promoting comprehensive business management services. In 2021, the organization imported a flagship version of the Hong Guang MINI EV from China (priced at 38,800 Chinese yuan, equivalent to 690,000 Japanese yen). For the purpose of dismantling and verification, the car was transferred to the Power Electronics Laboratory led by Professor Masayoshi Yamamoto at Nagoya University.

Professor Masayoshi Yamamoto's team dismantled the Hong Guang MINI EV. Although the car is small, the team discovered that "good things come in small packages." More importantly, they also uncovered many "cost-saving secrets" that are not widely known.

Through the dismantling, Masayoshi Yamamoto found that the model had "stripped down" most of the basic equipment found in pure electric vehicles, such as omitting the regenerative braking system and water cooling system. By indirectly "downgrading" some components, significant cost savings were achieved, with the lowest-end version priced at just 28,800 Chinese yuan.

The regenerative braking system converts the thermal energy generated during vehicle operation into mechanical energy, which is stored in the battery system and can be quickly released when needed. This system is crucial for extending driving range, but the Hong Guang MINI EV does not have it, resulting in a maximum driving range of only 170 kilometers.

Another detail is the cooling system. The motor and other components of the Hong Guang MINI EV use air cooling instead of water cooling.

The lifespan of the Hong Guang MINI EV's inverter is approximately 8 years or 120,000 kilometers, compared to 20 years or 200,000 kilometers for most pure electric vehicles on the market.

Of course, another reason is the large-scale use of off-the-shelf parts. The Hong Guang MINI EV's core bearings, as key components, do not use specialized designs but rather general-purpose products that meet performance requirements.

Although the inverter and other equipment use semiconductors from leading manufacturers such as Texas Instruments and Infineon, they are products tailored for household appliances rather than more durable automotive chips.

Masayoshi Yamamoto found that while some components of the Hong Guang MINI EV are prone to failure, the manufacturer has adopted a "clever" design concept, allowing for easy repair by replacing entire modules.

At an electric vehicle seminar hosted by Japan's Ministry of Economy, Trade, and Industry this year, 70 Japanese automotive parts companies visited the dismantling exhibition to discuss the body structure and components of Chinese-made electric vehicles.

Electric vehicles on display included over ten Chinese models such as the BYD ATTO 3 (Yuan PLUS in the Chinese market) and NIO ET5, as well as non-Chinese models like the Tesla Model Y, involving over 90,000 automotive components in total.

At the seminar, participating manufacturers discussed why Chinese EVs can be produced at low cost. After an in-depth analysis of the BYD ATTO 3, they concluded that the commonality of components, in-house research and development of core components, and large-scale production are the main reasons.

A representative from Sanyo Trading stated that Chinese manufacturers place great emphasis on low-cost production and have different quality requirements compared to Japanese companies.

Japanese media revealed that after an in-depth analysis of the BYD ATTO 3, it was concluded that the integration of components is a crucial tool for cost reduction.

In the electric drive unit "E-Axle," in addition to the motor, inverter, and reducer, the BYD ATTO 3 also integrates eight components such as the on-board charger and DC-DC converter. This integration reduces costs while also decreasing weight.

In addition, models like the BYD ATTO 3 leverage their sales volume advantage to reduce component costs through large-scale mass production. However, some designs are not perfect, and many participants believe that the waterproof performance of the on-board battery is insufficient and has room for improvement.

Core components, technology reigns supreme

"For some time, Japan's impression of Chinese EVs was still Stay in on popular models like the Hong Guang MINI EV. Many believed that these models were popular mainly due to their low prices, not necessarily because of their technological prowess."

Japanese media reported that in the past two years, Chinese-made EVs have begun to go global, exported to many overseas markets. It is gradually being recognized that new electric vehicles launched by Chinese automakers not only have a price advantage but also gradually lead the world in technological strength, especially in intelligence and new energy fields.

"It has surpassed Tesla's Gigacast."

"The golden bricks of the battery shine, not inferior to BYD."

After dismantling the Geely Zeekr 007, the Japanese industry marveled at its advanced technology and decided to replicate the approach used for the BYD Seal by compiling the dismantling details into a book for public sale. In their view, the Geely Zeekr 007, which uses a plethora of cutting-edge electric technology and is priced at around 250,000 Chinese yuan, is "incredible" to many Japanese experts.

For example, the integrated die-cast body.

Nikkei BP dedicated a significant portion to detailing the integrated die-cast aluminum rear body of the dismantled Geely Zeekr 007, which was the focus of this dismantling project.

The first impression of the Japanese expert team was that the integrated die-cast components were "really huge." The entire rear body, connecting the trunk and battery pack, is integrated into one piece. Removing the tires reveals that the interior is also made through integrated die-casting. Compared to traditional manufacturing processes, the reduction of 81 parts and 820 weld points significantly inhibits body vibration and noise.

Another example is Geely's self-developed golden brick battery.

A year ago, when Nikkei BP dismantled the BYD Seal, the most eye-catching feature was the company's blade battery. This time, with the Geely Zeekr 007 as the dismantling target, the details of the battery pack remained a key focus for Japanese experts.

By comparing performance parameters with previously dismantled models such as the BYD Seal, Tesla Model 3, and Volkswagen ID.3, the team concluded that in terms of battery design, the technologies and product philosophies of Geely and BYD are currently effective solutions that balance price and performance.

After dismantling the model, Nikkei BP also conducted surveys and interviews with technical experts. Upon collation, it was found that Geely's advanced deployment in the new era of automotive transformation and the commercialization of many cutting-edge technologies benefited from its hidden strength in patents.

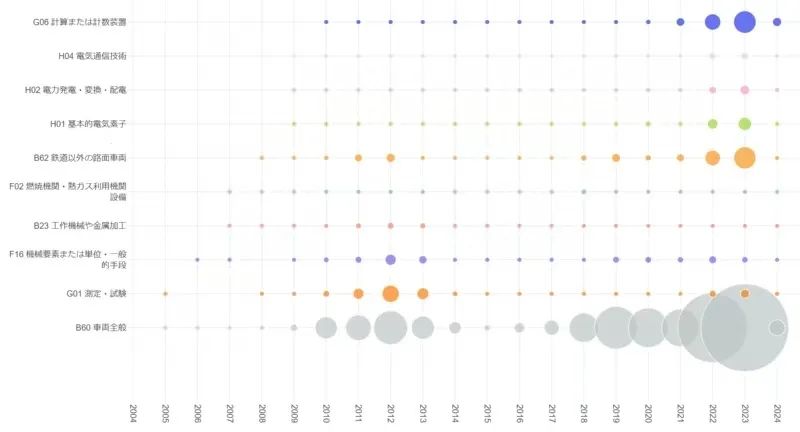

In September this year, the dismantling team used the patent information search platform Patent Field to analyze the relevant patents of China's Geely Holding Group. From 2004 to 2024, a 20-year period, the number of patents under the group's name directly highlights its rapidly rising technological capabilities in recent years.

Among them, most of the technological patents with increasing applications in recent years are related to basic electrical components and the three electrics (battery, motor, and electronic control). From the latest technological interpretation of the dismantling, the commercialization of these technologies has begun to achieve phased results.