"Zhang Yong", the "punching bag", has quit. Why did the once top-selling Neta Auto fall?

![]() 12/09 2024

12/09 2024

![]() 522

522

Neta Auto, whose situation is perilous, was once seen as the next WM Motor by the outside world.

But unexpectedly, Zhang Yong, the CEO most closely associated with Neta Auto in the public eye, has stepped down.

Previously, netizens joked that those named Zhang Yong are all very impressive, and some people indeed confused Haidilao founder Zhang Yong, former Alibaba CEO Daniel Zhang, and Neta Auto's Zhang Yong.

However, among these three, only Neta Auto CEO Zhang Yong was called a "punching bag" by everyone.

Zhou Hongyi, a shareholder of Neta Auto's parent company, criticized him face-to-face during a live broadcast, not only criticizing the brand name but also the model strategy;

In one live broadcast, Zhang Yong crossed his legs and sat casually, which was criticized by netizens;

With Neta Auto's declining sales and an unsmooth IPO, it's unknown whether he will be criticized.

But he is undoubtedly the auto company leader who has been criticized the most in public, and his image as a "punching bag" is deeply ingrained in people's minds.

Image source: Zhang Yong's Weibo

Of course, Zhang Yong is no ordinary person.

Once full of high spirits, he was invited by his university classmate and colleague Fang Yunzhou to join Hozon Auto six years ago.

Over the past six years, he led the renaming of Neta and leveraged the popularity of the movie; the sales volume peaked at 152,000 units the year before last, making it the top-selling new energy vehicle brand.

Signs of his resignation seemed to have emerged earlier. Keen-eyed netizens noticed that Zhang Yong had not promoted Neta on social media for two months, a stark contrast to his previous online activity.

According to media reports, from March to the present, Zhang Yong has filmed 177 videos, making him one of the most active auto company leaders online.

The two months of his silence coincided with Neta Auto's most tumultuous period in recent years, including capital chain issues, large-scale layoffs, employee salary arrears, and production halts and reductions.

According to Neta Auto's response to the media, Zhang Yong has stepped down as CEO of Neta Auto and taken on the role of company consultant, with Neta Auto founder and Chairman Fang Yunzhou concurrently serving as CEO.

Next, we will see how Fang Yunzhou will turn the tide.

01

Zhang Yong's Silence: 60 Turbulent Days

Signs of the concentrated problems at Neta Auto actually emerged as early as October.

Zhang Yong's Weibo was last updated on October 14, when he was keeping track of Zhou Hongyi's progress in obtaining a driver's license and comparing it to his own timing for obtaining a racing license.

Throughout 2024, he and Zhou Hongyi "exchanged traffic" on social media. At the beginning of the year, he led Zhou Hongyi, known as the "Red Shirt Pope," on a live tour of the factory. In the middle of the year, they hyped up the renaming of Neta Auto together. In August, they even appeared together on a variety show.

One is a CEO earning tens of millions of yuan in annual salary, and the other is the third-largest shareholder of Hozon Auto. For the sake of company performance, there is no such thing as over-hyping marketing efforts.

However, it is not easy to prop up a crumbling edifice.

At the end of August, Zhang Yong launched the Neta S Shooting Brake version priced at only 159,900 yuan. New energy shooting brake cars at this price point are relatively rare.

However, many car owners found after booking that the delivery deadlines were repeatedly delayed, fully exposing Neta's production capacity issues.

Image source: Neta Auto Weibo

According to an on-site investigation by IT Times reporters, all three Neta factories were shut down in November. Additionally, media outlets captured images of a large number of Neta cars parked in the factories, all with various missing parts, indicating supply chain issues.

On November 8, Efort Intelligent Equipment sued Hozon Auto for payment of the 48 million yuan in contract payments owed; on December 6, Deas Public Relations sued Hozon Auto for over 50 million yuan involved in the case.

Paying salaries also became a problem. As early as October, employees posted that they had not received their September salaries. According to Mirror Studio reports, Neta has laid off over 2,900 employees, representing a 50% reduction.

Factory shutdowns, supplier debt collection, and over 50% layoffs...

It's hard to believe that this is happening to the top-selling new energy vehicle brand in 2022. The "punching bag" Zhang Yong has taken the blame, but who will Neta rely on for its future?

02

The Disappearance of the Sales Champion: Why the Downward Trend?

When it comes to new energy vehicle brands, the first thing that comes to mind is "NIO, XPeng, and Li Auto."

However, Hozon Auto, founded in 2014, is also a member of the new energy vehicle sector and became the annual sales champion among new energy vehicle brands in 2022.

Fang Yunzhou, the founder of Hozon Auto, is a 16-year veteran of Chery Automobile and officially founded Hozon Auto in 2014. In 2018, his university classmate and former colleague Zhang Yong joined as president, allowing Fang Yunzhou to focus on technical research and development.

In the same year, Hozon launched its first vehicle, the Neta N01. Leveraging the popularity of the following year's Neta animated film, it gained significant attention and attracted investment from Yichun State-owned Assets. In 2021, Zhou Hongyi also invested, with 360 investing 2.9 billion yuan and becoming the second-largest shareholder.

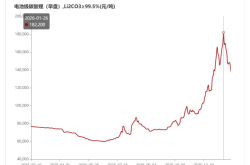

2022 was a high point for Neta Auto, with annual sales of 152,100 units, surpassing "NIO, XPeng, and Li Auto" to become the top-selling new energy vehicle brand.

However, it has since begun to decline, with sales falling to 127,500 units in 2023 and only 85,900 units in the first ten months of 2024, falling short of the original annual target of 300,000 units.

While fewer cars were sold, the losses were significant. According to its prospectus, Neta Auto's net losses from 2021 to 2023 totaled 18.4 billion yuan.

Moreover, after a decade of establishment, it has completed 10 rounds of financing totaling 22.8 billion yuan. However, as of the end of 2023, Neta Auto's net assets were only 2.931 billion yuan.

Image source: Neta Auto Weibo

Why did Neta Auto fall so quickly after its high point?

In fact, the high sales volume in 2022 was mainly driven by models like the Neta V/U, which are priced below 100,000 yuan. Some believe that much of this volume came from the online car-hailing market.

However, Zhang Yong was not satisfied with this and hoped to break into the mid-to-high-end market. He invested 2 billion yuan to develop the Shanhai platform and launched sports car models like the Neta S and Neta GT, but the high prices and niche market made them unsellable.

It is said that Neta also has a smart driving team of over 1,000 people.

The only model that could sell in volume this year was the Neta L SUV, which received marketing support from the "Red Shirt Pope," and orders quickly surpassed 30,000. However, due to funding issues, Neta Auto was unable to deliver the cars on time, leading to a large number of cancellations and further jeopardizing Neta's capital chain.

The annual discussion about whether to change the name reflects Neta Auto's conflicting strategy: on the one hand, it wants to break into the high-end market, but on the other hand, it cannot maintain its entry-level base.

In contrast, Zero Run Automobile has seen a significant sales increase due to its precise positioning as the "half-price ideal" option. Its third-quarter revenue increased by 74.3% year-on-year, with monthly sales exceeding 30,000 units.

03

Rescuing Neta: Can Going Abroad Lead to a Second Startup?

After Zhang Yong's retirement, Fang Yunzhou returned to the forefront. In an open letter, he outlined six reform measures, emphasizing streamlining and expanding overseas.

He believes that "establishing a global footprint based in China is the answer to Neta Auto's second startup." He also listed four main goals:

First, to go all in on achieving an IPO;

Second, to achieve a 50-50 sales split between domestic and international markets within the next 2-3 years;

Third, to turn the overall gross margin positive by 2025;

Fourth, to achieve overall company profitability by 2026.

In summary, the two key points are going public and expanding overseas.

In fact, the benefits of going abroad are obvious: an insider once told Heiban Jun that Neta loses 20,000 yuan on each car sold domestically but earns 20,000 yuan on each car sold internationally.

While there may be some exaggeration here, the general picture remains the same: the domestic auto market is highly competitive, with price wars driving down gross margins.

Last October, Neta Auto planned to establish a presence in over 30 countries and regions, with over 100 channels. In the first half of this year, Neta exported 17,687 new energy vehicles, maintaining its position as the top exporter among new energy vehicle brands.

Currently, Neta Auto is mainly present in markets such as Thailand, Indonesia, and Brazil. In October 2024, Neta's share of the pure electric vehicle market in Thailand reached 22%, with the Neta X being the top-selling pure electric SUV in Thailand that month.

In Thailand, Neta Auto already has a factory with an annual production capacity of 30,000 units. The Indonesian factory is already in operation, and a Malaysian factory is under construction.

Image source: Neta Auto Weibo

Among new energy vehicle brands, Neta Auto is indeed one of the most determined in its overseas expansion efforts. If multiple overseas factories can operate normally, they can to some extent circumvent pressure from Europe and the United States, giving Neta a certain first-mover advantage.

According to reports, in November, Nanning Industrial Investment Group reached a strategic cooperation agreement with Hozon Auto (Neta), with Nanning Industrial Investment providing supply chain financial support to facilitate the production and delivery of Neta Auto's overseas models.

The path is clear: both capital and the founder will adhere to the overseas strategy.

Compared to a domestic new energy penetration rate of over 50%, the global rate is still below 20%. It remains to be seen whether Neta's capital chain can return to normal operation.

On the other hand, Zhou Hongyi has not discussed Neta Auto on social media for four months, even during the change of leadership at Neta.

According to 360's financial report, the book value of its investment in Neta Auto has decreased by 1.76 billion yuan over two years. It's no wonder that the "Red Shirt Pope" previously pulled Zhang Yong into marketing live streams, hoping to recoup their losses.

However, he has recently talked less about cars and instead heavily promoted his new AI search product, the "Nano Search" APP.

It's understandable. The "Red Shirt Pope" has little influence in the area of auto exports. Now, he can only hope that Neta can reshape itself and succeed in stirring up the ocean one day.