How a $50,000 Debt Brought Down a $1.4 Billion Company

![]() 12/14 2024

12/14 2024

![]() 572

572

"(The entire company) is in turmoil, and it all came together like this. No matter how much we promote our product, no one recognizes it. The team is disorganized, and instead of working hard, they're constantly fighting over territories." On the day the CEO was besieged, a former GeeX employee vented to Guangzhui Intelligence.

On the morning of December 12, emotionally charged employees besieged the GeeX headquarters conference room in Jiading, Shanghai, where CEO Xia Yiping was located. Despite their reluctance, everyone had to accept that GeeX had suddenly collapsed.

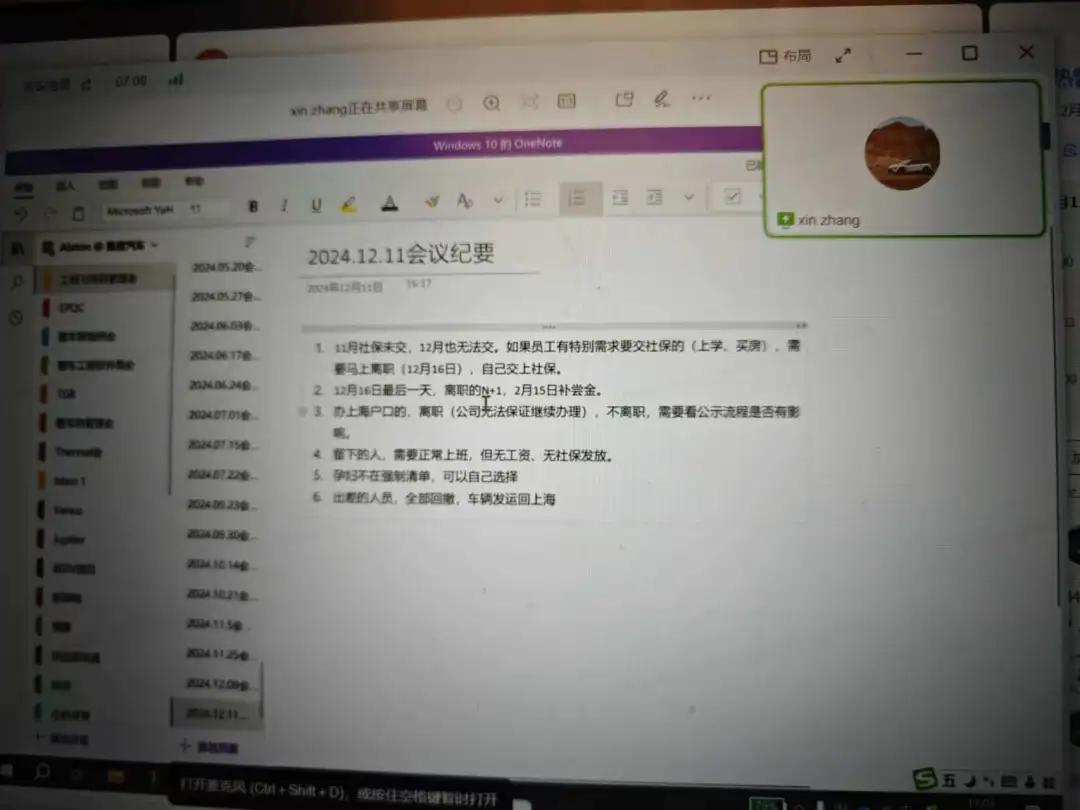

Online information indicates that GeeX has come to a complete standstill, with employees' social security contributions halted and outsourced vehicles being recalled. For employees to stay at GeeX, they must now choose to "pay to work".

Just the day before, Xia Yiping outlined four requirements for the "GeeX Entrepreneurship 2.0 Phase" in an internal letter, including long-term investment, strengthening sales and service capabilities, improving workflow efficiency, and enhancing financial performance.

After the initial confrontation ended, calmer employees began considering their futures. Some gathered to discuss their next jobs, while others took out selfie sticks and seized the opportunity to start their own media accounts. They posed under a slogan wall that read, "In the history of smart cars in China, every GeeXer's name will be remembered," creating a scene reminiscent of Wong Kar-wai's ironic style.

On the afternoon of December 12, Xia Yiping met with employee representatives in the conference room. Throughout the meeting, Xia Yiping smiled and fidgeted, comforting everyone present. "The lack of transparency is because things happened so suddenly. In the past few weeks, the process, including financing, went smoothly for several months before." Xia Yiping also promised to resolve this month's social security contributions.

The GeeX office building gradually grew quiet, but the impact of this incident was far from over.

Guangzhui Intelligence contacted several GeeX stores in Shanghai, and some reported that they were currently unable to deliver vehicles. Some online live streamers cheered that their live broadcast room finally had 200 viewers, and last month's performance exceeded expectations. However, they soon lamented that their "home base had been stolen".

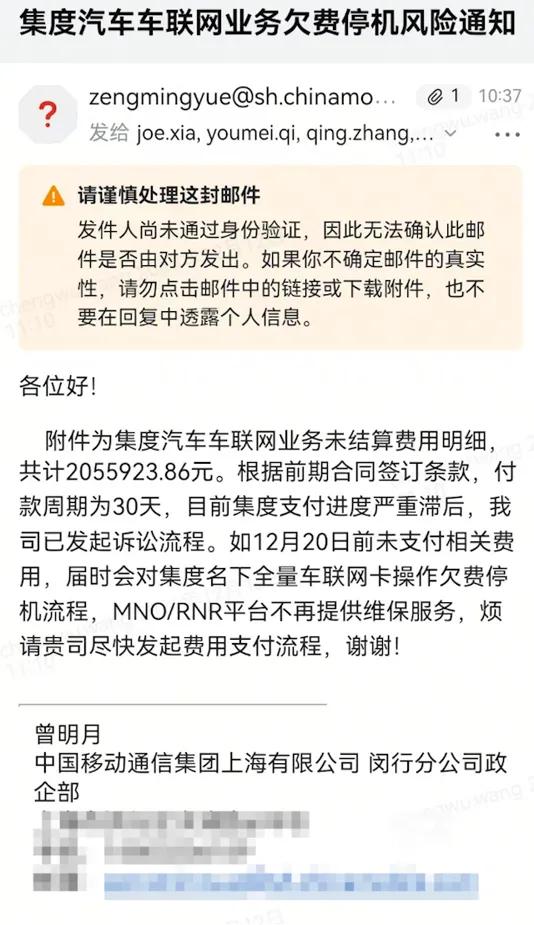

Meanwhile, some car owners claimed that the high-level autonomous driving system (ADS) they bought from GeeX was no longer functional and demanded a refund of their subscription fees; however, some other owners said it was still working. China Mobile demanded that Geely Auto's connected vehicle business pay a debt of $2.9 million, or it would suspend service for all connected vehicle SIM cards under Geely Auto's name on December 20, and the MNO/RNR platform would no longer provide maintenance services.

The recent events at GeeX have stunned everyone.

Just last month, Xia Yiping invited car owners to have hotpot together to celebrate the one-year anniversary of the GeeX 01. On December 1, Xia Yiping also spoke at the TEDx Sinan Road 2024 Annual Conference, saying, "I really love this career, so no matter what difficulties I encounter, I have never regarded them as reasons to give up but have faced them head-on." Until December 11, the company was still operating normally, suppliers were preparing accessories for the next month, and video platforms were still filled with marketing videos explaining GeeX's automotive design philosophy.

But starting from when a media outlet publicly demanded $50,000 in arrears from GeeX, the chain reaction of employees and suppliers grew like a snowball, instantly creating a financial hole of $1 billion.

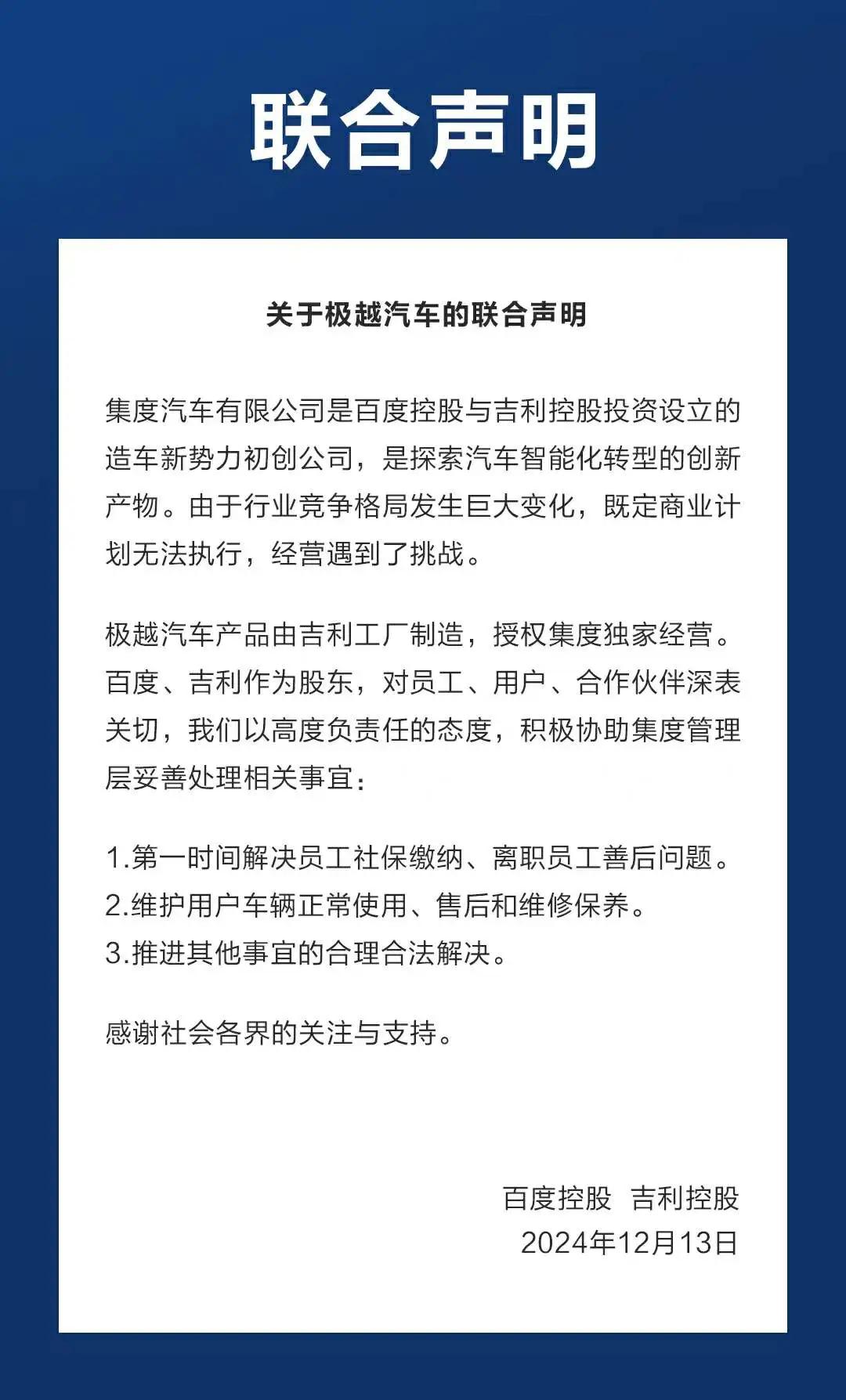

On December 13, under pressure, Baidu and Geely finally stepped in to mediate. Their joint statement read, "We will properly resolve issues related to social security and resignation, undertake the subsequent use, maintenance, and repair of products, and promote the reasonable and legal resolution of other matters."

A great edifice will fall, not supported by a single pillar. Discussing how to save GeeX now is meaningless. In the era of the rise of smart cars in China, we have witnessed too many "messy situations".

"The timing was already late, and mistakes kept being made." The former GeeX employee also pointed out the core reason for this incident.

Behind GeeX's collapse lies a lack of focus on producing quality products.

Behind GeeX's "disbandment on the spot" lie strategic mistakes and management chaos.

Before its collapse, GeeX had actively sought survival.

After the poor performance of the GeeX 01 launch, Xia Yiping attributed the problem to insufficient consumer awareness and reflected, "From April 2023 to September 2023, we did not promote ourselves externally for nearly half a year. Users have only been aware of GeeX for seven months, and the GeeX 01 has only been on the market for four months."

First, at the price level, GeeX began a promotional model of "reducing prices without hesitation." On November 30, 2023, just one month after the launch of the GeeX 01, all models received a price cut of $4,200. The adjusted starting price of the GeeX 01 Max was $31,000.

At the organizational level, GeeX also began significant reforms in 2024. After adjustments, Xia Yiping personally led the three major departments of marketing, sales, and user services. At the same time, in terms of product design, GeeX also began to emphasize its radical ideas. For example, the GeeX 07 completely eliminated door handles, physical gear shifts, adopted a half-rim steering wheel, and an integrated ultra-wide in-car screen.

Regarding these "counterintuitive" product designs, Xia Yiping believed that consumers "did not understand advanced concepts" while also initiating frequent brand exposure and product self-verification.

Inspired by Lei Jun's support for Xiaomi's SU7, Xia Yiping also personally participated in live streaming and video shooting. Regarding the specific workload, Xia Yiping stated during the launch of the GeeX 07, "I now basically do one live stream per week and one short video per day, sometimes four or five short videos per day." The content of the videos was almost all-encompassing. Besides common driving and intelligent driving chats, there were also a series of automotive performance verifications such as low-temperature testing, track running, and battery fire testing. Driven by Xia Yiping, it is estimated that the entire GeeX brand alone released 13,000 videos in August this year.

With continuous efforts, during the first ten months of 2024, GeeX's monthly sales volume climbed from less than 200 units to 2,500 units. However, for a brand targeting the mainstream consumer market, such performance was undoubtedly inadequate.

So, why did this brand, which has the backing of Baidu, Geely, and CATL and brings together the best in China's smart car industry chain, ultimately exit in such an undignified manner?

On the one hand, Xia Yiping has not deviated from his previous entrepreneurial path, and GeeX's operational strategy has never focused on products.

Before joining GeeX, Xia Yiping was a prominent figure in the internet industry as the founder of Mobike. In the competition with ofo, the two companies chose different competitive models. Simply put, ofo tended to reduce vehicle costs and quickly deploy nationwide while ensuring basic riding functionality. In contrast, Mobike focused more on vehicle design (making it easier to ride) and hoped to erode ofo's user base with this feature and charge higher service prices in the future.

As everyone knows, the business model of shared bicycles was not successful. The core reason for the failure was that the subsequent operating costs of shared bicycles grew at a rate that exceeded the expectations of all players. After Mobike was taken over by Meituan, the unrealized monetization logic became a "lingering hurdle" in Xia Yiping's mind.

"Based on my experience at Mobike, the company achieved 250 million registered users in 2021. Therefore, during the initial stages of GeeX's creation, I naively fantasized that the user engagement methods of the internet could be applied to the automotive industry. Of course, the reality of the industry dealt me a significant blow. There is a huge gap between a $1 product and a $28,000 product, and there are also significant differences in growth strategies. The automotive industry is a long chain industry, and the company's strategic adjustments cannot quickly demonstrate their intended effects." Xia Yiping's speech at the TEDx Sinan Road 2024 Annual Conference on December 6 revealed the reason behind the radical product definition of the GeeX brand.

Xia Yiping is still operating the automotive brand using the internet industry's logic of driving traffic, acquiring customers, and monetizing. He believes that the only difference between cars and shared bicycles is price.

With this perception, Xia Yiping continues to believe that as long as the product is eye-catching enough (with sufficiently long strengths, or sufficiently "sci-fi"), consumers will naturally make a purchase.

However, this logic is precisely limited by GeeX's identity. Because in the areas of common consumer concern, GeeX relies on Baidu for intelligence, Geely for its automotive architecture, and CATL for battery life. The only parts truly representing GeeX are controversial designs that consumers may not accept, such as the lack of door handles, screen gear shifts, and a half-rim steering wheel.

Now, amidst the "mess" at GeeX, it is highly probable that Baidu, Geely, and CATL will not take over. After all, Baidu now has Robotaxi and no longer needs to prove its autonomous driving capabilities, while its L2 business is also shrinking; Geely has just announced plans to integrate brands and resources and has no need to recover a negative asset that still owes it money; CATL has launched the Qilin battery (which requires deep involvement in automotive design with CTB) and has obtained a "passport" to further penetrate the automotive industry.

In other words, GeeX no longer has any tradable chips. Even though Baidu has invested a cumulative total of approximately $1.2 billion to date. In September of this year, Baidu also promised to continue investing $420 million with the condition that GeeX would purchase automotive intelligence solutions for three years.

GeeX's sudden collapse caused the last glimmer of hope to dissipate.

GeeX is not suited for the automotive industry

With the impending exit of GeeX, NIO, and HiPhi, the smart car industry has fully entered a "battle royale" mode.

Facing an increasingly tense situation, Geely was the first to press the "acceleration button".

In September of this year, Geely emphasized "strategic focus" in the Taizhou Declaration. The previous "big family" model of "having more children to fight better" was terminated, and Geely began to reuse the R&D system as much as possible, reduce investments, integrate resources, and shift from a decentralized to a centralized approach. Two months later, multiple holding subsidiaries under Geely, including Lynk & Co and ZEEKR, began to merge.

From a tactical perspective, Geely's move means the end of the "era of separate exploration." To find the answer in the era of electric and intelligent automobiles, Geely fielded nine brands and found the answer in ZEEKR + Geely. At the same time, Geely Holdings will also recover $3.6 billion (from ZEEKR's payment for merging Lynk & Co shares) + $800 million (from Geely Auto's acquisition of ZEEKR shares) for further capital operations during its contraction. Subsequently, it may be a "full bet" by the Geely system on the market, or Li Shufu may continue to operate the listing of assets in his automotive supply chain.

Geely's strategy undoubtedly has its own considerations. However, considering this year's "turnaround" of NIO and XPeng, it seems that the underlying logic of successful operation in the automotive industry is the rational allocation of resources and the creation of differentiation.

Among them, NIO primarily relied on operating a "1+N" marketing network (one 4S store as the center driving multiple display stores in the region) channel model this year, allowing the brand, which emphasizes cost-effectiveness, to fully engage with the lower-tier market.

According to financial reports, NIO had 560 sales outlets at the end of 2023, covering 182 cities. By 2024Q3, there were 493 sales outlets and 362 service outlets, covering 204 cities. Such an operational model allowed NIO to leverage operational leverage, reducing the number of self-operated stores while increasing sales volume from 140,000 units in 2023 to 300,000 units (estimated for the full year of 2024). Furthermore, NIO has also transformed and upgraded from its original "low-priced small car" label to a mainstream family car image in the $21,000 price range.

On the other hand, XPeng underwent a two-year transformation, reorganizing all its resources. After resource integration, He Xiaopeng established the label of "affordable intelligent driving." With the newly launched MONA M03 and P7+, XPeng focused on "fashion + intelligent driving" and "large space sedan + intelligent driving," resulting in two instant hits.

The changes at Geely, NIO, and XPeng demonstrate that the automotive industry can certainly accommodate dreams. For intelligent driving technology, market space, and consumer awareness, automakers can certainly have their own long-term goals (or even be maverick). Consumers will pay for products that have undergone rational resource allocation and exhibit sufficient differentiation, not just "wishful thinking" based on a certain concept.

NIO heavily relied on its previous product strategy of low-priced small cars. Despite some success in exporting to Southeast Asia, it ultimately struggled to keep pace with evolving demands in China's mainstream market, teetering on the brink of collapse amidst the rise of intelligent vehicles.

HiPhi adopted a luxury-focused product strategy, capitalizing on the window of opportunity when other brands had yet to introduce high-end offerings. However, as the automotive supply chain scaled up production and other automakers formulated high-end strategies centered around intelligent driving, HiPhi, without diversifying its approach, found itself reduced to a mere emblem of opulence devoid of substance.

GeeX faces a similar predicament. A former GeeX employee shared with Guangzhui Intelligence, "Before leaving, I constantly questioned whether there was any compelling reason to buy a GeeX 01. Even until my departure, I couldn't find one."

Although GeeX's foray into the highly competitive 200,000 yuan price segment represents one of the most fiercely contested markets in China's automotive industry, it is peculiar that a brand backed by Baidu's intelligence, Geely's automotive platform, and CATL's battery technology has struggled to rise above the "red ocean" of competition.

It's worth noting that the immediate popularity of the ZEEKR 001 was primarily fueled by its large battery capacity and cost-effectiveness. Similarly, Xiaomi's SU7 saw a surge in orders following Lei Jun's initial "livestream selling" campaign. However, sustained consumer support hinges on delivering core qualities that meet rigorous standards. In China, the world's largest automotive consumption and export market, there should be ample room for numerous brands to thrive.

Each industry operates according to its unique logic, and it seems that GeeX simply doesn't fit into this particular one.