IPO Failure Could Mean Extinction for New Car Manufacturers

![]() 12/16 2024

12/16 2024

![]() 609

609

Reviewing the week's auto stocks, we observe various trends in the automotive market.

The news of Jiyue Automobile's collapse was shocking, occurring in just one day. This favored child, endowed with a 'golden key' thanks to investments from Baidu and Geely, suddenly became an outcast.

It is widely believed that the primary reason is Baidu's withdrawal of investment. Reports indicate that Baidu sent a financial team to conduct due diligence on Jiyue in October 2024 and discovered a financial hole of up to 7 billion yuan, prompting the decision to discontinue further investment.

The lack of funds became the final straw that broke Jiyue Automobile's back. This also explains why many new entrants have been eager to support their subsequent development through IPO 'blood transfusions'.

For instance, WM Motor, which has already left the stage, struggled to secure capital support and attempted three IPOs, all of which failed. Similarly, Aiways reportedly planned a listing on the STAR Market in June 2021, with later rumors of a US IPO.

During the 'golden period' of rapid development of new energy vehicles in previous years, many new car manufacturers successively went public, including NIO, XPeng, Li Auto, and ZERO Run. However, after 2024, very few new car manufacturers have successfully 'landed' on the stock market.

An industry insider explains, "I believe there are three reasons for the hindered IPOs of new car manufacturers. First, the domestic capital market has continued to decline. To boost morale, the state has tightened policies on corporate listings. Second, the boom in new energy vehicle manufacturing has passed, decreasing capital enthusiasm for this sector. Third, capital is no longer optimistic about unlisted newcomers in the automotive industry. For those who failed to reach the top tier in the previous round, there is almost no market space left for them because winning market share requires taking a piece of the pie from brands like BYD and Li Auto, which is almost impossible."

Besides the aforementioned automakers, Nezha Auto has also long placed hope in using an IPO for a 'blood transfusion'.

In fact, as early as July 2020, Nezha Auto initiated the application process for a listing on the STAR Market and planned to complete the listing in 2021.

However, the results were not smooth. Nezha Auto's listing plans collided with the new policy of the STAR Market, which requires strengthened scrutiny of the technological content of listed companies. This led to the termination of listing plans on the STAR Market for multiple automakers, including Nezha Auto. Subsequently, the Hong Kong Stock Exchange became an ideal destination for IPOs of multiple new car manufacturers.

At the beginning of 2022, rumors spread in the market that Nezha Auto planned an IPO in Hong Kong. Subsequently, one of Nezha Auto's shareholders, the listed company 360 Security Technology, began clearing 'obstacles' for it.

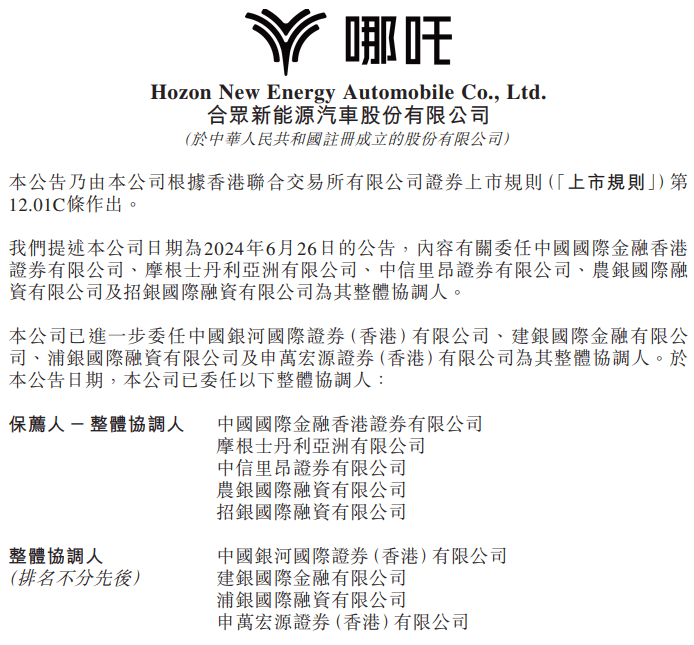

On June 26th of this year, Nezha Auto's parent company, Hezhong New Energy Automobile Co., Ltd. (hereinafter referred to as 'Hezhong Auto'), submitted listing application materials to the Hong Kong Stock Exchange, with CICC, Morgan Stanley, CITIC Securities, ABC International, and China Merchants International serving as joint sponsors.

According to the information disclosed in the prospectus, Hezhong Auto's total revenue in 2023 was 13.55 billion yuan. Of this, domestic revenue was 11.93 billion yuan, accounting for 88% of total revenue; overseas revenue was 1.62 billion yuan, accounting for 12% of total revenue; the net loss for the year reached 6.87 billion yuan. As of December 31, 2023, the company's gross loss reached 2.014 billion yuan, with a gross profit margin of -14.9%; in addition, the company's R&D expenditure in 2023 reached 1.597 billion yuan.

It is worth mentioning that from 2021 to 2023, Hezhong Auto has been in a state of significant losses. The net loss was 4.84 billion yuan in 2021, 6.666 billion yuan in 2022, and 6.87 billion yuan in 2023.

Simultaneously, Hezhong Auto's operating cash flow has consistently been negative. In 2021, the net cash flow generated from its operating activities was -2.991 billion yuan, -5.408 billion yuan in 2022, and -4.354 billion yuan in 2023. As of the end of 2023 and April 2024, Hezhong Auto's net current liabilities were 1.991 billion yuan and 1.795 billion yuan, respectively.

In terms of sales volume, Nezha Auto's sales declined in 2023, with a total annual sales volume of only 127,000 units. It was the only new car manufacturer whose annual sales volume declined year-on-year. In 2024, Nezha Auto's sales volume did not recover. From January to September, Nezha Auto sold 86,000 units, a year-on-year decrease of 12%; sales figures for October and November are temporarily unavailable.

Obviously, due to poor financial and sales conditions, Hezhong Auto urgently needs funds for a 'blood transfusion' to increase its capital reserves. This is also the main reason why Nezha Auto has been struggling to pursue an IPO.

On December 6th, Nezha Auto announced that due to company strategy, Zhang Yong would no longer serve as CEO and would instead become a company advisor; the founder and chairman, Fang Yunzhou, would concurrently serve as CEO.

With the change in CEO, Nezha Auto was sued by multiple suppliers for owing nearly hundreds of millions of yuan in payments. Simultaneously, it was embroiled in numerous controversies such as layoffs and unpaid wages. Many negative keywords surrounded this once-star new car manufacturer, and the IPO that was originally on the agenda was now far off in the distance.

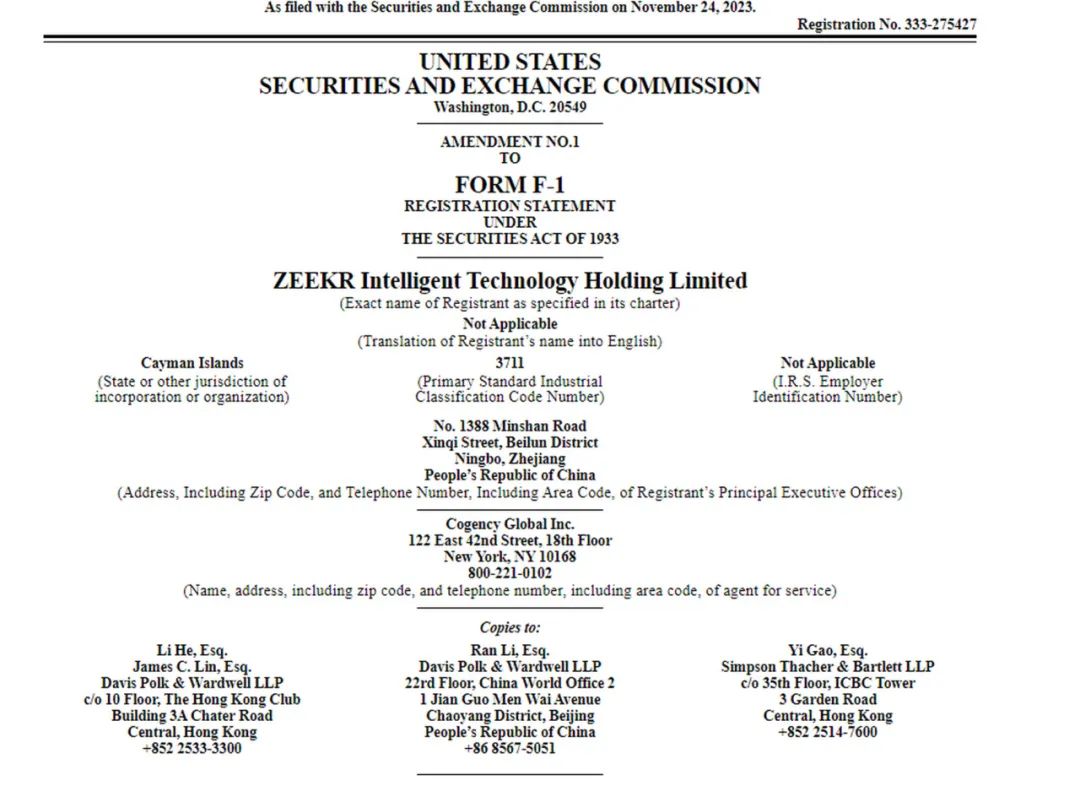

In contrast, from brand launch to IPO, Zeekr set a new record for the fastest IPO among new energy vehicles with a timeline of 37 months and became the first 'second-generation' automaker to successfully go public.

On May 10th, US Eastern Time, Zeekr successfully rang the bell for its listing on the New York Stock Exchange and officially listed for trading under the stock code 'ZK'. Zeekr issued a total of 21 million American Depositary Shares at a price of $21 per share, raising approximately $441 million. On its first trading day, Zeekr's share price increased by 34.57%, closing at $28.26 per share with a market value of $6.85 billion.

The IPO of new car manufacturers, which had been dormant for a long time, was finally reignited by Zeekr. However, in reality, it was not easy for Zeekr to complete its IPO.

Geely's expectations for Zeekr's IPO were laid down long before the planning and establishment of Zeekr. However, like Nezha, due to the tightening of IPO policies on the STAR Market, Geely withdrew its IPO application materials in June 2021. Simultaneously, Geely announced that it would explore different external financing solutions to achieve sustainable development for Zeekr.

According to the prospectus, Zeekr plans to issue 17.5 million American Depositary Shares (ADS), with an expected issue price per ADS ranging from $18 to $21, and a fundraising scale ranging from $315 million to $367.5 million. The fundraising scale could reach up to $422 million if the over-allotment option is exercised.

The prospectus discloses that Zeekr's revenues for 2021 to 2023 were 6.528 billion yuan, 31.9 billion yuan, and 51.67 billion yuan, respectively, with a year-on-year increase of 62%. The growth in revenue was mainly driven by an increase in vehicle sales. Gross profits were 1.038 billion yuan, 2.472 billion yuan, and 6.85 billion yuan, respectively; the gross profit margin increased significantly, reaching 1.8%, 4.7%, and 15.0%, respectively. Compared with peers, in 2023, NIO, XPeng, Li Auto, and Tesla had gross profit margins of 9.5%, -1.6%, 21.5%, and 18.2%, respectively.

Although revenues and gross profits continue to improve, like many domestic new energy vehicle manufacturers, Zeekr is also in a state of continuous losses.

The prospectus shows that Zeekr's net losses for 2021 to 2023 were 4.514 billion yuan, 7.655 billion yuan, and 8.264 billion yuan, respectively. In terms of peers, in addition to BYD and Li Auto, most new energy automakers in China, such as NIO, XPeng, and ZERO Run, are still in a state of loss.

The research and production of electric vehicles require significant capital investment. To support product leadership and rapid iteration, Zeekr's R&D expenses have been gradually increasing over the past three years, contributing to the company's losses. The prospectus shows that Zeekr's R&D expenses for 2021 to 2023 were 3.16 billion yuan, 5.446 billion yuan, and 8.369 billion yuan, respectively, with year-on-year increases of 72.3% and 53.67%. In addition, sales and administrative expenses were another cause of losses, amounting to 2.2 billion yuan, 4.245 billion yuan, and 6.92 billion yuan, respectively.

Although the amount of losses has increased, Zeekr's profitability has improved, with a full-year net profit margin of -15.99%, an improvement from -24.00% in 2022.

According to the prospectus, at the end of 2023, Zeekr's cash and cash equivalents amounted to 3.26 billion yuan, which is insufficient to cover the next year's R&D and marketing expenses. To alleviate Zeekr's financial pressure, the Geely Group provided capital support to Zeekr through loans to maintain its operations and R&D.

On the one hand, loans can alleviate Geely's cash flow pressure; on the other hand, increased loans also indirectly increase the company's asset-liability ratio. According to the latest prospectus, Zeekr's asset-liability ratio for the fiscal year 2023 has reached 132%. Compared with the debt ratios of other new energy vehicle manufacturers (XPeng: 57%, Li Auto: 58%, NIO: 75%), Zeekr's asset-liability ratio is relatively high.

However, on the afternoon of November 14th, Geely Automobile announced that Geely Holding and Volvo Cars would sell their shares in Lynk & Co to Zeekr, and after the transaction, Zeekr would hold a 51% stake in Lynk & Co. This means that resources between Zeekr and Lynk & Co will be further integrated.

On the same day, Zeekr also announced its financial results for the first three quarters. As of September 30, 2024, Zeekr's cumulative revenue for the first three quarters reached 53.13 billion yuan, with a year-on-year increase of over 50%, surpassing its full-year performance in 2023. Simultaneously, its profitability also improved.

After going public, Zeekr officially became the ninth listed company in the Geely Group, underscoring its importance to Geely.

Previously, Geely's capital market landscape already included eight listed companies: Geely Automobile, Qianjiang Motorcycle, Hanma Technology, Lifan Shares, Lotus, Polestar, Ecarx, and Volvo Cars. In addition, Cao Cao Chuxing is also on the path to an IPO and is likely to become the tenth listed company under 'Big Geely'.

It is worth noting that Zeekr's IPO has also set an example for peers to accelerate their layout in the capital market. In March of this year, at the media communication session of the 2024 Electric Vehicle Hundred People Forum, Gu Huinan, general manager of GAC Aion, said that GAC Aion's IPO process was also awaiting a market recovery.

In the view of an automotive industry analyst, the IPOs of new car manufacturers can be simply divided into three stages: the first stage is when a good story is enough for listing, the second stage requires good sales volume, and the third stage requires both good sales volume and a high gross profit margin per vehicle. "We are currently in the third stage, and the investment market has higher requirements for IPO companies," the analyst said.

Therefore, against the backdrop of a rationalizing capital market, the stories of these new entrants can no longer serve as a gimmick for fundraising. Industry insiders believe that actual products and technologies are more attractive to industrial capital.

Note: Some images are sourced from the internet. Please contact us for removal if there is any infringement.