GeeX "Flash Crash": Who Holds the Soul of Chinese Cars?

![]() 12/19 2024

12/19 2024

![]() 550

550

Author | Wuji Learn more about financial information | BT Finance Data Link The text totals 3,858 words and is expected to take 9 minutes to read

“GeeX CEO Xia Yiping apologized in a long post, feeling wronged; aren't Baidu and Geely also feeling wronged?”

Early on the morning of December 16, GeeX CEO Xia Yiping posted a lengthy message on his WeChat Moments, stating, "The fault is all mine. But I beg everyone not to deny the evaluation of GeeX's innovation and product capabilities because of me. No matter what happens, I am proud of our products." His words exuded a sense of grievance and indignation.

It's worth noting that Baidu and Geely, as shareholders, stepping in to aid GeeX is already a demonstration of social responsibility beyond legal obligation, not their mandatory duty. Aren't Geely and Baidu also feeling wronged?

Recently, People's Daily published a commentary titled "Leading the Stable and Long-term Development of the New Energy Vehicle Industry with Innovation." The article emphasized that automobiles should possess both a "core" and a "soul," specifically mentioning NIO as a domestic new energy vehicle enterprise that is "independently controllable, with both a core and a soul," poised to open up new horizons in China's automotive market through technological innovation, attracting widespread social attention.

The GeeX incident is merely a microcosm of many emerging automakers. What constitutes the soul of today's automotive industry? Both Baidu and Geely are financially robust, so why has GeeX, backed by these giants, sunk to this level?

1

Why Doesn't Baidu Want to Invest Anymore?

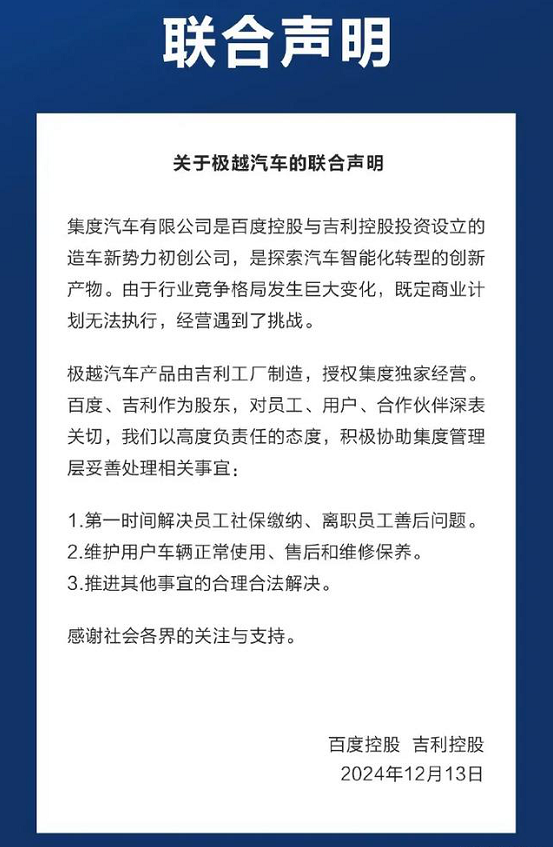

Partnering in car manufacturing is no easy feat. GeeX, the emerging automaker jointly created by Baidu and Geely in 2021, failed to survive its fourth year.

Initially named Jidu, GeeX was a smart car research and development company established by Geely and Baidu, with Baidu holding 55% of the shares and Geely holding 45%. Baidu occupied a dominant position and controlled the essence of this new player. However, Geely was obviously reluctant to play a mere supporting role. During subsequent cooperation, the shareholding structure underwent multiple changes, ultimately resulting in Geely's shareholding ratio rising to 65% and Baidu's falling to 35%. Geely became the guiding force behind this emerging automaker, making the name Jidu somewhat inappropriate (one theory suggests it was to acquire qualifications as soon as possible). Therefore, in August 2023, Jidu was renamed GeeX.

According to The Paper, GeeX has lost 10 billion yuan since its inception, and Baidu and Geely, who once competed to be the "soul" of GeeX, have gradually reduced their investment. Informed sources revealed that GeeX Auto originally planned to secure a 3 billion yuan financing in the second half of this year, but Baidu suddenly decided not to fund it, further exacerbating the company's financial woes.

According to China Securities Journal, a significant disagreement erupted during a GeeX board meeting in August attended by core executives such as Baidu's CFO and Geely's CFO. The conflict began to escalate, exposing shortcomings in the CEO's management and operational capabilities, necessitating intervention from the board of directors and shareholders' meetings. The CEO proposed to shareholders that the CFO was not cooperating and requested corresponding adjustments, publicly airing the contradiction between the two sides.

The "disbanding" incident of GeeX swiftly became a trending topic on social media. Affected by this, Geely, GeeX's largest shareholder, saw its share price fall by 5.09% on December 13, the largest single-day decline in the past month. Baidu's share price also experienced a slight decline due to this impact.

According to 21st Century Business Herald, Baidu sent a financial team to conduct due diligence on GeeX in October. However, after the due diligence, Baidu discovered that GeeX had a financial shortfall of 7 billion yuan and decided not to continue investing. GeeX responded that the 7 billion yuan was not a financial deficit but a projected loss amount of 7 billion yuan reported to Baidu at the end of 2023, including 3 billion yuan for research and development, 3 billion yuan for marketing, and 1 billion yuan for administrative expenses.

Since March 2021, both Round A and Round B have been invested by Baidu and Geely, with investments of US$600 million and nearly US$400 million, respectively. Round C amounted to 1.7 billion yuan, of which Baidu invested 650 million yuan, with some external investors also participating. These financings totaled over 8 billion yuan. However, Li Bin has stated that the entry-level requirement for the new energy vehicle sector is at least 20 billion yuan, while He Xiaopeng believes that it is difficult to succeed without 30 billion yuan. With over 8 billion yuan in financing, Jidu is still far from this minimum standard and cannot yet turn a profit, relying solely on external funding.

At that meeting, GeeX executives reported on the development of new models and inquired whether Baidu would continue to invest in the continuous development of new models. This request was halted by Baidu's then-CFO Luo Rong, citing excessive costs. After the "disbanding" incident of GeeX, Baidu and Geely are in the process of transferring funds to pay the outstanding November social security contributions for employees, essentially cleaning up GeeX's "mess."

Investor Shi Baogang believes, "Initially, Baidu attempted to achieve the greatest results with the least amount of money, having complete control over GeeX, following the iQIYI model of internal incubation and external professional management, with more equity given for good management. However, Geely is likely to have disagreements with Baidu on this point, hoping for a model similar to smart, with each holding 50% of the shares and equal voting rights."

Shi Baogang points out that this super-voting right structure, where equity is significantly lower than voting rights, is not uncommon. It's designed to protect shareholders with super-voting rights, ensuring they have a greater voice in corporate decision-making. Domestic companies like Alibaba and JD.com, as well as international companies like Google and Facebook, adopt this special voting structure. The difference is that these companies are internet companies, whereas GeeX is strictly speaking a manufacturing entity. It's questionable whether this special structure can be adapted.

GeeX has only sold 14,000 vehicles so far this year. In the fiercely competitive new energy vehicle sector, this sales volume may not have met Baidu's expectations.

2

SAIC's "Soul Theory" Faces Scrutiny

The concept of a car's "soul" originated from the SAIC Group.

At the 2021 shareholders' meeting, Chen Hong, the former chairman of SAIC, stated, "SAIC finds it difficult to accept a single supplier providing us with a complete solution. This would make them the soul, while SAIC would become the body. SAIC cannot accept such an outcome; our soul must be in our own hands."

At that time, SAIC did have the capital to advocate the "soul theory," ranking first in China's auto sales for 16 consecutive years since 2006 and injecting technological advantages through partnerships with Alibaba and Zhangjiang Hi-Tech Park. However, in just three years, the rise of new energy vehicles has transformed the automotive landscape. SAIC's top sales position was usurped by BYD. In the first three quarters of this year, BYD sold a cumulative total of 2.757 million vehicles, while SAIC sold approximately 2.65 million, with BYD surpassing SAIC by over 100,000 vehicles.

In terms of sales, SAIC Group's production and sales bulletin for September showed that SAIC Volkswagen's cumulative sales for the first nine months of this year were 772,091 vehicles, a year-on-year decrease of 7.24%. SAIC GM's cumulative sales were 278,485 vehicles, a significant year-on-year drop of 61.55%, making it the brand with the largest decline within the SAIC Group.

Even brands like the "national god car" SAIC-GM-Wuling and SAIC Passenger Cars experienced significant sales declines, directly impacting SAIC Group's profits. In the first three quarters, the company's consolidated operating revenue was 430.48 billion yuan, and its net profit attributable to shareholders of the listed company was 6.91 billion yuan, a decrease of 39.4% compared to the same period last year (11.41 billion yuan). In the third quarter, SAIC's revenue was 145.796 billion yuan, a year-on-year decrease of 25.91%, with a net profit attributable to shareholders of only 280 million yuan, a significant year-on-year decline of 93.53%. After deducting non-recurring gains and losses, the net profit plummeted to only 29.166 million yuan, a year-on-year drop of 99.23% to just 29 million yuan.

However, thanks to the popularity of Wuling electric vehicles, SAIC Group's new energy sector performed well. In the first three quarters of this year, SAIC delivered a cumulative total of 886,000 new energy vehicles, a year-on-year increase of 29.5%.

Previously, to possess a "soul," SAIC chose NVIDIA to create one for itself. SAIC also became the largest shareholder of Horizon Robotics, the largest supplier of intelligent driving computing power chips in China, and invested in the autonomous driving company Momenta, jointly developing an autonomous driving system with them. However, these layouts to control the "soul" have hardly been successful. The "internal competition" between Feifan and IM Intelligence has wasted a significant amount of time and resources, leaving IM Intelligence, born with a silver spoon, with a monthly sales volume of just over 10,000 vehicles, barely squeezing into the top ten among many new energy vehicle brands. Meanwhile, SAIC's self-developed intelligent driving system started relatively late. In 2016, SAIC launched the world's first internet car, the Roewe RX5, but this intelligent in-car system was mainly equipped in fuel vehicles. In terms of electric transformation and intelligent upgrades, SAIC was slightly slower.

From the beginning of 2024 to the present, SAIC's performance and sales have subjected its "soul theory" to scrutiny in the market. The sales of its "beloved son" IM Intelligence are an even greater concern for SAIC, as they are similar to those of GeeX, both performing poorly with even lower growth rates than GeeX.

It seems that treating high-end joint venture brands as the soul may not work, and using the concept of fuel vehicles as the soul of smart cars may be even more unfeasible.

3

Where Lies the Soul of Chinese Cars?

With the widespread adoption of smart cars, currently, only BYD and Lixiang are profitable in the new energy vehicle sector. NIO, which has faced several life-or-death situations and is celebrating its tenth anniversary, has not only failed to turn a profit but has also seen its losses continue to widen. Xpeng's profitability is also far off, and the fourth newly listed company, Zeekr, is also unlikely to become profitable in the short term.

As a heavy asset industry, the automotive sector requires significant upfront investment. When GeeX was first established, its workforce quickly expanded to 5,000 employees, including about 3,000 in the vehicle team and 2,000 in the sales team. Although this heavy asset operation model reduces dependence on the Geely platform, it also incurs huge costs, requiring continuous external funding. Once funding decreases or stops, a "flash crash" may occur.

In an era where emerging automakers are flocking to the market, various automakers have announced their annual targets at the beginning of the year. With only one month left in the year (current sales figures are as of November), very few have met their annual targets. BYD has already surpassed its annual target of 3.6 million vehicles with 3.757 million vehicles sold, while NIO has also achieved its annual target of 250,000 vehicles with 251,200 vehicles sold in the same period.

Most other new energy vehicle enterprises have been unable to achieve their targets, and even profitable Lixiang has fallen short. As of the end of November, Lixiang had sold a cumulative total of 441,995 vehicles, with an annual target of 560,000 to 640,000 vehicles (originally 800,000, adjusted due to the failure of the MEGA project), leaving a minimum shortfall of 120,000 vehicles. GAC has sold a cumulative total of 366,092 vehicles, with a target of 700,000 vehicles, and has yet to complete 60% of this target. Arcfox has sold 207,307 vehicles so far, falling short of its target of 280,000 vehicles by over 70,000, making it virtually impossible to achieve its annual target.

Among them, Xpeng and IM Intelligence have only achieved about half of their targets. IM Intelligence's sales completion rate is less than half of its target, meaning that with sales of 10,007 vehicles in November, its annual sales target completion rate will be the lowest among many automakers. Xpeng's target task is 280,000 vehicles. After launching the pure electric model Xpeng MONA, Xpeng's sales in the first 11 months were only 153,000 vehicles, making it virtually impossible to achieve the target in the remaining month. In contrast, Xiaomi, a rising star among emerging automakers, has sold a cumulative total of 110,500 vehicles since launching its new car in March. With sales of 23,156 vehicles in November, it is a foregone conclusion that Xiaomi will meet its upper target of 120,000 vehicles.

Automotive media personality Zhang Zhiyong believes that currently, the soul of new energy vehicles lies in the three major components: batteries, motors, and electronic control systems. Currently, only BYD has mastered and is leading in these areas, which is why BYD is profitable and has become China's most valuable automaker.

Judging from sales performance over the first eleven months, BYD's sales of 3.757 million vehicles stand significantly ahead. In the first three quarters, BYD's R&D expenses amounted to 33.32 billion yuan, marking a 33.61% increase year-on-year, positioning it as the domestic automaker with the highest R&D investment. This substantial investment has laid the foundation for BYD's dominance in batteries and other components.

GeeX's "flash crash" may suggest that the automotive sector is a grueling endurance race in terms of both time and capital. When investors are ill-prepared for potential losses, they often start off generous but become increasingly stingy. Over the years, many automotive brands have vanished following extensive market washouts. The automotive industry generally concurs that among the myriad of new energy vehicle brands, no more than five will ultimately survive.

Returning to the initial question, what constitutes the soul of today's automotive industry? One thing is indisputable: only automakers with a distinct soul will endure.