The Geyue Saga Concludes: Who Should Shoulder the Burden?

![]() 12/25 2024

12/25 2024

![]() 586

586

The turmoil at Geyue Automobile subsided as investors stepped in to address employee concerns.

On December 11, Xia Yiping, CEO of Geyue Automobile, announced in an internal letter that the company would merge redundant departments and positions, axe non-revenue-generating projects, and embark on a "Startup 2.0 Phase." The management team pledged to rally with all employees to navigate through the challenges. During an all-hands meeting that day, Xia Yiping confirmed the suspension of November's social security contributions for employees.

Faced with the salaries, social security, and provident funds of nearly 5,000 employees, Xia Yiping issued a lengthy apology on his WeChat Moments early on December 16. As CEO, he admitted numerous mistakes and expressed deep regret to employees, car owners, suppliers, and even investors. He vowed, if given another chance, to take full responsibility, rectify past errors, and steer the company back on track.

However, CEO Xia Yiping did not assume corresponding responsibility and even suggested employees approach the company's investors for financial assistance.

According to reports, Baidu and Geely have invested tens of billions in Geyue Automobile over three years, with Geyue still owing nearly a billion yuan in technical service fees to Baidu. On Geely's side, despite handling Geyue's production and manufacturing, Geyue owes Geely nearly 3 billion yuan in OEM fees.

The Geyue saga has also thrust Baidu and Geely into the limelight. Some media reports suggest that the blame for Geyue Automobile's current predicament cannot solely rest on Xia Yiping, claiming that "investors failed to lend a helping hand despite knowing the company's cash flow issues, leading to Geyue's collapse."

So, in the wake of Geyue's abrupt collapse, should Baidu and Geely come to its rescue?

Should investors bear the blame for Geyue's sudden downfall?

In reality, Baidu and Geely have demonstrated utmost sincerity in addressing issues for employees and car owners.

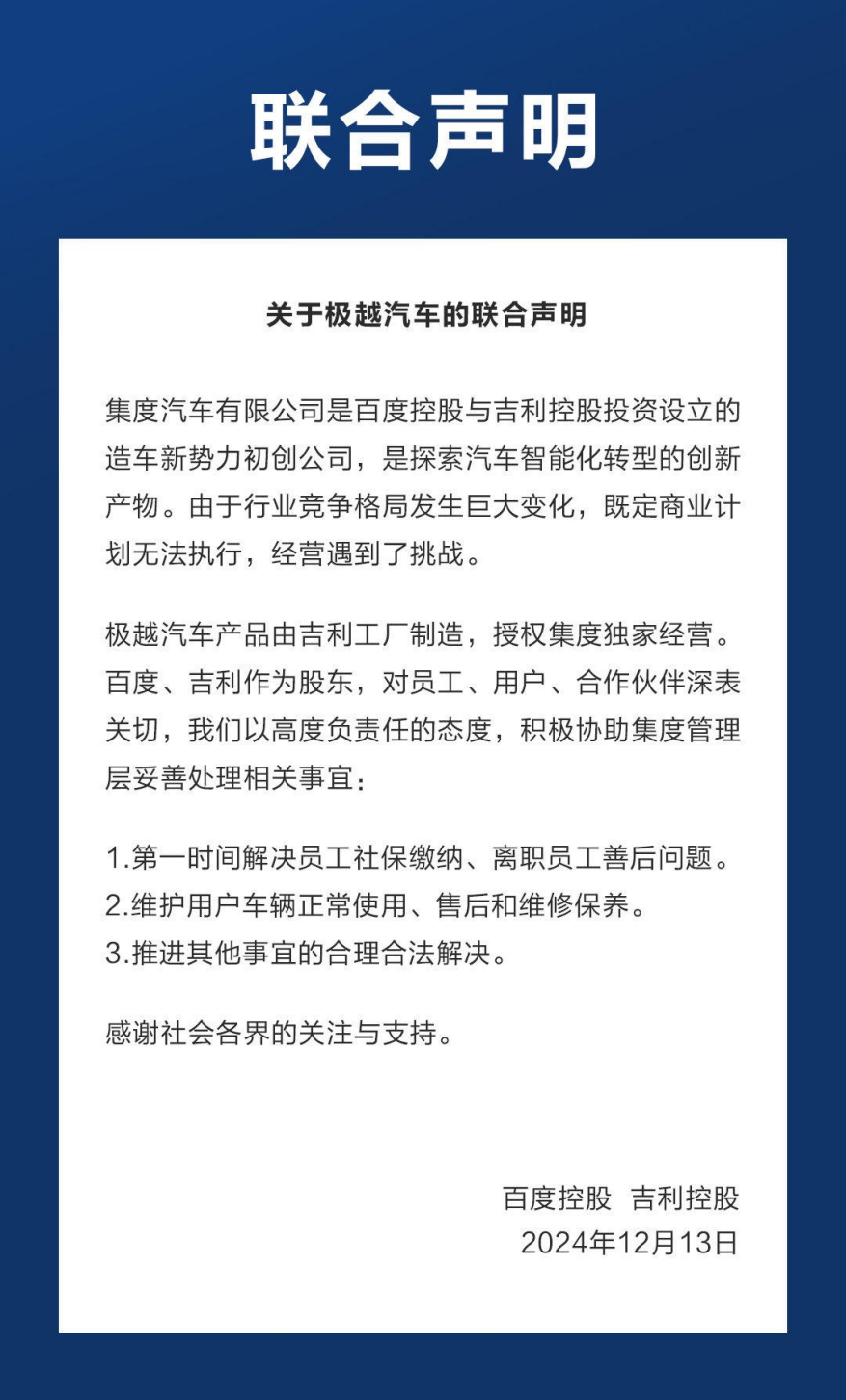

On December 13, Baidu and Geely issued a joint statement, pledging to actively assist Geyue's management in addressing related matters, including resolving employee social security contributions and providing aftercare for departing employees promptly; ensuring the normal use, after-sales support, and maintenance of user vehicles; and facilitating the reasonable and legal resolution of other issues.

On December 19, a document outlining a plan to address the aftermath for Geyue employees was leaked online. The document revealed the establishment of a jointly supervised account, funded by advance payments from Baidu and Geely, to cover relevant employee expenses under the guidance and witness of relevant government departments.

Regarding after-sales solutions for car owners, a Link&Co. customer service representative confirmed that Link&Co. could currently ensure normal maintenance, servicing, and roadside assistance for Geyue car owners. Geyue Automobile also announced on its official APP that car owners could inquire about after-sales service through the Link&Co. hotline, with offline Link&Co. service centers handling repairs, including basic bodywork and painting. Meanwhile, the supply of Geyue after-sales parts was being coordinated, with relevant service progress updates to follow.

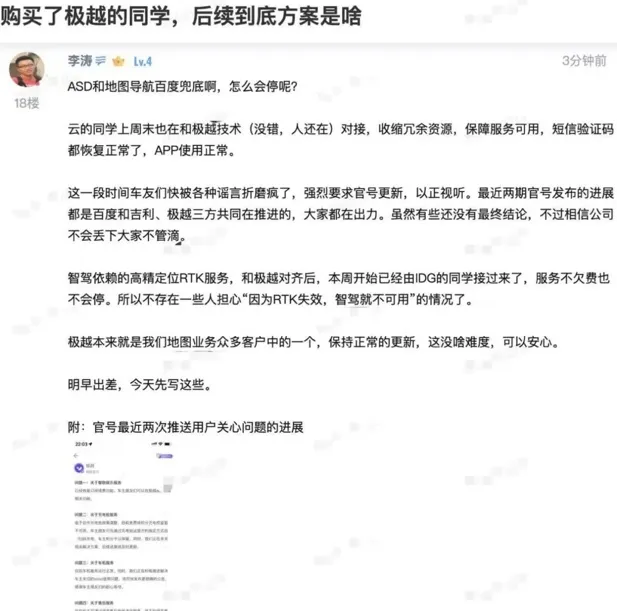

Li Tao, head of Baidu IDG Operations Management, announced that Baidu would cover ASD and map navigation services, ensuring their continuity. The Baidu Cloud and Map team closely collaborated with the Geyue technical team to fully support related services. Regarding users' concerns about the high-precision positioning RTK service, Li Tao assured that the team had full control, preventing situations where "intelligent driving functions become unusable due to RTK failure," allowing users to use the service with confidence.

Behind Geyue's sudden collapse, Baidu and Geely, as investors, stepped in to address issues for vulnerable employee and car owner groups, driven not just by legal social responsibility but also by the responsibility of large enterprises.

However, from a business operations perspective, Baidu and Geely unfairly bore the blame for Geyue's operational issues.

According to the "Company Law of the People's Republic of China," Geyue is a limited liability company, with its debts borne by the company's assets. Investors are only liable for the company's debts to the extent of their capital contributions, limited to the tens of billions invested by Baidu and Geely in the early stages. Beyond this, Baidu and Geely are not obligated to bear other debts.

From a legal standpoint, investor and senior executive responsibilities are clearly delineated: investors are responsible for capital contributions, while senior executives handle daily management. As an independent company, Geyue raises funds and operates independently. Investors Baidu and Geely primarily rely on the CEO for management and typically do not interfere in daily operations. Operational issues do not stem from investors and should not be blamed on them.

Thus, this time, as investors, Baidu and Geely proactively assisted in paying employee salaries, social security, provident funds, and other expenses out of social responsibility. However, according to the "Company Law," these expenses, including Geyue's other "external debts," are not statutory obligations for investors.

For instance, investors are not obligated to cover supplier arrears. Suppliers differ from employees; employees are individuals, whereas suppliers are companies. Paying employees is a matter of social responsibility but cannot justify requiring payment to other companies collaborating with Geyue.

Simultaneously, the relationship between investors and the invested limited liability company is not one of "son's debt, father pays." Especially in Geyue's dealings with legal entities like suppliers, debt liquidation between the parties should adhere to laws like the "Civil Code" and the "Company Law," proceeding through legal channels. Bankruptcy liquidation should be considered when necessary, without shifting responsibility to investors.

Therefore:

From a legal perspective, Geyue is a limited liability company, with the company bearing responsibility for its debts with all its assets;

From a contractual spirit perspective, the CEO should courageously assume responsibility rather than shift blame;

From a market economy environment perspective, once this precedent is set, should investors always cover for future company operational difficulties?

From any angle, Baidu and Geely do not need to cover for Geyue. Ideally, Geyue should undergo the bankruptcy process independently, allowing employees to receive compensation as per the law rather than having investors step in to shoulder the blame and costs.

Amidst the hustle and bustle, it's time to see things clearly.

In the long run, enterprise development necessitates a rational, orderly, and rule-based market economy environment, alongside a rational and transparent public opinion climate. The leading role of law should complement business ethics, with the interests of all parties, including employees, investors, and suppliers, protected in accordance with the law.

Furthermore, if the Geyue incident fails to receive appropriate legal regulation and industry reflection due to investor coverage, it risks triggering a severe butterfly effect in the future.

Imagine if all new automakers and even the entire industry develop a sense of luck, believing that no matter how reckless their business practices, investors will ultimately clean up the mess. In such a scenario, industry development would plunge into an extremely perilous situation.

For example, companies might arbitrarily withhold employee salaries, disregard labor regulations protecting employee rights, or maliciously default on supplier payments. Even when the capital chain snaps, rather than undergoing legal and compliant bankruptcy liquidation or reorganization, they might incite users to approach investors for funds, uncontrollably shifting operational risks onto others.

When the limited liability system is arbitrarily breached, and investors are expected to bear responsibilities beyond their scope, it disrupts the entire market economic order.

In the long term, capital will inevitably shy away from such a chaotic and highly risky industry, reluctant to invest easily. Entrepreneurs will struggle to secure adequate financing due to capital withdrawal, forcing their technological innovation dreams into a quagmire, unable to transform into tangible productivity and commercial value.

Ultimately, it is our vast majority of ordinary people who will be most impacted. Stagnant technological innovation means we cannot enjoy more advanced products and services, hindering revolutionary improvements in travel methods and impeding quality of life enhancements. The pace of social development will also slow.

Therefore, when addressing issues like Geyue, compliance with the law is paramount. The law is the law, and claiming innocence solely due to vulnerability is unreasonable.

Source: Lei Technology