China's Automotive Market Sees Heightened Competition Amidst EV Transition: Will Honda and Nissan's Merger Set a New Precedent?

![]() 01/03 2025

01/03 2025

![]() 508

508

In 2024, China's automotive market witnessed an unprecedented surge in competition. Amidst this landscape, brands such as BYD, Hongmeng Smart Mobility, and Xiaomi Auto emerged as frontrunners with their economies of scale, advanced driving systems, and late-mover advantages. Conversely, some automakers struggled to keep pace.

The shift from gasoline to electric vehicles accelerated significantly, with new energy vehicles (NEVs) penetration rate rising from 32.80% in January 2024 to 51.10% in July, remaining above 50% through November. According to the China Electric Vehicle Hundred Person Council, China's auto sales are projected to reach 32 million units in 2025, with NEVs still in a crucial phase of scale accumulation. This indicates that the gasoline-electric rivalry has entered a stalemate, with both segments vying for market share.

These market dynamics are influencing multinational brands' strategies. Auto Insight reports that some automakers are revising their 2025 delivery plans downwards, while Nissan and Honda's official merger negotiations have garnered widespread industry attention.

This move signifies automakers' strategic quest for mutual support amidst fierce competition and numerous challenges. If successful, this merger would be the largest reorganization in the global automotive industry since the 2021 merger of Fiat Chrysler Automobiles and PSA to form Stellantis, valued at $52 billion.

▍A Decision Amidst "Internal and External Turmoil"

The global automotive market has undergone transformative changes with the rise of electrification and intelligence. Innovators like Tesla have posed significant challenges to traditional automakers with their unique business models and technological prowess. Stringent environmental regulations and consumer demand for NEVs have compelled traditional brands to accelerate their transformation. Honda and Nissan, two prominent Japanese automakers, find themselves under unprecedented pressure.

In key markets like China, both Honda and Nissan have seen performance declines. In 2023, Honda sold 3.98 million vehicles globally but only 1.23 million in China, a 10% drop. Nissan's China sales fell by 24%. From January to November 2024, Honda sold 740,000 vehicles in China, down 30.7% year-on-year, while Nissan sold 620,000, down 10.5%. Both companies are losing ground to local and international competitors.

Nissan's Sylphy once enjoyed great success in China, but slow product updates and a failure to meet consumer demand for intelligence and electrification have led to declining sales. Honda faces similar challenges.

Regarding product strategy, the industry believes Nissan has been too conservative in its model positioning, failing to capture the trend of young consumers' demand for personalization and technological advancement. Honda, on the other hand, has lagged in deploying hybrid and pure electric models, missing early market opportunities.

Both companies are financially strained, with declining sales and increased R&D investments squeezing profit margins. Amidst these internal and external challenges, a merger appears as a potential way out for Nissan and Honda to break the stalemate.

▍A Rocky Road to Merger

Industry observers hold mixed views on the potential Nissan-Honda merger. Optimists see it as a chance to create a global automotive giant with cost advantages from resource integration and enhanced innovation through technology synergy, potentially reshaping Japan's position in the industry and enabling it to compete more effectively with European, American, and Chinese automakers.

However, cautious observers warn of the merger's difficulties. Integrating corporate culture and organizational structure could lead to short-term chaos, affecting production and sales. Mismanagement of product planning and brand positioning conflicts could weaken both companies' market advantages.

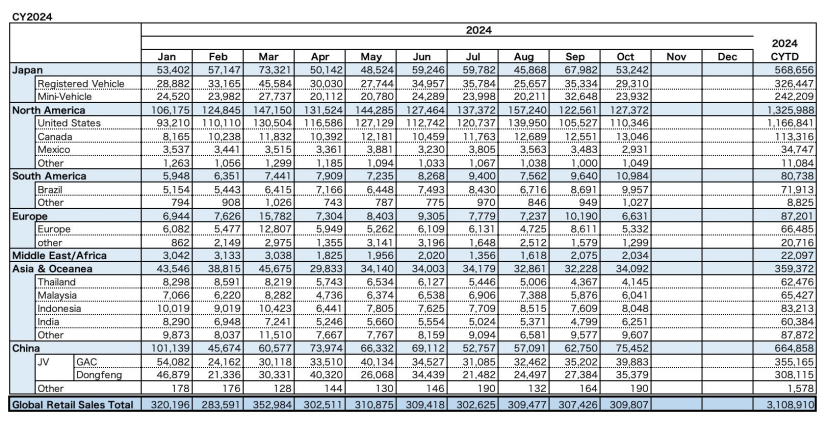

Honda's Global Retail Sales from January to October 2024

Carlos Ghosn, former Nissan Chairman, expressed doubts about the success of a potential merger, stating he was not optimistic. Cui Dongshu, Secretary-General of the China Passenger Car Association, also expressed skepticism, emphasizing the need for increased local R&D investment and leveraging China's supply chain advantages for product innovation. He suggested focusing on technological innovation and upgrading rather than merely reducing manufacturing costs through scale.

Japanese media believes significant differences between the two companies could lead to post-merger issues. For instance, while Toyota operates multiple subsidiaries as affiliated companies, if the merged company's shares were distributed based on current market values, Honda would hold 77% to 78%, Nissan 15% to 16%, and Mitsubishi Motors 6% to 7%. This structure could lead to Nissan losing decision-making power.

Honda is known for its technological innovation and independent decision-making, while Nissan, influenced by the Renault-Nissan-Mitsubishi Alliance, has a more complex decision-making process. Post-merger, harmonizing management structures, decision-making processes, and internal communication is crucial to avoid slow decision-making and inefficiencies.

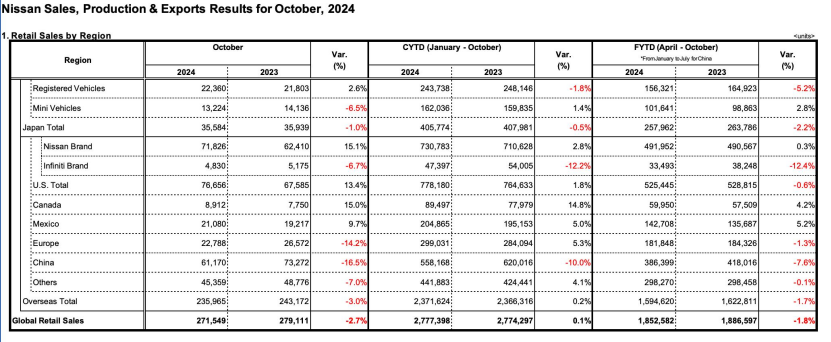

Nissan's Global Retail Sales from January to October 2024

While Honda excels in hybrid technology with its i-MMD system, Nissan has experience in electrification with its e-POWER range extender system. However, their technological paths differ, posing challenges in achieving technology fusion to create competitive NEV products. Both companies must increase investment in key technologies like electrification and intelligence to stay competitive.

Post-merger, efficient R&D resource allocation is essential to avoid duplication and waste, focusing on areas like electrification and intelligence. However, inconsistencies in R&D directions and resource competition may arise, affecting technological innovation.

From a competitiveness perspective, the merged company must adapt swiftly to changing market demands, allocating resources to launch new products. However, integration could take at least two years, during which maintaining market share and launching competitive products will be crucial.

As a Renault-Nissan-Mitsubishi Alliance partner, Renault has stated it will "discuss and consider all possible options" with Nissan regarding the merger and is open to cooperating with Honda and Nissan, potentially holding a stake in the new company.

In 2025, China's automotive market players continue to strengthen and seek breakthroughs. Changan Automobile Chairman Zhu Huarong recently noted that market competition is deepening cooperation among traditional automakers, with Honda and Nissan's merger indicative of the market's choices, posing challenges to all brands. It is widely recognized that China's automotive market does not need to sustain such a large number of brands.

Typeset by Yang Shuo | Image Sources: Honda Official Website, Nissan Official Website, Shotu.cn